- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Tax Service - Use the Tax Service Simulator

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

lucas_baldo

Discoverer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

11-22-2019

3:12 PM

You can check the way in which the tax service determines and calculates tax on sales or purchase transactions by using the Tax Service Simulator. This application allows you to enter details of a product (such as the ID, shipping information, and exemption details), import data in JSON format and see the request payload that the service generates.

Below, you can see the steps to access the Tax Service Simulator and an example scenario.

note: Tax Service Simulator is not available for Brazilian scenarios.

For more details on how to access it, please check the official documentation here.

Example: Here’s the scenario of a Canadian domestic sale of material from Alberta to Ontario:

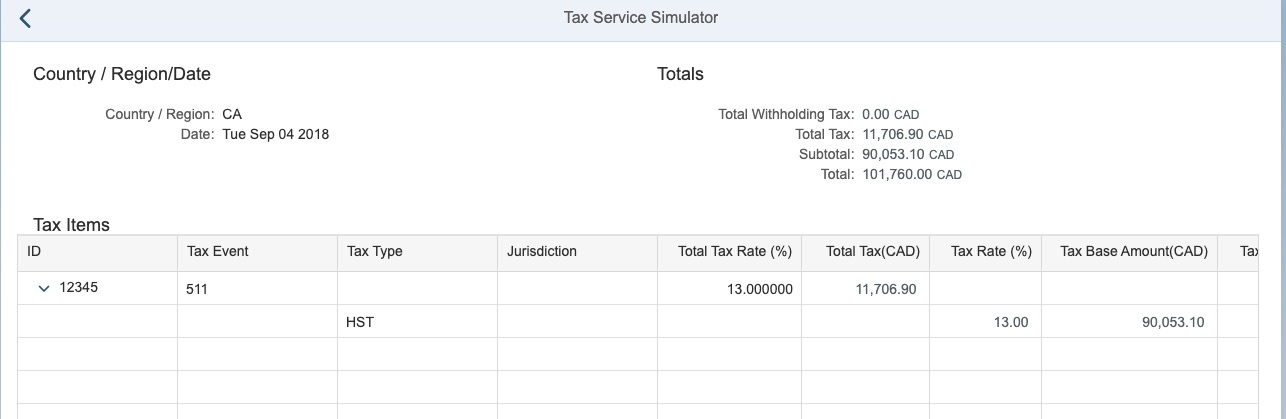

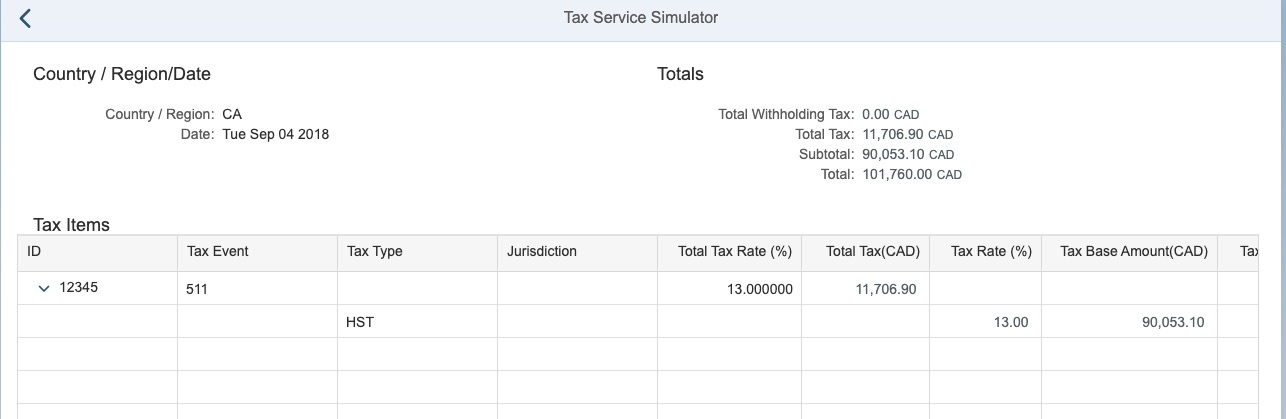

Example: See below the tax results for this example business scenario.

Result: You get a JSON response with exactly what the tax service sends back to your consuming application when it calls the tax service quote endpoint.

For this business scenario, the tax service responded as Regular HST Sales transaction, represented by taxcode 511. In taxValues, only HST tax was returned, with taxTypeCode 2 and dueCategory P, representing a payable position.

For more details about the tax service and how to test the service, have a look at the documentation in the SAP Help Portal.

Below, you can see the steps to access the Tax Service Simulator and an example scenario.

note: Tax Service Simulator is not available for Brazilian scenarios.

Access Tax Service Simulator from your SAP Cloud Platform account

- Login to your SAP Cloud Platform account.

- In the platform's cockpit, go to Applications > Subscriptions.

- In the HTML5 Applications, choose the simulationui application.

For more details on how to access it, please check the official documentation here.

Use Tax Service Simulator

- In the Tax Service Simulator selection screen, you can define the business scenario you want to simulate.

Example: Here’s the scenario of a Canadian domestic sale of material from Alberta to Ontario:

- Choose Simulate.

Example: See below the tax results for this example business scenario.

- Choose Show Payload Response.

Result: You get a JSON response with exactly what the tax service sends back to your consuming application when it calls the tax service quote endpoint.

For this business scenario, the tax service responded as Regular HST Sales transaction, represented by taxcode 511. In taxValues, only HST tax was returned, with taxTypeCode 2 and dueCategory P, representing a payable position.

For more details about the tax service and how to test the service, have a look at the documentation in the SAP Help Portal.

- SAP Managed Tags:

- Localization

Labels:

1 Comment

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

153 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

214 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- Value disappeared in Enhanced Limit tab in PR in Enterprise Resource Planning Q&A

- Posting Journal Entries with Tax Using SOAP Posting APIs in Enterprise Resource Planning Blogs by SAP

- Sales Organizational Structure - Ad Service Industry in Enterprise Resource Planning Q&A

- How to set up the Data Migration Cockpit in Enterprise Resource Planning Blogs by Members

- service object in es31 are popup to open Zdrive in Enterprise Resource Planning Q&A

Top kudoed authors

| User | Count |

|---|---|

| 11 | |

| 11 | |

| 7 | |

| 6 | |

| 6 | |

| 4 | |

| 4 | |

| 4 | |

| 4 | |

| 3 |