- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- ECC to S/4 HANA - Finance Conversion

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

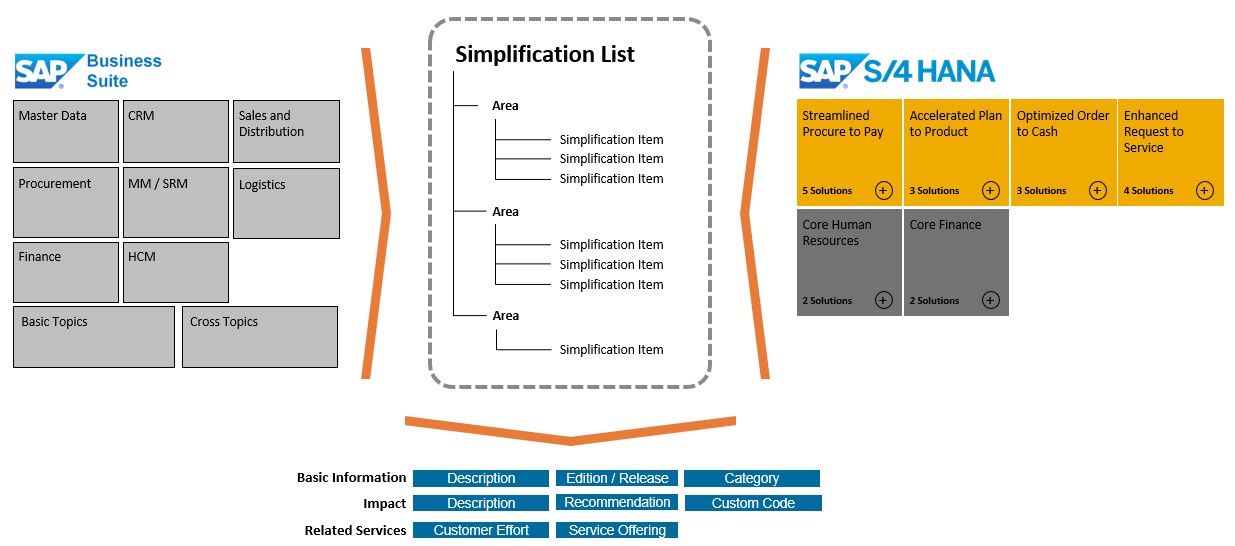

As a first step we need to determine the business processes that will be impacted when making the conversion to S/4. For that you need to check the simplification list Simplification

As approach it is important to know the following points:

• Business Partner Approach (Customer/Vendor integration) mandatory in S/4HANA

• The FI-AR-CR Credit Management has been replaced by SAP Credit Management (FIN-FSCM-CR)

• Material Ledger mandatory for material valuation

• Classic Cash Management has been replaced by new SAP Cash Management.

• New Asset Accounting Required

• Classic Real Estate has been replaced by New Real Estate

• Fiori 2.0 required if Fiori is used in 1709

• Traditional Foreign Trade functionality in SD/MM replaced by Global Trade Server

• Revenue Recognition in SD (SD-RR) has been replaced by free of charge add on Revenue Accounting and Reporting

Check this link:

https://help.sap.com/doc/f45c88b65643403d97682484273216d0/1809.000/en-US/SIMPL_OP1809.pdf

Now it is necessary to understand that: S/4 HANA Conversion is not a technical upgrade only. It includes functional changes. This must be considered appropriately in the project plan.

And now talking about Finance Conversion you need know:

- SAP conversion programs read data from old tables and transfer them to new structures.

- Compatibility views (tables) are created to make old reports / transaction codes work.

- Configuration/customizing has to be adapted in some areas (see Simplification List).

- For Finance the customizing has to be done during Conversion. It cannot be prepared in the old system.

- With a system Conversion it is not possible to activate new functionalities like document split, parallel ledgers etc. Classic general ledger is transferred technically to new general ledger/ACDOCA without activating new functionalitie

The tasks to be performed in the source system before conversion are the following:

- Identify and review the relevant Simplification items

- Prepare Asset Accounting and Material Ledger

- Run Customizing pre-checks and adapt settings, if needed

- Check consistency and reconcile data

- Period end closing activities

- Document your posting data

- Archive data no longer need

Preparing Application Specific Tasks

Finally at the time of making the conversion it is important to know 2 things:

1- During the migration of information, errors of information inconsistencies can be detected:

- Inconsistencies caused by hardware defect (e.g. corrupt blocks)

- Inconsistencies caused by user handling errors (e.g. switching off line item display in FI

- without line item deletion, missing balance carry forward, etc.)

- Customer reports without consistent updates on the database

- Manipulation on the database (e.g. direct postings on reconciliation accounts)

- Improper customizing changes (without respecting warning messages)

- Wrong migration (from former migrations)

- Wrong data management strategy (e.g. deletion of wrong data, archiving of FI data of the current fiscal year)

2- Recon Reports (to be run before and after conversion)

- The financial statements (program RFBILA00)

- The asset history sheet (program RAGITT_ALV01)

- The depreciation run for the planned depreciations (program RAHAFA_ALV01)

- The totals report for cost centers (transaction S_ALR_87013611)

- Sales order selection (program RKKBSELL)

- The G/L account balance list (program RFSSLD00)

- The general ledger line items list (program RFSOPO00)

- The compact document journal (program RFBELJ00)

- The vendor sales (program RFKUML00)

- The vendor open item list (program RFKEPL00)

- The customer sales (program RFKUML00)

- The customer open item list (program RFDEPL00)

- The customer recurring entry original documents (program RFDAUB00)

- The cost centers: actual/plan/variance (transaction GR55 with report group 1SIP)

THANKS!

- SAP Managed Tags:

- SAP S/4HANA,

- SAP S/4HANA Finance,

- FIN (Finance)

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

20 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

23 -

Expert Insights

114 -

Expert Insights

150 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,687 -

Product Updates

202 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

85

- Manage Supply Shortage and Excess Supply with MRP Material Coverage Apps in Enterprise Resource Planning Blogs by SAP

- The Role of SAP Business AI in the Chemical Industry. Overview in Enterprise Resource Planning Blogs by SAP

- Select Quantity only in CASES from SOURCEBIN while creating WAREHOUSE TASK in Enterprise Resource Planning Q&A

- Five Key assessments for a Smooth ECC to S/4HANA Transformation in Enterprise Resource Planning Q&A

- SAP Enterprise Support Academy Newsletter April 2024 in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 5 | |

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 |