- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- IFRS 15 / ASC 606 Case: Compound Performance Oblig...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Advisor

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

11-10-2017

5:27 PM

Sell a printing machine with mandatory paper feeder unit

SAP introduced enhancements to SAP Business ByDesign to allow customers to comply with accounting standard IFRS15/ASC606 revenue recognitions requirements. A series of case documents introduces the key requirements of IFRS15 /ASC606 along with steps to be taken by the client to implement the functionality.

This case document focuses on:

- Compound performance obligation identification

- Standalone selling price and revenue allocation basis

- Realization

- Basic posting examples

Business Scenario – Introduction

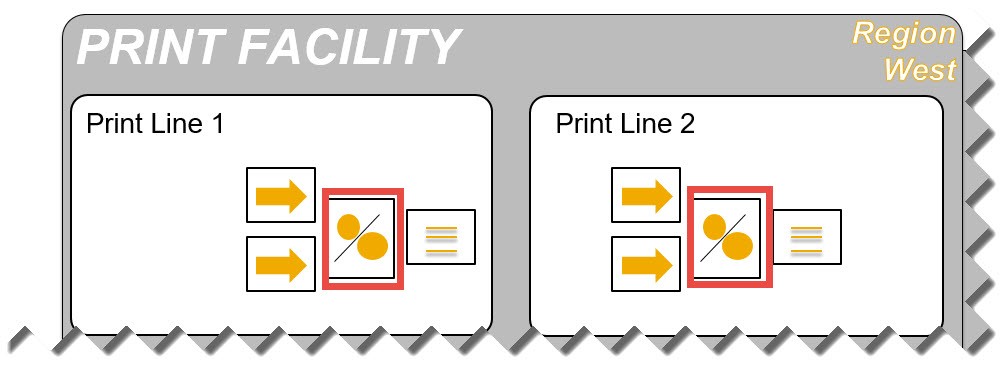

Media Productions Limited orders a new printing line incl. setup and installation service. The printing line consists of two specially designed paper feeders and the printing machine itself. The setup could have been done by the service crew at Media Productions Limited themselves but due to resource constraints they purchased the service offered by the manufacturer of the printing machine. The sales representative of Printing Solution Corp closes the deal by granting a 50% discount on the setup and installation service and a 10% discount on the printing machines, since he expects significant future business.

Situation prior to IFRS 15 / ASC 606

The company Printing Solutions Corp creates a sales order with 3 items in their SAP Business ByDesign system.

The printing machine and service are subject to revenue recognition:

- Printing Machine – recognize at invoice

- Paper Feeders – recognize at invoice

- Setup and Installation Service – realize cost immediately

Realization in ByDesign

POB assignment and revenue allocation

Applying the 5-step-model, the accountant assesses that the customer cannot benefit from either the printing machine or the specialized paper feeder individually, but instead the benefit is realized when both items are delivered. Therefore, he assigns both product items in the sales order to the same performance obligation. The service to install the machine forms another performance obligation.

For performance obligation 10, the amounts of the single items are summed up to calculate the SSP and transaction price. In the case where a manual SSP would have been assigned, it would have been entered at the sales document item level. This is not the case in this scenario.

The algorithm allocates revenue first to performance obligations and then down to the sales document items using SSPs.

The system does not check whether the assigned sales document items share the same accrual method or CRM line item type (such as “Product Sales” or “Service - Fixed Price without Actuals”). When assessing valid combinations of item types, we found valid reasons to allow all possible combinations. On the downside, the user will need to check for valid combinations of sales document items within a compound performance obligation. Restrictions stated in the standard are to determine the method of transfer (“over time”, “at a point in time”, IFRS 15.31f), to apply the same “measure of progress” (IFRS 15.40) and to apply a reasonable measure.

Determination of progress and some considerations on accrual methods

For compound performance obligations, progress is measured for each sales document item according to the accrual methods assigned. In our example, progress is assumed when an invoice has been issued. At first, with each revenue recognition run, the system determines an item’s progress and then calculates the revenue and billable amounts accordingly. These values are summed up at the (compound) POB and are considered as the POB’s progress.

In other words, SAP Business ByDesign does not determine the progress at the POB level, but instead it determines the progress of the assigned items and assumes that assigned items share the same progress. This works best for services invoiced at T&M or for fixed price projects with a project POC. The restriction is that the project POC is calculated for the entire project, therefore this works best if a single POB is assigned to the project. This leads to more complicated situations when goods are delivered that need to be at the customer in certain combinations. For example in this case, the customer can only benefit when receiving exactly one printing machine with two paper feeders. In the case that one paper feeder is late, he doesn’t benefit from the delivery and hence no revenue shall be realized. In SAP Business ByDesign, there is currently no way to define this relationship on the sales order. However, there are options available to solve this situation. By using the accrual method “at invoice”, you can ensure that invoicing is done when all deliveries are out or that only complete sets are invoiced. Another option would be to use the manual accrual methods.

In the end, the concept applied here comes with limitations in some use cases, but allows a large variety of work flows.

Simplified posting example

Period 1 – Order entry, delivery #1

In period 1, the sales order is signed. The sales order shown above is being entered into SAP Business ByDesign and the initial allocation base is calculated.

The printing machine and one paper feeder get delivered. The delivery of the second paper feeder is delayed to Period 2 due to production issues faced by Printing Solutions Corp.

Period 1 – Period end close

At period end, the revenue recognition run is started and finds, based on assigned accrual methods “At Invoice”, no progress in satisfaction of the POB.

For period 1, only COGS postings from delivery can be found.

Period 2 – Delivery #2 and customer invoice

The second paper feeder is completed and delivered to the customer. Also, the service to install the printing line is confirmed “completed”.

With completion of all sales order lines, all performance obligations are satisfied. A customer invoice is being created.

Resulting postings are listed below.

Period 2 – Period end close

At period 2 close, the revenue recognition run determines:

- Measure of progress for all items is “at invoice”.

- For each items of performance obligation 10, it calculates revenue based on invoiced quantity. In this case, this means full realization of expected revenue (=allocated amount).

- POB 20 is invoiced and therefore has realizable revenue also.

- All items arefully delivered and invoiced.

- No deviation in invoicing from ordered values, therefore no need for final accrual.

For all items, a progress of 100% is being determined.

Revenue recognition realizes revenue and cost of sales in total.

Summary

Journal Entries

Profit and Loss

Balance Sheet: Assets

Balance Sheet: Liabilities

Other use cases

Beyond the example shown here, where goods get delivered, the model of compound performance obligations could also be applied on other use cases, such as the examples given below.

- Project execution at fixed price with different roles like senior consultant and junior consultant.

- Providing time-based services, like software-as-a-service or other types of subscriptions.

- Combinations – the execution of a project to enhance a delivered good.

The model as described here is flexible, due to its ability to aggregate progress up from sales document items to method of revenue allocation. Nevertheless, a customer should be cautious in setting the correct accrual method or assess a manual entry of progress in work center Cost & Revenue.

- SAP Managed Tags:

- SAP Business ByDesign

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

22 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

156 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

217 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- Building the foundation for digital refinery and Petrochemical in Enterprise Resource Planning Blogs by SAP

- Asset Management in Utilities – part 8: SAP Innovations on the 2023 Roadmap in Enterprise Resource Planning Blogs by SAP

- SAP RAR Optimized Contract Management: Period End Activities & Reporting in Enterprise Resource Planning Blogs by Members

- SAP RAR Optimized Contract Management: Intercompany Billing Based Fulfillment Business Use Case in Enterprise Resource Planning Blogs by Members

- SAP RAR Optimized Contract Management: Acceptance Date Manual Fulfillment Business Use Case in Enterprise Resource Planning Blogs by Members

Top kudoed authors

| User | Count |

|---|---|

| 12 | |

| 11 | |

| 8 | |

| 8 | |

| 7 | |

| 6 | |

| 4 | |

| 4 | |

| 4 | |

| 3 |