- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Receivables Collection Management

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Advisor

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

10-10-2018

10:56 AM

Introduction

SAP Business ByDesign’s accounts receivable processing allows to invoice, remind and dun customers. Release 1811 adds Collection Management, a more interactive, customer-centric way to get due amounts paid while increasing customer’s satisfaction.

Only a few items are overdue because of customer’s shortage of liquidity, but by a large variety of other reasons. More often, you might find issues in internal processes, either in your own organization or at customer side, issues with your product quality or customer satisfaction, or reveal a payer’s tactics to defer a due date.

Based on my talks with debt collectors here are some typical reasons for outstanding payments:

- The customer just did not receive your invoice due to a wrong address. The document may have arrived but is cycling around somewhere. You need to issue a corrected invoice.

- The customer received the invoice but needs more time for internal approval or processing. You may accept this and change the due date.

- Your engineers have performed a certification service, but the customer did not yet receive the certificate. Therefore, the customer refuses payment. So, you need to call the engineer and ask him to issue the certificate.

- The product delivered does not meet customer expectation. There’s a negotiation with your sales representative which has not been reported to accounting. You block the invoice from dunning and try to get your internal parties together to align on next steps.

Collection management enables companies to stay in close contact with their customers, even after performance of a service or product delivery. Using this feature, companies can reduce their day sales outstanding (DSO).

In the following, I will shortly describe the main components and explain how to use them best.

To get an introduction, you may also review my roll-out video.

Process of Collection Management

Overview

So, but how does it work? Customer interaction in collection management ranges from phone calls to customer visits by a sales representative, for example in case of quality issues, or even a meeting between both companies’ CEOs. In some cases, one might assure at management level that a business relationship is still sustainable and if an extension of the customer credit line is acceptable. Of course, as a last level of escalation the legal dispute remains. But the goal is its avoidance, and collection management can help here.

For collection management, there are, surely, best practices. One of it is having a collection and credit policy to define clearly the mission and objectives of the collection department, allowing to come to a consistent interaction with customers, in alignment with the corporate culture. This allows to derive a manual for collectors, to define a proceeding around the topic, that includes customer credit lines, assessment of the risk class for a customer, approvals for collector actions like discounting, instructions for the assignment to agencies and other topics.

Another good habit is, but not suitable to all industries, to call the customer some days after issuing the invoice, to make sure the right contact has received it, accepted it and no complaints about it.

I don’t want to deepen this here, but as a conclusion I’d like to state there is, besides the recommendation to have a collection policy and manual, not the “one golden way” to do collection management. But the content of such policy and manual depends on a company’s industry, local trade habits and the number and type of customers (B2B, B2C, B2P, …). A company shall find its own way of customer relationship and due item collection.

Having defined the rules how to do collection management, SAP Business ByDesign supports you in a flexible way. It creates a collection case for each due item, and orders those to trigger actions by a collector. It is always accurate and in sync with the customer’s due item and is being closed when it is payed. Events in collecting a case can be documented and classified with categories, giving guidance how to deal with it with instructions and setting a follow-up date (called Next Activity Due Date).

As a recipe for implementation, what you should do is:

- Make yourself familiar with collection management in SAP Business ByDesign.

- Describe your procedure in a manual and manual, if you don’t already have one.

- Adapt fine-tuning, so that categories, sub-categories fit to your procedures.

- Train the collectors.

The process of collection management in SAP Business ByDesign

|

| Elements of a collection case. |

This is how SAP Business ByDesign does collection management:

- For each due item, a collection case is being automatically opened, which tracks customer interaction and helps to organize next steps.

- Collectors can assign cases to themselves or to a colleague, to clearly define responsibility.

- Collection cases can be categorized. Collection categories give instructions on further interaction, to ensure a collection policy is followed. It defines as well a “Next Activity Date” for the collection agent and allows to assign a promise-to-pay date.

- Notes can be tracked and assigned to one or several collection cases.

- Each case is prioritized, to make sure the most important calls are done first.

- Integration with accounts receivable assure a collection agent’s data are valid.

- Reports help to manage a collection management department, to get a simulation of expected payments and to know a company’s status in customer loans.

But let’s introduce the functions one after the other.

List of Collection Cases

The starting point of a collector is the list of Collection Cases in the work center Receivables. Several views can be selected, own selections can be personalized.

|

| A collector's list of cases. The lower sections gives details, e.g. the notes history) for the case selected. |

The main, pre-delivered view My Worklist contains all cases assigned to a collector plus those not yet assigned to anyone. This ensures those are not forgotten. It is sorted by Next Activity Due Date.

From here, a user can open a collection case, assign notes, responsible or category to either one or several cases.

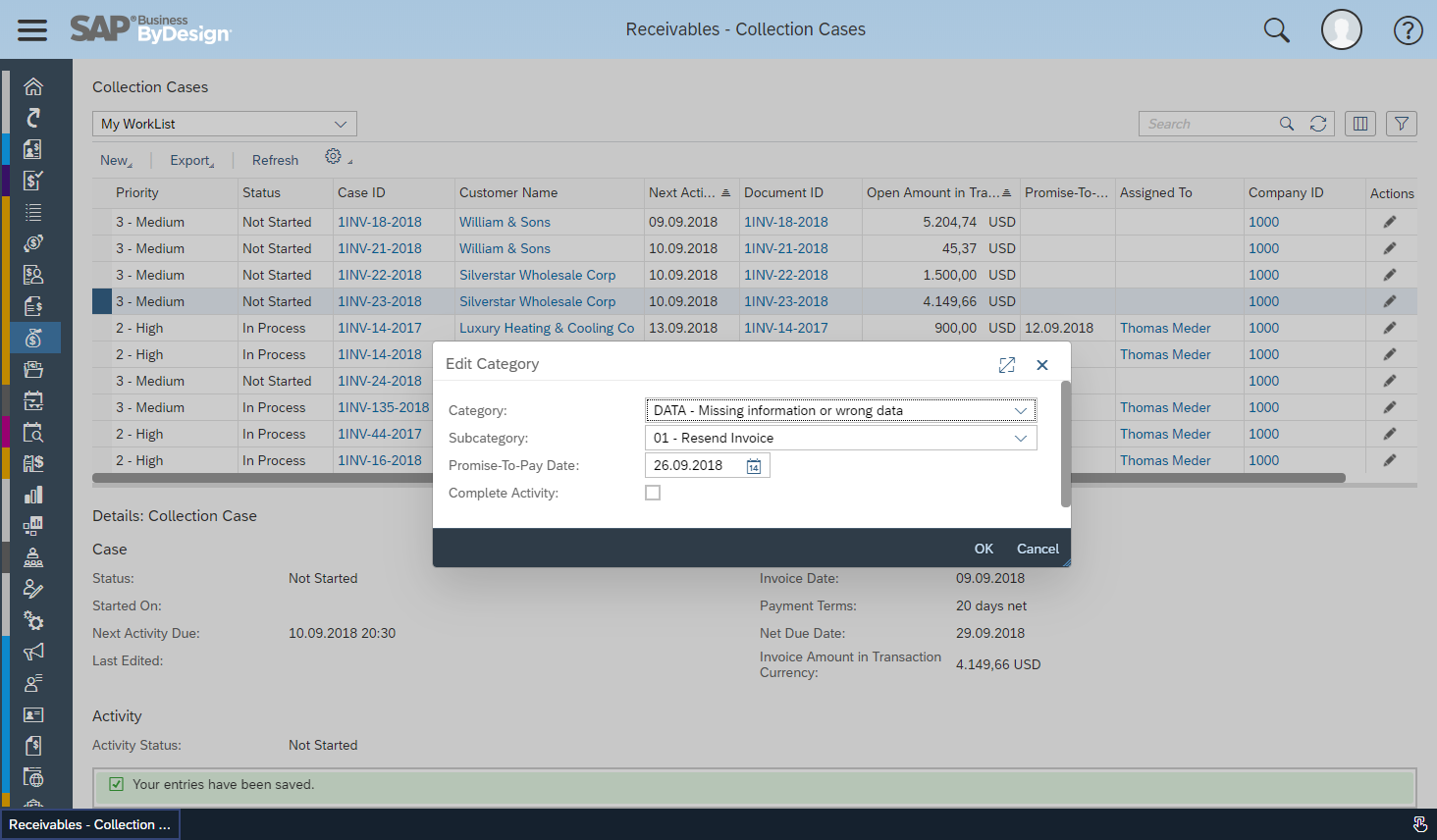

|

|

| The list of collection cases allows mass actions. Here, a communication is being noted down for three cases (upper screen), and an activity is being assigned (lower screen - to one single case only). |

Collection Case

For each customer invoice, a Collection Case is being opened. It is closed once the related due item is paid (i.e. cleared). Also, a split or reposting of the due item will close the case and create a new one.

|

| A collection case has been opened. |

A collection case consists of case data, the current activity, notes and the due items data. There, even after a split, the collector will find the initial invoice number in the field External Reference.

An activity is a “To Do” to be executed or a remark of a status (e.g. “Customer will pay as agreed”). To track activities, it is recommended to enter the customer contact the collector has spoken to. The category and subcategory states if some action must be taken. In the example shown, the customer did receive an invoice with a due date that was deviating from the agreement sales had with the customer. It is now the collector to either call the AR accountant or to change the due item by himself. The action can also be triggered using the Business Task Management that is embedded in SAP Business ByDesign using the button New.

|

| New offers the integration into business task management (BTM), to trigger action by a colleague. |

Setting the category and subcategory has two effects: The Next Activity Due Date is set, and an instruction is shown (see below to understand how this can get fine-tuned to your needs).

An activity can be set to complete by clicking the dedicated button at the top of the case. This will set the activity’s status to complete and move it to the activity history.

It is also highly recommended to use notes. Those can be entered with longer texts, saving a case will take them to the notes history.

A cases’ priority is increased based on the open amount, the date when the collector last worked on the case and the Promise-to-Pay date, if given.

Activities

Activities are characterized by categories and subcategories. A cases’ Next Activity Due Date (further referred to as NAD) can be influenced by its subcategory: The initial NAD is invoice date plus three days. When an activity gets assigned, the NAD changes to today plus a certain number of days, depending on the activity’s subcategory. The number of days can be set per subcategory in fine-tuning. This number of days is, based on the field Last Edited, repeatedly applied for every change of the case (e.g. addition of notes). Once the activity is completed, and a Promise-to-Pay-Date (further referred to as PTP) has been agreed, NAD is changed to PTP + 1 day.

|

| The determination of the Next Activity Due Date. |

If PTP is passed, the next day after PTP is taken as NAD. In case no PTP is given and the activity is complete, the NAD is set to the completion date plus one day. In other words: completing an activity sets a follow-up to tomorrow or, if a PTP is given, to the day after PTP.

The initial NAD is day of issue plus three days. This helps customers that call customers in advance of the due date to make them aware of an invoice and to make sure everything is correct and as agreed with the invoice.

The NAD has also an effect on priority calculation. This is currently hard coded and defined as follows:

- Priority is high if NAD is passed and the amount open is high or the days overdue is more than 60.

- Medium if the amount is not high.

- Low if the NAD is not yet passed.

Also, instructions are displayed dependent from subcategory. This feature intends to ensure compliance of the action with the policy. They should take the time to set-up a policy and clearly state in the instructions what a collector is supposed to do in specific cases.

Analytical Reports

Currently, the solution provides two analytical reports. Report Collection Cases allows to track performance of the collection management team and to balance its workload. Report Collection Case Transactions forecasts expected incoming payments, based on due date and on PTP.

Key User Analytics can use data source Collection Case to build operational reporting. As a starting point, a sample implementation can be found here. It can be added to the system using the upload functionality for reports, as described here (the video is on KPIs, but the process works with the file provided similarly).

Scoping Option and Fine-Tuning Activity

|

| In the fine-tuning activity, categories and sub-categories can be defined. The Days to Complete set-up here are used in the calculation of the NAD. |

To make collection management available, it is necessary to activate it in scoping. A dedicated fine-tuning activity Receivables Collection Management allows to define further categories and subcategories.

The solution provides a predefined set of activities and subcategories, that will allow a first start. Nevertheless, it is recommended to extend or replace those, depending on your collection policy.

Extensibility

Collection cases can be functionally extended by using the SAP Cloud Applications Studio. Some possible enhancement examples are an automated assignment of responsible to cases, an alternative prioritization or a more specific determination of the initial NAD.

Summary

With 1811, Collection Management gets available. It is an alternative, more customer-oriented way to manage due items which enhances the existing accounts receivable capabilities. It is based on prioritized collection cases, which provide a follow-up on necessary actions and track all customer communication and interaction.

- SAP Managed Tags:

- SAP Business ByDesign

Labels:

11 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

153 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

211 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- The Role of SAP Business AI in the Chemical Industry. Overview in Enterprise Resource Planning Blogs by SAP

- Business Rule Framework Plus(BRF+) in Enterprise Resource Planning Blogs by Members

- What You Need to Know: Security and Compliance when Moving to a Cloud ERP Solution in Enterprise Resource Planning Blogs by SAP

- FAQ on Upgrading SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- Beyond Basic (2): Certificate-Based Authentication in SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 11 | |

| 10 | |

| 7 | |

| 7 | |

| 4 | |

| 4 | |

| 4 | |

| 4 | |

| 3 | |

| 3 |