- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Depreciation key configuration- Degressif deprecia...

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member52

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

07-29-2019

12:45 PM

Hi All,

It's always been one of my dream to have my own blog to share my learning but never dared as few thoughts stopped me taking the STEP. But today i have decided to write and here I am writing my first blog post.

In this very first post, i am sharing depreciation key configuration for degressive depreciation with an example below.

About Degressif depreciation:

1. Degressif depreciation is used to calculate French tax depreciation.

1.Depreciation should be calculated on the residual value and at a specific depreciation rate(1.25 in example).

2. When the dégressif depreciation becomes less than (St.line) , then following months depreciation should retain the (St.line) amount. (retained amount: 391.93 in example).

To achieve this requirement, a depreciation key needs to be created as explained in steps below:

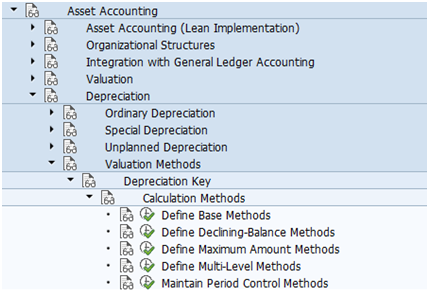

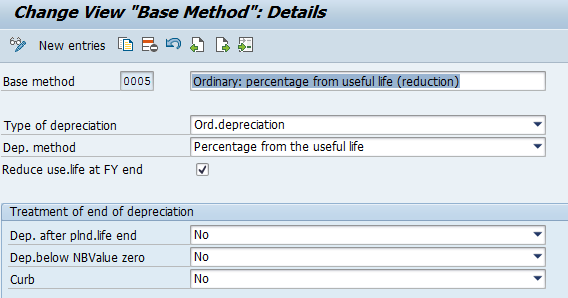

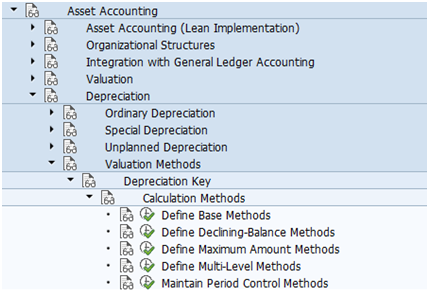

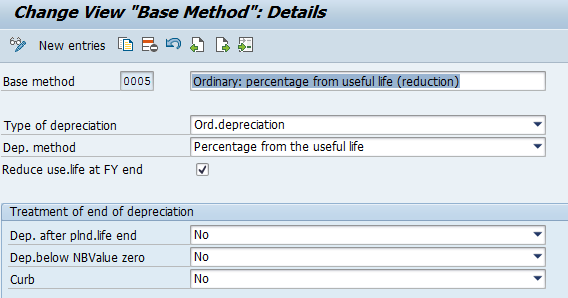

1.Base Method: This method used to calculate the depreciation .Generally base methods supplied by SAP are enough to meet any requirement.

use existing Base method 0007(phase1) and 0005(phase2) for the above scenario.

2. Declining-Balance Method: Now as there is certain rate to be applied on depreciation calculated from the above method. We need to maintain that %age in this method

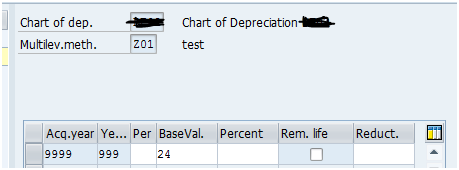

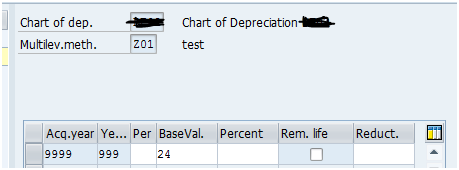

3. Multilevel method: If you observe, degressif depreciation is calculated by (NBV/total useful life) every time and (St.line) by the(( NBV of degressif depreciation) / remaining life).

This setting is made in Multi level method. We create two multilevel methods to get deprecation for both the methods.

MLM for Degressif depn(phase1)

MLM for (St.line) depn (phase2)

Base value

Note: Rem.life indicator is set as (St.line) column depreciation is calculated by NBV of degressif depreciation//rem.life .

Now we are ready to create the depreciation key using above methods.

Depreciation key tcode – AFAMA

Our depreciation key is going to have two phases as changeover is required in year 2021 because actual degrissf dep ((2743.49/10)*1.25= 342.93) is < st.line depn (2743.49/7 = 391.93).

PHASE1- Declining based depreciation

PHASE2- ( St.line) depreciation

Now let's create asset and assign dep key and see how the values are calculated in SAP.

Hope you find this useful. Your feedback and suggestions are highly appreciated.

Quote: "The First step is you have to say that you can"

Thank You,

Nikhila

It's always been one of my dream to have my own blog to share my learning but never dared as few thoughts stopped me taking the STEP. But today i have decided to write and here I am writing my first blog post.

In this very first post, i am sharing depreciation key configuration for degressive depreciation with an example below.

About Degressif depreciation:

1. Degressif depreciation is used to calculate French tax depreciation.

1.Depreciation should be calculated on the residual value and at a specific depreciation rate(1.25 in example).

2. When the dégressif depreciation becomes less than (St.line) , then following months depreciation should retain the (St.line) amount. (retained amount: 391.93 in example).

To achieve this requirement, a depreciation key needs to be created as explained in steps below:

1.Base Method: This method used to calculate the depreciation .Generally base methods supplied by SAP are enough to meet any requirement.

use existing Base method 0007(phase1) and 0005(phase2) for the above scenario.

2. Declining-Balance Method: Now as there is certain rate to be applied on depreciation calculated from the above method. We need to maintain that %age in this method

3. Multilevel method: If you observe, degressif depreciation is calculated by (NBV/total useful life) every time and (St.line) by the(( NBV of degressif depreciation) / remaining life).

This setting is made in Multi level method. We create two multilevel methods to get deprecation for both the methods.

MLM for Degressif depn(phase1)

MLM for (St.line) depn (phase2)

Base value

Note: Rem.life indicator is set as (St.line) column depreciation is calculated by NBV of degressif depreciation//rem.life .

Now we are ready to create the depreciation key using above methods.

Depreciation key tcode – AFAMA

Our depreciation key is going to have two phases as changeover is required in year 2021 because actual degrissf dep ((2743.49/10)*1.25= 342.93) is < st.line depn (2743.49/7 = 391.93).

PHASE1- Declining based depreciation

PHASE2- ( St.line) depreciation

Now let's create asset and assign dep key and see how the values are calculated in SAP.

Hope you find this useful. Your feedback and suggestions are highly appreciated.

Quote: "The First step is you have to say that you can"

Thank You,

Nikhila

- SAP Managed Tags:

- FIN Asset Accounting

7 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- Is it possible to group all open items into a single payment document? in Enterprise Resource Planning Q&A

- License Type Configuration Vs. Item Category in Enterprise Resource Planning Q&A

- SPRO configuration to track changes to Batch master field MCHA-SGT_SCAT(stock segment) in Enterprise Resource Planning Q&A

- Explanation of the Delta Posting Logic in Advanced Foreign Currency Valuation in Enterprise Resource Planning Blogs by SAP

- Advance Return Management complete configuration(SAP ARM) in Enterprise Resource Planning Blogs by Members

Top kudoed authors

| User | Count |

|---|---|

| 6 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |