- SAP Community

- Products and Technology

- Financial Management

- Financial Management Blogs by SAP

- SAP S/4 HANA Flexible Real Estate Management (RE-F...

Financial Management Blogs by SAP

Get financial management insights from blog posts by SAP experts. Find and share tips on how to increase efficiency, reduce risk, and optimize working capital.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Advisor

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

12-02-2019

12:58 PM

Overview:

Service charge settlement in SAP S/4 HANA Flexible Real Estate Management is to distribute apportion-able costs that arise during a particular settlement period to the tenants. Service charge settlement contains the functions for settling all service charges for Real Estate contracts and rental objects. In Service charge settlement you can do Internal settlement of operating costs and heating expenses.

Example:

A Commercial Complex where shops are let out on a rental basis to various units, like restaurants, fashion stores, other retail shops, bank ATMS etc and common facilities are provided and paid for by the lessor. Costs incurred for the maintenance of such facilities are paid by the landlord for the complex as a whole and need to be recovered from all tenants based on usage. This requires a system that will allocate costs among various tenants every month based on agreed upon parameters and debit them for settlement.

In SAP S/4 HANA all the service charges are generally settled through settlement units, which must be defined for each service charge that needs to be settled. A new settlement unit must be created for each type of service charge that is defined in the service charge key and that participates in the settlement.

Various parameters based on which apportionment expenses can be made:

Process Flow:

Rental objects comprise three objects:

The data elements of the usage view applicable in our scenario are business entity, building, property, pooled space, rental space, and rental unit.

** Nothing to key in measurement tab.

Similarly Created another RO: XXXX/ZZ/Q44

The identification of a group of rental objects that participate in a service charge settlement. In other words, participation group is made up of tenants who are required to share common expenses incurred for all. Rental objects are part of this group that participates in the settlement of one or more cost elements. Example: water charges paid by the mall owner need to be recovered from all the shops that are leased out for rent. We must define the participation group containing these shops, which are created as rental objects in the system.

Business entities, buildings, land, and rental objects can be part of a participation group. If a business entity containing rental objects is assigned, rental objects assigned to it are also automatically assigned to the participation group. All rental objects assigned to a participation group participate in the apportionment of costs, provided that this participation group is assigned to a settlement unit.

Both the assignment of the group and the assignment of rental objects within a group is time dependent.

Click on create to create settlement Unit master data. Update all fields as highlighted below:

Assign objects to a participation group. Here two rental objects representing two shops selected and assigned.

Create a settlement unit to settle service charges, each service charges (Electricity, water) will have a separate service charge key, and assign participation group.

Create settlement Unit master data as highlighted below:

Cost collectors are defined for each settlement period to enable costs to be posted to a settlement unit. The costs of a settlement unit are collected on a cost collector for settlement for each settlement period. When we post to a settlement unit, the system determines the cost collector based on the specified settlement reference date.

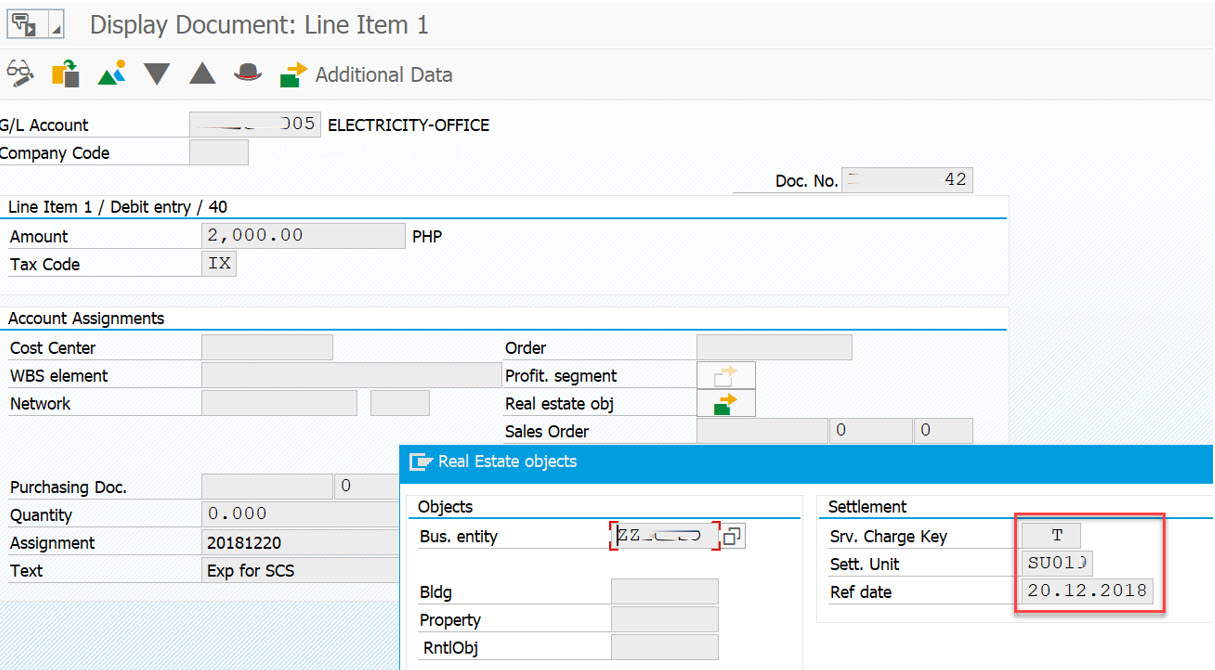

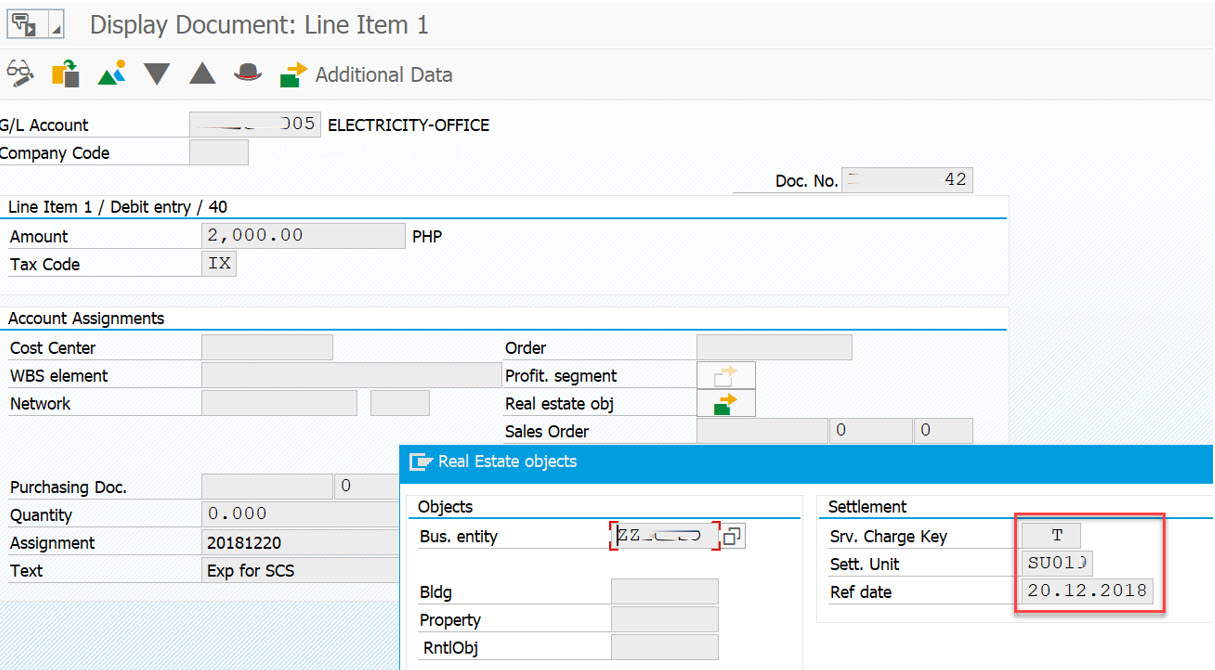

Vendor invoices must be posted in FI with account assignment of the cost item to a settlement unit. Transaction FB60 or FB01 doesn't matter.

The costs posted are collected for each settlement unit and settlement period. Master data of the settlement units contain the distribution rules, to which rental objects is to distribute, the measurement that has to be used and the service charge period.

Service charge settlement is a period task, depending on the settlement period, where the collected costs are distributed to rental objects or contracts.

While posting expenses user must manually fill in the Real Estate objects in each expense line items as in screen as below:

The settlement amount is transferred automatically to the correct settlement period by means of the settlement reference date.

There are several steps involved in the settlement. You can save each step (except posting) and call it again.

The results of settlement can be posted directly to Financial Accounting.

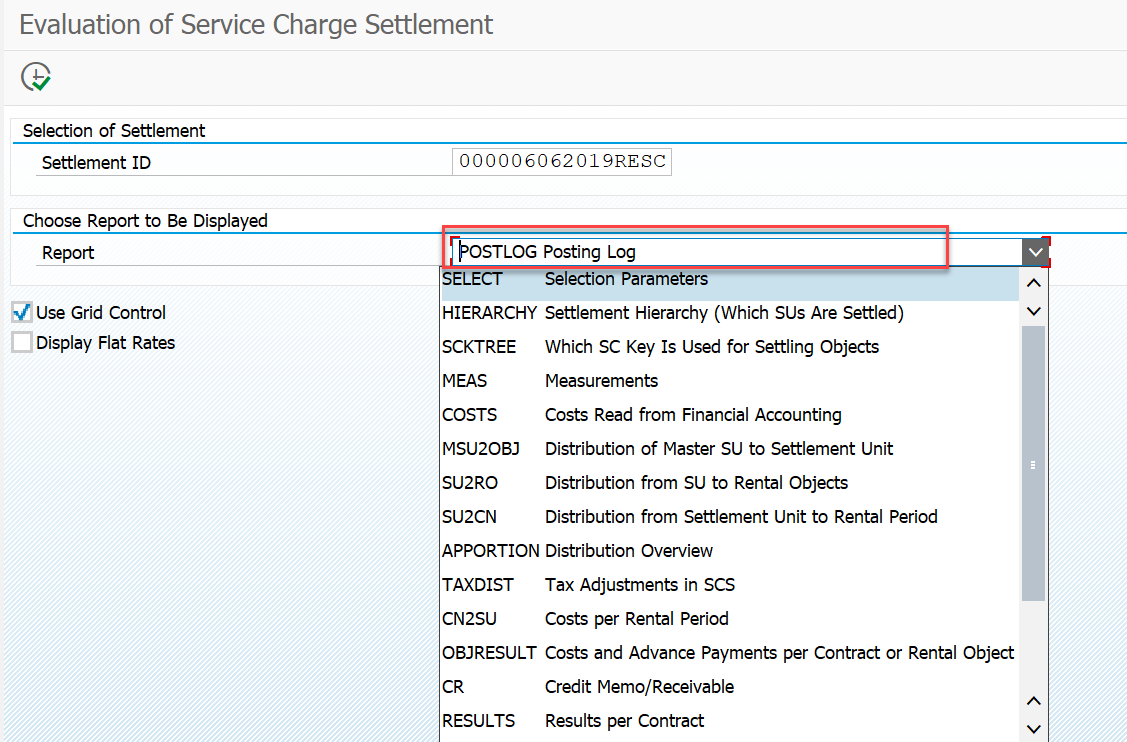

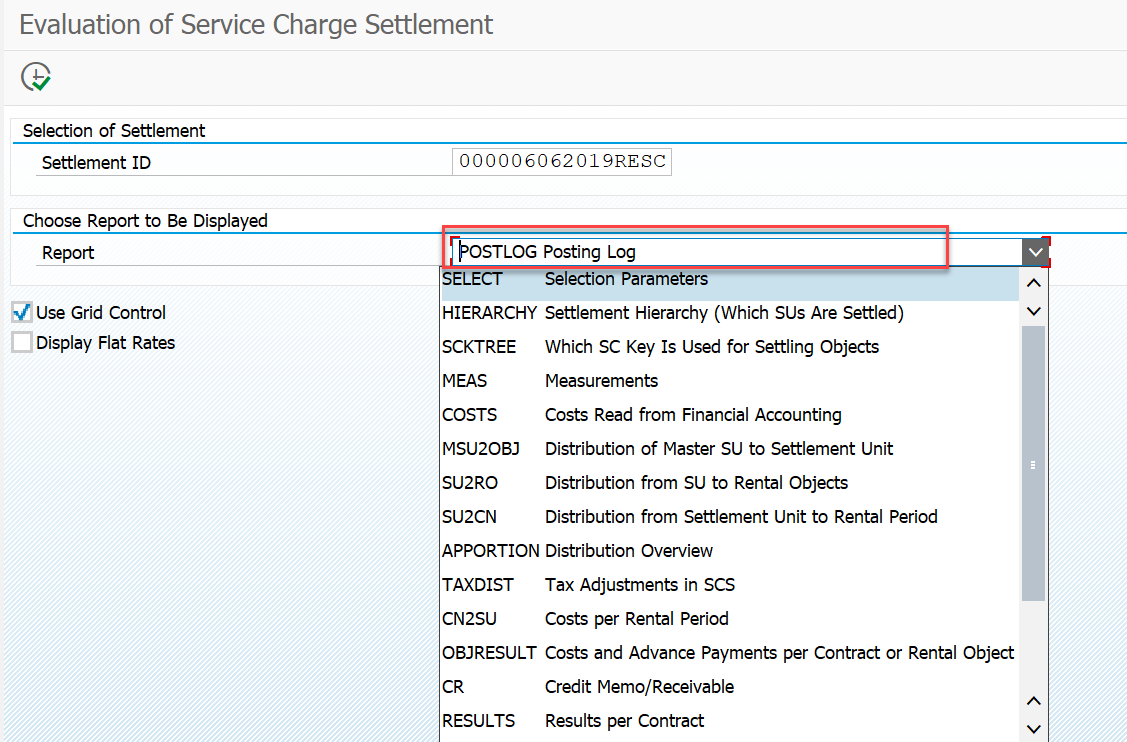

Execute the settlement and if your settlement contains errors, you can display the error log by choosing Settlement Log.

Execute report to see output below:

Results:

If costs for more than one settlement unit are to be jointly invoiced, you have to create a master settlement unit.

Configuration steps:

Service charge settlement in SAP S/4 HANA Flexible Real Estate Management is to distribute apportion-able costs that arise during a particular settlement period to the tenants. Service charge settlement contains the functions for settling all service charges for Real Estate contracts and rental objects. In Service charge settlement you can do Internal settlement of operating costs and heating expenses.

Example:

A Commercial Complex where shops are let out on a rental basis to various units, like restaurants, fashion stores, other retail shops, bank ATMS etc and common facilities are provided and paid for by the lessor. Costs incurred for the maintenance of such facilities are paid by the landlord for the complex as a whole and need to be recovered from all tenants based on usage. This requires a system that will allocate costs among various tenants every month based on agreed upon parameters and debit them for settlement.

In SAP S/4 HANA all the service charges are generally settled through settlement units, which must be defined for each service charge that needs to be settled. A new settlement unit must be created for each type of service charge that is defined in the service charge key and that participates in the settlement.

Various parameters based on which apportionment expenses can be made:

- Apportionment according to fixed values where a fixed amount that will be charged to each tenant is agreed upon by the parties

- Apportionment according to consumption values wherein you capture the number of units consumed by each tenant for electricity usage and charge based on the total units for which the landlord made a bill payment

- Apportionment according to percentage shares where you agree to share a specific percentage of costs between various units

- Equal apportionment where an equal amount is allocated to each tenant

Process Flow:

- Create Rental Object – Master Data

- Create Participation Group – Master Data

- Create Settlement Unit – Master Data

- Actual Expense Posting

- Service Charge Settlement Execution

- Settlement Report

- Rental object (REBDRO)

Rental objects comprise three objects:

- Rental unit: A rental unit is created when one unit is to be leased out in totality and is treated as one complete piece.

- Pooled space: This is the total space available from which we can take rental spaces for lease-out. We can have a proper regulation in the space that can be leased out as pooled space and will allow the exact rental spaces to be rented out.

- Rental space: A space extracted from a pooled space for lease-out.

The data elements of the usage view applicable in our scenario are business entity, building, property, pooled space, rental space, and rental unit.

** Nothing to key in measurement tab.

Similarly Created another RO: XXXX/ZZ/Q44

- Participation Group (RESCPG)

The identification of a group of rental objects that participate in a service charge settlement. In other words, participation group is made up of tenants who are required to share common expenses incurred for all. Rental objects are part of this group that participates in the settlement of one or more cost elements. Example: water charges paid by the mall owner need to be recovered from all the shops that are leased out for rent. We must define the participation group containing these shops, which are created as rental objects in the system.

Business entities, buildings, land, and rental objects can be part of a participation group. If a business entity containing rental objects is assigned, rental objects assigned to it are also automatically assigned to the participation group. All rental objects assigned to a participation group participate in the apportionment of costs, provided that this participation group is assigned to a settlement unit.

Both the assignment of the group and the assignment of rental objects within a group is time dependent.

Click on create to create settlement Unit master data. Update all fields as highlighted below:

Assign objects to a participation group. Here two rental objects representing two shops selected and assigned.

- Create Settlement Unit (RESCSU)

Create a settlement unit to settle service charges, each service charges (Electricity, water) will have a separate service charge key, and assign participation group.

Create settlement Unit master data as highlighted below:

Cost collectors are defined for each settlement period to enable costs to be posted to a settlement unit. The costs of a settlement unit are collected on a cost collector for settlement for each settlement period. When we post to a settlement unit, the system determines the cost collector based on the specified settlement reference date.

- Posting Actual Expenses (FB60/ FB01)

Vendor invoices must be posted in FI with account assignment of the cost item to a settlement unit. Transaction FB60 or FB01 doesn't matter.

The costs posted are collected for each settlement unit and settlement period. Master data of the settlement units contain the distribution rules, to which rental objects is to distribute, the measurement that has to be used and the service charge period.

Service charge settlement is a period task, depending on the settlement period, where the collected costs are distributed to rental objects or contracts.

While posting expenses user must manually fill in the Real Estate objects in each expense line items as in screen as below:

The settlement amount is transferred automatically to the correct settlement period by means of the settlement reference date.

- Settlement Unit Settlement (RESCSE)

There are several steps involved in the settlement. You can save each step (except posting) and call it again.

The results of settlement can be posted directly to Financial Accounting.

Execute the settlement and if your settlement contains errors, you can display the error log by choosing Settlement Log.

- Settlement Report: (RESCIS)

Execute report to see output below:

Results:

- Depending on the control factors, the service charge settlement performs the following activities:

- Calculation of total costs for the settlement period for each service charge key

- Cost apportionment to the relevant contracts or rental objects

- Posting cost shares to tenant accounts

- Determination of the advance payments (actual payments) made by the tenant for which credit transfer postings are made

- Calculation of the adjustment of the new advance payments/flat rates on the basis of the actual costs (optional)

If costs for more than one settlement unit are to be jointly invoiced, you have to create a master settlement unit.

Configuration steps:

- Define Service Charge Keys

- Settlement Variants

- Usage Types for Service Charge Settlement

- Define Measurement Types

- Define Characteristics

- Measuring Point Category

- Settlement by Consumption/Meter Reading: Measurement Type Characteristics

- Condition Types for Advance Payments and Flat Rates

- Assign Default Condition Type to Service Charge Key

- Assign RE-Specific Properties to G/L Account

- Assign Clearing Accounts to Cost Account

- Assign Reference Flow Types for Receivables/Credit from SCS

- SAP Managed Tags:

- SAP Real Estate Management,

- FIN Real Estate

Labels:

23 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

Related Content

- Navigating Tax Requirements in the Digital Era: Learn How SAP Helps You Revolutionizing Compliance in Financial Management Blogs by SAP

- Scale Up Subscription Initiatives with SAP Billing and Revenue Innovation Management in Financial Management Blogs by SAP

- SAP ECC Conversion to S/4HANA - Focus in CO-PA Costing-Based to Margin Analysis in Financial Management Blogs by SAP

- Understanding the Basic SAP Revenue Accounting and Reporting (RAR) in Financial Management Q&A

- Tax law changes you need to know for 2024 from Avalara in Financial Management Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 6 | |

| 3 | |

| 3 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |