- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- SAP Credit Management in S/4HANA (1909)

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Product and Topic Expert

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

11-06-2019

2:08 PM

This blog provides an update on Credit Management capabilities based upon the S/4HANA 1909 release.

Basic Overviews of SAP Credit Management

The following blogs provide excellent overviews of SAP Credit Management:

SAP Credit management: Functional overview

SAP Credit Management in S/4HANA

Features of SAP Credit Management in S/4HANA

Overview of the features of Credit Management in S/4HANA from a functional perspective:

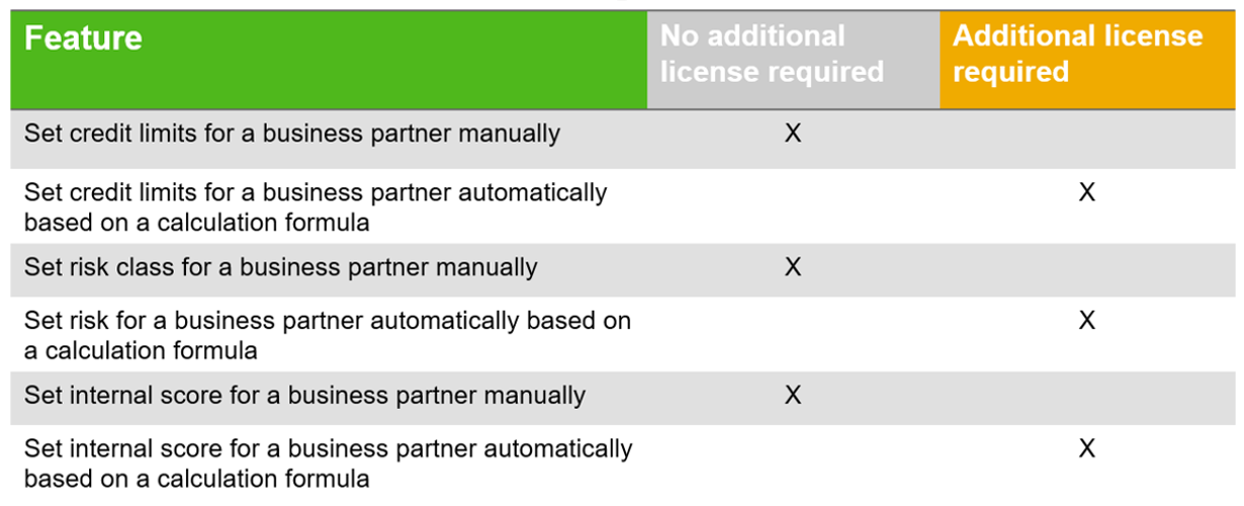

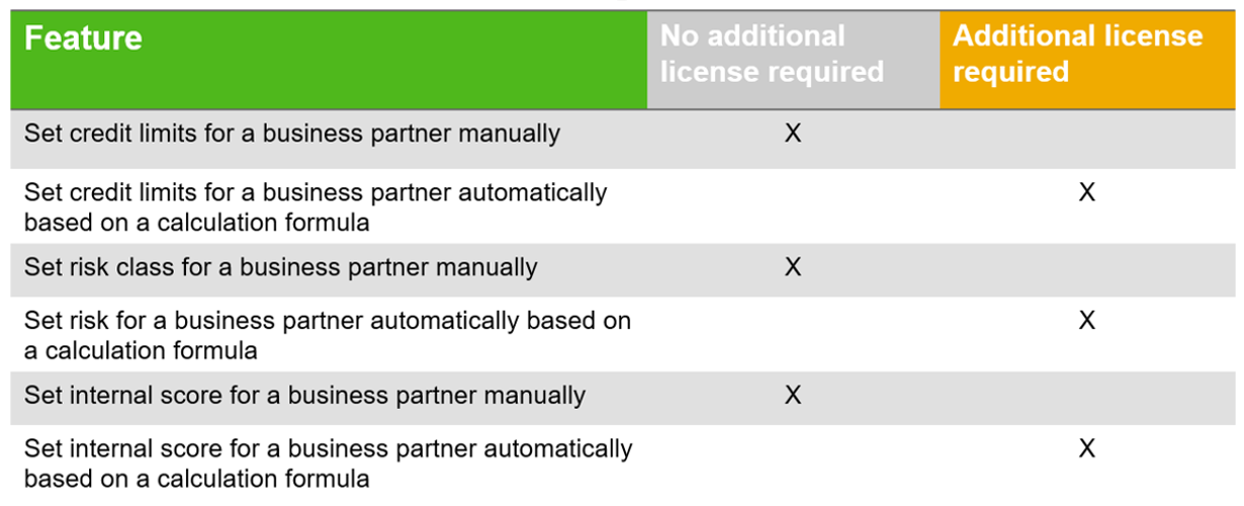

What is Included in the Basic License of SAP Credit Management in S/4HANA?

The basic license includes the manual features for setting credit limits, setting risk classes and setting an internal score for a Business Partner. If an automated calculation is needed, then an additional license is required for the Advanced Credit Management with S/4HANA option.

Summary of features:

For the link to an external credit agency, an xml formatted file can be added as project work or the data can be input manually on the Business Partner as a part of the base license. An additional license is required to use the cloud-based link to credit agencies. The cloud-based service provides about 20-30 credit agencies such as Dun & Bradstreet right out of the box.

SAP Cloud for Credit Integration

An additional option for credit integration is the SAP Cloud for Credit Integration application service. SAP S/4HANA Cloud for credit integration allows you to use external credit risk information in order to make better credit decisions and to automate the monitoring of your customers’ credit risk.

Features:

New capabilities for SAP S/4HANA 1909:

Schedule Credit Management Jobs

The following update jobs may now be scheduled:

Additional details can be located at: https://help.sap.com/viewer/a8aaa72cb39a48528b39b61623c15baa/1909.000/en-US/83d992d1e8c847678fb89bd9...

Fiori Credit Management Apps

New Fiori Credit Management Apps for SAP S/4HANA 1909:

Additional Fiori Credit Management Apps for SAP S/4HANA 1909:

Where is Credit Management Information displayed in S/4HANA?

The Business Partner displays where the Credit Management data is stored. In the BP Role of “SAP Credit Management” the Scoring Rules, Risk Class, Check Rule and the integration to External Credit Agencies are all listed. This can be accessed via the GUI t/code “BP” (refer to the Credit Profile and Creditworthiness tabs) or in Fiori by the “Manage Business Partner” app. Here is an example of the BP t/code:

What is the Minimum Configuration Required for SAP Credit Management in S/4HANA?

Following the “Principle of One “where there was overlapping functionality across applications, the S/4HANA solution is simplified to one. At its core, SAP Credit Management in S/4HANA is for all intents and purposes FSCM which was re-branded in S/4HANA. The former AR and SD features were then added. SAP Credit Management in S/4HANA resides in the Finance Module. For the minimum configuration of SAP Credit Management in S/4HANA, perform the “required” actions in the Task List PDF attached to the SAP Note 2270544.

2270544 - S4TWL - Credit Management

Summary

This blog identified the major changes in Credit Management functionality in S/4HANA 1909. Let me know what you think of this blog or if you have ideas for other blogs that are needed.

Basic Overviews of SAP Credit Management

The following blogs provide excellent overviews of SAP Credit Management:

SAP Credit management: Functional overview

SAP Credit Management in S/4HANA

Features of SAP Credit Management in S/4HANA

Overview of the features of Credit Management in S/4HANA from a functional perspective:

What is Included in the Basic License of SAP Credit Management in S/4HANA?

The basic license includes the manual features for setting credit limits, setting risk classes and setting an internal score for a Business Partner. If an automated calculation is needed, then an additional license is required for the Advanced Credit Management with S/4HANA option.

Summary of features:

For the link to an external credit agency, an xml formatted file can be added as project work or the data can be input manually on the Business Partner as a part of the base license. An additional license is required to use the cloud-based link to credit agencies. The cloud-based service provides about 20-30 credit agencies such as Dun & Bradstreet right out of the box.

SAP Cloud for Credit Integration

An additional option for credit integration is the SAP Cloud for Credit Integration application service. SAP S/4HANA Cloud for credit integration allows you to use external credit risk information in order to make better credit decisions and to automate the monitoring of your customers’ credit risk.

Features:

- Connect to the world’s leading credit bureaus

- Seamless integration of credit risk evaluation and reports delivered by credit agencies

- More than 10 agencies already available.

