- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- IFRS 15 / ASC 606 Case: Customer projects

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Advisor

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

10-13-2017

8:09 AM

Basic Project Scenario

SAP introduced enhancements to SAP Business ByDesign to allow customers to comply with accounting standard IFRS15/ASC606 revenue recognitions requirements. A series of case documents introduces the key requirements of IFRS15 /ASC606 along with steps to be taken by the client to implement the functionality.

The following topics will be outlined in this case document:

- Sales orders and performance obligations with projects

- Manual adjustment of standalone selling price

- When to realize and accrual methods

- Fixed price items / time and material Items

- Handling of Write-Offs (e.g. hrs not to be invoiced)

Note: SAP Business ByDesign cannot give legal advice nor can we assess the future best practices of how the professional services industry or customer projects taking IFRS 15/ASC 606 regulations into account are to be handled. The project related case documents reflect the typical project sales business process that customers currently follow in SAP Business ByDesign. It outlines conceptually how the SAP Business ByDesign enhancements can support existing and future customers to comply to the standard in project sales scenarios.

Note: In this document, we will not cover SAP Business ByDesign generic capabilities, e.g. how the customer projects are handled in detail. In general, with customer projects two related object types are used. The sales orders reflect the commercial terms, the invoicing schedules, the accrual methods, etc. of a project and the assigned project(s) represent the fulfillment part with resources, time confirmations, task structures. In this use case, IFRS 15/ASC 606 requirements are handled by sales orders. Therefore, the relationship and role of the fulfilling project is not highlighted.

Editorial note on this blog

This scenario has been rewritten, due to new insights into the application of the standard we got. In SAP Business ByDesign’s use cases, it is most likely that sales document items delivered on a T&M (“time and material”) base are to be realized with every hour delivered and without applying any effect of revenue allocation.

Business scenario – introduction

Media Productions Limited has decided to build a new printing facility in the Mid Region. Media Productions has contracted with Printing Solution Corp to prepare the construction plans for the new printing facility. Printing Solution Corp offers a project covering:

- Concept definitionbased on given specifications of the new printing facility

- machine park layout

- go-live support

The two parties have agreed to the following price and invoicing terms:

- Concept definition at a fixed price of 12.000 USD, invoicing at defined milestones:

- Concept draft: 40%

- Final concept: 60%

- Based on the concept, provide a machine park layout, at a fixed price of 16.000 USD.

- Go-live support by experienced consultants on T&M base. The parties agreed on 100h, to be delivered within one month, at a price of 75,00 USD = 7.500 USD. The hour rate contains a discount of 25% compared to the regular price list. Invoicing should happen at each month end touched.

The project plan is shown below.

Applying the 5-step process

Printing Solutions Corp will need to assess the following five key concepts of IFRS 15/ASC 606 to ensure compliance:

- Identification of a contract

- Identification of performance obligations (POB)

- Determine the transaction price

- Allocate the transaction price to the performance obligations by usage of fair values as basis for revenue allocation

- Recognize revenue when or as entity satisfies performance obligations.

Identifying the contract and performance obligations

Below is the assessment Printing Solution Corp has made:

The contract is about a project to be delivered with three parts:

- The concept, even if billed twice, because the concept draft wouldn’t be a distinct piece of work Media Solutions could either benefit from or let another company complete without re-investing an immense quantity of time to be able to complete the final concept on this base.

- The machine park layout.

- Availability of service engineers in a certain time frame to deliver support on an T&M base.

Hence, it is now possible to enter a sales order into SAP Business ByDesign and to create a revenue accounting contract. The customer contract shown above gets assigned.

The items concept, machine park layout and go-live support represent the agreed deliverables as well as the performance obligations identified.

Determine the transaction price and allocate to performance obligations

The transaction price is represented by the sales order list prices and granted discounts. Nevertheless, for the means of revenue allocation, the go-live support needs to be excluded because it is a T&M item where every hour delivered can be realized immediately, it forms, in the end, a series pob. Hence, the transaction price relevant for allocation is 12.000 USD + 16.000 USD = 38.000 USD.

