- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- SAP S/4HANA Currency Setup

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Employee

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

01-02-2018

5:38 PM

Objective

This blog is aimed to provide an insight and overall understanding and consideration of currency setup in S/4HANA environment and have tried to answer the following queries.

What is currency type

Currency Types in S/4HANA

We have following standard Currency types in SAP S/4HANA

Currency Type 00

Document currency is the currency that is applied for the document and company code currency is the currency where the document is generated. Example : An Indian company does a posting for a Sale of goods in USA. In this case the document currency would be USD and the Company code currency would be INR

Currency Type 10

Company code currency is defied at company code level in transaction OX02

11- Co Code Currency Group Valuation (used in Transfer Pricing)

12- Co Code Currency PC Valuation (used in Transfer Pricing)

(Currency Type 11 and 12 are explained in transfer pricing section)

You can select currency type 10 in controlling area only if all company codes assigned to the controlling area uses same currency.

Currency Type 20

If data is returned from Controlling to financial accounting in your application, for example via order settlement, you must use a currency type in the controlling area that is also used as the currency type of a parallel currency in the assigned company codes. Typically, these are the currency types for a group currency, hard currency or index-based currency.

--> Currency type 20 cannot be used in FI.

Currency type 20 is supported in FINSC_LEDGER, therefore only for compatibility reasons; if currency type 20 was already used in CO, then after migration of the currency configuration, "KSL" field of ACDOCA will be used for CO only, and FI will work with the fields HSL, OSL and VSL.

For new installations we strongly recommend to configure currency type 30 in CO and in FI (for the KSL (Group Currency) field in ACDOCA).

Currency Type 30

You define the currency key for these currency types when you define the client. You can define it by T-code: SCC4.

Currency type 20 is only known by cost accounting, whereas currency type 30 is known in financial accounting also. Therefore, data transmission via the modules CO, AM, and FI works seamlessly without any difficulties if currency type 30 is used by all.

Whether to use currency type 20 or 30 to know more detail you may read OSS note 119428

31- Group Currency Group Valuation (used in Transfer Pricing)

32- Group Currency PC Valuation (used in Transfer Pricing)

(Currency Type 31 and 32 are explained in transfer pricing section)

Currency Type 40 and 50

Hard Currency and Index Based Currency

You define the currency key for this currency type when defining the countries in the "Hard currency" field T-code: OY01

If you select currency type 40 or 50 in controlling area, the company codes must either be in the same country, or the countries must use the same index-based currency or hard currency.

Currency Type 60 - Global Company Currency

If you select currency type 60 in Controlling area, the company codes must belong to the same company, or the companies must use the same currency.

With currency types 40, 50, and 60, specify the currency only as long as no company codes have been assigned. If company codes have been assigned, the system defaults the currency automatically.

Currency Type 70 Object currency (CO)

Each object in Controlling, such as cost center or internal order, may use a separate currency specified in its master data. When you create an object in CO, the SAP system defaults the currency of the company code to which the object is assigned as the object currency. You can specify a different object currency only if the controlling area currency is the same as the company code currency. There is an object currency for the sender as well as one for the receiver.

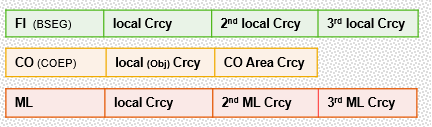

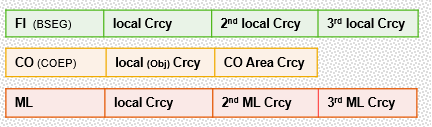

Supported currencies in ERP

Still in S/4HANA till On-premise 1709 release we have maximum 3 currencies in FI(BSEG), 2 currencies in CO and 3 currencies in ML. However in Universal Journal table(ACDOCA) we can have maximum upto 10 currencies.

Currencies used in S/4HANA 1610 Onwards

From SAP S/4HANA 1610 On Premise version as well with SAP S/4 HANA Finance 1605 we can have upto 10 currencies in Universal Journal (ACDOCA)

Go to SPRO -> Financial Accounting->Financial Accounting Global Settings-> Ledgers-> Ledger -> Define Settings for Ledgers and Currency Types

In this Customizing activity, you configure the currency types and currency conversion settings that you use in Accounting and define the corresponding ledger settings and assign accounting principles for ledgers and company codes.

Currency Types

Check your currency settings and create additional currency types if required. Your own currency types must begin with the letter Y or Z, for example Y1, Y2, ZA etc.

For each currency type you decide whether you want the corresponding currency conversion settings to be valid globally for all company codes or want to define the currency conversion settings at company code-level.

You can’t make any changes to the SAP standard currency types Document Currency (00) and Company Code Currency (10). For the other standard currency types, you can define whether the corresponding currency conversion settings are valid globally or at company code-level.

If you are using transfer prices, create the required number of currency types (depending on the valuation methods you need) and select the valuation view you need (legal, group, or profit center valuation). For the currency types with group or profit center valuation, you need to enter the base currency type, meaning the currency type with the legal valuation view on which the transfer prices valuation will be based. For each base currency type there can be only one currency type using group valuation and one using profit center valuation.

Global Currency Conversion Settings

For your own currency types, enter the currency into which the conversion is to be made (Currency field), and the currency from which currency conversion is to be made (Source Currency field). In addition, enter the exchange rate type and the date on which the translation is to be carried out (document date, posting date, or translation date). You can also decide whether the currency conversion shall be done in real-time. If you don’t select the Real-time Conversion checkbox, you can do this at period-end closing using the foreign currency run.

Currency Conversion Settings for Company Codes

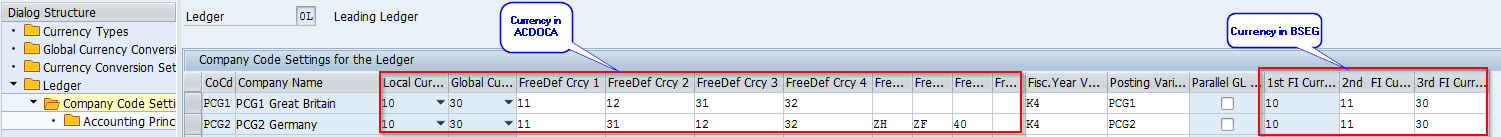

Company code settings for the ledger

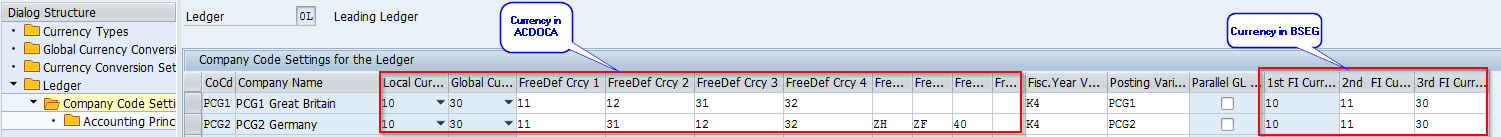

ACDOCA V/s BSEG currency settings

First 2 Currency fields are derived from local currency i.e company code currency and controlling area currency and rest 8 fields are freely defied currency per ledger and all these fields you may see in Universal Journal table (ACDOCA)

There is no dependency on the currency types of the leading ledger.

Real-time currency conversion for all currency types is possible (or with foreign currency valuation program at period-end

Still BSEG is populated with 3 currencies so you may choose which 3 currencies you want to populate in BSEG (of course first currency will be default to company code currency for BSEG)

For further detail you may refer OSS note 2344012 (Currencies in Universal Journal)

Currencies used in Controlling

The system uses this currency for cost accounting. This currency is set up when you create the controlling area. It is based on the assignment control indicator and the currency type, following possible currencies can be assigned to controlling area, these are explained in currency type section above.

10 Company code currency

30 Group currency

40 Hard currency

50 Index-based currency

60 Global company currency

Controlling Area Currency

SPRO-> Controlling-> General Controlling-> Organization-> Maintain Controlling Area

Transaction Currency (CO)

Documents in Controlling are posted in the transaction currency. The transaction currency can differ from the controlling area currency and the object currency. The system automatically converts the values to the controlling area currency at the exchange rate specified.

The transaction currency is USD, the controlling area currency is EUR, and the object currency is SFR (Swiss francs). The system converts the amounts as follows:

Material Ledger Currencies

SPRO->Controlling->Product Cost Controlling-> Actual Costing/Material Ledger-> Assign Currency Types and Define Material Ledger Types

Currency Type 10, 30

With Transfer Pricing active

For example we can have following currency types in Material Ledger

Currency Type 10, 31

Or

Currency Type 10, 32

Or

Currency Type 10, 31,32

Profit Center Currency with Transfer Pricing

Transaction 0KE5

It is common to set 30 in the controlling area, 10 and 32 in the currency and valuation profile, and 10 and 32 in the material ledger.

If you then set the profit center local currency type to 30 and valuation view 2 (profit center valuation) in Profit Center Accounting, the currency type 32 is continuously used. In Profit Center Accounting, 32 is updated as profit center local currency in the currency field KSL. The company code local currency in the profit center valuation (12) is then translated from the values 32 with the exchange rate type M with the current exchange rate (and updated in the field HSL). This means that in Profit Center Accounting, only the PCA valuation is available. The legal valuation (10, 30) is no longer available in PCA.

Similarly, if you then set the profit center local currency type to 30 and valuation view 1 (Group Valuation) is selected in profit center accounting then the currency type 31 is used. In Profit Center Accounting, 31 is updated as profit center local currency in the currency field KSL. The company code local currency in the profit center valuation (11) is then translated from the values 31 with the exchange rate type M with the current exchange rate (and updated in the field HSL). This means that in Profit Center Accounting, only the group valuation is available. The legal valuation (10, 30) is no longer available in PCA.

The flows of goods in legal valuation and in profit center valuation are valuated differently, even if the currency key is identical. For details. Please read the SAP note 1442153 .

If you need to change, add or delete any currency settings after the Material Ledger is productive, you would need to reverse the customizing changes, deactivate the Material Ledger, change the customizing to the desired values and restart the Material Ledger again. As a consequence, you will lose all the Material Ledger data in the system. Please, check the KBA 1511335 on this topic. Take into account that deactivation means running report SAPRCKMJX, and this report deletes all the Material Ledger data for the corresponding plant.

An alternative would be to use the SLO conversion services so that all Material Ledger data in the tables for currency type 20 are converted to currency type 30. Please, consider that this is a chargeable service.

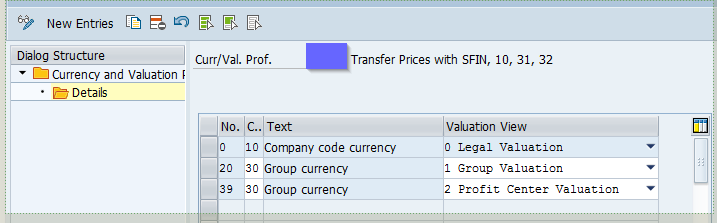

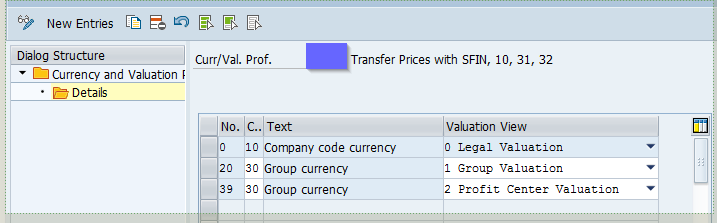

Transfer Pricing Define Currency + Valuation Profile

You only need the currency and valuation profiles if you want to manage various valuations in parallel in your system

Group and profit center valuation must also be managed correspondingly in the material ledger as a currency type and valuation category as explained in material ledger section.

Typical currency settings with profit center valuation:-

FI: 10, 32

CO: 30

Currency and valuation profile: 10, 32

Material ledger: 10, 32

Profit Center Accounting: 30 and profit center valuation (= 32)

PCA 32 (KSL), 12 (HSL)

Currency type 12 is translated from 32 with Exchange rate type M at current rate

This means that in Profit Center Accounting, only the PCA valuation is available. The legal valuation (10, 30) is no longer available in PCA

Typical currency settings with Group valuation:-

FI: 10, 31

CO: 30

Currency and valuation profile: 10, 31

Material ledger: 10, 31

Profit Center Accounting: 30 and profit center valuation (= 31)

PCA 32 (KSL), 11 (HSL)

Currency type 12 is translated from 32 with Exchange rate type M at current rate

This means that in Profit Center Accounting, only Group valuation is available. The legal valuation (10, 30) is no longer available in PCA

Transfer Pricing Currency setup in Account V/s Ledger approach

The following two functions are available: For your valuation views, you can either use separate ledgers or map multiple valuation views within a ledger.

If you decide on the scenario with separate ledgers, assign a valuation view to a ledger: The legal, group, or profit center valuation view. In this ledger, you can only configure currency types in the appropriate valuation view. The local and global currency are then always configured in the valuation view of the respective ledger.

If you want to use multiple valuation views within a ledger, do not assign a valuation view to the ledger. The local and global currency are then always used in the legal valuation view in this ledger.

Separate ledger approach is available from S/4HANA1610 onwards that means if customers are already using transfer pricing in their source system and doing a conversion to S/4HANA 1610 or higher version then the second approach i.e "Several valuation views within a ledger" would be possible solution.

For further detail you may use this link:-

https://help.sap.com/viewer/651d8af3ea974ad1a4d74449122c620e/1709%20000/en-US/f550d7531a4d424de10000...

This question is asked quite often that why, when you activate profit center valuation, both currency types 12 and 32 need to be maintained in the new currency customizing (transaction FINSC_LEDGER) (similarly, when you activate group valuation, both currency types 11 and 31). ?

Although only one currency type is maintained for a valuation approach in the currency and valuation profile, both currency types of a valuation are necessary for updating data in Controlling. With the introduction of the universal journal, the data model has been simplified and harmonized. The universal journal uses the ledger approach for general ledger accounting and for all subledgers. Therefore, in ACDOCA, the currency types in the company code currency and the 'global currency' (currency 2 in transaction FINSC_LEDGER = controlling area currency) must exist for each valuation view.

For more detail you may refer SAP note 2882025

Restriction- ML can not be deactivated in S/4HANA

As of 1709 release , In the case the productive start was carried out and the material ledger postings exist in ACDOCA( = there are BSX line items), and customer wants to change any settings that might influence material ledger postings (change of the CURTPs in ML Type, any customizing change of GL that influence the set up of the table FMLT_CURTP_ML, just to name some of them) then there is no other solution but to introduce the new company code and start from the scratch the ML setup. This is recommendable for the test system.

For detail you may refer OSS note 2512618

Operating Concern Currency

This determines the currency and the valuation view in which the values in CO-PA are to be displayed or planned.

Actual data can be updated simultaneously in all the combinations of currency type and valuation that are described below, planning data is always updated in one currency only - the currency specified for that particular plan version.

If you deactivate the company code currency, you can no longer use plan versions and reports that use the company code currency.

New Asset Accounting Currency

For each currency defined in General Ledger Accounting, you have to create parallel depreciation areas in new Asset Accounting.

Fixed Asset Accounting currently only supports the FI relevant (BSEG-) Currencies.

For additional currency types, which are not BSEG relevant, you do not need to create dep area; these currencies are converted during posting. This means, the sum of all depreciations does not balance with the activation value for the additional currencies.

Introduction of new currencies with S/4HAN 1809

With release S/4HANA OP 1809 it is possible to introduce additional currency, tool allows you to introduce new, flexible currencies for company codes and ledgers that are already used in your production system. Afterward, the newly introduced currencies are available in the Universal Journal (table ACDOCA) and can be used in both accounting specific processes and reporting. The new currency and its calculated value is added to all journal entries that are available in the system.

Limitation

- It is not possible to introduce a BSEG-relevant currency ("2nd or 3rd FI Currency")

- It doesn’t include reconciliation for entities in asset accounting, controlling, and

inventory accounting.

- Archived data can’t be enriched with the new currency.

For detail refer :- SAP Help- Manage Currencies

For detail understanding on how to configure new asset accounting by aligning the depreciation area /accounting principal with currencies defined in Finance , please refer this blog on S/4 HANA- New Asset Accounting – Considering Key Aspects:-

https://blogs.sap.com/2017/03/25/s4-hana-new-asset-accounting-considering-key-aspects/

Amount Field Length Extension with S/4HANA 1809 release

In SAP S/4HANA, currency amount fields with a field length between 9-22 including 2 decimals have been extended to 23 digits including 2 decimals and how this can be used and what is recommendation for using 23 digit currency please refer detailed SAP note 2628654

If you want to know what should be approach to select appropriate currency type for controlling area , you may read this blog

This blog is written based on my own experience and have referred various OSS notes, Your feedback is welcome.

Thanks

Brought to you by the S/4HANA RIG

Ajeet Agarwal

Product Expert (SAP S/4HANA Regional Implementation Group- APJ)

This blog is aimed to provide an insight and overall understanding and consideration of currency setup in S/4HANA environment and have tried to answer the following queries.

- What is currency type

- In SAP S/4HANA how many kind of currency types exists

- How to setup custom currency type

- How to set a currency key with the custom currency types

- How to setup currency in Finance and linking Currency and Ledger

- Options to setup currency in material Ledger

- Options to setup currency in Transfer Pricing

- Options to setup currency in Controlling Area

- Options to setup currency in COPA

- Options to setup currency in New Asset Accounting

- Introduction of new currencies with S/4HANA 1809 release

- Amount Field Length Extension with S/4HANA 1809 release

What is currency type

In SAP configuration, currency plays an important role. In SAP, all currencies are maintained according to ISO Standard. We can configure currencies as per the rules of the country defined in the company code. SAP provides currencies of every country and we can also define our own currency if we require.

Currency Types in S/4HANA

We have following standard Currency types in SAP S/4HANA

Currency Type 00

Document currency is the currency that is applied for the document and company code currency is the currency where the document is generated. Example : An Indian company does a posting for a Sale of goods in USA. In this case the document currency would be USD and the Company code currency would be INR

Currency Type 10

Company code currency is defied at company code level in transaction OX02

11- Co Code Currency Group Valuation (used in Transfer Pricing)

12- Co Code Currency PC Valuation (used in Transfer Pricing)

(Currency Type 11 and 12 are explained in transfer pricing section)

You can select currency type 10 in controlling area only if all company codes assigned to the controlling area uses same currency.

Currency Type 20

If data is returned from Controlling to financial accounting in your application, for example via order settlement, you must use a currency type in the controlling area that is also used as the currency type of a parallel currency in the assigned company codes. Typically, these are the currency types for a group currency, hard currency or index-based currency.

--> Currency type 20 cannot be used in FI.

Currency type 20 is supported in FINSC_LEDGER, therefore only for compatibility reasons; if currency type 20 was already used in CO, then after migration of the currency configuration, "KSL" field of ACDOCA will be used for CO only, and FI will work with the fields HSL, OSL and VSL.

For new installations we strongly recommend to configure currency type 30 in CO and in FI (for the KSL (Group Currency) field in ACDOCA).

Currency Type 30

You define the currency key for these currency types when you define the client. You can define it by T-code: SCC4.

Currency type 20 is only known by cost accounting, whereas currency type 30 is known in financial accounting also. Therefore, data transmission via the modules CO, AM, and FI works seamlessly without any difficulties if currency type 30 is used by all.

Whether to use currency type 20 or 30 to know more detail you may read OSS note 119428

31- Group Currency Group Valuation (used in Transfer Pricing)

32- Group Currency PC Valuation (used in Transfer Pricing)

(Currency Type 31 and 32 are explained in transfer pricing section)

Currency Type 40 and 50

Hard Currency and Index Based Currency

You define the currency key for this currency type when defining the countries in the "Hard currency" field T-code: OY01

If you select currency type 40 or 50 in controlling area, the company codes must either be in the same country, or the countries must use the same index-based currency or hard currency.

Currency Type 60 - Global Company Currency

If you select currency type 60 in Controlling area, the company codes must belong to the same company, or the companies must use the same currency.

With currency types 40, 50, and 60, specify the currency only as long as no company codes have been assigned. If company codes have been assigned, the system defaults the currency automatically.

Currency Type 70 Object currency (CO)

Each object in Controlling, such as cost center or internal order, may use a separate currency specified in its master data. When you create an object in CO, the SAP system defaults the currency of the company code to which the object is assigned as the object currency. You can specify a different object currency only if the controlling area currency is the same as the company code currency. There is an object currency for the sender as well as one for the receiver.

Supported currencies in ERP

Still in S/4HANA till On-premise 1709 release we have maximum 3 currencies in FI(BSEG), 2 currencies in CO and 3 currencies in ML. However in Universal Journal table(ACDOCA) we can have maximum upto 10 currencies.

Currencies used in S/4HANA 1610 Onwards

From SAP S/4HANA 1610 On Premise version as well with SAP S/4 HANA Finance 1605 we can have upto 10 currencies in Universal Journal (ACDOCA)

Go to SPRO -> Financial Accounting->Financial Accounting Global Settings-> Ledgers-> Ledger -> Define Settings for Ledgers and Currency Types

In this Customizing activity, you configure the currency types and currency conversion settings that you use in Accounting and define the corresponding ledger settings and assign accounting principles for ledgers and company codes.

Currency Types

Check your currency settings and create additional currency types if required. Your own currency types must begin with the letter Y or Z, for example Y1, Y2, ZA etc.

For each currency type you decide whether you want the corresponding currency conversion settings to be valid globally for all company codes or want to define the currency conversion settings at company code-level.

You can’t make any changes to the SAP standard currency types Document Currency (00) and Company Code Currency (10). For the other standard currency types, you can define whether the corresponding currency conversion settings are valid globally or at company code-level.

If you are using transfer prices, create the required number of currency types (depending on the valuation methods you need) and select the valuation view you need (legal, group, or profit center valuation). For the currency types with group or profit center valuation, you need to enter the base currency type, meaning the currency type with the legal valuation view on which the transfer prices valuation will be based. For each base currency type there can be only one currency type using group valuation and one using profit center valuation.

Global Currency Conversion Settings

For your own currency types, enter the currency into which the conversion is to be made (Currency field), and the currency from which currency conversion is to be made (Source Currency field). In addition, enter the exchange rate type and the date on which the translation is to be carried out (document date, posting date, or translation date). You can also decide whether the currency conversion shall be done in real-time. If you don’t select the Real-time Conversion checkbox, you can do this at period-end closing using the foreign currency run.

Currency Conversion Settings for Company Codes

Company code settings for the ledger

ACDOCA V/s BSEG currency settings

First 2 Currency fields are derived from local currency i.e company code currency and controlling area currency and rest 8 fields are freely defied currency per ledger and all these fields you may see in Universal Journal table (ACDOCA)

There is no dependency on the currency types of the leading ledger.

Real-time currency conversion for all currency types is possible (or with foreign currency valuation program at period-end

Still BSEG is populated with 3 currencies so you may choose which 3 currencies you want to populate in BSEG (of course first currency will be default to company code currency for BSEG)

For further detail you may refer OSS note 2344012 (Currencies in Universal Journal)

Currencies used in Controlling

The system uses this currency for cost accounting. This currency is set up when you create the controlling area. It is based on the assignment control indicator and the currency type, following possible currencies can be assigned to controlling area, these are explained in currency type section above.

10 Company code currency

30 Group currency

40 Hard currency

50 Index-based currency

60 Global company currency

Controlling Area Currency

SPRO-> Controlling-> General Controlling-> Organization-> Maintain Controlling Area

Transaction Currency (CO)

Documents in Controlling are posted in the transaction currency. The transaction currency can differ from the controlling area currency and the object currency. The system automatically converts the values to the controlling area currency at the exchange rate specified.

The transaction currency is USD, the controlling area currency is EUR, and the object currency is SFR (Swiss francs). The system converts the amounts as follows:

- From transaction currency to controlling area currency (USD to EUR)

- From controlling area currency to object currency (EUR to SFR)

Material Ledger Currencies

SPRO->Controlling->Product Cost Controlling-> Actual Costing/Material Ledger-> Assign Currency Types and Define Material Ledger Types

Currency Type 10, 30

With Transfer Pricing active

For example we can have following currency types in Material Ledger

Currency Type 10, 31

Or

Currency Type 10, 32

Or

Currency Type 10, 31,32

Profit Center Currency with Transfer Pricing

Transaction 0KE5

It is common to set 30 in the controlling area, 10 and 32 in the currency and valuation profile, and 10 and 32 in the material ledger.

If you then set the profit center local currency type to 30 and valuation view 2 (profit center valuation) in Profit Center Accounting, the currency type 32 is continuously used. In Profit Center Accounting, 32 is updated as profit center local currency in the currency field KSL. The company code local currency in the profit center valuation (12) is then translated from the values 32 with the exchange rate type M with the current exchange rate (and updated in the field HSL). This means that in Profit Center Accounting, only the PCA valuation is available. The legal valuation (10, 30) is no longer available in PCA.

Similarly, if you then set the profit center local currency type to 30 and valuation view 1 (Group Valuation) is selected in profit center accounting then the currency type 31 is used. In Profit Center Accounting, 31 is updated as profit center local currency in the currency field KSL. The company code local currency in the profit center valuation (11) is then translated from the values 31 with the exchange rate type M with the current exchange rate (and updated in the field HSL). This means that in Profit Center Accounting, only the group valuation is available. The legal valuation (10, 30) is no longer available in PCA.

The flows of goods in legal valuation and in profit center valuation are valuated differently, even if the currency key is identical. For details. Please read the SAP note 1442153 .

If you need to change, add or delete any currency settings after the Material Ledger is productive, you would need to reverse the customizing changes, deactivate the Material Ledger, change the customizing to the desired values and restart the Material Ledger again. As a consequence, you will lose all the Material Ledger data in the system. Please, check the KBA 1511335 on this topic. Take into account that deactivation means running report SAPRCKMJX, and this report deletes all the Material Ledger data for the corresponding plant.

An alternative would be to use the SLO conversion services so that all Material Ledger data in the tables for currency type 20 are converted to currency type 30. Please, consider that this is a chargeable service.

Transfer Pricing Define Currency + Valuation Profile

You only need the currency and valuation profiles if you want to manage various valuations in parallel in your system

Group and profit center valuation must also be managed correspondingly in the material ledger as a currency type and valuation category as explained in material ledger section.

Typical currency settings with profit center valuation:-

FI: 10, 32

CO: 30

Currency and valuation profile: 10, 32

Material ledger: 10, 32

Profit Center Accounting: 30 and profit center valuation (= 32)

PCA 32 (KSL), 12 (HSL)

Currency type 12 is translated from 32 with Exchange rate type M at current rate

This means that in Profit Center Accounting, only the PCA valuation is available. The legal valuation (10, 30) is no longer available in PCA

Typical currency settings with Group valuation:-

FI: 10, 31

CO: 30

Currency and valuation profile: 10, 31

Material ledger: 10, 31

Profit Center Accounting: 30 and profit center valuation (= 31)

PCA 32 (KSL), 11 (HSL)

Currency type 12 is translated from 32 with Exchange rate type M at current rate

This means that in Profit Center Accounting, only Group valuation is available. The legal valuation (10, 30) is no longer available in PCA

Transfer Pricing Currency setup in Account V/s Ledger approach

The following two functions are available: For your valuation views, you can either use separate ledgers or map multiple valuation views within a ledger.

If you decide on the scenario with separate ledgers, assign a valuation view to a ledger: The legal, group, or profit center valuation view. In this ledger, you can only configure currency types in the appropriate valuation view. The local and global currency are then always configured in the valuation view of the respective ledger.

If you want to use multiple valuation views within a ledger, do not assign a valuation view to the ledger. The local and global currency are then always used in the legal valuation view in this ledger.

Separate ledger approach is available from S/4HANA1610 onwards that means if customers are already using transfer pricing in their source system and doing a conversion to S/4HANA 1610 or higher version then the second approach i.e "Several valuation views within a ledger" would be possible solution.

For further detail you may use this link:-

https://help.sap.com/viewer/651d8af3ea974ad1a4d74449122c620e/1709%20000/en-US/f550d7531a4d424de10000...

Why we need to maintain additional parallel currencies for respective valuation i.e. Group or Profit Center ?

This question is asked quite often that why, when you activate profit center valuation, both currency types 12 and 32 need to be maintained in the new currency customizing (transaction FINSC_LEDGER) (similarly, when you activate group valuation, both currency types 11 and 31). ?

Although only one currency type is maintained for a valuation approach in the currency and valuation profile, both currency types of a valuation are necessary for updating data in Controlling. With the introduction of the universal journal, the data model has been simplified and harmonized. The universal journal uses the ledger approach for general ledger accounting and for all subledgers. Therefore, in ACDOCA, the currency types in the company code currency and the 'global currency' (currency 2 in transaction FINSC_LEDGER = controlling area currency) must exist for each valuation view.

For more detail you may refer SAP note 2882025

Restriction- ML can not be deactivated in S/4HANA

As of 1709 release , In the case the productive start was carried out and the material ledger postings exist in ACDOCA( = there are BSX line items), and customer wants to change any settings that might influence material ledger postings (change of the CURTPs in ML Type, any customizing change of GL that influence the set up of the table FMLT_CURTP_ML, just to name some of them) then there is no other solution but to introduce the new company code and start from the scratch the ML setup. This is recommendable for the test system.

For detail you may refer OSS note 2512618

Operating Concern Currency

This determines the currency and the valuation view in which the values in CO-PA are to be displayed or planned.

Actual data can be updated simultaneously in all the combinations of currency type and valuation that are described below, planning data is always updated in one currency only - the currency specified for that particular plan version.

If you deactivate the company code currency, you can no longer use plan versions and reports that use the company code currency.

New Asset Accounting Currency

For each currency defined in General Ledger Accounting, you have to create parallel depreciation areas in new Asset Accounting.

Fixed Asset Accounting currently only supports the FI relevant (BSEG-) Currencies.

For additional currency types, which are not BSEG relevant, you do not need to create dep area; these currencies are converted during posting. This means, the sum of all depreciations does not balance with the activation value for the additional currencies.

Introduction of new currencies with S/4HAN 1809

With release S/4HANA OP 1809 it is possible to introduce additional currency, tool allows you to introduce new, flexible currencies for company codes and ledgers that are already used in your production system. Afterward, the newly introduced currencies are available in the Universal Journal (table ACDOCA) and can be used in both accounting specific processes and reporting. The new currency and its calculated value is added to all journal entries that are available in the system.

Limitation

- It is not possible to introduce a BSEG-relevant currency ("2nd or 3rd FI Currency")

- It doesn’t include reconciliation for entities in asset accounting, controlling, and

inventory accounting.

- Archived data can’t be enriched with the new currency.

For detail refer :- SAP Help- Manage Currencies

For detail understanding on how to configure new asset accounting by aligning the depreciation area /accounting principal with currencies defined in Finance , please refer this blog on S/4 HANA- New Asset Accounting – Considering Key Aspects:-

https://blogs.sap.com/2017/03/25/s4-hana-new-asset-accounting-considering-key-aspects/

Amount Field Length Extension with S/4HANA 1809 release

In SAP S/4HANA, currency amount fields with a field length between 9-22 including 2 decimals have been extended to 23 digits including 2 decimals and how this can be used and what is recommendation for using 23 digit currency please refer detailed SAP note 2628654

If you want to know what should be approach to select appropriate currency type for controlling area , you may read this blog

SAP S/4HANA Controlling Area Currency Type setup

This blog is written based on my own experience and have referred various OSS notes, Your feedback is welcome.

Thanks

Brought to you by the S/4HANA RIG

Ajeet Agarwal

Product Expert (SAP S/4HANA Regional Implementation Group- APJ)

- SAP Managed Tags:

- SAP S/4HANA,

- SAP S/4HANA Finance,

- FIN General Ledger,

- FIN Material Ledger

Labels:

45 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

22 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

156 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

217 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- Unable to add the event filters in the Event Enablement Channel in Enterprise Resource Planning Q&A

- Five Key assessments for a Smooth ECC to S/4HANA Transformation in Enterprise Resource Planning Q&A

- Norway has per diems with different currencies from 1.1.2024. in Enterprise Resource Planning Q&A

- DDMRP setup SAP S4HANA GUI in Enterprise Resource Planning Q&A

- How to track exchange rates for outgoing payment in different currency? in Enterprise Resource Planning Q&A

Top kudoed authors

| User | Count |

|---|---|

| 12 | |

| 11 | |

| 8 | |

| 8 | |

| 7 | |

| 6 | |

| 4 | |

| 4 | |

| 4 | |

| 3 |