New capabilities for SAP S/4HANA 1909:

Schedule Credit Management Jobs

The following update jobs may now be scheduled:

- Repeat the credit check of SD documents

- released documents are checked only if the validity period for release is over (number of days).

- re-check SD documents to find out if the creditworthiness of the customer has changed in the period between the sales order date and the delivery date.

- re-check SD documents that have passed the initial credit check successfully, but for which in the meantime negative events might have happened. For example, the credit limit of the customer might have been reduced or other the dunning level might have been raised.

- Update the score for business partners

- perform mass updates to the score of business partner

- You can restrict update by Business Partner, Rule, and Valid-to date of score.

- Update the credit limit for business partners

- perform mass changes to the credit limit in the credit account of business partners

- restrict updates by:

- Business partner, Rating procedure, Credit segment, and Valid-to date of the credit limit

- the field Only Blocked in Credit Management, then only those credit accounts that are blocked in Credit Management are selected,

- the field Only Special Attention, then only those credit accounts that are marked for special attention are selected

- Update the rule for scoring and credit limit calculation, and the checking rule

- restrict updates by filtering on the previous rule for scoring and credit limit calculation and/or the business partner

- Assign the Credit Management role to business partners

- select on or more business partners to assign them the Credit Management role

Additional details can be located at: https://help.sap.com/viewer/a8aaa72cb39a48528b39b61623c15baa/1909.000/en-US/83d992d1e8c847678fb89bd9...

Fiori Credit Management Apps

New Fiori Credit Management Apps for SAP S/4HANA 1909:

- Analyze Credit Loss Allowances

- Create Credit/Debit Memos (Mass Processing)

- Schedule Credit Management Jobs

- Manage Sales Document Workflows / Manage Credit Memo Request Workflow

Additional Fiori Credit Management Apps for SAP S/4HANA 1909:

- Analyze Credit Exposure

- Confirm Customer List (Accounting)

- Credit Limit Utilization (S/4HANA)

- Display Business Partner

- Display Credit Data - Credit Profile

- Display Credit Data - Segment

- Display Credit Exposure

- Display Credit Limit Utilization

- Display Credit Management Log

- Display Credit Master Data

- Display Payment Behavior

- Import External Credit Information

- Manage Business Partner - Credit Profile

- Manage Credit Cases

- Manage Credit Rules

- Manage Documented Credit Decisions

- Navigate to specific DCD

Where is Credit Management Information displayed in S/4HANA?

The Business Partner displays where the Credit Management data is stored. In the BP Role of “SAP Credit Management” the Scoring Rules, Risk Class, Check Rule and the integration to External Credit Agencies are all listed. This can be accessed via the GUI t/code “BP” (refer to the Credit Profile and Creditworthiness tabs) or in Fiori by the “Manage Business Partner” app. Here is an example of the BP t/code:

What is the Minimum Configuration Required for SAP Credit Management in S/4HANA?

Following the “Principle of One “where there was overlapping functionality across applications, the S/4HANA solution is simplified to one. At its core, SAP Credit Management in S/4HANA is for all intents and purposes FSCM which was re-branded in S/4HANA. The former AR and SD features were then added. SAP Credit Management in S/4HANA resides in the Finance Module. For the minimum configuration of SAP Credit Management in S/4HANA, perform the “required” actions in the Task List PDF attached to the SAP Note 2270544.

2270544 - S4TWL - Credit Management

Summary

This blog identified the major changes in Credit Management functionality in S/4HANA 1909. Let me know what you think of this blog or if you have ideas for other blogs that are needed.

- SAP Managed Tags:

- SAP S/4HANA,

- SAP S/4HANA Finance

Labels:

6 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

152 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

208 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

88

Related Content

- How to manage two credit limits for one customer in same sales area ? in Enterprise Resource Planning Q&A

- Manage Supply Shortage and Excess Supply with MRP Material Coverage Apps in Enterprise Resource Planning Blogs by SAP

- Business Rule Framework Plus(BRF+) in Enterprise Resource Planning Blogs by Members

- Crédit management (OVA8) in Enterprise Resource Planning Q&A

- SAP ERP Functionality for EDI Processing: UoMs Determination for Inbound Orders in Enterprise Resource Planning Blogs by Members

Top kudoed authors

| User | Count |

|---|---|

| 8 | |

| 6 | |

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 |