- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Legal Tax Return Form Changes in SAP Business ByDe...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member56

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

10-02-2018

5:56 AM

Tax Return form filed by a business at the end of a fiscal year depends upon its Form of Business. SAP Business ByDesign has been delivering such Legal Forms for Tax Reporting in countries like the United States and Germany. These Legal Forms require changes every year, specific to that year’s format. Forms that are currently delivered by SAP Business ByDesign on a yearly basis are as follows:

The above-mentioned forms are edited every year with the required cosmetic changes and delivered by Business ByDesign.

From the upcoming year i.e. 2020, these forms will have to be edited by the customers themselves if only cosmetic or layout changes are required.

This blog post is divided into six parts: -

The templates for the above-mentioned forms have been pre-delivered for the next few years by SAP Business ByDesign. The users can find them in WorkCentre Application and User Management -> Business Flexibility -> “Form Template Maintenance”.

Currently, all these pre-delivered templates of upcoming years, by default contain forms required to file tax returns in 2019 i.e. Annual Returns for 2018 and Monthly Returns for 2019. The customers are expected to replace these existing form template variants of upcoming years with the current year forms every year.

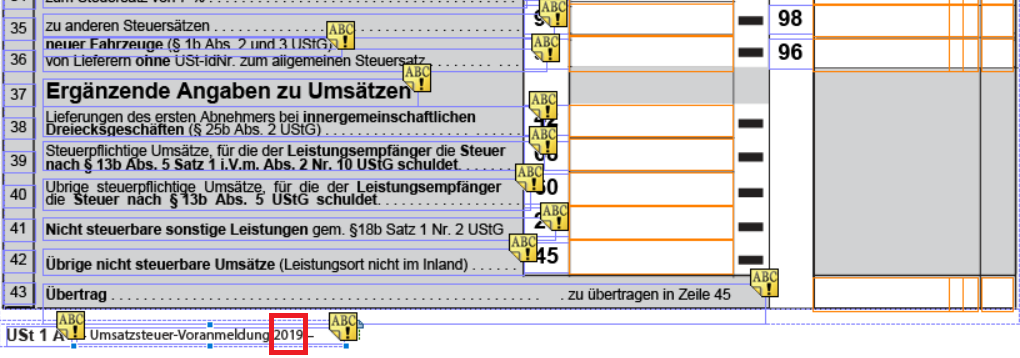

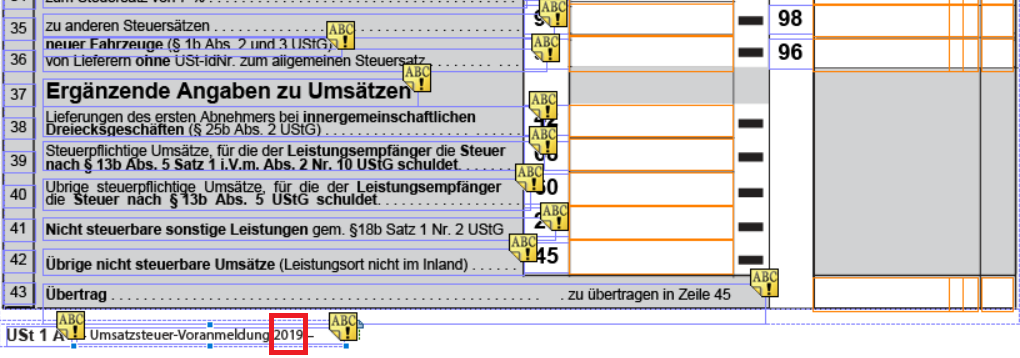

Fig: - Templates of German Yearly VAT Return Forms for upcoming years

Please note that forms which will be used to file tax returns in 2019 are already delivered by ByDesign and do not require any changes. This process is to be followed from the year after that or can also be followed if one wishes to make any cosmetic changes to the new 2019 variant other than what has been delivered for them.

The forms can be edited using the Adobe® LiveCycle® Designer, either integrated or offline.

To use the integrated Adobe® LiveCycle® Designer, follow the steps in the help-center document Edit a Form Template Using Adobe® LiveCycle® Designer.

The steps to edit forms offline are as follows: -

1. Download the latest version of Adobe® LiveCycle® Designer.

2. Go to the WorkCentre Application and User Management -> Business Flexibility -> “Form Template Maintenance”. Select the form template variant for the previous recent year and download it.

Fig: - Download previous year’s template

3. Open the Designer and click on the Folder Icon at the top.

4. A pop-up window appears. Select the .xdp file from the downloaded zip folder to open it in the designer.

5. Make Changes in the form’s Design View and then Preview and Save it. (The complete information and instructions for this point are provided in the later part of the post).

6. Go to the WorkCentre Application and User Management -> Business Flexibility -> “Form Template Maintenance”-> Select the form for the desired year and click “Upload” -> “to Replace Existing Variant”. Let us suppose, one wants to create tax returns for the year 2020. The form that must be replaced is the one that belongs to the 2020 template.

Here, “Upload” -> “As New Variant” can also be done but only one variant can be published for a specific country and language at a time.

7. Click “Browse” on the pop-up modal and select the newly edited .xdp file from the system.

8. Once the upload is successful, click “OK”. Select the uploaded form and click “Publish”.

Click “OK” on the confirmation window. The form will be published successfully.

9. Check if the correct form has been published in the system. Select the form and click “Open” -> “Adobe Reader”.

10. On the follow-up screen click “Open External”.

The newly uploaded form opens in pdf format. Check if it is the same form that is desired for that specific year.

Check the detailed documentation of the Adobe® LiveCycle® Designer here: https://help.adobe.com/en_US/livecycle/11.0/DesignerHelp/index.html

Although the Adobe® LiveCycle® Designer offers an interactive “Design View”, below are a few tips on how to edit a form in the designer: -

1. Suppose, one wants to edit a static text on the form (more technical term would be “Object Type “Text”). For example, year on a form is to be edited. One needs to make a right click on that specific text Object in the “Design View” of the form, select “Edit Text”, and then change it to the desired year. For details, have a look at the figure below.

Fig: - How to edit an Object of Type “Text”

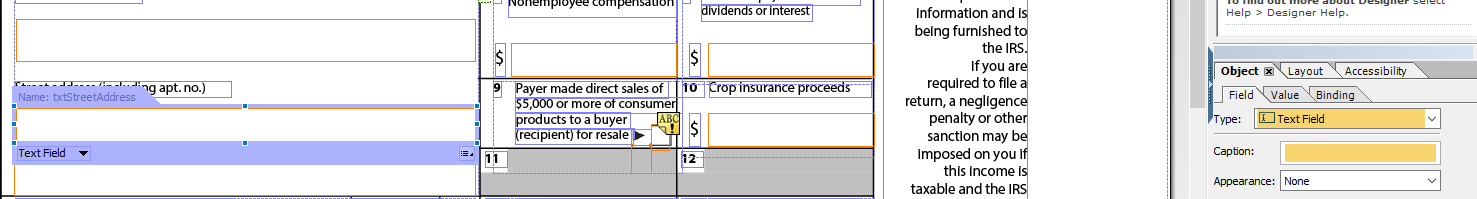

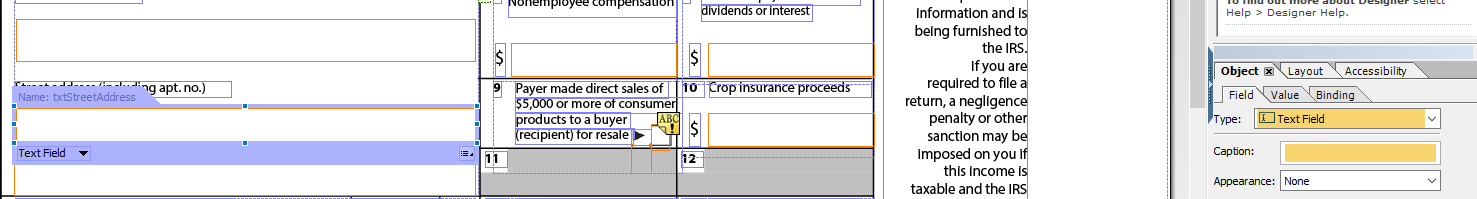

2. Text Fields, with or without captions can be dragged and dropped, expanded or contracted as desired, in the design view.

3. The captions of Text Fields can be changed at any point of time if required.

Fig: - Text Field with a caption

There are few changes in the forms of German VAT Returns and the US Withholding Tax Returns that are delivered by Business ByDesign every year. These are relevant year changes on the forms. For all these changes, one must follow steps 1 to 5 from “Guidelines” section above, and then to edit right click on the corresponding Text-> click “Edit Text”-> change the year to current year and click “Save” on the top of the designer. As these are static text changes, for details follow the 1st point from section “How to Edit a form”.

Changes required in Umsatzsteuer-Voranmeldung form every year: -

1. The year relevant text at the beginning of the form, on the first page, as per highlighted in the figure below.

2. Static year text on the footer of the first page of the form, as per highlighted below.

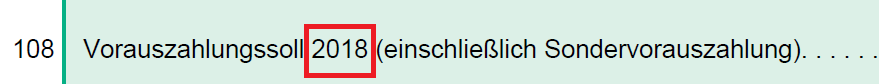

Changes required in Umsatzsteuererklärung form every year: -

1. Year on the header of the form.

2. Year on box number 16, as per highlighted below.

3. Year texts on the footer of each page of the form, as per highlighted below.

4. Years on box number 32 and 33. These correspond to sales in the current calendar year and previous calendar year. The year near box number 32 is to be changed to the previous year and the year near box number 33 is to be changed to the current year.

5. Year near box number 72 is to be changed to the year of the return.

6. Year on box number 75.

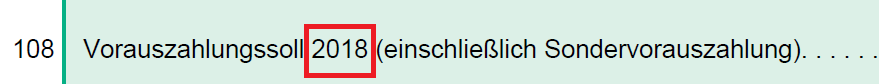

7. Year on box number 108.

Changes required in Withholding Tax 1042-S Copy B form every year: -

1. Year change on the header of the form.

2. Year change on the footer of the form.

Changes required in Withholding tax 1099-MISC form every year: -

1. The suffix of the year on the top of the form. Refer to the highlight on the figure below.

These are just the major changes that are required every year. The other cosmetic changes like adding new text boxes and changing the texts or captions of the existing objects are also to be taken care of by the customers.

Editing of forms in an improper manner may affect the data that is populated on them on creating a Tax Return in the system. Therefore, while editing the forms in Adobe® LiveCycle® Designer the following points are to be taken care of: -

1. Objects of Type “Text” can be removed, added or updated at any point because they do not have any scripts attached to them and contain static texts.

2. One needs to be careful with the Objects of Type “Text field” and “CheckBox”, which have scripts attached to them, because such fields are auto-populated with data maintained in the system. Shifting them or changing their names may lead to loss of data while previewing the returns. Such objects are configured with their names and hierarchy which should not be disturbed.

3. The Text Fields which do not have a caption are the ones which usually have scripts attached to them, while the ones with a caption have no scripts attached to them.

Fig: - Text Field without Caption

Fig: - Text Field with Caption

4. It is recommended to edit forms only in the “Design View” of the designer and not touch the “XML Source”.

5. In case, any layout changes are made to the form, make sure the scripts have the correct path of the text fields by following the points mentioned in the below section of “Validating an Edited Form”.

Once a user has edited his form for the current year in the designer, other than just text changes, it’s very important to confirm that the changes have not corrupted the .xdp, so that the data that is to be populated on the form from the system continues to populate correctly. The user must follow the following steps to validate: -

1. Open the form in designer and click on Window -> Script Editor.

2. Select the Object of the form which is at the highest level in hierarchy i.e. page and select “Events with Scripts” in the Show drop-down.

These are the scripts associated with the objects in the form. While making either of the two changes mentioned below, these scripts should be checked: -

Example: - Suppose, I am editing a form where I am shifting a text field “txtFirstLineofDesc” which falls in Subform1 of Page1 and changing the name of the field to “txtFirstLineofDescription”.

While shifting the object, I can either, change its position in such a manner that its path remains the same (refer to the figure below)

Fig: - Depicting the path of a Text Field

or, if I am changing the name and path of the object (refer to figure below)

Fig: - Moving a Text Field outside the Subform1 and placing it directly under Page1

I can do the following: -

1. Follow Steps 1 and 2 mentioned above and go to the “Events with Scripts”.

2. Search where the field is mapped with the field name.

3. Change the path and name to the current path and name of the field (refer to the figure below).

4. Save the file.

In case, there are any other changes required other than just cosmetic changes, as in addition of new fields that need to be configured within the existing system, ByDesign will be delivering the content for that specific year and upcoming years.

- Umsatzsteuer-Voranmeldung or VAT Advance Notification: - Entrepreneurs in Germany are subject to submitting VAT pre-registrations on a monthly or quarterly basis, to report an existing VAT to the tax office, and pay or get reimbursed for a pre-tax excess.

- Umsatzsteuererklärung or Annual VAT Declaration: - The Annual VAT Return must be filed by an entrepreneur in Germany, regardless of whether or not the VAT pre-registration has been done in the course of the year.

- Withholding Tax 1042-S Copy B: - This form is filed with the IRS (Internal Revenue Service) to report a Foreign Person’s US source of income which is subject to withholding.

- Withholding tax 1099-MISC Copy B: - The income received throughout the year, other than the salary paid by one’s employer, is reported via this IRS tax return document. This is mostly meant for non-employee individuals, such as independent contractors.

The above-mentioned forms are edited every year with the required cosmetic changes and delivered by Business ByDesign.

From the upcoming year i.e. 2020, these forms will have to be edited by the customers themselves if only cosmetic or layout changes are required.

This blog post is divided into six parts: -

- Form Template Maintenance in ByDesign: Information about what are the delivered forms and where can one find them within the ByDesign system.

- Guidelines to edit a form and replace an existing Form Template Variant.

- Editing Fields and Controls in a form: Tips and tricks to edit a form.

- Common Changes required every year in Tax Return Forms: A detailed highlight of the changes which the customers will have to do every year to their respective form templates, in order to generate tax return for that year from the system.

- Editing forms in case changes are other than the change of year: If the changes are not restricted only to changes mentioned in the 4th point or textual changes and there are layout changes involved (such as shifting of boxes).

- Validating an Edited Form: If the changes are similar to that as explained in the 5th point, the .xml should also be checked as explained here.

Form Template Maintenance in ByDesign

The templates for the above-mentioned forms have been pre-delivered for the next few years by SAP Business ByDesign. The users can find them in WorkCentre Application and User Management -> Business Flexibility -> “Form Template Maintenance”.

Currently, all these pre-delivered templates of upcoming years, by default contain forms required to file tax returns in 2019 i.e. Annual Returns for 2018 and Monthly Returns for 2019. The customers are expected to replace these existing form template variants of upcoming years with the current year forms every year.

Fig: - Templates of German Yearly VAT Return Forms for upcoming years

Please note that forms which will be used to file tax returns in 2019 are already delivered by ByDesign and do not require any changes. This process is to be followed from the year after that or can also be followed if one wishes to make any cosmetic changes to the new 2019 variant other than what has been delivered for them.

Guidelines to edit a form and replace an existing Form Template Variant

The forms can be edited using the Adobe® LiveCycle® Designer, either integrated or offline.

To use the integrated Adobe® LiveCycle® Designer, follow the steps in the help-center document Edit a Form Template Using Adobe® LiveCycle® Designer.

The steps to edit forms offline are as follows: -

1. Download the latest version of Adobe® LiveCycle® Designer.

2. Go to the WorkCentre Application and User Management -> Business Flexibility -> “Form Template Maintenance”. Select the form template variant for the previous recent year and download it.

Fig: - Download previous year’s template

3. Open the Designer and click on the Folder Icon at the top.

4. A pop-up window appears. Select the .xdp file from the downloaded zip folder to open it in the designer.

5. Make Changes in the form’s Design View and then Preview and Save it. (The complete information and instructions for this point are provided in the later part of the post).

6. Go to the WorkCentre Application and User Management -> Business Flexibility -> “Form Template Maintenance”-> Select the form for the desired year and click “Upload” -> “to Replace Existing Variant”. Let us suppose, one wants to create tax returns for the year 2020. The form that must be replaced is the one that belongs to the 2020 template.

Here, “Upload” -> “As New Variant” can also be done but only one variant can be published for a specific country and language at a time.

7. Click “Browse” on the pop-up modal and select the newly edited .xdp file from the system.

8. Once the upload is successful, click “OK”. Select the uploaded form and click “Publish”.

Click “OK” on the confirmation window. The form will be published successfully.

9. Check if the correct form has been published in the system. Select the form and click “Open” -> “Adobe Reader”.

10. On the follow-up screen click “Open External”.

The newly uploaded form opens in pdf format. Check if it is the same form that is desired for that specific year.

Editing Fields and Controls in a form

Check the detailed documentation of the Adobe® LiveCycle® Designer here: https://help.adobe.com/en_US/livecycle/11.0/DesignerHelp/index.html

Although the Adobe® LiveCycle® Designer offers an interactive “Design View”, below are a few tips on how to edit a form in the designer: -

1. Suppose, one wants to edit a static text on the form (more technical term would be “Object Type “Text”). For example, year on a form is to be edited. One needs to make a right click on that specific text Object in the “Design View” of the form, select “Edit Text”, and then change it to the desired year. For details, have a look at the figure below.

Fig: - How to edit an Object of Type “Text”

2. Text Fields, with or without captions can be dragged and dropped, expanded or contracted as desired, in the design view.

3. The captions of Text Fields can be changed at any point of time if required.

Fig: - Text Field with a caption

Common Changes required every year in Tax Return Forms

There are few changes in the forms of German VAT Returns and the US Withholding Tax Returns that are delivered by Business ByDesign every year. These are relevant year changes on the forms. For all these changes, one must follow steps 1 to 5 from “Guidelines” section above, and then to edit right click on the corresponding Text-> click “Edit Text”-> change the year to current year and click “Save” on the top of the designer. As these are static text changes, for details follow the 1st point from section “How to Edit a form”.

Changes required in Umsatzsteuer-Voranmeldung form every year: -

1. The year relevant text at the beginning of the form, on the first page, as per highlighted in the figure below.

2. Static year text on the footer of the first page of the form, as per highlighted below.

Changes required in Umsatzsteuererklärung form every year: -

1. Year on the header of the form.

2. Year on box number 16, as per highlighted below.

3. Year texts on the footer of each page of the form, as per highlighted below.

4. Years on box number 32 and 33. These correspond to sales in the current calendar year and previous calendar year. The year near box number 32 is to be changed to the previous year and the year near box number 33 is to be changed to the current year.

5. Year near box number 72 is to be changed to the year of the return.

6. Year on box number 75.

7. Year on box number 108.

Changes required in Withholding Tax 1042-S Copy B form every year: -

1. Year change on the header of the form.

2. Year change on the footer of the form.

Changes required in Withholding tax 1099-MISC form every year: -

1. The suffix of the year on the top of the form. Refer to the highlight on the figure below.

These are just the major changes that are required every year. The other cosmetic changes like adding new text boxes and changing the texts or captions of the existing objects are also to be taken care of by the customers.

Editing forms in case changes are other than the change of year

Editing of forms in an improper manner may affect the data that is populated on them on creating a Tax Return in the system. Therefore, while editing the forms in Adobe® LiveCycle® Designer the following points are to be taken care of: -

1. Objects of Type “Text” can be removed, added or updated at any point because they do not have any scripts attached to them and contain static texts.

2. One needs to be careful with the Objects of Type “Text field” and “CheckBox”, which have scripts attached to them, because such fields are auto-populated with data maintained in the system. Shifting them or changing their names may lead to loss of data while previewing the returns. Such objects are configured with their names and hierarchy which should not be disturbed.

3. The Text Fields which do not have a caption are the ones which usually have scripts attached to them, while the ones with a caption have no scripts attached to them.

Fig: - Text Field without Caption

Fig: - Text Field with Caption

4. It is recommended to edit forms only in the “Design View” of the designer and not touch the “XML Source”.

5. In case, any layout changes are made to the form, make sure the scripts have the correct path of the text fields by following the points mentioned in the below section of “Validating an Edited Form”.

Validating an Edited Form

Once a user has edited his form for the current year in the designer, other than just text changes, it’s very important to confirm that the changes have not corrupted the .xdp, so that the data that is to be populated on the form from the system continues to populate correctly. The user must follow the following steps to validate: -

1. Open the form in designer and click on Window -> Script Editor.

2. Select the Object of the form which is at the highest level in hierarchy i.e. page and select “Events with Scripts” in the Show drop-down.

These are the scripts associated with the objects in the form. While making either of the two changes mentioned below, these scripts should be checked: -

- If a text field is being shifted from one place to another (Refer to Example below), or

- If the name of a text field is being changed (Refer to Example below).

Example: - Suppose, I am editing a form where I am shifting a text field “txtFirstLineofDesc” which falls in Subform1 of Page1 and changing the name of the field to “txtFirstLineofDescription”.

While shifting the object, I can either, change its position in such a manner that its path remains the same (refer to the figure below)

Fig: - Depicting the path of a Text Field

or, if I am changing the name and path of the object (refer to figure below)

Fig: - Moving a Text Field outside the Subform1 and placing it directly under Page1

I can do the following: -

1. Follow Steps 1 and 2 mentioned above and go to the “Events with Scripts”.

2. Search where the field is mapped with the field name.

3. Change the path and name to the current path and name of the field (refer to the figure below).

4. Save the file.

In case, there are any other changes required other than just cosmetic changes, as in addition of new fields that need to be configured within the existing system, ByDesign will be delivering the content for that specific year and upcoming years.

- SAP Managed Tags:

- SAP Business ByDesign

Labels:

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

154 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

216 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- SAP Fiori for SAP S/4HANA - Composite Roles in launchpad content and layout tools in Enterprise Resource Planning Blogs by SAP

- Improvements to manage treasury position in SAP Treasury and Risk Management in Enterprise Resource Planning Blogs by SAP

- SAP GTS classification not recorded at compliance document creation in Enterprise Resource Planning Q&A

- Exchange rate update for existing transactions for foreign vendors and customers in sap b1 in Enterprise Resource Planning Q&A

- Update of the SAP Activate Roadmap for SAP S/4HANA (on prem) upgrades with the Clean Core Strategy in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 12 | |

| 11 | |

| 7 | |

| 6 | |

| 6 | |

| 4 | |

| 4 | |

| 4 | |

| 4 | |

| 3 |