- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- IFRS 15 / ASC 606 Case: Header discounts and invoi...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Advisor

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

10-13-2017

8:08 AM

Sell printing machine incl. setup service with header discount

SAP introduced enhancements to SAP Business ByDesign to allow customers to comply with accounting standard IFRS15/ASC606 revenue recognitions requirements. A series of case documents introduces the key requirements of IFRS15 /ASC606 along with steps to be taken by the client to implement the functionality.

This case document focuses on:

- Implication of sales order header discounts on the fair value and revenue allocation calculation

- Implication of deviations with final invoice from sales order on revenue allocation

Business scenario – example

At Media Productions Limited, the printing machines of printing line 1 and 2 should be replaced by new ones. The existing paper feeders and packaging units will be kept.

They order 2 new printing machines including setup and installation service. The setup could have been done by the service crew at Media Productions Limited themselves but due to resource constraints they purchased the service offered by the manufacturer of the printing machine.

The sales representative gives:

- a 10% discount on the printing machines

- a 50% discount on the setup and installation service

- and an additional 10% header discount, since he expects a large opportunity for future business.

Representation in ByDesign

The company Printing Solutions Corp creates a sales order with 2 items.

The printing machine and service are subject to revenue recognition:

- Printing Machine – recognize at delivery

- Setup and Installation Service – recognize at fulfillment

Both items shall form an individual POB (performance obligation) and the sales order forms a single revenue accounting contract.

The allocation of the header discount amount to the sales order line items is based on the net value at the sales order item level. The header discount is deducted from the Sales Order Item Net Value to calculate the Sales Order Item Transaction Price. The method of allocating the header discount amount to the sales order items has not changed.

The SSP (standalone selling price) derivation as the basis for revenue allocation is not affected by the sales order based header discount.

The view on the Revenue Accounting Contract after the sales order creation is depicted below:

Because the header discount impacts both the sales order item transaction price and the performance obligation (POB) transaction price, the header discount will impact the allocated revenue amounts at the POB Level.

Dealing with invoice deviations in revenue allocation

Business example: The printing machines were delivered and installed. Unfortunately, the truck broke down during delivery causing a significant delay. The sales representative agrees with the customer to waive the setup and installation service charge to compensate for the delay so as not to endanger the relationship with the customer. The invoice deviates from the sales order by showing a 100% discount on the setup and installation service.

The final invoice is adapted and has the following lines:

| 27-10 | 2x Paper Machines | 162.000 $ |

| 27-20 | 2x Setup and Install | 0 $ |

| Total | 162.000 $ |

What are the implications of IFRS 15/ASC 606 dealing at the completion of all performance obligations that deviate from the ordered quantity or prices?

The ByDesign implementation interprets the IFRS 15/ASC 606 standard such that with the completion of the contract (meaning all POBs must be finally fulfilled) the revenue allocation basis must switch from ordered quantity and amounts to invoiced quantity and invoiced amount.

This is illustrated below:

- The revenue allocation basis at situation ‘as ordered’:

- The revenue allocation basis when all performance obligations have been fulfilled as per the contract:

Simplified Posting Example

- Step 1 / period 1: Sales order creation

- Step 2 / period 4: Goods Issue 2 printing machines for delivery (21 days late)

- Step 3 / period 4: Service Crew arrives and completes install in 2 days.

- Step 4 / period 4: Revenue Recognition Run

- Step 5 / period 5: Final Invoice with deviating 100% discount for setup and install

- Step 6 / period 5: Revenue Recognition Run

Step 1 / period 1: Sales order creation

The sales representative enters the sales order as already shown above with sales order item and header discount. The 2 printing machines are to be delivered on the 20th March 2018. The Setup and Install should take place the day after delivery and is scheduled to take 2 days. Both items are assessed to be individual performance obligations. The view of the revenue accounting contract is shown below:

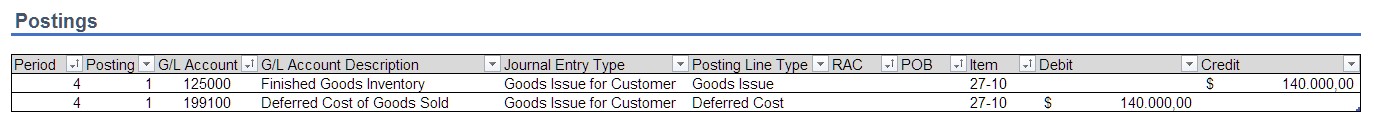

Step 2 / period 4: Goods issue 2 printing machines for delivery (21 days late)

The delivery happens late and delayed in period 4. The simplified financial posting is shown below.

Step 3 / period 4: Service crew arrives and completes install in 2 days

The service crew arrives and confirms that the service has been completed by entering a goods and service acknowledgement. The resulting simplified journal entry is shown below:

Step 4 / period 4: Revenue recognition run

Both POBs have been 100% completed.

Both items have not been invoiced.

Revenue recognition realizes revenue and discounts and builds up unbilled receivables. According to the matching principle COGS are realized as well. The resulting simplified journal entry is shown below.

The calculation basis for the created posting is shown below.

Step 5 / period 5: Final invoice with deviating 100% discount for setup and install

The customer Media Production Ltd calls the sales representative at Printing Solutions Corp. They clearly articulate that they are not happy about the delivery delay. After negotiations, the sales representative agrees to give a 100% discount on the installation service to compensate for the delay.

The invoices lead to following simplified journal entries:

Step 6 / period 5: Revenue recognition run

It is important to note that the allocation basis will switch as the entire contract has been fulfilled. The allocation basis at ‘final accrual’ will take the quantity and price deviations into account.

The basis for revenue recognition has considered that the second POB has been 100% discounted in the invoice. Therefore, the overall contract price is now lower and POB allocated revenue has been reduced.

Switched Allocation Basis:

The resulting simplified journal entry in period 5 resulting from the revenue recognition would show:

Summary

Journal entries

Profit and loss statement

Balance sheet: assets

Balance sheet: liabilities

- SAP Managed Tags:

- SAP Business ByDesign

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

23 -

Expert Insights

114 -

Expert Insights

151 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

205 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

85

Related Content

- How to always maintain the check box for Cash Discount as ticked in Invoice Requests in Enterprise Resource Planning Q&A

- SAP S/4HANA Cloud Private Edition | 2023 FPS01 Release – Part 1 in Enterprise Resource Planning Blogs by SAP

- Sales Order/Invoice Total Selling Price before Discount in Enterprise Resource Planning Q&A

- Cash Discount Changing Total Tax Amount - Greece Localization in Enterprise Resource Planning Q&A

- Enhancements in EBS - BADI FIEB_CHANGE_BS_DATA in Enterprise Resource Planning Blogs by Members

Top kudoed authors

| User | Count |

|---|---|

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 | |

| 2 |