As allocation basis, the SSPs for fixed price items can be derived from the regular list prices for consulting service regular rates, using planned hours. To calculate this, the revenue accountant requests the planned hours from the project manager. The project manager points him to the analytical report “project plan values”. In the report, he finds the figures split by pricing-relevant roles like Junior Accountant, Senior Accountant and Engineer.

He extracts the report to Microsoft Excel and valuates the planned hours with regular rates Printing Solution Corp would invoice to this customer usually.

Hence, the applicable standalone selling price for the concept is 17.000 USD and 10.000 USD for the machine park layout.

To apply these values, the revenue accountant adjusts the SSP by manual entry:

Additionally, the T&M item, gets excluded from allocation. This step is a manual one in this release, but will get automated.

The allocated amount is being calculated based on the manual SSP entered in the RAC, excluding performance obligations with the "no allocation" flag.

The allocation base can also be reviewed using an analytical report “revenue accounting contract list – allocation base”.

Prepare measure to recognize revenue

In SAP Business ByDesign, accrual methods define when and based on which measure of progress revenue or cost can be realized. The revenue accountant decides on the the accrual methods to be set:

- Concept: Cost-to-Cost POCA cost-based percentage of completion is being calculated, using the “estimated cost” entered at the sales order item (see next paragraph).

- Machine Park Layout: At completed contractRevenue and cost of the sales order item is fully realized when bot conditions are met: it is finally invoiced and the assigned project task/phase is set to completed.

- Go-Live-Support: At deliveryRevenue and cost of each “delivered” (=recorded) hour is being immediately (=after the revenue recognition run) realized.

To allow a POC calculation, the revenue accountant enters the Estimated Cost, as calculated in the project system, into the sales order’s pricing.

Note: Customers can label performance obligations as well is the revenue accounting contract itself with meaningful text during sales order creation. This makes the identification of specific revenue accounting contracts or performance obligations easier.

Note on manual changes of standalone selling prices

Changing a standalone selling price is only possible in a work center that should be assigned to financial accountants. In SAP Business ByDesign the concerns of the sales representative and a financial accountant are separated. Activities like changing accrual methods, applying manual accruals or manually changed basis of accruals are enhanced by the capability to change the standalone selling price. The manually changed standalone selling price always precedes the derived value in the sales order.

According to price list derivation following standalone selling prices are submitted to the revenue accounting contract by the sales order.

Automated determination of accrual methods

It is possible to automatically derive accrual methods, and this is what is being recommended. A key user should adapt the accrual method determination in fine-tuning. The next two screenshots show possible choices for project-relevant accrual methods.

Accrual methods for fixed price items:

Note: Please read last paragraph about limitations in initial scope of IFRS 15/ASC 606 enhancements.

Time and material items:

Recognize revenue

Accounting period February

- The Project starts. Employees start recording time on project phase “Concept”, executing task “concept draft”.Based on cost rates maintained, cost centers are being credited while the project task “Concept” gets charged. In a second step, the project tasks’ cost are being assigned to sales order items, to allow full controlling (order profit).

- Concept draft gets delivered, the milestone gets confirmed. This allows the company to invoice 40% of the fixed price of project phase “Concept”.In SAP Business ByDesign, the project manager sets the milestone to complete and triggers a scheduled project invoice request.

After release, a customer invoice is being issued.

- Project staff continues with task “final concept”, which is the second part of the “concept” priced at 12.000 USD.

- At the end of the month, the accountant starts the revenue recognition run.

- Based on the hours recorded (column “Incurred Cost”), which are measured against the cost estimate in the sales order item (column “Plan Costs”), it calculates a percentage of completion of 60%.A PoC of 60% means that …

… 60% of 12.000 USD (price for the “concept”) can be invoiced.

= 7.200,00 USD

Invoicable amount

4.800,00 USD have been invoiced already. Hence, unbilled receivable:

7.200,00 USD

- 4.800 USD

= 2.400 USD

Unbilled Receivable

… 60% of 17.629,63 USD (allocated amount for POB 10) can be realized.

= 10.577,78 USD

Earned revenue

Invoicable Amount is lower than revenue means we have a contract asset.

10.577,78 USD

- 7.200,00 USD

= 3.377,78 USD

Contract Asset

We have invoiced 4.800,00 USD already, hence unbilled receivable:

7.200,00 USD

- 4.800 USD

= 2.400 USD

Unbilled Receivable

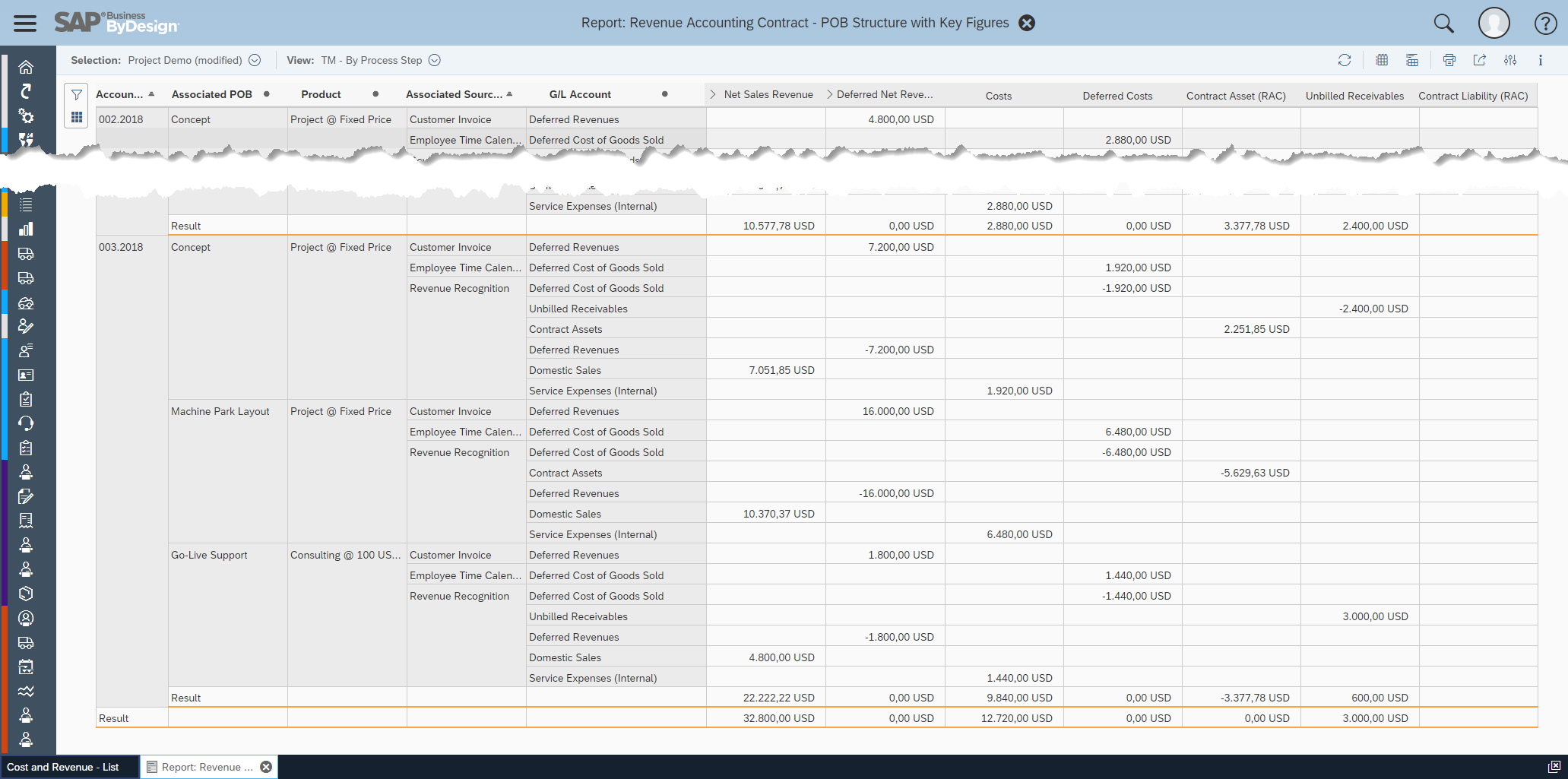

Compare these values with the log of the revenue recognition run:

- Reviewing the transactions recorded to sales ledger accounts, we find same values.

Accounting period March

- Project task “final concept” proceeds and get finished. The milestone is passed. This allows the company to invoice further 60% of the fixed price agreed for project phase “Concept”.

- This completes the “concept” phase.

- A customer invoice is being issued.

- Project phase “Machine Park Layout” starts, employees start recording time to it.

- Project phase “Machine Park Layout” completed. The amount agreed for the machine park layout (16.000 USD) can be invoiced as well, but the project manager decides to await month end.

- The customer goes live with the new printing facility. Project phase “Go-live support” starts, support engineers are called and deliver 3 days in March. At month end, those hours are invoiced, as agreed, on an T&M base.

- A manual project invoice request is being created, invoicing the fixed price for the machine park layout and the 3 days (24h) for the go-live support.

- At the end of the month, the accountant starts the revenue recognition run.

It determines a POC of 100% for both fixed price project phases, hence realizes those with full allocated amount. The T&M item is, by nature, out of revenue allocation. Therefore, no contract asset will remain.

Revenue recognition log for the fixed-price sales order items: Revenue recognition log for the T&M sales order item:

Revenue recognition log for the T&M sales order item: Overview of postings for April in the sales ledger:

Overview of postings for April in the sales ledger:

Accounting period April

- Another 5 days are being delivered for the “go-live support”, until customer closes this period and tells Printing Solution Corp, that remaining hours (4,5 days) won’t be requested any longer.

- The project manager closes the project and creates the final customer invoice.

- At month end, the accountant starts the revenue recognition run. Revenue and cost of the T&M hours are being realized.

- Overview of postings in sales ledger in April:

Summary

Besides the reports shown above (“Revenue Accounting Contracts – POB Structure with Key Figures” or “Revenue Accounting Contracts – Allocation Base”), report “Revenue Accounting Contract List – Key Figure Overview” can help to understand transactions and postings better. It provides helpful key figures like “contract asset” or “unbilled receivables”.

Limitations

Billable direct cost projects are not supported by the SAP Business ByDesign IFRS 15/ASC 606 enhancements. It is strongly recommended in a transition project to introduce regular project sales scenarios.

Multi-customer projects are not supported by the SAP Business ByDesign IFRS 15/ASC 606 enhancements.

- SAP Managed Tags:

- SAP Business ByDesign

1 Comment

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

154 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

215 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- Improvements to manage treasury position in SAP Treasury and Risk Management in Enterprise Resource Planning Blogs by SAP

- Posting Journal Entries with Tax Using SOAP Posting APIs in Enterprise Resource Planning Blogs by SAP

- Migrating data from SAP ECC to SAP S4/HANA with the migration cockpit in Enterprise Resource Planning Blogs by Members

- Integration of SAP Service and Asset Manager(SSAM) with SAP FSM to support S/4HANA Service Processes in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Cloud Public Edition: Security Configuration APIs in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 12 | |

| 11 | |

| 7 | |

| 6 | |

| 6 | |

| 4 | |

| 4 | |

| 4 | |

| 4 | |

| 3 |