- SAP Community

- Groups

- Industry Groups

- SAP for Public Sector

- Blogs

- The new Tax Agency Boundary – far, far away from o...

SAP for Public Sector Blogs

Read and write blog posts showcasing creative initiatives, technology advancements, and success stories in public sector transformation powered by SAP.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member20

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

07-03-2017

5:59 PM

The Tax Gap is one of the main focuses for any Tax Agency meaning that actual revenue collected in comparison to what is expected, if all tax obligations would be fulfilled as per current legislation, is a concern in any given country.

Before tackling the issue and define measures to reduce the GAP, it is imperative to understand the motives/drivers for such behaviours in order to develop effective policies and procedures to combat big pain point.

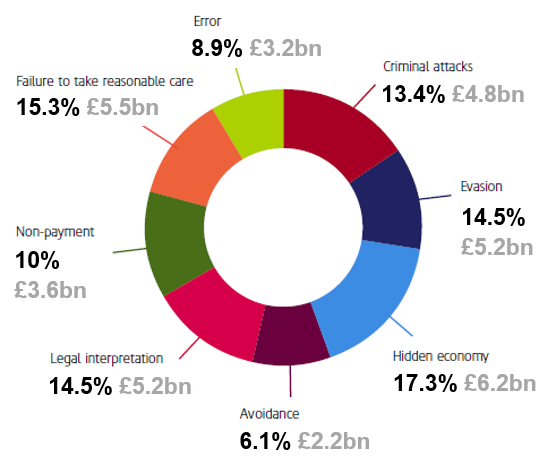

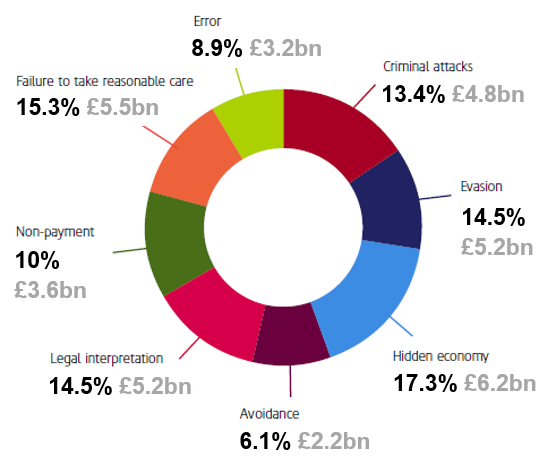

There are quite a few references and analysis of the GAP structure and main reasons to justify it. An example of this, is the image below which represents the GAP Structure in the UK.

Source: HMRC – Measuring tax gaps 2016 edition

It is possible to identify varied reasons beyond pure tax evasion. Legal interpretations alone run at 14.5% and errors at 8.9%, which represent a total of £8.4bn pounds.

Management of the taxation system is the responsibility of Tax Agencies in defining the tax structure and regulation. As well, there are increasing demands from tax payers for better support by being informed and having services the facilitate the completion of their tax obligations.

The complexity of the taxation regulation, in place, and its constant changes demand extra effort from taxpayers as they comply with their tax obligations, as well as, carries a financial weight because of the required IT updates on a regular basis.

Based on this scenario, allow me to focus the rest of the article on the legal entities (organizations) which I segment in two categories:

The boundary between the Tax Agency’s responsibility and the taxpayers’ accountability collides with the taxpayers’ capacities to perform their tax obligations. However, it is of interest to the Tax agencies to promote i) best practices that will diminish this pain point; ii) promote services that provide visibility to taxpayers to follow through with their obligations; iii) enable incoming error free information; and iv) provide immediate updated information on regulation changes adjusted to taxpayers’ reality.

Is it realistic to request Tax Agencies to provide such kind of services to the taxpayers aiming at the same time to reduce the GAP?

In my opinion, the next step that Tax Agencies need to take is to shift the paradigm from authority agency to a collaborative partner.

This can be obtained through existing technologies such as i) making use of process simplification and automation (digital transformation), ii) manage several sources of data (big data); iii) cloud computing (cloud); iv) engagement platform (mobile/online services) break down the barrier/border between the taxpayer and the tax agency, creating conditions to automation of generation, validation and report over the overall tax process.

It’s within this scenario that I defend a higher participation from the Tax Agency’s side given that it owns all legal tax requirements for all categories of taxpayers as well as their detailed record. With this information, it is possible to take the next step in providing online services tailored to each taxpayer’s profile.

Then, which approach should be taken?

Let’s imagine a scenario where a Tax Agency provides, a TaaS (Tax as a Service) concept, which permits the taxpayer:

Going beyond the pure TaaS, let’s imagine a more elaborate scenario, already in place in some countries, where the usage of API (Application Programming Interface) permits a direct connection to POS (Point of Sales) terminals registering details on all transactions and sending this information in real time to the Tax Agency e.g. FURS - Slovenia. As mentioned in my last blog, this option shifts the tax paradigm (i.e. IVA) from an auto-declared process to a pre-populated tax declaration.

The proposed approach enable Tax Agencies with a truly engagement platform, allowing them to make available micro-services, such the describe ones, but most important, making possible that third parties start building, on top of those services, a range of new Taxpayer oriented apps. ERP software vendors can also leverage their capabilities and solutions providing the necessary compliance and interface with the Tax Agency and at same time keeping an audit trail of operations.

Resuming, from Taxpayer perspective, benefits such as lower cost to fulfil their tax obligations, be compliant with the regulations all the time; visibility over their accounts and status of processes are key factors to become compliant.

In regards of the Tax agency benefits is possible to highlight the Taxpayer individual management with pro-active actions, reduce internal error handling or clarification processes, capability to close the loop between the generation of information and their tax treatment.

Tried here to raise the importance of the better usage of technology by Tax Agencies in favor of increase Taxpayer service and in line with the mitigation of the Tax GAP, releasing the internal Staff to focus on other activities, tackling those who requires harder measures to combat the remaining part of the GAP, such as the Evasion and the shadow economy.

Being closer to Taxpayers with the described approach is in my opinion the way to go, jumping over the traditional boundaries of Tax Agencies reality.

Before tackling the issue and define measures to reduce the GAP, it is imperative to understand the motives/drivers for such behaviours in order to develop effective policies and procedures to combat big pain point.

There are quite a few references and analysis of the GAP structure and main reasons to justify it. An example of this, is the image below which represents the GAP Structure in the UK.

Source: HMRC – Measuring tax gaps 2016 edition

It is possible to identify varied reasons beyond pure tax evasion. Legal interpretations alone run at 14.5% and errors at 8.9%, which represent a total of £8.4bn pounds.

Management of the taxation system is the responsibility of Tax Agencies in defining the tax structure and regulation. As well, there are increasing demands from tax payers for better support by being informed and having services the facilitate the completion of their tax obligations.

The complexity of the taxation regulation, in place, and its constant changes demand extra effort from taxpayers as they comply with their tax obligations, as well as, carries a financial weight because of the required IT updates on a regular basis.

Based on this scenario, allow me to focus the rest of the article on the legal entities (organizations) which I segment in two categories:

- Taxpayers with ERP software which are capable of complying with all legal requirements providing all necessary information to Tax Agency

- Small Business Taxpayers for whom the completion of tax obligations become a processual burden

The boundary between the Tax Agency’s responsibility and the taxpayers’ accountability collides with the taxpayers’ capacities to perform their tax obligations. However, it is of interest to the Tax agencies to promote i) best practices that will diminish this pain point; ii) promote services that provide visibility to taxpayers to follow through with their obligations; iii) enable incoming error free information; and iv) provide immediate updated information on regulation changes adjusted to taxpayers’ reality.

Is it realistic to request Tax Agencies to provide such kind of services to the taxpayers aiming at the same time to reduce the GAP?

In my opinion, the next step that Tax Agencies need to take is to shift the paradigm from authority agency to a collaborative partner.

This can be obtained through existing technologies such as i) making use of process simplification and automation (digital transformation), ii) manage several sources of data (big data); iii) cloud computing (cloud); iv) engagement platform (mobile/online services) break down the barrier/border between the taxpayer and the tax agency, creating conditions to automation of generation, validation and report over the overall tax process.

It’s within this scenario that I defend a higher participation from the Tax Agency’s side given that it owns all legal tax requirements for all categories of taxpayers as well as their detailed record. With this information, it is possible to take the next step in providing online services tailored to each taxpayer’s profile.

Then, which approach should be taken?

Let’s imagine a scenario where a Tax Agency provides, a TaaS (Tax as a Service) concept, which permits the taxpayer:

- To receive pro-active notifications about their fiscal/tax obligations

- To upload information immediately validated within a rules engine respecting a set of rules in regards with current and historical legislation. This facilitates immediate assessment/validation as well reduces internal work handling errors

- To provide online information over tax processes statuses

- To allow online payments or request for payment agreements

- To make possible the generation of business intelligence reports with analysis and benchmarks

Going beyond the pure TaaS, let’s imagine a more elaborate scenario, already in place in some countries, where the usage of API (Application Programming Interface) permits a direct connection to POS (Point of Sales) terminals registering details on all transactions and sending this information in real time to the Tax Agency e.g. FURS - Slovenia. As mentioned in my last blog, this option shifts the tax paradigm (i.e. IVA) from an auto-declared process to a pre-populated tax declaration.

The proposed approach enable Tax Agencies with a truly engagement platform, allowing them to make available micro-services, such the describe ones, but most important, making possible that third parties start building, on top of those services, a range of new Taxpayer oriented apps. ERP software vendors can also leverage their capabilities and solutions providing the necessary compliance and interface with the Tax Agency and at same time keeping an audit trail of operations.

Resuming, from Taxpayer perspective, benefits such as lower cost to fulfil their tax obligations, be compliant with the regulations all the time; visibility over their accounts and status of processes are key factors to become compliant.

In regards of the Tax agency benefits is possible to highlight the Taxpayer individual management with pro-active actions, reduce internal error handling or clarification processes, capability to close the loop between the generation of information and their tax treatment.

Tried here to raise the importance of the better usage of technology by Tax Agencies in favor of increase Taxpayer service and in line with the mitigation of the Tax GAP, releasing the internal Staff to focus on other activities, tackling those who requires harder measures to combat the remaining part of the GAP, such as the Evasion and the shadow economy.

Being closer to Taxpayers with the described approach is in my opinion the way to go, jumping over the traditional boundaries of Tax Agencies reality.

- SAP Managed Tags:

- Public Sector,

- Digital Transformation

4 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.