- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Foreign Currency Remeasurement Run for Cash - Int...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Product and Topic Expert

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

09-12-2017

3:00 PM

Hello Everyone,

When validating Remeasured Balances and postings resulting from a FCR-Run for Cash users at times cannot make sense of resulting postings. Gains and Losses seem to be exaggerated and/or the Historic Valuation Amount does not seem accurate for a specific key-date.

This post aims to address the most common misconception when interpreting figures showing in the 'Remeasured Balances' tab of a FCR-Run.

When doubting the plausibility of Gains/Losses for a specific period - this should be checked against settings made in Fine Tuning Activity: Foreign Currency Remeasurement Methods for Cash.

The indicator No Subsequent Reversal Posting (Y/N) for a particular Accounting Principle and Foreign Currency Remeasurement Method will indicate whether acknowledged Gains/Losses will be carried forward and therefore cumulate over several periods.

We want to illustrate the calculation-logic using a generic example and differing results depending on applied FCR-Method.

-------------------------------------------------------------------------------------------------------------------------------------

Scenario:

Company Currency: EUR; Bank Account Currency: USD; Exchange Rate: EUR/USD

Starting with period 005/2017 we record one monthly bank-transfer over 1,000.00 USD (EUR/USD = 1.00) over 3 periods resulting in a ending balance in USD in 07/2017 = 3,000.00 USD.

Based on bank account transactions and EXR-movements in 005/2017 and 006/2017 losses are incurred incurred as:

-------------------------------------------------------------------------------------------------------------------------------------

I. FCR-Run for 007/2017; SoB 4010; No Subsequent Reversal Postings - 'N' (i.e. Reversal Postings)

Executing the FCR-Run after 3 months for 007/2017 thus shows us the following results.

In this example for 007/2017 an EXR-Loss of only -200,00 EUR has been expected.

006/2017 closed with 2,000.00 USD and a Key Date Valuation Amount of 1,800.00 EUR.

Adding 1,000.00 USD * 007/2017 EXR (0,8 EUR/USD) leaves us with:

3.000,00 USD evaluated against Key Date EXR (0,8 EUR/USD) = 2,400.00 EUR.

The incurred loss of 300,00 EUR appears too high for period 007/2017 - also implying that the Historic Valuation Amount 2,700.00 EUR seems not accurate and not reflecting the actual converted transactions on this bank g/l account up to this key-date.

Causal is that the Historic Valuation Amount represents the cumulated balance of all transactions in EUR including Foreign Currency Remeasurement.

Here for Set of Books 4010 Foreign Currency Remeasurement Method A002 - No Subsequent Reversal Posting is flagged as (N), therefore indicating that realized Gains/Losses from EXR valuation shall be reversed on the first day of a subsequent period.

The cumulative effect leads to the realisation of differences including previous EXR-differences in a period (and again their reversal in a subsequent period) - since EXR-Differenes-Postings are reversed and therefore carried-forward on the g/l bank account.

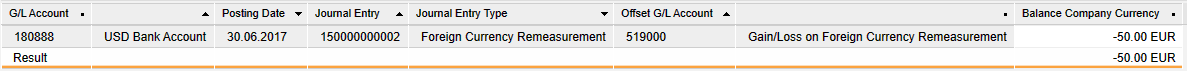

Typical Postings for FCR-Run in 006/2017 showing the cumulated EXR-Difference acknowledgement and its reversal in the subsequent period:

-------------------------------------------------------------------------------------------------------------------------------------

II. FCR-Run for 007/2017; SoB 700; No Subsequent Reversal Postings - 'Y' (i.e. No Reversal Postings)

Contrasting this Remeasurement Method with another Set of Book's Remeasurement Method shows following results for the same bank g/l account:

Tuning Activity: Foreign Currency Remeasurement Methods for Cash

Executing the FCR-Run after 3 months for 007/2017 shows the expected EXR-Loss over -200.00 EUR.

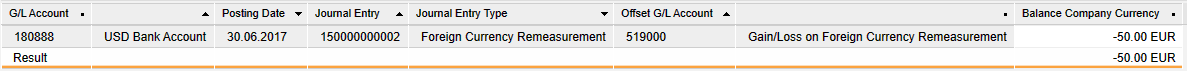

Typical Posting for FCR-Run in 006/2017 showing the EXR-Difference realization incurred in 006/2017 and no subsequent reversal:

-------------------------------------------------------------------------------------------------------------------------------------

Comparing both methods and approaches - evaluating and realizing gains/losses from changes in foreign currency it is worth noting that the cumulative effect can go in either direction or level out. Whether postings are to be reversed in the next period - or not - completely depends on applied accounting principles and local auditing-requirements.

When validating Remeasured Balances and postings resulting from a FCR-Run for Cash users at times cannot make sense of resulting postings. Gains and Losses seem to be exaggerated and/or the Historic Valuation Amount does not seem accurate for a specific key-date.

This post aims to address the most common misconception when interpreting figures showing in the 'Remeasured Balances' tab of a FCR-Run.

When doubting the plausibility of Gains/Losses for a specific period - this should be checked against settings made in Fine Tuning Activity: Foreign Currency Remeasurement Methods for Cash.

The indicator No Subsequent Reversal Posting (Y/N) for a particular Accounting Principle and Foreign Currency Remeasurement Method will indicate whether acknowledged Gains/Losses will be carried forward and therefore cumulate over several periods.

We want to illustrate the calculation-logic using a generic example and differing results depending on applied FCR-Method.

-------------------------------------------------------------------------------------------------------------------------------------

Scenario:

Company Currency: EUR; Bank Account Currency: USD; Exchange Rate: EUR/USD

Starting with period 005/2017 we record one monthly bank-transfer over 1,000.00 USD (EUR/USD = 1.00) over 3 periods resulting in a ending balance in USD in 07/2017 = 3,000.00 USD.

Based on bank account transactions and EXR-movements in 005/2017 and 006/2017 losses are incurred incurred as:

- 005/2017: EXR = 0.95 EUR/USD: -50.00 EUR

- 006/2017: EXR = 0.90 EUR/USD: -50.00 EUR

- 007/2017: EXR = 0.80 EUR/USD: -200.00 EUR

-------------------------------------------------------------------------------------------------------------------------------------

I. FCR-Run for 007/2017; SoB 4010; No Subsequent Reversal Postings - 'N' (i.e. Reversal Postings)

Executing the FCR-Run after 3 months for 007/2017 thus shows us the following results.

- Balance Amount is USD balance on 31.07.2017 is 3,000.00 USD

- Key Date Exchange Rate (EXR) = 0.8

- Key Date Valuation Amount = Balance Amount * Key Date EXR - here: 2,400.EUR

- Historic Valuation Amount is the cumulated balance of all transactions in EUR on 31.07.2017 - here: 2,700.00 EUR.

- EXR Loss/Gain = Key Date Valuation Amount - Historic Valuation Amount

Here: 2,400.00 EUR - 2,700.00 EUR = - 300,00 EUR

In this example for 007/2017 an EXR-Loss of only -200,00 EUR has been expected.

006/2017 closed with 2,000.00 USD and a Key Date Valuation Amount of 1,800.00 EUR.

Adding 1,000.00 USD * 007/2017 EXR (0,8 EUR/USD) leaves us with:

- USD Balance: 3.000,00 USD

- EUR Balance: 2,600.00 EUR (1,800.00 + 800.00)

3.000,00 USD evaluated against Key Date EXR (0,8 EUR/USD) = 2,400.00 EUR.

The incurred loss of 300,00 EUR appears too high for period 007/2017 - also implying that the Historic Valuation Amount 2,700.00 EUR seems not accurate and not reflecting the actual converted transactions on this bank g/l account up to this key-date.

Causal is that the Historic Valuation Amount represents the cumulated balance of all transactions in EUR including Foreign Currency Remeasurement.

Here for Set of Books 4010 Foreign Currency Remeasurement Method A002 - No Subsequent Reversal Posting is flagged as (N), therefore indicating that realized Gains/Losses from EXR valuation shall be reversed on the first day of a subsequent period.

The cumulative effect leads to the realisation of differences including previous EXR-differences in a period (and again their reversal in a subsequent period) - since EXR-Differenes-Postings are reversed and therefore carried-forward on the g/l bank account.

Typical Postings for FCR-Run in 006/2017 showing the cumulated EXR-Difference acknowledgement and its reversal in the subsequent period:

-------------------------------------------------------------------------------------------------------------------------------------

II. FCR-Run for 007/2017; SoB 700; No Subsequent Reversal Postings - 'Y' (i.e. No Reversal Postings)

Contrasting this Remeasurement Method with another Set of Book's Remeasurement Method shows following results for the same bank g/l account:

Tuning Activity: Foreign Currency Remeasurement Methods for Cash

Executing the FCR-Run after 3 months for 007/2017 shows the expected EXR-Loss over -200.00 EUR.

- Since previously acknowledged EXR-Losses have not been reversed the Historic Valuation Amount of all transactions in EUR on 31.07.2017 shows: 2,600.00 EUR.

- EXR Loss/Gain = Key Date Valuation Amount - Historic Valuation Amount

Here: 2,400.00 EUR - 2,600.00 EUR = - 200,00 EUR

Typical Posting for FCR-Run in 006/2017 showing the EXR-Difference realization incurred in 006/2017 and no subsequent reversal:

-------------------------------------------------------------------------------------------------------------------------------------

Comparing both methods and approaches - evaluating and realizing gains/losses from changes in foreign currency it is worth noting that the cumulative effect can go in either direction or level out. Whether postings are to be reversed in the next period - or not - completely depends on applied accounting principles and local auditing-requirements.

- SAP Managed Tags:

- SAP Business ByDesign

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

23 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

158 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,684 -

Product Updates

218 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- Introduction into Advanced Foreign Currency Valuation in Enterprise Resource Planning Blogs by SAP

- Non monetary remeasurement - IAS21 - CPC in Enterprise Resource Planning Q&A

- Foreign Currency Remeasurement for Inventory in Enterprise Resource Planning Q&A

- Top 5 Enhancements in SAP Business ByDesign 2205 Release in Enterprise Resource Planning Blogs by Members

- SAP Business ByDesign – What’s New 22.05 in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 13 | |

| 11 | |

| 10 | |

| 7 | |

| 7 | |

| 6 | |

| 6 | |

| 4 | |

| 4 | |

| 4 |