- SAP Community

- Products and Technology

- Technology

- Technology Blogs by SAP

- Is Lending Club worth the Risk? Find out with SAP...

Technology Blogs by SAP

Learn how to extend and personalize SAP applications. Follow the SAP technology blog for insights into SAP BTP, ABAP, SAP Analytics Cloud, SAP HANA, and more.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

jasonyeung

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

07-25-2018

2:52 PM

About Lending Club

For those not familiar with Lending Club, it's the world's largest peer-to-peer lending platform. It enables borrowers to get unsecured personal loans (up to $40k) and investors can put as little as $25 in to help partially fund these loans. Its technology operates as a credit marketplace, but with much lower costs and interest rates than traditional banks. For investors, the interest rates are much higher than a traditional bank and they have solid predictable returns - but they carry the risk of unsecured loans.

To help investors, Lending Club shares all of its historical data around their loans, borrowers, payments, interest rates, defaults, and so on. This is great for data savvy investors to generate their own insights - to see if the return was worth the risk.

Tell Me More About The Data

Like most things analytics, we need to start at the beginning. Here are some statistics about Lending Club since their inception in 2007.

If we drill down and look at this by year, we can see that they've achieved significant growth (in terms of number of loans), but have seen flat growth over the past two years.

What Types of Loans Are Borrowers Getting?

The typical loan is a 3-year loan between $5-15k.

Who's Applying for Loans and Where Are They From?

If we look at who's applying for these loans, we can see that its the typical middle-class worker. On the map, we can see that the majority of these loans tend are from California, New York, and Texas. With the high cost of living in New York and California, it's easy to see why these middle-income earners need a loan to pay off their debts.

What Are They Using These Loans For?

If you read the above chart from left-to-right, you can see that most loans are used to pay off debt or credit cards, the average loan amount for this is around $16, and borrowers have an average income of $84k. If you couple this visual with the one above (middle class workers in high-cost of living states), this begs the question of whether the borrowers will be able to pay off these loans.

What Does A Typical Payback Look Like For These Borrowers?

For a typical loan, a borrower can expect an average of $473 monthly payment over the next 3-5 years to payoff their credit card and other debts. From the chart below, we can see that the monthly payments and the interest rate varies on the loan amount.

What Impacts The Interest Rate?

The longer the term and the worse your credit, the higher the interest rate. But the reason for the loan impacts it too. If you break it down one level further, you can see that education and weddings yield the highest interest rates.

Where's the Risk / Reward for Investors?

With higher interest rates than a traditional bank, it's easy to see how Lending Club is a great investment. But there's risk. Since these loans are all unsecured, the investor assumes the liability if a borrower defaults on their loan.

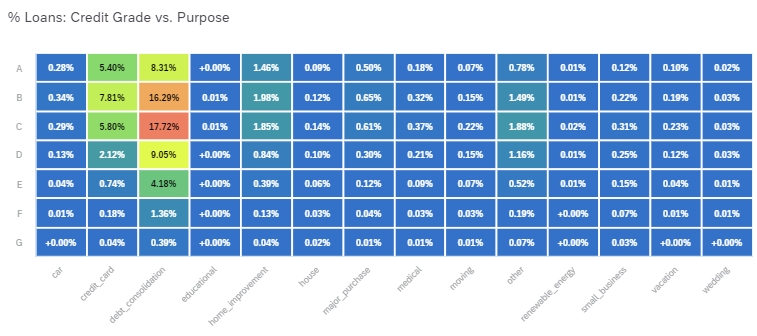

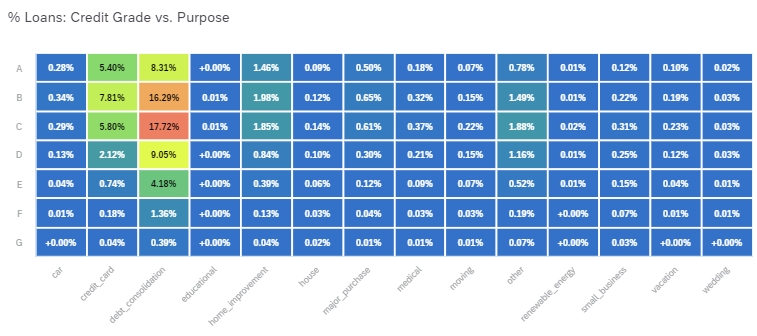

First, In the visual below, we can see the majority of loans are for borrowers with an average credit score (B or C) and they use this for debt consolidation.

Second, if we look at this by interest rate, we can see that the worse the credit, the higher the interest rate. We can also see that the interest rate is slightly lower if you use the loan for educational purposes. Perhaps the idea is that you better educate yourself, you will get a higher paying job and this will reduce the risk of you paying off your loan.

Finally, if we look at this by defaults (e.g. people not paying back their loans), we can see that the worse the credit, the higher the default rates. But there are some outliers. Those with bad credit and use these loans for "vacation" or "renewable energy" have a 50% chance of defaulting on their loans. We can also see that people will average credit have a higher chance of defaulting on a loan when used for "education" than those that use loans for other reasons.

Some Questions Left Unanswered

* What happens if we go into an economy downturn or recession?

* Will more borrowers default on their loans?

* Will investors be less likely to invest?

* Will interest rates change to offset these losses?

What Does This All Mean?

(1) Peer-to-Peer Lending Works. The growth of peer-to-peer lending coupled with the competition in this space shows how peer-to-peer lending is becoming a very popular alternative bank-funded loans.

(2) Data Reveals Our Challenges Managing Our Financials. This data illustrates just how hard it is for the middle class to make ends meet. Rising costs coupled with flat salaries has led to large debt that these families need to pay off - and a good number of them default on their payments.

(3) People need analytics, not data. While Lending Club and other banks do an excellent job providing timely and updated “raw data,“ they provide very little analytics and insight into this data, like we’re seeing above. This type of analytics let’s us see the whole story in the data and to allow us to do our own discovery.

Have a question off of this data or just want to see how you can find insights off of your data, leave a comment below.

For those not familiar with Lending Club, it's the world's largest peer-to-peer lending platform. It enables borrowers to get unsecured personal loans (up to $40k) and investors can put as little as $25 in to help partially fund these loans. Its technology operates as a credit marketplace, but with much lower costs and interest rates than traditional banks. For investors, the interest rates are much higher than a traditional bank and they have solid predictable returns - but they carry the risk of unsecured loans.

To help investors, Lending Club shares all of its historical data around their loans, borrowers, payments, interest rates, defaults, and so on. This is great for data savvy investors to generate their own insights - to see if the return was worth the risk.

Tell Me More About The Data

Like most things analytics, we need to start at the beginning. Here are some statistics about Lending Club since their inception in 2007.

If we drill down and look at this by year, we can see that they've achieved significant growth (in terms of number of loans), but have seen flat growth over the past two years.

What Types of Loans Are Borrowers Getting?

The typical loan is a 3-year loan between $5-15k.

Who's Applying for Loans and Where Are They From?

If we look at who's applying for these loans, we can see that its the typical middle-class worker. On the map, we can see that the majority of these loans tend are from California, New York, and Texas. With the high cost of living in New York and California, it's easy to see why these middle-income earners need a loan to pay off their debts.

What Are They Using These Loans For?

If you read the above chart from left-to-right, you can see that most loans are used to pay off debt or credit cards, the average loan amount for this is around $16, and borrowers have an average income of $84k. If you couple this visual with the one above (middle class workers in high-cost of living states), this begs the question of whether the borrowers will be able to pay off these loans.

What Does A Typical Payback Look Like For These Borrowers?

For a typical loan, a borrower can expect an average of $473 monthly payment over the next 3-5 years to payoff their credit card and other debts. From the chart below, we can see that the monthly payments and the interest rate varies on the loan amount.

What Impacts The Interest Rate?

The longer the term and the worse your credit, the higher the interest rate. But the reason for the loan impacts it too. If you break it down one level further, you can see that education and weddings yield the highest interest rates.

Where's the Risk / Reward for Investors?

With higher interest rates than a traditional bank, it's easy to see how Lending Club is a great investment. But there's risk. Since these loans are all unsecured, the investor assumes the liability if a borrower defaults on their loan.

First, In the visual below, we can see the majority of loans are for borrowers with an average credit score (B or C) and they use this for debt consolidation.

Second, if we look at this by interest rate, we can see that the worse the credit, the higher the interest rate. We can also see that the interest rate is slightly lower if you use the loan for educational purposes. Perhaps the idea is that you better educate yourself, you will get a higher paying job and this will reduce the risk of you paying off your loan.

Finally, if we look at this by defaults (e.g. people not paying back their loans), we can see that the worse the credit, the higher the default rates. But there are some outliers. Those with bad credit and use these loans for "vacation" or "renewable energy" have a 50% chance of defaulting on their loans. We can also see that people will average credit have a higher chance of defaulting on a loan when used for "education" than those that use loans for other reasons.

Some Questions Left Unanswered

* What happens if we go into an economy downturn or recession?

* Will more borrowers default on their loans?

* Will investors be less likely to invest?

* Will interest rates change to offset these losses?

What Does This All Mean?

(1) Peer-to-Peer Lending Works. The growth of peer-to-peer lending coupled with the competition in this space shows how peer-to-peer lending is becoming a very popular alternative bank-funded loans.

(2) Data Reveals Our Challenges Managing Our Financials. This data illustrates just how hard it is for the middle class to make ends meet. Rising costs coupled with flat salaries has led to large debt that these families need to pay off - and a good number of them default on their payments.

(3) People need analytics, not data. While Lending Club and other banks do an excellent job providing timely and updated “raw data,“ they provide very little analytics and insight into this data, like we’re seeing above. This type of analytics let’s us see the whole story in the data and to allow us to do our own discovery.

Have a question off of this data or just want to see how you can find insights off of your data, leave a comment below.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

ABAP CDS Views - CDC (Change Data Capture)

2 -

AI

1 -

Analyze Workload Data

1 -

BTP

1 -

Business and IT Integration

2 -

Business application stu

1 -

Business Technology Platform

1 -

Business Trends

1,661 -

Business Trends

87 -

CAP

1 -

cf

1 -

Cloud Foundry

1 -

Confluent

1 -

Customer COE Basics and Fundamentals

1 -

Customer COE Latest and Greatest

3 -

Customer Data Browser app

1 -

Data Analysis Tool

1 -

data migration

1 -

data transfer

1 -

Datasphere

2 -

Event Information

1,400 -

Event Information

64 -

Expert

1 -

Expert Insights

178 -

Expert Insights

273 -

General

1 -

Google cloud

1 -

Google Next'24

1 -

Kafka

1 -

Life at SAP

784 -

Life at SAP

11 -

Migrate your Data App

1 -

MTA

1 -

Network Performance Analysis

1 -

NodeJS

1 -

PDF

1 -

POC

1 -

Product Updates

4,577 -

Product Updates

326 -

Replication Flow

1 -

RisewithSAP

1 -

SAP BTP

1 -

SAP BTP Cloud Foundry

1 -

SAP Cloud ALM

1 -

SAP Cloud Application Programming Model

1 -

SAP Datasphere

2 -

SAP S4HANA Cloud

1 -

SAP S4HANA Migration Cockpit

1 -

Technology Updates

6,886 -

Technology Updates

403 -

Workload Fluctuations

1

Related Content

- 体验更丝滑!SAP 分析云 2024.07 版功能更新 in Technology Blogs by SAP

- I cannot cancel an import in SAP Analytics Cloud from SAP Hana. in Technology Q&A

- Consolidation Extension for SAP Analytics Cloud – Automated Eliminations and Adjustments (part 1) in Technology Blogs by Members

- SAC Custom Widget for Uploading a load file(.xls) customization using Data Import API in Technology Q&A

- 10+ ways to reshape your SAP landscape with SAP Business Technology Platform – Blog 4 in Technology Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 12 | |

| 10 | |

| 9 | |

| 7 | |

| 7 | |

| 7 | |

| 6 | |

| 6 | |

| 5 | |

| 4 |