- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- SD Condition Based Down Payments

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member56

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

09-19-2019

8:20 AM

Introduction:

Often in business, especially in a make-to-order environment, customers may be required to pay some amount in advance before delivery of goods.

Normally, down payment agreements are made for producing and delivering goods to customers in the capital goods, or plant engineering and construction industries.

Down payments are payments made before completion of the product, with no interest. They represent short or medium term outside capital procurement and therefore improve the company’s liquidity situation.

This process is used to create requests for down payment, record the receipt of the down payment, create a final invoice after the deduction of the down payment received and a receipt of the final amount due on the invoice.

The integrated process allows for a proper document flow to be maintained between the sales and financial transactions.

Down payments form part of the agreement with the customer and are saved in the sales order.

The value of the agreed down payment can either be created as an amount or percentage value of the item.

Key Process Flow:

- Sales Order Entry - The down payment agreement is stored in the document condition AZWA in the sales document. Supported sales documents are quotations, orders, and debit memo requests.

- Post Down Payment - The incoming payment is posted in the FI system (transaction f-29). Here it is important that the accounting item is assigned to the sales and distribution document number.

- Delivery Processing - Depending on the process, the system creates a delivery

- Post Goods Issue

- Billing - Down payment clearing is carried out in the billing document. The system does not generate a down payment clearing line. Instead, it sets a down payment value that is to be cleared in the document condition AZWB. Order-related or delivery-related billing can be carried out.

- Down payment clearing

Prerequisite:

It must be ensured that the business function SD_01 under

ENTERPRISE_BUSINESS_FUNCTIONS is activated via T-code: SFW5. It’s the technical prerequisite for the condition-based down payment function.

Getting Started

Customizing – Sales & Distribution

Enhancing Pricing Procedure with Condition Type: AZWA, AZWB, AZDI

These condition types are supplied in the standard system:

AZWA for debit down payments. AZWA has the calculation type B (fixed amount). It is configured as a group condition and can be entered for the header or item.

AZWB for billing. AZWB has the calculation type G (formula) and the condition category e (down payment demand/settlement).

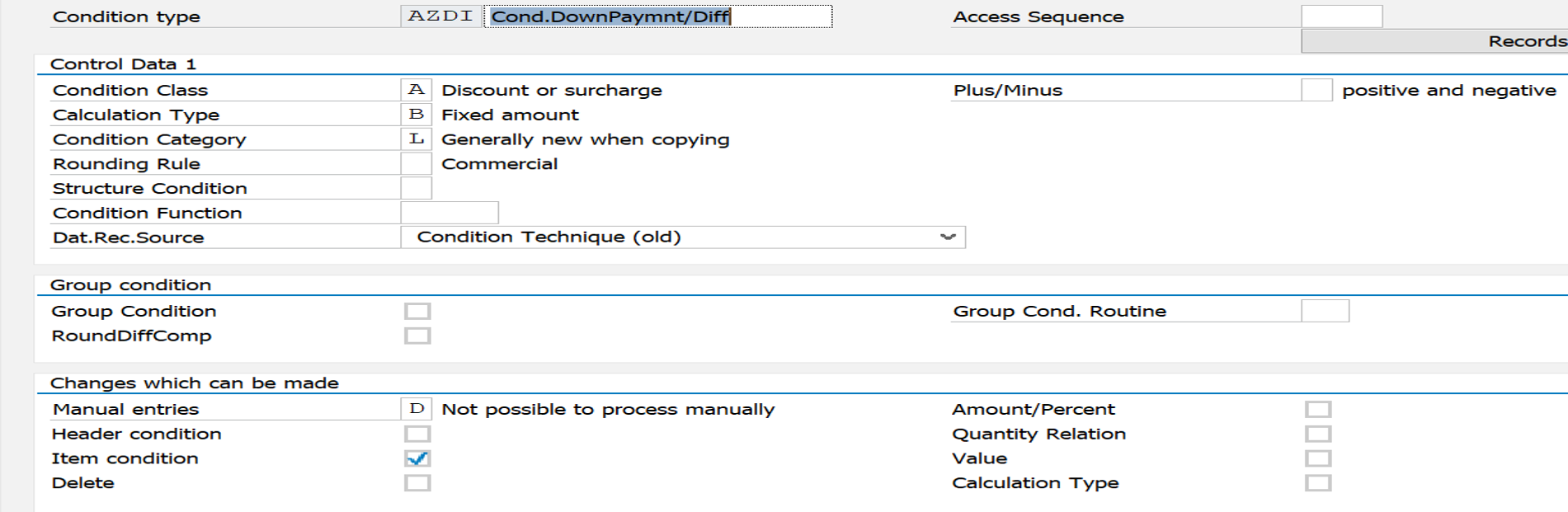

AZDI for rounding differentials balance. AZDI has the calculation type B (fixed amount), the condition class A (surcharges or discounts), condition type L (generally new when copying) and this condition cannot be edited manually. It is an item condition.

Enhancing Pricing Procedure with Condition Type: AZWA, AZWB, AZDI

Condition Type: AZWA

Condition Type: AZWB

Condition Type: AZDI

Use of Condition Type AZWR:

The condition type AZWR is used for down payment values that have already been provided, but which have not yet been cleared. This condition type must be included in the relevant pricing procedure before output tax with condition 2 (item with pricing) and the calculation formula 48 (down payment clearing value must not be bigger than the item value).

Before applying condition AZWR, create a subtotal with the base value calculation formula 2 (net value). If condition AZWR is changed manually, you can retrieve information about the original system proposal from the subtotal.

Maintain the printing indicator.

Condition type AZWR has calculation type B (fixed amount) and condition category E (down payment request / clearing).

Condition Type: AZWR

Customizing – Financial Accounting:

- Configure Reconciliation Account (OBXR) - Assign the field status area G031 for the G/L accounts Down Payments Received and Down Payments Requested chosen.

- Set Accounting Configuration (OBXB) - Configure the posting key for the down payments (ANZ) and the output tax billing (MVA).

- Configure posting Key (OB41) - Sales Order must be set as optional entry for the posting key 19.

- Set field status area (OB14) - You must set Sales Order as optional entry for field status variant 0001, field status group G031.

- Assign field status variants to company code (OBC5)

Business Process:

- Sales Order Entry

- Post Down Payment

- Delivery Processing and PGI

- Billing

Conclusion:

Down Payment Clearing - During Final Billing, the accounting document to settles the down-payment amount per the value in condition type AZWB. In the customer line item report via transaction code FBL5N select the Cleared items radial button and the Normal items tickbox. Execute the report and you can see that the customer invoice you created and the normalized transfer posting you made are now cleared. At this point the SAP customer down payment process is complete!

References and Further Reading:

1788841 - Consulting note for condition-based down payments

2714746 - Down payment clearing and delivered quantity

213526 - Customizing of down payment processing SD/FI

- SAP Managed Tags:

- SD Sales

15 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- Advance Return Management complete configuration(SAP ARM) in Enterprise Resource Planning Blogs by Members

- Posting Journal Entries with Tax Using SOAP Posting APIs in Enterprise Resource Planning Blogs by SAP

- Quick Start guide for PLM system integration 3.0 Implementation/Installation in Enterprise Resource Planning Blogs by SAP

- Business Rule Framework Plus(BRF+) in Enterprise Resource Planning Blogs by Members

- Introducing the market standard of electronic invoicing for the United States in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 6 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |