- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Vertex Configuration in SAP Business ByDesign

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member56

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

05-03-2019

11:11 AM

Introduction

Vertex is a Tax Provider in the United States which streamlines the process of taxation there. During tax calculation, SAP Business ByDesign makes a Soap call to Vertex by sending the document date, document types, addresses including postal codes, etc. and Vertex returns Tax Details, Jurisdiction Codes, Jurisdiction Types, and names, etc. The Vertex tax provider calculates and returns accurate taxes applicable to the sale or purchase of goods and services.

Preparation

In order to determine and calculate taxes using Vertex integration, some preparation is necessary. It's a two-step process: -

Step 1: Scoping In Vertex within ByDesign.

Following are the steps to scope in Vertex within the ByDesign System: –

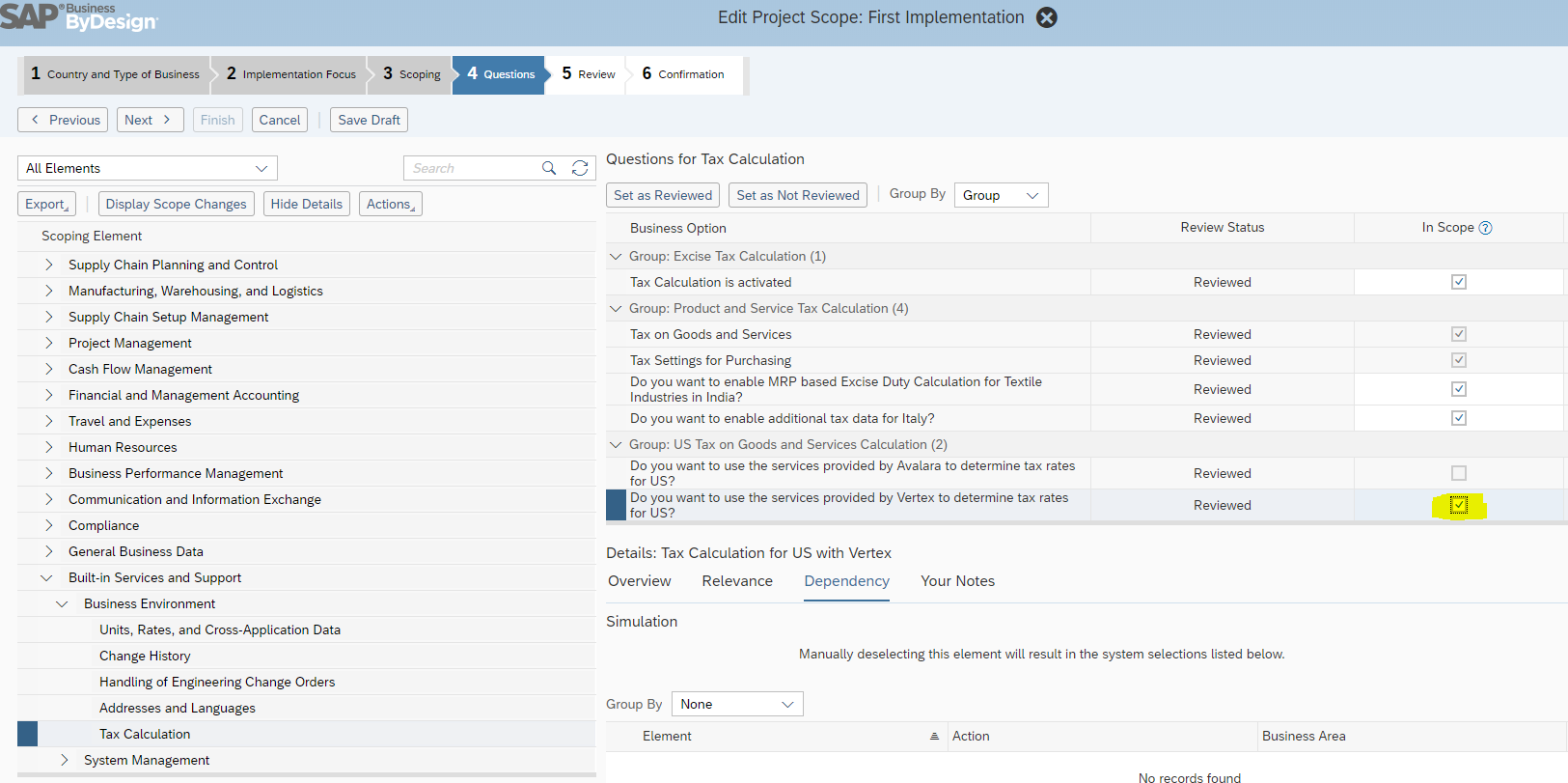

- Go to w/c Business Configuration -> Implementation Projects.

- Choose the main project and click on “Edit project scope”.

- Proceed to step 4 “Questions”

- Select Scoping Element “Tax Calculation” via path “Built-in Services and Support” -> “Business Environment” -> “Tax Calculation” and answer the question “Do you want to use the services provided by Vertex to determine tax rates for the US?” with “Yes”.

- Save the changes to trigger a Business Configuration deployment.

Step 2: Setup for Communication to Vertex.

Following are the steps to set up communication with Vertex: –

- Go to w/c Application and User Management -> Communication Systems.

- Create a new Communication System. Give hostname as “bydcsconnect.vertexsmb.com”. Mention the System Instance as per the below screenshot. Save the communication system and set it to Active by clicking on Action->Set to Active.

- Now create a new communication arrangement via Application and user Management->New Communication Arrangement. Choose “Request tax rates from Vertex”. This Communication Arrangement is a pre-built connection between ByDesign and the third-party software, Vertex.

- Set the communication system as created in the previous step (“VERTEX” in this case).

- Choose None in the authentication method and enter credentials.

- Click “Edit Advanced Settings”. Enter the details like hostname and path.

- Click on Next, Finish and Activate. Once done you should have the communication arrangement set up.

Testing

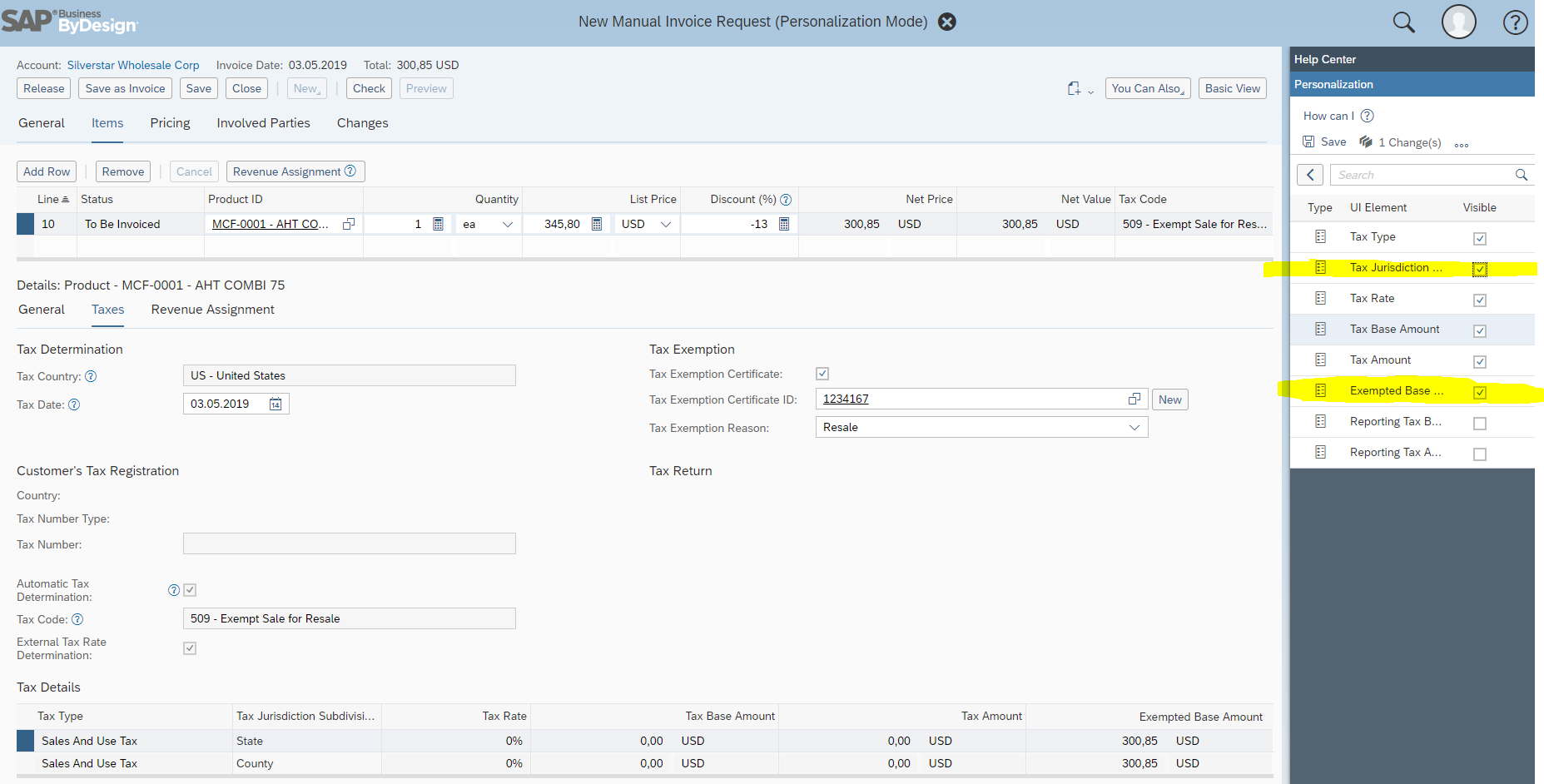

Create a new manual invoice with proper data such as account id, product, etc. The tax rates will be returned by Vertex and the field external tax determination is set to true.

For Tax jurisdiction subtype field, go to Personalize ->This screen ->Tax details and choose tax jurisdiction subtype field. For Exempted Base Amount field, choose Exempted Base Amount field on the same screen. Click Save.

The Tax code that can be chosen from the dropdown of tax codes are the standard tax codes for the US, no user created tax codes are displayed in a Vertex scoped system.

Please note that once Vertex is configured in the system, one has to make sure that all the addresses within the system are correct, especially the postal and region codes should be in sync because the external tax provider validates all the addresses being sent to it.

For more details, on recent enhancements made in the integration with external tax vendors, have a look at the Release Highlights video.

- SAP Managed Tags:

- SAP Business ByDesign

Labels:

2 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

152 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

208 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

88

Related Content

- Integration of SAP Service and Asset Manager(SSAM) with SAP FSM to support S/4HANA Service Processes in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Cloud Public Edition: Security Configuration APIs in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Cloud, public edition, ABAP Environment Case 8: Material Shelf Life Management in Enterprise Resource Planning Blogs by SAP

- Extending Bank Account Number Length for China in Enterprise Resource Planning Q&A

- Quick Start guide for PLM system integration 3.0 Implementation/Installation in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 8 | |

| 6 | |

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 |