- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- SAP CO-PA (Profitability Analysis)

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member49

Participant

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

01-16-2018

10:52 AM

In order to sustain and thrive in this contemporary and dynamic environment rapid and timely decision making is more essential then to make right decision.Organization profitability is one the core parameter to assess when it come to designing organization goals, objectives and strategies to achieve them. In this blog, I am going to discuss the tools incorporated in SAP ERP to analyze organization profitability.

The two useful tools provided by SAP to analyzed profitability of an organization are Profitability Analysis (CO-PA) and Profit Center Accounting (EC-PCA).

Mention below are the usage of both applications,

In Period Accounting, WIP Offset and Change in inventory account is used to calculated Inventory Changes in Balance sheet. The COGM and COGS is not calculated here since the expenses are not segregated so the production cost is not easily identified. The inventory is calculated through formula,

Inventory Changes in B/S = Opening Inventory - Ending Inventory (Physical Count)

In Cost of sales accounting, we segregate all expenses at time of entry functional area/department wise like Production, Sales and Marketing and Research and Development. So,here cost of Function area "Production" is our COGM. COGS is calculated through formula,

COGS = (Opening Inventory - Ending Inventory (Physical Count)) + COGM (Production Functional Area Cost)

The figure below illustrates the example of Period Accounting and Cost of Sales Accounting,

Profitability Analysis is one the most vital and valuable functionality provided by SAP Controlling module. It helps the management to analyze it Profitability from various dimension, develop its strategy and make decisions by collecting and analyzing all the useful data from other functions like, Material Management, Sale and Distribution, Production and Finance.

There are two types of CO-PA in SAP and we can used the both of these types simultaneously,

1- Account based CO-PA

In account based CO-PA, COGS is recorded in CO-PA at the time of billing in SD along with revenue generated from Invoice document generated here.

2- Costing based CO-PA

In case of Costing based CO-PA, the COGS is directly extracted from the Sales and distribution module through condition type 'VPRS'.

The below figure shows the flow of data from other modules in both types of CO-PA,

Chart below shows the difference between the Costing Based and Account Based CO-PA,

Below figure shows the two different Profit and Loss statement constructed through using account based and costing based CO-PA,

Previously in ECC, costing based CO-PA is recommended as it has more advantages over account based CO-PA. Now in S4 HANA third generation platform, most of the advantages of costing based COPA is combined with account based CO-PA. We can construct Profit and loss statement with contribution margin calculations now in account based CO-PA.

Now in S4/ HANA, most of the benefits of Costing based CO-PA is included in Account based CO-PA that why it is recommended to use Account based CO-PA in S4/ HANA.

The chart below shows the pros and cons of account based vs costing based CO-PA in S4/ HANA,

In the field of accounting, variable (direct) costing and absorption (full) costing are two different methods of applying production costs to products or services. The difference between the two methods is in the treatment of fixed manufacturing overhead costs.

Under the direct costing method, fixed manufacturing overhead costs are expense during the period in which they are incurred.

Under the full costing method, fixed manufacturing overhead costs are expense when the product is sold.

The figure below illustrates the structure of Absorption and Variable costing method,

In order to used functionality of CO-PA (Profitability Analysis), the operating concern must be create which is highest hierarchical unit in combined FICO module. The structure and assignment of operating concern, controlling area and company code is shown in the figure below,

The Operating Concerns contains the list of characteristics and value fields,

Characteristic defines the level at which you see the report. e-g; company code, sales area , customer and product. Following are the types of characteristics in CO-PA,

Fixed Characteristics: When we generate an operating concern there are some fixed characteristic which already generated in operating concerns.

e-g; Product, Company Code and sale area etc.

Predefined Characteristics: We can include more characteristics in an operating concern. These characteristics are already present in the field catalog and explicitly added to operating concern.

e-g; Sales Employee and Material group.

Customer -defined Characteristics: In field catalog we can also defined our own characteristics and from there we include them in our Operating Concern.

Profitability Segment Characteristics (Segment-Level Characteristics): Profitability segment is a unique combination of selected characteristics. i-e; Only the characteristics selected for the setting will be used in profitability segments as shown below.

T-Code: KEQ3

Example;

ProdA / Customer 1 = Proft seg 1

ProdB / Customer 1 = Proft seg 2

ProdA / Customer 2 = Proft seg 3

Value Field (only for Costing based CO-PA) defines the key figure you want to see in the report. It can be either an amount or a quantity field. Example, if you want to see customer wise revenue/ cost of sales / profit. Here customer is the characteristic and revenue/ cost of sales / profit are the value field.

VV010 Revenue,

VV030 Customer discount,

VV100 Outgoing Freight,

VV130 Internal sales commission,

VV140 COGS,

VV150 Material Input,

VV250 Mat OH,

VV400 Production costs,

VV700 Sales Quantity,

VVIQT Invoiced Quantity,

In costing based CO-PA, the data is transferred and recorded by the record types. The figure below illustrates the record types for the different transactions in costing based CO-PA.

Transfer of Sales and Distribution Billing: (T-Code: KE41)

Assignment of SD condition to value field. Sales and distribution data is directly transfer CO-PA using SD condition types mapping with CO-PA value field without valuation,

Transfer of Incoming Sales Order (T-Code: KE41):

Assignment of SD condition to value field. Sales and distribution data is directly transfer CO-PA using SD condition types mapping with CO-PA value field without valuation,

The activation of data transfer for Incoming orders would be done at following transaction,

If the company want to transfer the cost of training for specific Product e-g; sedan cars only, then it has to create and assign profitability segment sedan cars while making FI general ledger posting of training cost to Prof. segment field in FI transaction (FB50).

If we want to post to dual cost object like cost center and profitability segment, in that case the profitability segment is the real object and cost center is statistical.

Similarly, as in case of FI direct posting, the characteristic found in the financial document generated from Material Management module updates the profitability segments in CO-PA module. e-g; price difference, transfer inventory difference and expense from revaluation of materials.

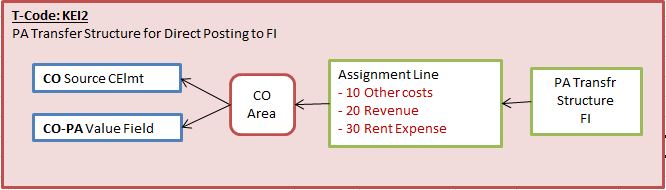

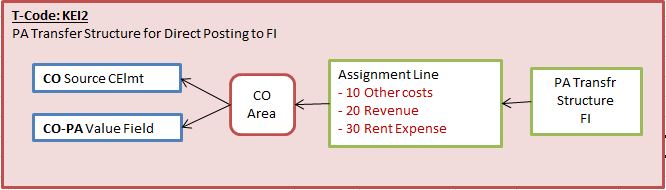

To transfer actual data from FI/MM to costing based CO-PA, we need to do define PA transfer structure in which we define source cost elements to target CO-PA value field as shown in figure below,

Order and Project settlement (T-Code: KEI1) :

To transfer actual data from Order or Project to costing based CO-PA, we need to do define PA transfer structure as in case of posting from FI/MM, in which we define source cost elements to target CO-PA value field and assigned that PA transfer structure to settlement Profile of an order/project as shown in figure below,

Assessment Cycle in CO-PA (T-Code: KEU1):

If we want to allocate any costs from cost centers like Marketing Cost center to the any CO-PA characteristic like product e-g Sedan cars we use assessment cycle to allocates costs. The Assessment cycle contains number of segments, which describes the receivers, senders, assessment cost element, CO-PA value field/ PA transfer structure and tracing factors as shown in the figure below,

Assessment costing element we assign in segment is to used to record cost on receiver profitability segment in account based CO-PA. While the CO-PA value field or PA transfer structure assigned in segment is used for costing based CO-PA.

Allocating Process in CO-PA (KEU1):

Notice that here you transfer the valuated process quantities and not the activity type quantities as with cost centers.

When you create the process allocation, you can specify a profitability segment as the receiver by selecting the Profit segment field. Then, when you press ENTER, the system displays a dialog box in which you can specify the characteristic values to which you want to allocate the process.

The process quantity is then valuated using the planned price for that process and credited to the cost center as actual data with the allocation cost element that was assigned to the relevant business process.

In account-based CO-PA, the costs are debited with the same allocation cost element. For costing-based CO-PA, you need to assign this allocation cost element to the required value field in the PA transfer structure CO.

Top Down Distribution for Actual Data:

Top down distribution of actual data is a periodic function that enables you to distribute this aggregated data to extensive levels, such as the division level or the customer level in CO-PA, based on reference information, such as the data from the previous year.

In case of information like revenue, sales deduction and COGM which are entered at extensive level like customer/ Product. Some information like freight invoices or insurance expense can only be entered at summarized level at company code or sale organization level which is needed to be distributed to extensive levels like Product/ Customers in order to generate report or analyze profitability at segment level. This splitting of summarized costs would be done through Top Down distribution.

After the completion of Production order/ Process or at the end of period we calculate production variances and settle it to accounting as well as CO-PA through allocation structure (for accounting) and PA transfer Structure (for CO-PA) as shown in figure below.

The PA transfer structure consists of one or more lines called assignment lines. In these lines we define the source cost element group and variance category for a value field of the operating concern.

All Cost elements can either group into a cost element group or we can define a number of groups for materials, internal activities, business processes, and other overhead costs elements.

The cost component of the standard cost estimate is linked to value fields. So, make sure that current standard cost estimate is selected for valuation in CO-PA. Also, the variance flag must be selected in settlement profile assigned to relevant Production Order.

Note: Only Target variance in version "0", is settled to CO-PA.

Derivation supplements or overwrites certain automatically mapped characteristic values.

A derivation strategy is a sequence of steps, where each step uses one derivation technique to calculate one or more values for one or more characteristics, respectively.

Some derivation steps are created by the system at generation time, of which some are modifiable.

Example;

Prod A / District North = Proft seg 1

Prod B / District North = Proft seg 2

Prod A / District South = Proft seg 3

Prod B / District South = Proft seg 4

Now, for above Profitability segments we do characteristic derivation like,

Segment 1: Sedan car in North

Segment 2: Hatchback car in North

Segment 3: Sedan car in South

Segment 4: Hatchback car in South

Valuation is optional functionality in costing based CO-PA which is used to extract or calculate additional information in CO-PA which is not available at the time of data transfer to CO-PA.

A valuation strategy can contain CO-PA costing sheets, Sales Order Management pricing procedures (in planning), product costing calls, and user exit calls, in a sequence that can be customized.

Example:

Sale deduction like commission, cash rebates which are not available in the invoice and calculated in CO-PA as provision. Special direct costs like transporting and packaging are also calculated or provisioned in CO-PA.

The various valuation techniques that populate the value fields in different ways are:

• 1- From Product Costing, cost components are mapped to value fields.•

2- With costing sheets, condition types are mapped to value fields.

• 3- Value fields are updated directly through user exits.

Through valuation, the product cost estimate information for CO-PC can be transferred into CO-PA, through cost component values. This function is used, so that cost-of-sales can be analyzed extensively in CO-PA and multiple margin values can be calculated and analyzed in CO-PA.

In configuration, cost components are mapped to value fields. Each component can be map to its own value field or multiple components to a single value field.You can also map the fixed and variable portions of a component to separate value fields.

The SD condition types are mapped with the CO-PA value fields to fetch the data of sales at the time of SD billing. It is an real time valuation which took place at the time of actual transaction and document with record type F is generated in costing based CO-PA during billing. The two condition type mainly use are base condition type and calculation condition type

Base condition types form the basis of calculation and assigned to the value field which is populated through other means.

Calculation condition types is populated through calculations on the lines in the costing sheets that represents subtotals of amounts, such as base amount. These condition types actually populate the value fields with values.

________________________________________________________________________________

Cost Component Split in Account based COPA SAP - ERP ECC

Through Enhancement

Cost Component Split in Account based COPA - What’s New in S/4HANA

1. Define Accounts for Splitting the Cost of Goods Sold

In this Customizing activity, you can refine the settings for changes in inventory or COGS postings to split the amount and post it to different accounts according to the cost components that are used in the underlying costing sheet. The respective cost component amount is then used for the corresponding journal entry line item.

Path: IMG → Financial Accounting (New) → General Ledger Accounting (New) → Periodic Processing → Integration → Materials Management→ Define Accounts for Splitting the Cost of goods sold.

2. Define Accounts for Splitting Price Differences

This customizing helps in posting production variances as per variances categories.

Path: IMG → Financial Accounting (New) → General Ledger Accounting (New) → Periodic Processing → Integration → Materials Management→ Define Accounts for Splitting the Cost of Goods Sold

3. Define Additional Quantity Fields

This customizing helps you having additional quantity fields in your transactions and reporting.

Path: IMG > Controlling > General Controlling > Additional Quantities > Define additional quantities

Valuation with material cost estimate: error with product "XXXXXXXX"

Message no. KE350

In Profitability Analysis (CO-PA), the system tried to valuate a line item using the current standard cost estimate.

In order to determine the current plan period, the system needs to read the valuation segment of the material master.

Example in my case There are some FERT Materials whose Inventory are build through Material Transfer (Movt Type. 309)

Valuation with material cost estimate: error with product "XXXXXXXX"

Message no. KE350

Below are the few solutions,

We decided to do the standard cost estimate without quantity. I will input the cost to each cost element on KKPAN.

Link: https://www.toolbox.com/tech/enterprise-software/question/copa-valuation-without-standard-cost-estim...

Link: https://blogs.sap.com/?p=1179605&preview=true&preview_id=1179605

T-Code: KEPC

a. Click on create

b. Choose "Assignment"

c. In the source fields, choose chars PLANT, MAT TYPE along with BWFKT VRGAR VERSI

d. Now click on "Maintain Rule values"

e. Maintain your costing keys for the combination of PLANT/MAT TYPE.

Link: https://blogs.sap.com/?p=1179605&preview=true&preview_id=1179605

Link: https://answers.sap.com/questions/7764108/error-message-ke350---valuation-with-material-cost.html

_____________________________________________________________________________

CO-PA Material Cost Estimate Valuation for MTO (make-to-Order) Materials.

To Settle Cost Estimate to CO-PA in MTO,we have 3 possible scenarios

A - Only Qty i.e. GR from Prod order is tagged to Sales Order.. Sales order is not a CO Object....

This scenario is as good as MTS... Only that GR is tagged to SO....

Your costs are collected on Prod order....

PGI uses GBB-VAX i.e. does not post to sales order... Billing updates revenue and COGS to costing based COPA

B - Prod Order is settled upon sales order.. GR from prod order does not update any accounting document. SO is cost obj with non valuated stock (SAP recommends this)

Sales order is settled to COPA.. Here you can use a PA Trf Str where in you have replicated your Cost Comp Str... i.e. You can create as many assignment lines in KEI1 as your CCS in OKTZ and assign each one of them to a separtae value field

No question of variances in this case

C - Prod order is not settled upon sales order.... GR from Prod order updates acc doc.... However, variance from prod order can be settled to the sales order if you create variance account as a cost element... Else, it is settled to COPA. SO is cost obj with valuated stock...

Upon PGI, the COGS is posted to Sales Order as a single line item

Here, in your PA Trf Str, you would create an Assignment line and tick "Qty Billed/Delivered".... This would update the Billing Qty to COPA upon settlement of Sales order

This Qty update will trigger KE4R.... i.e. You need to assign CCS to VF in KE4R for PV=01 and Rec Type = C.... This would update the CCS in COPA as per the Sales Order cost estimate

The Costing Key in KE40 should refer to "Sales order cost estimate" and not "Std Cost estimate"

(by, Ajay M)

Link: https://answers.sap.com/questions/8574596/copa-document-in-mto.html

Link: https://answers.sap.com/questions/7658521/ccs-details-are-not-getting-updated-to-copa-in-sal.html?ch...

________________________________________________________________________________

During Process Order Creation MAT is mandatory Settlement Receiver and automatically picked up in Process Order Distribution Rule.

During Process Order Creation MAT is not mandatory Settlement Receiver and nor allowed in Process Order Distribution Rule.

You have to set the SD1 Rule in settlement profile settings. So, SD1 (Sales Order) as Settlement Receiver gets automatically picked in Distribution Rule for Process Order.

Link: https://sapcollege.co/2020/05/27/functioning-of-co-pa-in-make-to-order-scenario/

Usually, reconciliation is done as part of the month end closure process.

In this blog, I would explain how to do SD-FI-COPA reconciliation and find without running through configurations.

SD-COPA and SD-FI are tightly integrated in SAP. As you all know, below is the integration of SD-FI-COPA.

SD is integrated to COPA via linking of SD pricing conditions to COPA value fields

FI/MM is integrated to COPA via PA transfer structure (Via linking of cost elements/cost element group to COPA value field)

By :Abishek Kumar

Link: http://www.sapspot.com/sd-fi-copa-reconciliation-part-1/

________________________________________________________________________________

This blog post will give you information about the various types of derivations available in COPA and specific scenarios with examples for which these can be used.

There are in total 5 types of derivations as below:

We will discuss each type in detail along with its usage. First of all, we need to understand why we require derivations.

Link: Different types of derivations in COPA | SAP Blogs

https://archive.sap.com/discussions/thread/613570

https://archive.sap.com/discussions/thread/1939416

https://archive.sap.com/discussions/thread/613570

https://archive.sap.com/discussions/thread/1939416#

https://blogs.sap.com/2019/10/04/combined-profitability-analysis-cpa-key-differentiators-with-existi...

https://launchpad.support.sap.com/#/notes/234409

https://blogs.sap.com/2019/09/25/combined-profitability-analysis-cpa-overview/

https://arman-sap-fico.blogspot.com/2019/02/splitting-cogs-with-sap-s4hana-finance.html?fbclid=IwAR3...

https://blogs.sap.com/2017/09/27/cost-of-good-sold-split-with-sap-s4-hana-finance/?fbclid=IwAR1lT6kQ...

