- SAP Community

- Products and Technology

- Technology

- Technology Blogs by SAP

- Commodity Pricing Engine (CPE) - Introduction

Technology Blogs by SAP

Learn how to extend and personalize SAP applications. Follow the SAP technology blog for insights into SAP BTP, ABAP, SAP Analytics Cloud, SAP HANA, and more.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member57

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

06-15-2018

5:49 PM

Standard Pricing Approach

To understand Commodity Pricing Engine knowledge of SAP standard pricing is very important. I will first give a quick review of standard pricing.

In standard pricing, there are one or multiple conditions that correspond to different things in business. For example, consider a case of shopping for shoes in the season of sale. In such case, the system will show one condition that corresponds to the base price of that shoe (ZBAS) and another that corresponds to the seasonal discount (ZDIS). In both these conditions, the value is fixed and is not dependent on any factor. This is the case which can be achieved easily using standard pricing where we can maintain the condition record using MEK2 (for purchase) or VK11(for sales).

Why Commodity Pricing Engine?

What about commodities which are traded on an exchange, commodities whose prices depend on weather condition or other variable factors? For all such commodities, standard SAP pricing is not enough and Commodities Pricing Engine comes into the picture. Example, the price of petrol or the price of soybean change frequently.

In standard SAP Pricing, it is not possible to maintain complicated formulas which can yield a realistic result whereas in Commodity Pricing Engine (CPE) it is possible to give a market reference so that the prices are adjusted accordingly. With CPE it is possible to define price quotations, currency exchange rate, surcharge rule, rounding rule and whatnot.

The graph below shows the price of copper being traded at London Metal Exchange (LME). It is evident that the prices are not stable and change frequently.

For material like copper or iron, the prices are fluctuating rapidly and a fixed price is not the correct way to achieve its price. Hence, CPE is the ultimate solution.

What is CPE?

CPE is an extended SAP ERP Pricing that allows special price calculation for commodities traded at exchanges. CPE is designed to handle complex rules regarding price quotations. Moreover, these prices depend upon the market and hence having a market reference it a very important aspect in deriving price for a commodity.

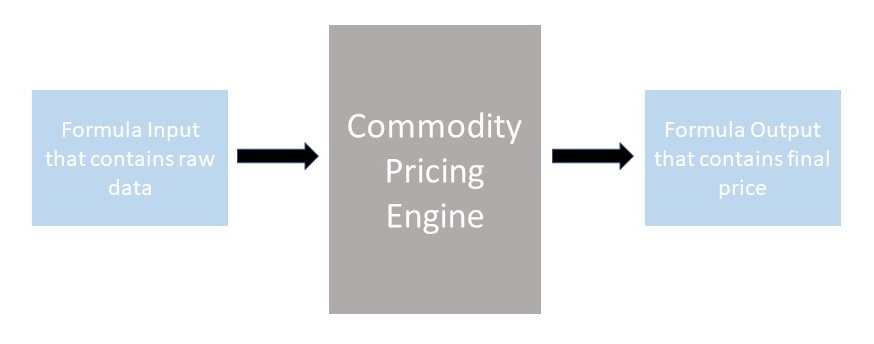

Consider CPE as a black box for now to which we input a series of formulas that we create based upon our requirements. CPE will now gather data by breaking down the formulas into tiniest factor and then calculate price using this data. The final output from CPE black box would be a price that is relevant for the commodity being traded at that specific instant.

What is CPE made of?

CPE consists of numerous items and some of the important ones are:

- Formula

- Term

- Quotation Rule and Market Reference(DCS and MIC)

- Price Fixation

- Period Determination Rule

- Term Rule

There can be multiple pricing approaches depending upon the type of commodity being traded. Some commodities are trade only in futures like copper whereas some commodities like soybean have multiple components like futures and basis.

Setting up data according is an important part of CPE that I will cover in the coming blogs along with a detailed chapter on each of the above-mentioned topics.

- SAP Managed Tags:

- SAP HANA

Labels:

14 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

ABAP CDS Views - CDC (Change Data Capture)

2 -

AI

1 -

Analyze Workload Data

1 -

BTP

1 -

Business and IT Integration

2 -

Business application stu

1 -

Business Technology Platform

1 -

Business Trends

1,661 -

Business Trends

87 -

CAP

1 -

cf

1 -

Cloud Foundry

1 -

Confluent

1 -

Customer COE Basics and Fundamentals

1 -

Customer COE Latest and Greatest

3 -

Customer Data Browser app

1 -

Data Analysis Tool

1 -

data migration

1 -

data transfer

1 -

Datasphere

2 -

Event Information

1,400 -

Event Information

64 -

Expert

1 -

Expert Insights

178 -

Expert Insights

276 -

General

1 -

Google cloud

1 -

Google Next'24

1 -

Kafka

1 -

Life at SAP

784 -

Life at SAP

11 -

Migrate your Data App

1 -

MTA

1 -

Network Performance Analysis

1 -

NodeJS

1 -

PDF

1 -

POC

1 -

Product Updates

4,577 -

Product Updates

329 -

Replication Flow

1 -

RisewithSAP

1 -

SAP BTP

1 -

SAP BTP Cloud Foundry

1 -

SAP Cloud ALM

1 -

SAP Cloud Application Programming Model

1 -

SAP Datasphere

2 -

SAP S4HANA Cloud

1 -

SAP S4HANA Migration Cockpit

1 -

Technology Updates

6,886 -

Technology Updates

407 -

Workload Fluctuations

1

Related Content

- Redis on SAP BTP, Hyperscaler Option Now Available for Customers on BTP@China! in Technology Blogs by SAP

- Redis on SAP BTP, Hyperscaler Option Now Available for Customers on BTP@China! in Technology Blogs by SAP

- Unleashing AI and Machine Learning in Sales: Advanced Price-Volume Forecasting with SAP Analytics Cl in Technology Blogs by SAP

- Integrate CI/CD with cTMS as part of SAP Cloud ALM in Technology Blogs by Members

- Deliver Real-World Results with SAP Business AI: Q4 2023 & Q1 2024 Release Highlights in Technology Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 13 | |

| 10 | |

| 10 | |

| 7 | |

| 7 | |

| 6 | |

| 5 | |

| 5 | |

| 5 | |

| 4 |