- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Valuation Areas - a generic approach

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

MarekTurczynski

Contributor

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

11-19-2018

5:37 AM

Introduction

Valuation areas in FI are used mostly in Foreign Currency Valuation. Unlike in classic GL in new GL they became mandatory in FCV. The usual approach is to create a valuation area per legal requirement – mostly represented by a country GAAP. Following such approach in an international company that operates in large number of countries would end-up in creating tenths of valuation areas.

The maintenance of it, variant creations for each country, complexity of description in user manuals would be quite uneasy.

Theoretically creating one valuation area per country should be enough – in the practise surely exceptions like in Turkey – where open items / GL balances except cash accounts must be valuated with buying rate and the cash accounts must be valuated based on effective buying rate – would extend the number of needed valuation areas extensively and the approach of using a valuation area representing a country would already have some exceptions.

As we all know exceptions make the SAP world brighter but there is a way to limit the exceptions in terms of valuation areas.

Considerations

Valuation areas have an valuation method assigned, which indicate (among others) which FX rate type is used for valuation.

This concepts assumption is that an international company has 2 valuation requirements - one for group valuation and one for local valuation (accordingly to each country GAAP).

The group valuation follows EUR currency and ECB FX rates. ECB only publishes FX rates based on EUR but the valuation must be also able handle non-EUR-based currency pairs like USD/PLN – for which cross-FX-rate calculation can be used.

Local valuation is based on each National Bank FX Rate or ECB if country is based in EUR-zone.

Concept

There are 4 possible valuation procedures in SAP:

- Lowest Value Principle

- Strict Lowest Value Principle

- Always Evaluate

- Revalue only

This actually means that, in very lean version, maximum 4 valuation areas – one per procedure should be enough to fulfil all local GAAP requirements.

In each of these valuation areas only one FX Rate type would be maintained. Theoretically under that one FX rate type all required FX from each country can be maintained. However, reading and selecting / checking the FX rates, when these are maintained under only one FX rate type, is not easy for regular accountants. That is the point where alternative FX rate can be used.

For all valuation methods the same FX rate type would be assigned, which in this example will be named as ‘CLLL’. For each FX pair an alternative FX rate type representing the national bank FX rate.

Illustrating it in an example:

Having USD/ PLN currency pair would result in creating pair under 2 FX rate types:

USD/ PLN in CLLL and alternative FX rate CLPL.

USD/ PLN in CLPL without alternative FX rate.

In such processing system will first access the USD/ RON in CLLL (assigned to valuation method) and using the alternative FX rate it will read the FX rate using CLPL rate type.

Such settings also enable using the reference currency for cross-currency calculation in 100% secure way – it is made sure that the cross-rate is calculated only based on one set of FX rates. Such cases can happen when a country can decide which FX can be used – like in Hungary, where company can choose between using ECB or Hungarian National Bank. In Hungarian case for an USD document there is no FX rate published officially by ECB – in such case it must be calculated using cross-rate scenario.

Rollout settings are basically restricted to only creating new currency pairs - without having a need to create a new valuation area.

Customizing

The customizing will only show how to configure local valuation areas – setting for group valuation are following the same way but they do not require alternative FX rates to be used.

In example customizing 3 countries would be used: Germany and Hungary using ECB FX and Poland using Polish National Bank.

At first the currency types used in valuation method should be defined. Following the concept 3 currency types are defined:

| Path | SAP NetWeaver --> General settings --> Currencies --> Valuate |

| Transaction | OB07 - Check Exchange Rate Types |

Now the translation rates can be defined.

| Path | SAP NetWeaver --> General settings --> Currencies |

| Transaction | OBBS - Define Translation Ratios for Currency Translation |

At first the main FX rate must be used to reference the alternative FX rate:

Then per National Bank the target FX translation rates are defined:

- For Poland

- For European Central Bank

For cross-rate calculation the currency pairs must also be updated in the customizing (like USD/HUF)– no FX entry is needed.

Having the FX rate customizing done valuation areas can be set up, starting with creation of valuation methods:

| Path | Financial Accounting (New) --> General Ledger Accounting (New) --> Periodic Processing --> Valuate |

| Transaction | Define Valuation Methods |

There are 2 accounting rules – in Germany only loss can be shown, Poland and Hungary should show both gain and loss from FX valuation. For this 2 valuation method would be needed.

| Valuation Method | Valuation principle |

| LGL | Local valuation: Gain and Loss – Always evaluate |

| LLO | Local valuation: Loss only – Lowest Value Principle |

Based on that the valuation areas can be created:

| Path | Financial Accounting (New) --> General Ledger Accounting (New) --> Periodic Processing --> Valuate |

| Transaction | Define Valuation Areas |

In this example following valuation areas for valuation of currency type 10 are created:

| Valuation Area | Valuation principle |

| LA | Local valuation: Gain and Loss |

| LO | Local valuation: Loss only |

Having valuation areas defined assignment to accounting principle representing a ledger is to be done:

| Path | Financial Accounting (New) --> General Ledger Accounting (New) --> Periodic Processing --> Valuate |

| Transaction | Assign Valuation Areas and Accounting Principles |

Basic settings for valuation areas are completed then.

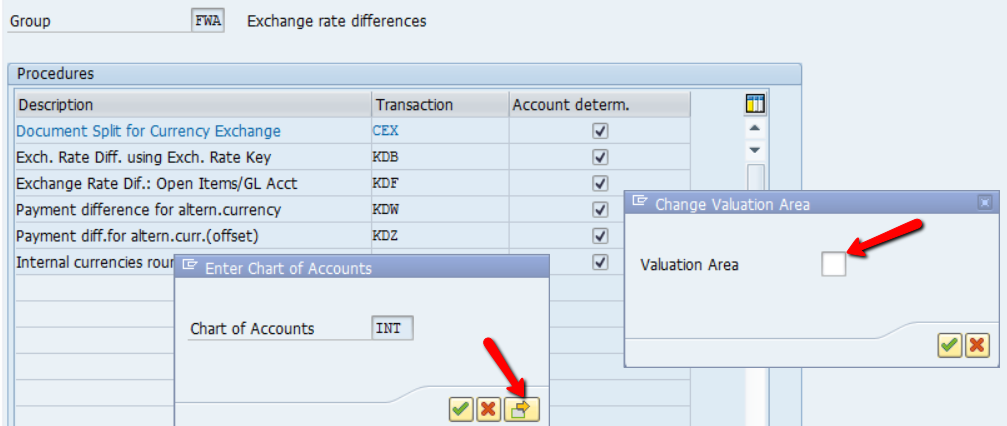

To finish settings the account determination would be needed – it can be valuation-area-dependent or not. Both ways are supported and by that the ledger and accounts approach are supported. This can be done using (in ECC):

| Path | Financial Accounting (New) --> General Ledger Accounting (New) --> Periodic Processing --> Valuate --> Foreign Currency Valuation |

| Transaction | OBA1 - Foreign Currency Valuation |

Here is a sample customizing of accounts for KDF – ‘Exchange Rate Dif.: Open Items/GL Acct’ type without using a valuation-area dependent entries:

Valuation-area dependent entries can be done using:

Having account assignment made customizing made the valuation areas customizing is finished. However, there are also additional settings which enable showing valuation values in line item reports like FBL1N/ FBL5N or FBL1H and FBL5H:

| Path | Financial Accounting (New) --> General Ledger Accounting (New) --> Business Transactions --> Closing --> Valuate --> Valuations |

| Transaction | OB_9 - Determine Values for Line Item Display |

Here to the valuation fields used in structure RFPOSXEXT can be assigned to valuation areas:

These fields must also be defined as special fields in the line item display (table T021S – see note 984305 for more details):

Example

The example shows valuation of companies existing in 3 abovementioned countries.

FX rates of ECB and Polish National Bank were maintained:

The documents were posted with different FX rate than used in valuation.

Valuation run done for each country:

- Germany – loss only- valuation area LO

Valuation is performed with the FX rate entered in OB08 (it’s converted from indirect to direct in this example) for currency type CLEB for USD/EUR FX rate:

- Hungary – always evaluate – valuation area LA

Valuation is performed with FX entered in OB08 for currency type CLEB and one cross-rate calculation for USD/HUF currency pair that is not provided by ECB:

System calculated an cross-rate for USD/HUF by using formula based on EUR currency (entered as reference in CLEB):

325,1 / 1,1318: 287,2415

- Poland – always evaluate – valuation area LA

Valuation is performed with FX entered in OB08 for currency type CLPL:

As it can be seen one valuation area can provide different values if we set it up in a generic way.

Once valuation is posted the results of it can be seen in FBL1N/ 5N in column ‘Valuation Difference’:

The highlighted columns contain the FAGL_FCV result shown in each valuation area.

Further thoughts

The above examples shown that restriction of valuation areas is possible and brings a number of benefits:

- Easy-to-monitor if all companies made the Group and Local FX valuation

- No constant changing of User Manual

- Simplified rollout settings

- Uncomplicated maintenance – only if new cross-rates are needed

On the other hand there are some constraints and some follow-up settings that must be kept if this approach is chosen:

- If multiple currencies are used in S4HANA then one valuation area can only handle 3 so multiple valuation areas would need to be created if more than 3 currencies would be used

- If you use currency translation and want to use the same valuation area then there must be one financial statement version that handles all requirements for currency translation

- If a country has two or more officially published rates are used for valuation (for example different for bank accounts and different for open items) then another generic valuation area must be created

- The valuation areas defined for FCV need to be also used in UM descriptions for other places using valuation areas (like Reclassification - FAGLF101)

Which approach to valuation areas have you chosen at your companies?

Marek

- SAP Managed Tags:

- FIN (Finance),

- FIN Accounts Receivable and Payable,

- FIN General Ledger

5 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- Improvements to manage treasury position in SAP Treasury and Risk Management in Enterprise Resource Planning Blogs by SAP

- Building Low Code Extensions with Key User Extensibility in SAP S/4HANA and SAP Build in Enterprise Resource Planning Blogs by SAP

- Deep Dive into SAP Build Process Automation with SAP S/4HANA Cloud Public Edition - Retail in Enterprise Resource Planning Blogs by SAP

- Cost component split when price control V in Enterprise Resource Planning Q&A

- Readiness for Universal Parallel Accounting in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 6 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 |