Cost Component Split in Account based COPA SAP - ERP ECC - Through Enhancement

https://www.erpfixers.com/blog/qa-enable-cost-component-split-in-g/l-accounts-before-sap-s/4hana

Cost Component Split in Account based COPA - What’s New in S/4HANA

Post | Feed | LinkedIn

Valuation with material cost estimate: error with product "XXXXXXXX"- Message no. KE350

https://blogs.sap.com/?p=1179605&preview=true&preview_id=1179605

https://answers.sap.com/questions/7764108/error-message-ke350---valuation-with-material-cost.html

https://www.toolbox.com/tech/enterprise-software/question/copa-valuation-without-standard-cost-estim...

https://answers.sap.com/questions/8788796/copa-kepc-settings.html

https://answers.sap.com/questions/9493223/assign-costing-key-to-any-characterstic-kepc.html

https://answers.sap.com/questions/7391002/copa-valuation-without-standard-cost-estimate.html

CO-PA Material Cost Estimate Valuation for MTO (make-to-Order) Materials.

https://answers.sap.com/questions/7658521/ccs-details-are-not-getting-updated-to-copa-in-sal.html?ch...

https://answers.sap.com/questions/8574596/copa-document-in-mto.html

https://answers.sap.com/questions/3218687/distribution-rule-could-not-be-created-automatical.html

http://www.sapspot.com/sd-fi-copa-reconciliation-part-1/

Different types of derivations in COPA | SAP Blogs

COPA Derivation Rules: By SAPguidance

COPA Derivation Rules Basics - YouTube

COPA - Derivation Type - Derivation Rules - YouTube

The two useful tools provided by SAP to analyzed profitability of an organization are Profitability Analysis (CO-PA) and Profit Center Accounting (EC-PCA).

Mention below are the usage of both applications,

| Profit Center Accounting (EC-PCA) | Profitability Analysis (COPA) |

| If an organization wants to analyze its internal Profits and loss department wise or as per different areas within your company, then its is recommended to used Profit center accounting. | CO-PA is used to help organization to analyze its profitability as per market segments by extracting sales, profit/loss and cost related data from other modules like SD , Production and MM. |

EC-PCA can be used by companies in any branch of industry (mechanical engineering, chemical, service industries and so on) and with any form of production (repetitive manufacturing, make-to-order manufacturing, process manufacturing). The profit-relevant data is displayed by period. Profit Center Accounting uses Period accounting and Cost-of-sales accounting. | CO-PA can be used by companies in any branch of industry (mechanical engineering, wholesale and retail, chemical, service industries and so on) and with any form of production (repetitive manufacturing, make-to-order manufacturing, process manufacturing). The data can be analyzed by period, or by order or project. Profitability Analysis uses Cost-of-sales accounting method. |

| In EC-PCA we structure the units which we want to evaluate as Profit centers. You can create profit center according to region ( branch offices, plants) function (production, sales), or product (product ranges, divisions). | The market segments are structured like product, customers, orders , other characteristic and Organization units such as company codes or business area wise.It support management in decision making by provided in-depth reports from market oriented viewpoint Customer+ Product= Market Segment (niche marketing) |

Periodic Accounting Vs Cost of Sales Accounting (Perpetual Accounting)

In Period Accounting, WIP Offset and Change in inventory account is used to calculated Inventory Changes in Balance sheet. The COGM and COGS is not calculated here since the expenses are not segregated so the production cost is not easily identified. The inventory is calculated through formula,

Inventory Changes in B/S = Opening Inventory - Ending Inventory (Physical Count)

In Cost of sales accounting, we segregate all expenses at time of entry functional area/department wise like Production, Sales and Marketing and Research and Development. So,here cost of Function area "Production" is our COGM. COGS is calculated through formula,

COGS = (Opening Inventory - Ending Inventory (Physical Count)) + COGM (Production Functional Area Cost)

The figure below illustrates the example of Period Accounting and Cost of Sales Accounting,

Account based Vs Costing based CO-PA

Profitability Analysis is one the most vital and valuable functionality provided by SAP Controlling module. It helps the management to analyze it Profitability from various dimension, develop its strategy and make decisions by collecting and analyzing all the useful data from other functions like, Material Management, Sale and Distribution, Production and Finance.

There are two types of CO-PA in SAP and we can used the both of these types simultaneously,

1- Account based CO-PA

In account based CO-PA, COGS is recorded in CO-PA at the time of billing in SD along with revenue generated from Invoice document generated here.

2- Costing based CO-PA

In case of Costing based CO-PA, the COGS is directly extracted from the Sales and distribution module through condition type 'VPRS'.

The below figure shows the flow of data from other modules in both types of CO-PA,

Chart below shows the difference between the Costing Based and Account Based CO-PA,

| Account-Based PA | Costing-Based PA |

| Account-Based PA uses cost and revenue elements | Costing-Based PA uses Value fields to group cost and revenue elements. |

| No reconciliation issues | Reconciliation issues : Reconciliation between FI and COPA. Delivery: In SD, COGS is updated in FI immediately but not in COPA during post good issue. Billing: During billing COPA is updated with COGS and revenue entry. Due to above reason reconciliation issues arouses, as delivery is done in one period and billing in a different period. So, CO-PA updates the COGS during billing not at delivery. |

| Incoming Sales Order data cannot be mapped in account based CO-PA | Incoming Sales Order data whose delivery for period is not yet taken place would be transfer through SD Condition types to analyze anticipated sales. (optional) |

| Cost component split is not possible | COGS can be split in to cost components |

| Variance analysis not possible | Variance analysis is possible |

| Uses standard tables EC-PCA COEJ : Actual COEP : Planned COSS/COSP : segment Level Only below table is generated, CE4xxxx : segment table | Following tables are generated with operating concern. CE1xxxx : actual line item table CE2xxxx : plan line item table CE3xxxx : segment level CE4xxxx : segment table |

| Incoming Sales Order data whose delivery for period is not yet taken place would be in transfer through SD Condition types to analyze anticipated sales with record type A. | Incoming Sales Order data cannot be mapped in account based CO-PA. |

Below figure shows the two different Profit and Loss statement constructed through using account based and costing based CO-PA,

CO-PA Simplifications in S/4 HANA

Previously in ECC, costing based CO-PA is recommended as it has more advantages over account based CO-PA. Now in S4 HANA third generation platform, most of the advantages of costing based COPA is combined with account based CO-PA. We can construct Profit and loss statement with contribution margin calculations now in account based CO-PA.

Now in S4/ HANA, most of the benefits of Costing based CO-PA is included in Account based CO-PA that why it is recommended to use Account based CO-PA in S4/ HANA.

The chart below shows the pros and cons of account based vs costing based CO-PA in S4/ HANA,

| Account based CO-PA | Costing based CO-PA |

| Costs and Revenue elements are used to transfer data from FI to Account based CO-PA. Same as before. | The Value Fields are used to mapped the costs to the of G/L accounts and SD condition types etc. |

| No reconciliation problem. FI and Account based CO-PA both are reconciled in S4 HANA as before. At the time of delivery, COGS is recorded in CO-PA. At the time of billing, revenue and discount is recorded in CO-PA. | Reconciliation is not guaranteed in S4 HANA. Example, if the delivery took place in one period and its billing is done in next period then at the time of billing the COGS is transferred to CO-PA |

| Cost Component split data can be sent to costing based CO-PA which is not possible in ECC. | Cost Component split data can be sent to Costing based CO-PA as before |

| Variance Analysis which was previously possible only for total Variance in Account based CO-PA, now is possible to analyze by variance category wise as in costing based CO-PA. | Variance analysis according variance category is possible same as before |

| Incoming Sales Order data cannot be mapped in account based CO-PA. | Incoming Sales Order data whose delivery for period is not yet taken place would be in transfer through SD Condition types to analyze anticipated sales with record type A. |

Absorption Costing Vs Variable Costing

In the field of accounting, variable (direct) costing and absorption (full) costing are two different methods of applying production costs to products or services. The difference between the two methods is in the treatment of fixed manufacturing overhead costs.

Under the direct costing method, fixed manufacturing overhead costs are expense during the period in which they are incurred.

Under the full costing method, fixed manufacturing overhead costs are expense when the product is sold.

The figure below illustrates the structure of Absorption and Variable costing method,

CO-PA Organization Structure

In order to used functionality of CO-PA (Profitability Analysis), the operating concern must be create which is highest hierarchical unit in combined FICO module. The structure and assignment of operating concern, controlling area and company code is shown in the figure below,

The Operating Concerns contains the list of characteristics and value fields,

Characteristic:

Characteristic defines the level at which you see the report. e-g; company code, sales area , customer and product. Following are the types of characteristics in CO-PA,

Fixed Characteristics: When we generate an operating concern there are some fixed characteristic which already generated in operating concerns.

e-g; Product, Company Code and sale area etc.

Predefined Characteristics: We can include more characteristics in an operating concern. These characteristics are already present in the field catalog and explicitly added to operating concern.

e-g; Sales Employee and Material group.

Customer -defined Characteristics: In field catalog we can also defined our own characteristics and from there we include them in our Operating Concern.

Profitability Segment Characteristics (Segment-Level Characteristics): Profitability segment is a unique combination of selected characteristics. i-e; Only the characteristics selected for the setting will be used in profitability segments as shown below.

T-Code: KEQ3

Example;

| Char | Description | CostBased+AcctBased |

| ARTNR | Product | X |

| KNDNR | Customer | X |

ProdA / Customer 1 = Proft seg 1

ProdB / Customer 1 = Proft seg 2

ProdA / Customer 2 = Proft seg 3

Value Field (Costing based CO-PA):

Value Field (only for Costing based CO-PA) defines the key figure you want to see in the report. It can be either an amount or a quantity field. Example, if you want to see customer wise revenue/ cost of sales / profit. Here customer is the characteristic and revenue/ cost of sales / profit are the value field.

VV010 Revenue,

VV030 Customer discount,

VV100 Outgoing Freight,

VV130 Internal sales commission,

VV140 COGS,

VV150 Material Input,

VV250 Mat OH,

VV400 Production costs,

VV700 Sales Quantity,

VVIQT Invoiced Quantity,

Flow of Actual Data

In costing based CO-PA, the data is transferred and recorded by the record types. The figure below illustrates the record types for the different transactions in costing based CO-PA.

| Record type | Description |

| B | FI --> CO-PA |

| C | CO --> CO-PA IO settlement to CO-PA MM Production Variances |

| F | SD Billing Data |

| A | Incoming Sales Order |

CO-PA Integration with Sales Order Management

Transfer of Sales and Distribution Billing: (T-Code: KE41)

Assignment of SD condition to value field. Sales and distribution data is directly transfer CO-PA using SD condition types mapping with CO-PA value field without valuation,

Transfer of Incoming Sales Order (T-Code: KE41):

Assignment of SD condition to value field. Sales and distribution data is directly transfer CO-PA using SD condition types mapping with CO-PA value field without valuation,

The activation of data transfer for Incoming orders would be done at following transaction,

- Activation on the Entry date

- Transfer with the delivery or planned settlement date

Direct Posting from FI/MM (T-Code: KEI2) :

If the company want to transfer the cost of training for specific Product e-g; sedan cars only, then it has to create and assign profitability segment sedan cars while making FI general ledger posting of training cost to Prof. segment field in FI transaction (FB50).

If we want to post to dual cost object like cost center and profitability segment, in that case the profitability segment is the real object and cost center is statistical.

Similarly, as in case of FI direct posting, the characteristic found in the financial document generated from Material Management module updates the profitability segments in CO-PA module. e-g; price difference, transfer inventory difference and expense from revaluation of materials.

To transfer actual data from FI/MM to costing based CO-PA, we need to do define PA transfer structure in which we define source cost elements to target CO-PA value field as shown in figure below,

Transfer of Overhead

Order and Project settlement (T-Code: KEI1) :

To transfer actual data from Order or Project to costing based CO-PA, we need to do define PA transfer structure as in case of posting from FI/MM, in which we define source cost elements to target CO-PA value field and assigned that PA transfer structure to settlement Profile of an order/project as shown in figure below,

Assessment Cycle in CO-PA (T-Code: KEU1):

If we want to allocate any costs from cost centers like Marketing Cost center to the any CO-PA characteristic like product e-g Sedan cars we use assessment cycle to allocates costs. The Assessment cycle contains number of segments, which describes the receivers, senders, assessment cost element, CO-PA value field/ PA transfer structure and tracing factors as shown in the figure below,

Assessment costing element we assign in segment is to used to record cost on receiver profitability segment in account based CO-PA. While the CO-PA value field or PA transfer structure assigned in segment is used for costing based CO-PA.

Allocating Process in CO-PA (KEU1):

Notice that here you transfer the valuated process quantities and not the activity type quantities as with cost centers.

When you create the process allocation, you can specify a profitability segment as the receiver by selecting the Profit segment field. Then, when you press ENTER, the system displays a dialog box in which you can specify the characteristic values to which you want to allocate the process.

The process quantity is then valuated using the planned price for that process and credited to the cost center as actual data with the allocation cost element that was assigned to the relevant business process.

In account-based CO-PA, the costs are debited with the same allocation cost element. For costing-based CO-PA, you need to assign this allocation cost element to the required value field in the PA transfer structure CO.

Top Down Distribution for Actual Data:

Top down distribution of actual data is a periodic function that enables you to distribute this aggregated data to extensive levels, such as the division level or the customer level in CO-PA, based on reference information, such as the data from the previous year.

In case of information like revenue, sales deduction and COGM which are entered at extensive level like customer/ Product. Some information like freight invoices or insurance expense can only be entered at summarized level at company code or sale organization level which is needed to be distributed to extensive levels like Product/ Customers in order to generate report or analyze profitability at segment level. This splitting of summarized costs would be done through Top Down distribution.

Transfer from Cost Object CO/ Production Order variances (KEI1):

After the completion of Production order/ Process or at the end of period we calculate production variances and settle it to accounting as well as CO-PA through allocation structure (for accounting) and PA transfer Structure (for CO-PA) as shown in figure below.

The PA transfer structure consists of one or more lines called assignment lines. In these lines we define the source cost element group and variance category for a value field of the operating concern.

All Cost elements can either group into a cost element group or we can define a number of groups for materials, internal activities, business processes, and other overhead costs elements.

The cost component of the standard cost estimate is linked to value fields. So, make sure that current standard cost estimate is selected for valuation in CO-PA. Also, the variance flag must be selected in settlement profile assigned to relevant Production Order.

Note: Only Target variance in version "0", is settled to CO-PA.

CO-PA Characteristic Derivation

Derivation supplements or overwrites certain automatically mapped characteristic values.

A derivation strategy is a sequence of steps, where each step uses one derivation technique to calculate one or more values for one or more characteristics, respectively.

Some derivation steps are created by the system at generation time, of which some are modifiable.

Example;

| Char | Description | CostBased+AcctBased |

| ARTNR | Product | X |

| KNDNR | District | X |

Prod A / District North = Proft seg 1

Prod B / District North = Proft seg 2

Prod A / District South = Proft seg 3

Prod B / District South = Proft seg 4

Now, for above Profitability segments we do characteristic derivation like,

Segment 1: Sedan car in North

Segment 2: Hatchback car in North

Segment 3: Sedan car in South

Segment 4: Hatchback car in South

CO-PA Valuation

Valuation is optional functionality in costing based CO-PA which is used to extract or calculate additional information in CO-PA which is not available at the time of data transfer to CO-PA.

A valuation strategy can contain CO-PA costing sheets, Sales Order Management pricing procedures (in planning), product costing calls, and user exit calls, in a sequence that can be customized.

Example:

Sale deduction like commission, cash rebates which are not available in the invoice and calculated in CO-PA as provision. Special direct costs like transporting and packaging are also calculated or provisioned in CO-PA.

Valuation Strategies and Techniques

The various valuation techniques that populate the value fields in different ways are:

• 1- From Product Costing, cost components are mapped to value fields.•

2- With costing sheets, condition types are mapped to value fields.

• 3- Value fields are updated directly through user exits.

Valuation using Material Cost Estimates:

Through valuation, the product cost estimate information for CO-PC can be transferred into CO-PA, through cost component values. This function is used, so that cost-of-sales can be analyzed extensively in CO-PA and multiple margin values can be calculated and analyzed in CO-PA.

| With Out valuation | COGS/COGM is determined from Material master standard price Cost component split is not possible |

| With Valuation | Without ML/Actual Costing: COGS/COGM is determined from Planned cost estimate Cost component split is possible |

With ML/Actual Costing: COGS/COGM is determined from Actual cost estimate Cost component split is possible |

In configuration, cost components are mapped to value fields. Each component can be map to its own value field or multiple components to a single value field.You can also map the fixed and variable portions of a component to separate value fields.

Valuation using Costing Sheet :

The SD condition types are mapped with the CO-PA value fields to fetch the data of sales at the time of SD billing. It is an real time valuation which took place at the time of actual transaction and document with record type F is generated in costing based CO-PA during billing. The two condition type mainly use are base condition type and calculation condition type

Base condition types form the basis of calculation and assigned to the value field which is populated through other means.

Calculation condition types is populated through calculations on the lines in the costing sheets that represents subtotals of amounts, such as base amount. These condition types actually populate the value fields with values.

In this article I have tried to explain the functionality of Profitability Analysis in detail. The blog provides the overview of different tools for analyzing organization profitability and the detail functionality of costing based CO-PA as it was most diversified tool to analyze profitability among others in SAP ERP. To gain more knowledge on the topic it is suggested to read the links mention in references. In my next blog, I will discuss the CO-PA Planning.

Hope you found this article useful. The time you took to read this blog is highly appreciated.

________________________________________________________________________________

Real Time Problem, Error Codes and Issues face by Businesses related to CO-PA

________________________________________________________________________________

Problem:

Cost Component Split in Account based COPA SAP - ERP ECC

Solution:

Through Enhancement

Link: https://www.erpfixers.com/blog/qa-enable-cost-component-split-in-g/l-accounts-before-sap-s/4hana

________________________________________________________________________________

Problem:

Cost Component Split in Account based COPA - What’s New in S/4HANA

Solution:

There are some glaring changes in S/4HANA in regard to account based CO-PA, mentioned below.

1. Define Accounts for Splitting the Cost of Goods Sold

In this Customizing activity, you can refine the settings for changes in inventory or COGS postings to split the amount and post it to different accounts according to the cost components that are used in the underlying costing sheet. The respective cost component amount is then used for the corresponding journal entry line item.

Path: IMG → Financial Accounting (New) → General Ledger Accounting (New) → Periodic Processing → Integration → Materials Management→ Define Accounts for Splitting the Cost of goods sold.

2. Define Accounts for Splitting Price Differences

This customizing helps in posting production variances as per variances categories.

Path: IMG → Financial Accounting (New) → General Ledger Accounting (New) → Periodic Processing → Integration → Materials Management→ Define Accounts for Splitting the Cost of Goods Sold

3. Define Additional Quantity Fields

This customizing helps you having additional quantity fields in your transactions and reporting.

Path: IMG > Controlling > General Controlling > Additional Quantities > Define additional quantities

Link: Post | Feed | LinkedIn

(By Leticia M.)

________________________________________________________________________________

Problem:

CO-PA valuation without Standard cost estimate

Valuation with material cost estimate: error with product "XXXXXXXX"

Message no. KE350

Diagnosis

In Profitability Analysis (CO-PA), the system tried to valuate a line item using the current standard cost estimate.

In order to determine the current plan period, the system needs to read the valuation segment of the material master.

Reason:

Normally, We ran standard cost estimate with quantity for Material type FERT.

Then for CO-PA Valuation for Material Cost Estimates, we configure KE4J & KE4R, to transfer the the break up cost to CO-PA.

However, for some FERT materials, we don't execute standard cost estimate and insert standard cost to material master directly.

Example in my case There are some FERT Materials whose Inventory are build through Material Transfer (Movt Type. 309)

In this case, the standard cost on material master cannot be transferred, since its not executed in System. That why system generates error,

Valuation with material cost estimate: error with product "XXXXXXXX"

Message no. KE350

Solution:

Below are the few solutions,

1- Execute the Standard Cost Estimate without Quantity Structure.

We decided to do the standard cost estimate without quantity. I will input the cost to each cost element on KKPAN.

Link: https://www.toolbox.com/tech/enterprise-software/question/copa-valuation-without-standard-cost-estim...

Link: https://blogs.sap.com/?p=1179605&preview=true&preview_id=1179605

2- To Configure and Use KEPC, to exclude those Materials from the CO-PA Material Cost Estimate.

T-Code: KEPC

a. Click on create

b. Choose "Assignment"

c. In the source fields, choose chars PLANT, MAT TYPE along with BWFKT VRGAR VERSI

d. Now click on "Maintain Rule values"

e. Maintain your costing keys for the combination of PLANT/MAT TYPE.

Link: https://blogs.sap.com/?p=1179605&preview=true&preview_id=1179605

Link: https://answers.sap.com/questions/7764108/error-message-ke350---valuation-with-material-cost.html

_____________________________________________________________________________

Problem:

CO-PA Material Cost Estimate Valuation for MTO (make-to-Order) Materials.

Solution:

To Settle Cost Estimate to CO-PA in MTO,we have 3 possible scenarios

A - Only Qty i.e. GR from Prod order is tagged to Sales Order.. Sales order is not a CO Object....

This scenario is as good as MTS... Only that GR is tagged to SO....

Your costs are collected on Prod order....

PGI uses GBB-VAX i.e. does not post to sales order... Billing updates revenue and COGS to costing based COPA

B - Prod Order is settled upon sales order.. GR from prod order does not update any accounting document. SO is cost obj with non valuated stock (SAP recommends this)

Sales order is settled to COPA.. Here you can use a PA Trf Str where in you have replicated your Cost Comp Str... i.e. You can create as many assignment lines in KEI1 as your CCS in OKTZ and assign each one of them to a separtae value field

No question of variances in this case

C - Prod order is not settled upon sales order.... GR from Prod order updates acc doc.... However, variance from prod order can be settled to the sales order if you create variance account as a cost element... Else, it is settled to COPA. SO is cost obj with valuated stock...

Upon PGI, the COGS is posted to Sales Order as a single line item

Here, in your PA Trf Str, you would create an Assignment line and tick "Qty Billed/Delivered".... This would update the Billing Qty to COPA upon settlement of Sales order

This Qty update will trigger KE4R.... i.e. You need to assign CCS to VF in KE4R for PV=01 and Rec Type = C.... This would update the CCS in COPA as per the Sales Order cost estimate

The Costing Key in KE40 should refer to "Sales order cost estimate" and not "Std Cost estimate"

(by, Ajay M)

Link: https://answers.sap.com/questions/8574596/copa-document-in-mto.html

Link: https://answers.sap.com/questions/7658521/ccs-details-are-not-getting-updated-to-copa-in-sal.html?ch...

________________________________________________________________________________

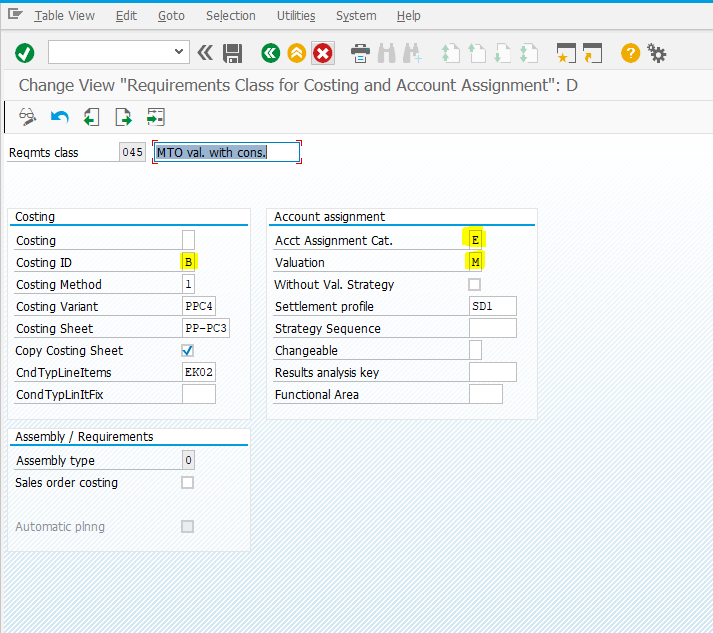

Requirement Class Settings for Valuated Sales Order Stock

Effects:

During Process Order Creation MAT is mandatory Settlement Receiver and automatically picked up in Process Order Distribution Rule.

Requirement Class Settings For Non Valuated Sales Order Stock

Effects:

During Process Order Creation MAT is not mandatory Settlement Receiver and nor allowed in Process Order Distribution Rule.

You have to set the SD1 Rule in settlement profile settings. So, SD1 (Sales Order) as Settlement Receiver gets automatically picked in Distribution Rule for Process Order.

Link: https://sapcollege.co/2020/05/27/functioning-of-co-pa-in-make-to-order-scenario/

Problem:

SD-FI-COPA reconciliation:

Solution:

Usually, reconciliation is done as part of the month end closure process.

In this blog, I would explain how to do SD-FI-COPA reconciliation and find without running through configurations.

SD-COPA and SD-FI are tightly integrated in SAP. As you all know, below is the integration of SD-FI-COPA.

SD is integrated to COPA via linking of SD pricing conditions to COPA value fields

FI/MM is integrated to COPA via PA transfer structure (Via linking of cost elements/cost element group to COPA value field)

By :Abishek Kumar

Link: http://www.sapspot.com/sd-fi-copa-reconciliation-part-1/

________________________________________________________________________________

Problem:

Different types of derivations in COPA

Solution:

This blog post will give you information about the various types of derivations available in COPA and specific scenarios with examples for which these can be used.

There are in total 5 types of derivations as below:

- Derivation rule

- Table look up

- Move

- Clear

- Enhancement

We will discuss each type in detail along with its usage. First of all, we need to understand why we require derivations.

By Rahul Agarwal

Link: Different types of derivations in COPA | SAP Blogs

References:

https://archive.sap.com/discussions/thread/613570

https://archive.sap.com/discussions/thread/1939416

https://archive.sap.com/discussions/thread/613570

https://archive.sap.com/discussions/thread/1939416#

https://blogs.sap.com/2019/10/04/combined-profitability-analysis-cpa-key-differentiators-with-existi...

https://launchpad.support.sap.com/#/notes/234409

https://blogs.sap.com/2019/09/25/combined-profitability-analysis-cpa-overview/

https://arman-sap-fico.blogspot.com/2019/02/splitting-cogs-with-sap-s4hana-finance.html?fbclid=IwAR3...

https://blogs.sap.com/2017/09/27/cost-of-good-sold-split-with-sap-s4-hana-finance/?fbclid=IwAR1lT6kQ...

Cost Component Split in Account based COPA SAP - ERP ECC - Through Enhancement

https://www.erpfixers.com/blog/qa-enable-cost-component-split-in-g/l-accounts-before-sap-s/4hana

Cost Component Split in Account based COPA - What’s New in S/4HANA

Post | Feed | LinkedIn

Valuation with material cost estimate: error with product "XXXXXXXX"- Message no. KE350

https://blogs.sap.com/?p=1179605&preview=true&preview_id=1179605

https://answers.sap.com/questions/7764108/error-message-ke350---valuation-with-material-cost.html

https://www.toolbox.com/tech/enterprise-software/question/copa-valuation-without-standard-cost-estim...

https://answers.sap.com/questions/8788796/copa-kepc-settings.html

https://answers.sap.com/questions/9493223/assign-costing-key-to-any-characterstic-kepc.html

https://answers.sap.com/questions/7391002/copa-valuation-without-standard-cost-estimate.html

CO-PA Material Cost Estimate Valuation for MTO (make-to-Order) Materials.

https://answers.sap.com/questions/7658521/ccs-details-are-not-getting-updated-to-copa-in-sal.html?ch...

https://answers.sap.com/questions/8574596/copa-document-in-mto.html

https://answers.sap.com/questions/3218687/distribution-rule-could-not-be-created-automatical.html

SD-FI-COPA reconciliation: By Abishek Kumar

http://www.sapspot.com/sd-fi-copa-reconciliation-part-1/

Different types of derivations in COPA - By Rahul Agarwal

Different types of derivations in COPA | SAP Blogs

COPA Derivation Rules: By SAPguidance

COPA Derivation Rules Basics - YouTube

COPA - Derivation Type - Derivation Rules - YouTube

- SAP Managed Tags:

- FIN Controlling,

- FIN Profitability Analysis

23 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

Ariba

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

3 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

mm purchasing

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

purchase order

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

Sourcing and Procurement

1 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- How to add characteristics for profitability analysis? in Enterprise Resource Planning Q&A

- Service with Advanced Execution and Fixed Price Billing in Enterprise Resource Planning Blogs by SAP

- Ad-hoc Service with Fixed Price billing or Billing Plan in Enterprise Resource Planning Blogs by SAP

- Ad-hoc Service with T&M billing (Time & Material) in Enterprise Resource Planning Blogs by SAP

- Condition Contract - Transfer of settlement documents to COPA in Enterprise Resource Planning Q&A

Top kudoed authors

| User | Count |

|---|---|

| 5 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |