- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- EU VAT quick fix 3-blog 1

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

RishabBucha

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

08-14-2019

1:31 PM

Introduction

The European Council has agreed to proposals from the European Commission to apply four ‘quick fixes’ to the current EU VAT system in February. Assuming that the European Parliament issues a favourable opinion in relation to these proposals, the Commission’s proposed VAT Directive will become effective throughout the EU on 1 January 2020. Latest on 2nd October 2018, the Council agreed on four adjustments to the EU's current VAT rules to fix specific issues.

There are four key adjustments concerns below areas namely:-

The adjustments will have implication on your business and we explore how you can manage these changes effectively in our ERP with focus on SAP. As each of the topic is quite large we will explore one of the in each of blog/ blogs and provide possibilities for business to comply with them. Naturally each business is different and uses their SAP system differently and their specific cases can be discussed further.

Link to Quick fix:-

https://circabc.europa.eu/sd/a/2c36f43c-80b8-4fb1-a209-a2c30e060eae/VEG%20080%20-%20VAT%20quick%20fi...

https://circabc.europa.eu/sd/a/7fcfb315-fb0a-4369-ba09-4a5abdced628/VEG%20079%20-%20VAT%20quick-fixe...

Problem Statement

In the first case we will explore the point no. 3- “Mandatory VAT identification number to apply the zero VAT rate”. As per this quick fix the implication is:-

“A customer’s valid VAT identification number a formal requirement for applying the zero VAT rate to intra-Community supplies of goods. But a ruling from Court of Justice of the European Union (CJEU) that, in principle, a taxable person only has to comply with the material conditions in order to apply the zero VAT rate. Therefore, the zero VAT rate cannot formally be refused due to the mere fact that a taxable person did not receive a valid VAT identification number from its customer.”

The text from VAT group is shown below and key point is availability of feature to allow Customer to provide the VAT ID to supplier.

Implication of the Fix on ERP

The quick fix 3 has below key implication for your ERP :-

Possible Solution (Specific to SAP)

We propose below setup in SAP to ensure provision to comply with the quick fix 3. We will cover the setup and required configuration to allow the setup for the solution proposed below.

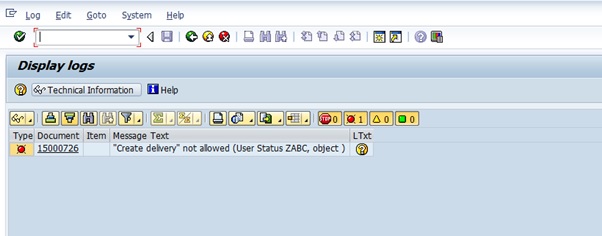

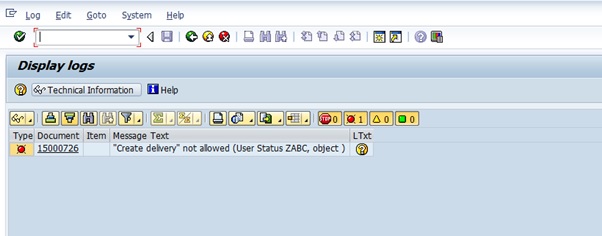

Additionally in case of extra validation needed a custom status profile can be setup on the sales order, this allows proper reporting and follow up for the orders where the VAT ID is not captured.

So with some custom development ( to be provided in next blog) we can ensure that if the VAT id field is filled the order status is updated.

We can also configure Delivery block in system to check against the order status.

However additional setup can be done to ensure the VAT ID is checked against the VIES provided check.

This will be web service call from SAP to VIES provided web service call. The technical information is can be obtained from:-

http://ec.europa.eu/taxation_customs/vies/technicalInformation.html

In the next blog we will demonstrate the various scenario ( e.g. EDI order etc.) and provide configuration for the proposal if client wants to go ahead with the proposed solution

https://blogs.sap.com/2019/08/19/eu-vat-quick-fix-3-blog-2/

Please do provide your feedback in term of comments or message on Linkedin and would love to know your perspective on this.

Regards

Rishab Bucha

Astron Technologies.

The European Council has agreed to proposals from the European Commission to apply four ‘quick fixes’ to the current EU VAT system in February. Assuming that the European Parliament issues a favourable opinion in relation to these proposals, the Commission’s proposed VAT Directive will become effective throughout the EU on 1 January 2020. Latest on 2nd October 2018, the Council agreed on four adjustments to the EU's current VAT rules to fix specific issues.

There are four key adjustments concerns below areas namely:-

- Treatment of call-off stock

- Mandatory VAT identification number to apply the zero VAT rate to intra-EU supplies

- Evidence of intra-EU supplies

- Chain transactions

The adjustments will have implication on your business and we explore how you can manage these changes effectively in our ERP with focus on SAP. As each of the topic is quite large we will explore one of the in each of blog/ blogs and provide possibilities for business to comply with them. Naturally each business is different and uses their SAP system differently and their specific cases can be discussed further.

Link to Quick fix:-

https://circabc.europa.eu/sd/a/2c36f43c-80b8-4fb1-a209-a2c30e060eae/VEG%20080%20-%20VAT%20quick%20fi...

https://circabc.europa.eu/sd/a/7fcfb315-fb0a-4369-ba09-4a5abdced628/VEG%20079%20-%20VAT%20quick-fixe...

Problem Statement

In the first case we will explore the point no. 3- “Mandatory VAT identification number to apply the zero VAT rate”. As per this quick fix the implication is:-

“A customer’s valid VAT identification number a formal requirement for applying the zero VAT rate to intra-Community supplies of goods. But a ruling from Court of Justice of the European Union (CJEU) that, in principle, a taxable person only has to comply with the material conditions in order to apply the zero VAT rate. Therefore, the zero VAT rate cannot formally be refused due to the mere fact that a taxable person did not receive a valid VAT identification number from its customer.”

The text from VAT group is shown below and key point is availability of feature to allow Customer to provide the VAT ID to supplier.

Implication of the Fix on ERP

The quick fix 3 has below key implication for your ERP :-

- Check and ensure the VAT ID present for your customer in ERP is current and ensure mechanism to have ERP master data is kept up to date.

- Ensure your ERP has option to capture the VAT ID from customer in case customer can provide it.

- Allow control on the order management to check the orders where VAT id is not captured ( and is not present in Customer master)

- Ensure VAT determination can handle the VAT id provided by Customer ( in case customer has multiple VAT registration in EU).

Possible Solution (Specific to SAP)

We propose below setup in SAP to ensure provision to comply with the quick fix 3. We will cover the setup and required configuration to allow the setup for the solution proposed below.

| Implication from Quick fix 3 | Setup in SAP |

| Allow customer to provide VAT ID | Ensure SAP system has ability to capture the VAT ID on the order. Additionally allow control on Sales order entry to check the order where the VAT ID is not provided by order entry ( EDI order etc) |

| Validation for VAT ID | Ensure check is done on the SAP customer master data with EU vies system. |

- Allow capture of customer VAT id during the order entry:-At the Sales item level set of a custom field allows the entry of VAT ID from customer. This can be done at the sales header level.

- VAT number can be defaulted based on customer master (where applicable).

Additionally in case of extra validation needed a custom status profile can be setup on the sales order, this allows proper reporting and follow up for the orders where the VAT ID is not captured.

So with some custom development ( to be provided in next blog) we can ensure that if the VAT id field is filled the order status is updated.

We can also configure Delivery block in system to check against the order status.

- Validation of SAP VAT data- SAP will allow check on the VAT ID based on the ISO code e.g.

However additional setup can be done to ensure the VAT ID is checked against the VIES provided check.

This will be web service call from SAP to VIES provided web service call. The technical information is can be obtained from:-

http://ec.europa.eu/taxation_customs/vies/technicalInformation.html

In the next blog we will demonstrate the various scenario ( e.g. EDI order etc.) and provide configuration for the proposal if client wants to go ahead with the proposed solution

https://blogs.sap.com/2019/08/19/eu-vat-quick-fix-3-blog-2/

Please do provide your feedback in term of comments or message on Linkedin and would love to know your perspective on this.

Regards

Rishab Bucha

Astron Technologies.

- SAP Managed Tags:

- SAP Tax Compliance

2 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- Quick Start guide for PLM system integration 3.0 Implementation/Installation in Enterprise Resource Planning Blogs by SAP

- Introducing the GROW with SAP, core HR add-on in Enterprise Resource Planning Blogs by SAP

- Itemized Down Payment Clearing in MIRO in Enterprise Resource Planning Q&A

- FAQ on Upgrading SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- SAP S4 Hana Cloud trial user account in Enterprise Resource Planning Q&A

Top kudoed authors

| User | Count |

|---|---|

| 6 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |