- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- S4 HANA FINANCE MIGRATION – what’s on your plate?....

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Former Member

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

01-25-2017

6:53 AM

Welcome back to continuation of my blog on S4HANA Finance Migration - what's on your plate ? In fact, my plate was full for past few weeks due to the 'Go-Live' of our S4HANA FIN migration project. Everything went smooth as expected and we are looking forward to the first period close after the migration - hoping for no surprises.

We structured the precheck list as below on SAP documentation that is available along with other documents like Release Notes, Installation and Upgrade information. A detailed Migration guide is available at http://help.sap.com/sfin300. We updated the steps with relevant notes and specific comments. Hope these steps would prove useful to you as a quick reference. I will also go thru the Customizing, data migration and post migration steps. In fact, the S4HANA FIN 1605 provides enhances IMG activities with various consistency checks after the migration. There is now a Migration monitor (t-code FIN_MIG_STATUS) available that makes it easier to debug on specific errors and address more effectively.

Once the pre-checks are done, the Basis team will prepare and carry out the Installation and Upgrade. The back- up tables are created for the totals and Index tables, original Index and totals tables deleted, create compatibility views etc. No posting is possible henceforth until the Migration is set to complete.

IMG Activity provides step by step instructions to complete the customizing, migration and post migration checks.

Preparation and Migration of Customizing for General Ledger (S4HANA FIN 1605)

There is detailed documentation available for each step in the customizing activities.

Preparations and Migration of Customizing for Controlling

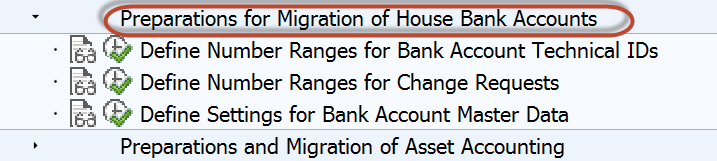

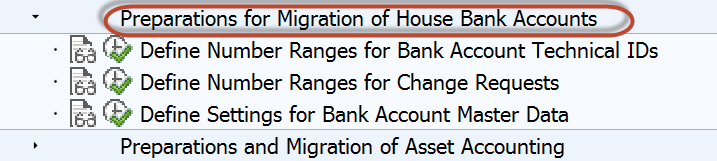

Preparation and Migration of House Bank Account

Preparation and Migration and Migration of Asset Accounting

There are certain manual steps needs to be performed in customizing New Asset Accounting. Special attention is required to understand these steps, current configuration and impact after migrating to New Asset Accounting.

Data Migration

Data Migration Monitor provides detailed error log. The steps could be stopped and re-run after remediation.

Typically, the migration could take from 6 hours to 15 hours depending on size of the transactional data. Due to the time required for migration, the post migration steps could be performed at later time. The postings could be done once the migration.

Detailed Error Log

Post Migration Steps

Though the Customizing and Migration is an IMG activity in depth understanding of current system, S4HANA Architecture and understanding impact is very important. It is advisable to go through SAP study material, test concepts and critical scenarios in the Lab System or in SandBox. The S4HANA FIN migration project we just completed had some challenges in implementing Account Based COPA. More than implementing AB COPA we had challenge bringing historical data of the Cost Based COPA. SAP provided excellent support and we were able to sail through swiftly. We also had some issues in the Enrichment step in migration and depreciation calculations. The list of SAP notes that we implemented to resolve these issues. It would be helpful to go thru these notes to be better prepared.

Issue SAP Note/s for Remediation

This is all for the blog on Migration. Hope it provided some sort of overview on the S4HANA Migration process.

I already started another blog on S4HANA Reporting and I am so eager to explore and share my experience with you – its all Blue Ocean, full of opportunities.

Please provide your feedback so I could improve writing my next blogs.

We structured the precheck list as below on SAP documentation that is available along with other documents like Release Notes, Installation and Upgrade information. A detailed Migration guide is available at http://help.sap.com/sfin300. We updated the steps with relevant notes and specific comments. Hope these steps would prove useful to you as a quick reference. I will also go thru the Customizing, data migration and post migration steps. In fact, the S4HANA FIN 1605 provides enhances IMG activities with various consistency checks after the migration. There is now a Migration monitor (t-code FIN_MIG_STATUS) available that makes it easier to debug on specific errors and address more effectively.

| Step | Description |

| 1 | Install (Basis) SAP Note 2129306 to install the pre check programs in ECC. Check note 2240666 |

| 2 | Make sure that you have either posted or deleted all held documents. |

| 3 | RASFIN_MIGR_PRECHECK |

| From SAP Note 1939592 , implement report RASFIN_MIGR_PRECHECK and test whether the necessary prerequisites for new Asset Accounting have been fulfilled using report RASFIN_MIGR_PRECHECK (Check on Prerequisites Before FI-AA Migration). | |

| If you discover when executing report RASFIN_MIGR_PRECHECK that currency areas are missing, you have to create these first in a separate project and have the system determine the values. | |

| 4 | Check Business Function 'EA-FIN' is activated. Transaction SFW5 to activate business extensions and business functions. |

| 5 | Run GLE_MCA_DELETE_LEDGERS |

| Unwanted content like ledgers 0D, 0M, 1D, 1L, 0MCA, 1MCA and Co Codes MCA1, MCA2, MCA3, MCA4 is delivered and can cause errors in consistency checks. If errors appear for this content, please delete this | |

| content by applying the correction instructions of notes 1990560 and 2159137. Afterwards | |

| execute the ABAP program GLE_MCA_DELETE_LEDGERS as mentioned in note 1990560 | |

| 6 | Make sure that you have carried forward all of the balances in all applications to the current fiscal year. This also applies to the sub ledgers. Use the following transactions. THIS IS UTMOST IMPORTANT. |

| * In case your SandBox has older data from previous years, these steps are essential to avoid issues in migration | |

| FAGLGVTR, if you are using new General Ledger Accounting | |

| F.16 , if you are using classic General Ledger Accounting | |

| AJRW , if you are using Asset Accounting | |

| F.07, if you are using Accounts Receivable and Accounts Payable | |

| 7 | FINS_MIG_PRECHECK_CUST_SETTNGS |

| You perform the following activities in your test system and if you are using classic General Ledger Accounting, new General Ledger Accounting or the Simple Finance add-on 1.0. | |

| Check whether the currency settings and the CO configuration in your system allow you to upgrade to SAP S/4HANA Finance. To do this, run report FINS_MIG_PRECHECK_CUST_SETTNGS. This report is found in SAP Note 2129306 . | |

| 8 | Consistency Checks Before Installation and Migration |

| Execute report RFINDEX_NACC with the option Indexes vs Documents. You perform this activity if you are using classic General Ledger Accounting, new General Ledger Accounting, or the SAP Simple Finance add-on 1.0. | |

| Check documents against transaction figures for all fiscal years, in which archiving has not yet taken place. | |

| If you are using new General Ledger Accounting, execute the reconciliation for the general ledger and the sub ledgers. Use report TFC_COMPARE_VZ to do this or choose transaction FAGLF03. | |

| Reconcile the general ledger with Asset Accounting for the leading valuation and parallel valuation. Use the following reports in sequence: | |

| Reconciliation Program FI-AA <-> General Ledger: List with Difference Accounts (Report RAABST02). You use this report if you are using classic and new Asset Accounting. | |

| Consistency Check for FI-AA (New) and FI-GL (New) (Report RAABST01). You use this report if you are using classic Asset Accounting. | |

| Compare the ledgers if you are using new General Ledger Accounting. Use report RGUCOMP4 to do this or choose transaction GCAC. you perform this step if you are using new General Ledger Accounting. | |

| Reconcile Materials Management (MM) with GL. Choose report RM07MBST/ RM07MMFI to do this. | |

| You perform this step if you are using classic or new General Ledger Accounting. | |

| 9 | Check Customer-Defined Coding |

| Check if you have write accesses to the tables in your own customer objects in your customer namespace. You have to replace these accesses, since the views with same names allow only read access. | |

| Check if you have your own customer-specific views in your own objects in your customer namespace for the tables that no longer exist. You have to replace these views with an open-SQL SELECT or the call of a read module, since the Data Dictionary does not support database views that are based on other views. | |

| · This STEP needs to be performed by ABAP team | |

| 10 | Handling Customer-Defined Fields and Interfaces |

| If you are using new General Ledger Accounting and also using customer-defined fields, these fields are generated to the appropriate compatibility views. | |

| For customer fields in BSEG and the index tables, note the following for the creation of the views with the same names: | |

| If a customer field exists in both BSEG and in the indexes, it is automatically generated into the view with the same name. It is not transferred into a view with the same name if the customer field only exists in the index. In this case the field must first be included in the BSEG and filled using a customer program. | |

| If you transferred data from your Z tables to new General Ledger Accounting during the migration to the Financial Accounting Add-On 1.0, you have to delete the data of these Z tables before the migration to SAP S/4HANA Finance, On-Premise-Edition. If you do not delete the data, the data of the Z tables is migrated again and transferred to the new table structure. The values would then be duplicated. | |

| If you have used interfaces to connect your system to external systems that make postings to General Ledger Accounting (in real time or subsequently), check whether adjustments need to be made to the interfaces. For more information, see FI-GL (New), Transfer of Totals and Single Documents in Distributed Systems. | |

| In SAP S/4HANA Finance, there is only partial support for ALE scenarios. An SAP S/4HANA Finance system cannot serve as an ALE receiver for CO line items. The reason is that FI and CO line items use the same persistence table in SAP S/4HANA Finance. Therefore, the CO line items cannot be posted alone without the FI line items they belong to. SAP does not provide a check to determine if this scenario is used in the system. You have to check this manually. ALE scenarios for the distribution of CO master data, such as cost centers, continue to be supported. | |

| · This step needs to be performed by the ABAP team | |

| 11 | Period-End Closing Activities |

| Lock the current and previous periods in Materials Management (program RMMMPERI) | |

| Perform closing for periodic asset postings (with program RAPERB2000) You perform this step if you are using Asset Accounting. | |

| Execute the periodic depreciation posting run (with program RAPOST2000). You perform this activity if you are using classic Asset Accounting, new Asset Accounting, or the SAP Simple Finance add-on 1.0. | |

| Check for update terminations in your system and correct any you find. | |

| Make sure that all held documents have either been posted or deleted. To post held documents, use transaction FB50, for example. In the menu for the transaction, choose Edit Select Held Document. To delete held documents, you can use program RFTMPBLD. | |

| If you are already using account-based profitability analysis, perform a delta upload to SAP BW for all account-based CO-PA Data Sources for which you use the delta method. You perform this activity if you are using classic General Ledger Accounting, new General Ledger Accounting, or the SAP Simple Finance add-on 1.0. | |

| Make sure that you have carried forward all of the balances in all applications to the current fiscal year. This also applies to the sub ledgers. Use the following transactions: FAGLGVTR, if you are using new General Ledger Accounting F.16, if you are using classic General Ledger Accounting AJRW, if you are using Asset Accounting F.07, if you are using Accounts Receivable and Accounts Payable | |

| The following applies for Asset Accounting: Close all fiscal years except the current fiscal year. Use program RAJABS00 to do this. | |

| You perform this step if you have been using classic General Ledger Accounting, and used the foreign currency valuation with function Valuation for Balance Sheet Preparation there. | |

| In this case, you have to set the valuation differences in the open items to zero; this means you reset the valuations for all periods in the current fiscal year. Reset the valuations using program SAPF100. | |

| This step is required because the foreign currency valuation in new General Ledger Accounting does not take into account the results of the function Valuation for Balance Sheet Preparation in classic General Ledger Accounting. If you do not reset the valuations, this could result in incorrect values. | |

| Execute all scheduled jobs and do not schedule any new jobs. | |

| Lock the periods in Financial Accounting (program SAPL0F00) and Controlling (Plan/Actual) (program SAPMKCSP). | |

| Execute progam RASFIN_MIGR_PRECHECK again to make sure that the prerequisites for Asset Accounting have been met. | |

| Lock all users in the system that do not have any tasks associated with the installation or the migration. | |

| 12 | List of reports for validation - Save in Excel Files |

| The financial statements (program RFBILA00) | |

| The totals report for cost centers (transaction S_ALR_87013611) | |

| Order: Actual/Plan/Variance (transaction S_ALR_87012993) | |

| The G/L account balance list (program RFSSLD00) | |

| The general ledger line items list (program RFSOPO00) | |

| The compact document journal (program RFBELJ00) | |

| The asset history sheet (program RAGITT_ALV01) | |

| The depreciation run for planned depreciation (RAHAFA_ALV01) | |

| The vendor sales (program RFKUML00) | |

| The vendor open item list (program RFKEPL00) | |

| The customer sales (program RFDUML00) | |

| The customer open item list (program RFDEPL00) | |

| The customer recurring entry original documents (program RFDAUB00) |

Once the pre-checks are done, the Basis team will prepare and carry out the Installation and Upgrade. The back- up tables are created for the totals and Index tables, original Index and totals tables deleted, create compatibility views etc. No posting is possible henceforth until the Migration is set to complete.

IMG Activity provides step by step instructions to complete the customizing, migration and post migration checks.

Preparation and Migration of Customizing for General Ledger (S4HANA FIN 1605)

There is detailed documentation available for each step in the customizing activities.

Preparations and Migration of Customizing for Controlling

Preparation and Migration of House Bank Account

Preparation and Migration and Migration of Asset Accounting

There are certain manual steps needs to be performed in customizing New Asset Accounting. Special attention is required to understand these steps, current configuration and impact after migrating to New Asset Accounting.

Data Migration

Data Migration Monitor provides detailed error log. The steps could be stopped and re-run after remediation.

Typically, the migration could take from 6 hours to 15 hours depending on size of the transactional data. Due to the time required for migration, the post migration steps could be performed at later time. The postings could be done once the migration.

Detailed Error Log

Post Migration Steps

Though the Customizing and Migration is an IMG activity in depth understanding of current system, S4HANA Architecture and understanding impact is very important. It is advisable to go through SAP study material, test concepts and critical scenarios in the Lab System or in SandBox. The S4HANA FIN migration project we just completed had some challenges in implementing Account Based COPA. More than implementing AB COPA we had challenge bringing historical data of the Cost Based COPA. SAP provided excellent support and we were able to sail through swiftly. We also had some issues in the Enrichment step in migration and depreciation calculations. The list of SAP notes that we implemented to resolve these issues. It would be helpful to go thru these notes to be better prepared.

Issue SAP Note/s for Remediation

| No entry in compatibility view item for entry in original table (ANEP) FINS_RECON741 | 2367771 |

| "Reconciliation account : total without asset assignment | 2346879 |

| FINS_RECON763" | |

| "Error in Initial Depreciation Calculation: | 2342928 |

| FINS_FI_MIG150" | If issue is not resolved then |

| 2250574 | |

| Inconsistent Balance Carry Forward Error Message FINS_RECON033 | 2371163 |

| 2373439 | |

| Line Item Display in FBL1H/FBL5H when entered without Company Code | 2345625 |

| System status 012, 013 could be assigned to a dispute case i | 2010875 |

| SFIN migration: Check of ledgers of balance migration for in | 2317216 |

This is all for the blog on Migration. Hope it provided some sort of overview on the S4HANA Migration process.

I already started another blog on S4HANA Reporting and I am so eager to explore and share my experience with you – its all Blue Ocean, full of opportunities.

Please provide your feedback so I could improve writing my next blogs.

- SAP Managed Tags:

- SAP S/4HANA,

- SAP S/4HANA Finance

14 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- migration jobs in S/4HANA Cloud troubleshooting in Enterprise Resource Planning Q&A

- Data migration approach for Open PO and Contract in Public Cloud in Enterprise Resource Planning Q&A

- WORKFLOW FORWARDING FROM MIGRATION USER in Enterprise Resource Planning Q&A

- Manage Supply Shortage and Excess Supply with MRP Material Coverage Apps in Enterprise Resource Planning Blogs by SAP

- How to Migrate of Product variant configuration data ? in Enterprise Resource Planning Q&A

Top kudoed authors

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |