- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Next Level of Consolidation with SAP Group Reporti...

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member27

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

11-08-2019

2:25 PM

We have seen various tools and customizing done to achieve Financial Consolidation. Many teams based on the industry or processes they follow, consolidate data differently. In this blog post I will attempt to explain how to consolidation of your financial data is done using SAP Group Reporting.

SAP identified there is a demand for a tool which helps you in gathering all the financial, managerial, and operational data from business units, consolidate this data and optimise performance with real-time reporting and analytics. This is exactly what Group Reporting helps achieve.

As a principle before attempting to use any tool, it is important to understand the result. In our case consolidation is targeted towards 3 main areas

To consolidate Master Data, we are required to define and analyse data such as Consolidation Units, Consolidation Group Structure, Global Accounting Hierarchies and Financial Statements. Depending on what source system you use the process of consolidation differs.

If you use S/4 Hana as your Finance data source, then Group reporting has built-in integration with S/4 Hana, which helps in retrieving all the relevant data for consolidation.

If you use systems such as SAP ECC, or Non-S/4 Hana system there is no direct integration with SAP Group Reporting. The option available is a Flexible upload method, or by defining/creating data manually in Group reporting tool under corresponding applications.

SAP provides as part of Group Reporting a set of applications which allows the management of Master data for consolidation–

In order to define master data specific to each unit of the Organization like country, currency, currency translation method, validation methods, data transfer method (Flexible upload or Read from Universal Journal) and currency integration method (whether to use local currency defined in the Journal or from the uploaded document) the Consolidation Unit – Display application features are used.

This application enables us to assign Consolidation Units to Consolidation groups and configure parameters like Period of First consolidation, Period of Divestiture and the Consolidation methods for each of these units, like Parent method, Equity method or Purchase method.

This application enables us to configure hierarchies like Region, Legal, Line of Business, Customer Groups or Management based on various master data types like Units, Profit center, Segments which will be used in reporting. It is also used to define custom hierarchies with corresponding nodes and sub nodes.

For Example, when defining Region hierarchy based on Consolidation Units, the following structure is observed –

Mainly used to define the key element for the Consolidation process – Finance Statements. This is the basis for the Data collection, Posting and Reporting in consolidation. These items are used in balance sheets, Profit and Loss statements or for maintaining the statistical accounts.

In this application we define/display financial statements, Consolidation chart of accounts, Elimination, Currency translation and Role attributes. These FS items can be incorporated under the corresponding hierarchy in Manage Global Accounting Hierarchies application.

This application is used to validate Group Journal entry parameters - Period, Ledger, Chart of Account, Posting information, Transaction amount for each line items, and corresponding FS item details. It is also used to view details on the Shareholding percentage of all the consolidation units in their respective Consolidation Group.

In the details of the Journal entry there are 34 dimensions available that can be used for Group reporting. All the Journal entries are defined in the Local accounting and is displayed as part of Group reporting.

This starts with Setting up the Global parameters, where you select the Consolidation group and Unit (Optional), version and time period, COA and Ledger for running the Consolidation. You can define various versions for different consolidation types such as IFRS or Constant Currency based on your needs.

Then using the Data monitor application, we can validate the financial data reported by the Consolidation units of the selected Group. Various validation tasks include, Universal Journal release, Validation of Collected Data, Universal Journal validation, Net Income Calculation, Validation of Reported Data, Validation of Manually posted values, Currency Translation, and Validation of Standardized Data.

These Validation tasks can be defined and configured in Manage Data Validation tasks application. Users can select the existing standard financial rules or they can also define their own validation rules as per the requirements in the Define Rule expression section.

Once the data validation is successful, we move to Consolidation monitor application to perform the actual Consolidation tasks like Intercompany eliminations, Investment Consolidation and so on. You can monitor the overall status of the consolidation like Open, Initial stage, Error and so on.

With SAP Group reporting, you can add milestones for each Consolidation tasks. And you can monitor and validate each task.

When you complete the consolidation all the Overall status of the Consolidation group will be green and all the tasks are locked.

In Group reporting, we have the ability to perform the validations on Reported financial data in local currency, Reported financial data in group currency according to validation methods and on the Consolidated data. Validations are done with the defined validation methods based on financial principles like economic entity assumption or cost principle etc.

Group data analysis application helps users to analyse their consolidated financial statements, Balance sheets, Profit and Loss statements and also the operational data. Users can define and submit the Prompt parameters like Version, ledger, COA, Fiscal year and hierarchy to generate the Consolidation Report which can be exported into the file system.

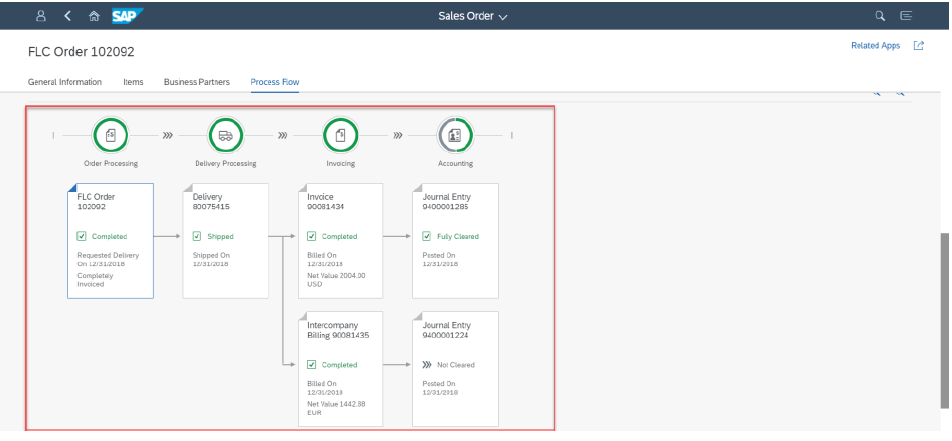

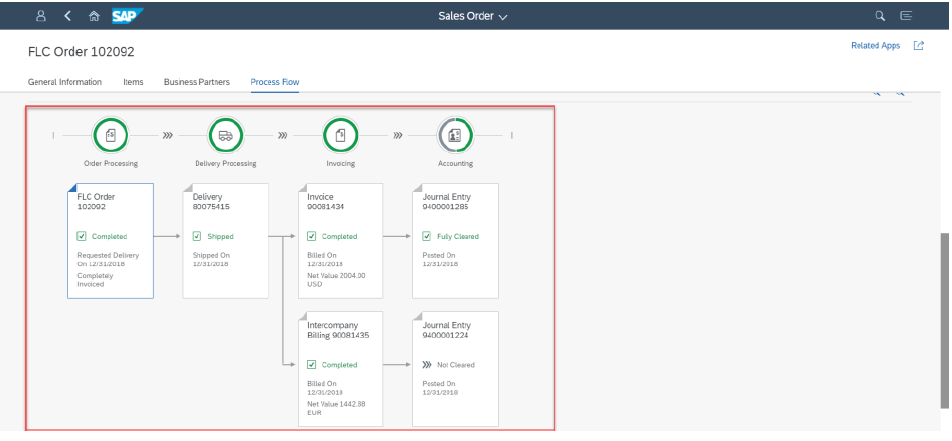

Based on the requirement users can define variants and perform reporting by different segments, dimensions and view underlying data for each line item. With its advanced capabilities SAP Group Reporting helps in analysis of each transaction with Process flow diagrams.

With its integration between SAC and S/4 Hana, users can perform reporting on the Realtime data using the live data connection and other advanced features available in SAC. We will go through the Reporting part of S/4 Group Reporting in a separate blog post.

Group reporting brings large improvements to the Consolidation process with its Simplified architecture, Continuous accounting and Unified local and group close. However, there are some limitations like Unavailable Custom extensions in Universal journal entry and Multicurrency reporting. Non-S/4 users have to rely on Manual FS Data mapping for Consolidation in Group reporting or they should get a separate license of SAP Group reporting Data collection for gathering their financial data for Consolidation.

Watch out for my next blog post that covers the detailed process of Financial Data mapping for Consolidation.

SAP identified there is a demand for a tool which helps you in gathering all the financial, managerial, and operational data from business units, consolidate this data and optimise performance with real-time reporting and analytics. This is exactly what Group Reporting helps achieve.

As a principle before attempting to use any tool, it is important to understand the result. In our case consolidation is targeted towards 3 main areas

- Master Data

- Process

- Reporting

Consolidation Master Data

To consolidate Master Data, we are required to define and analyse data such as Consolidation Units, Consolidation Group Structure, Global Accounting Hierarchies and Financial Statements. Depending on what source system you use the process of consolidation differs.

If you use S/4 Hana as your Finance data source, then Group reporting has built-in integration with S/4 Hana, which helps in retrieving all the relevant data for consolidation.

If you use systems such as SAP ECC, or Non-S/4 Hana system there is no direct integration with SAP Group Reporting. The option available is a Flexible upload method, or by defining/creating data manually in Group reporting tool under corresponding applications.

SAP provides as part of Group Reporting a set of applications which allows the management of Master data for consolidation–

Consolidation Unit - Display

In order to define master data specific to each unit of the Organization like country, currency, currency translation method, validation methods, data transfer method (Flexible upload or Read from Universal Journal) and currency integration method (whether to use local currency defined in the Journal or from the uploaded document) the Consolidation Unit – Display application features are used.

Manage Consolidation Group Structure – Group View

This application enables us to assign Consolidation Units to Consolidation groups and configure parameters like Period of First consolidation, Period of Divestiture and the Consolidation methods for each of these units, like Parent method, Equity method or Purchase method.

Manage Global Accounting Hierarchies

This application enables us to configure hierarchies like Region, Legal, Line of Business, Customer Groups or Management based on various master data types like Units, Profit center, Segments which will be used in reporting. It is also used to define custom hierarchies with corresponding nodes and sub nodes.

For Example, when defining Region hierarchy based on Consolidation Units, the following structure is observed –

- EU (Europe Region)

- SN023 (Germany)

- SN022 (Belgium)

- SN030 (France)

- NA (North America Region)

- SN010 (US West)

- SN011 (US East)

Define FS Items –

Mainly used to define the key element for the Consolidation process – Finance Statements. This is the basis for the Data collection, Posting and Reporting in consolidation. These items are used in balance sheets, Profit and Loss statements or for maintaining the statistical accounts.

In this application we define/display financial statements, Consolidation chart of accounts, Elimination, Currency translation and Role attributes. These FS items can be incorporated under the corresponding hierarchy in Manage Global Accounting Hierarchies application.

Display Group Journal Entry –

This application is used to validate Group Journal entry parameters - Period, Ledger, Chart of Account, Posting information, Transaction amount for each line items, and corresponding FS item details. It is also used to view details on the Shareholding percentage of all the consolidation units in their respective Consolidation Group.

In the details of the Journal entry there are 34 dimensions available that can be used for Group reporting. All the Journal entries are defined in the Local accounting and is displayed as part of Group reporting.

Consolidation Process

This starts with Setting up the Global parameters, where you select the Consolidation group and Unit (Optional), version and time period, COA and Ledger for running the Consolidation. You can define various versions for different consolidation types such as IFRS or Constant Currency based on your needs.

Then using the Data monitor application, we can validate the financial data reported by the Consolidation units of the selected Group. Various validation tasks include, Universal Journal release, Validation of Collected Data, Universal Journal validation, Net Income Calculation, Validation of Reported Data, Validation of Manually posted values, Currency Translation, and Validation of Standardized Data.

These Validation tasks can be defined and configured in Manage Data Validation tasks application. Users can select the existing standard financial rules or they can also define their own validation rules as per the requirements in the Define Rule expression section.

Once the data validation is successful, we move to Consolidation monitor application to perform the actual Consolidation tasks like Intercompany eliminations, Investment Consolidation and so on. You can monitor the overall status of the consolidation like Open, Initial stage, Error and so on.

With SAP Group reporting, you can add milestones for each Consolidation tasks. And you can monitor and validate each task.

When you complete the consolidation all the Overall status of the Consolidation group will be green and all the tasks are locked.

In Group reporting, we have the ability to perform the validations on Reported financial data in local currency, Reported financial data in group currency according to validation methods and on the Consolidated data. Validations are done with the defined validation methods based on financial principles like economic entity assumption or cost principle etc.

Consolidation Reporting

Group data analysis application helps users to analyse their consolidated financial statements, Balance sheets, Profit and Loss statements and also the operational data. Users can define and submit the Prompt parameters like Version, ledger, COA, Fiscal year and hierarchy to generate the Consolidation Report which can be exported into the file system.

Based on the requirement users can define variants and perform reporting by different segments, dimensions and view underlying data for each line item. With its advanced capabilities SAP Group Reporting helps in analysis of each transaction with Process flow diagrams.

With its integration between SAC and S/4 Hana, users can perform reporting on the Realtime data using the live data connection and other advanced features available in SAC. We will go through the Reporting part of S/4 Group Reporting in a separate blog post.

Group reporting brings large improvements to the Consolidation process with its Simplified architecture, Continuous accounting and Unified local and group close. However, there are some limitations like Unavailable Custom extensions in Universal journal entry and Multicurrency reporting. Non-S/4 users have to rely on Manual FS Data mapping for Consolidation in Group reporting or they should get a separate license of SAP Group reporting Data collection for gathering their financial data for Consolidation.

Watch out for my next blog post that covers the detailed process of Financial Data mapping for Consolidation.

- SAP Managed Tags:

- SAP Analytics Cloud,

- SAP S/4HANA Finance for group reporting,

- SAP S/4HANA

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- One legal entity with multiple company code or One company code with multiple plant-Changes to setup in Enterprise Resource Planning Q&A

- Group Reporting: Custom fields not included in data release for plandata in Enterprise Resource Planning Q&A

- SAP Document and Reporting Compliance Brazil: Dashboard do Usage Analytics in Enterprise Resource Planning Blogs by SAP

- Learn about Localization with SAP’s Experts at the DSAG-SAP Globalization Symposium 2024 in Enterprise Resource Planning Blogs by SAP

- Group Reporting Data Audit in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 5 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |