- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- The IT/Business Analyst’s Dilemma: How can I deli...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Advisor

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

10-24-2016

10:22 AM

IT and business analysts go to trade shows and conferences and return home full of great ideas, such as business process extensions and sexy analytics. Analysts want to deliver innovation to their business partners, not be seen as a barriers to innovation.

There are however many restrictions about how often upgrades and new functionality can be made available in a productive systems landscape.

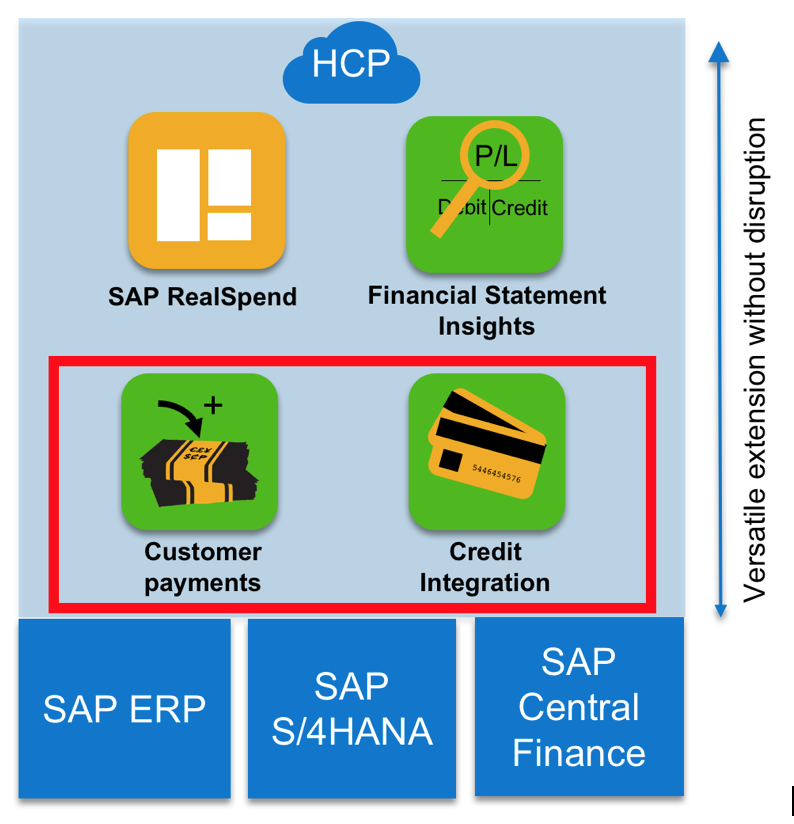

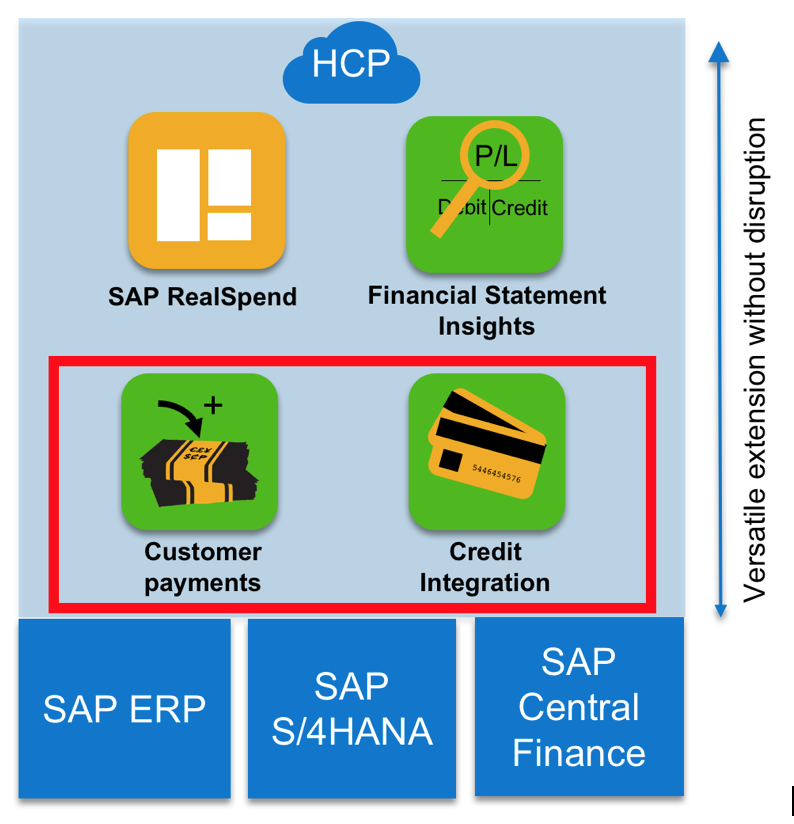

One way you can deliver innovation in a way that works with maintenance and downtime schedules is via the HANA Cloud Platform (HCP). While your ECC or S/4HANA Core system remains stable, you can extend business processes or adopt new functionality using applications (apps) available in the HCP. The HCP provides infrastructure services and an environment for the speedy development of apps. Companies can build their own apps, partners can use the HCP as a delivery mechanism for their own apps, and in some cases, SAP is delivering finished apps as well.

One advantage of the HCP, is that the apps can be developed and managed centrally, and then can work in a hybrid scenario with different release levels of backend systems. For example, an SAP-delivered app can be made available for customers on ECC releases or S/4HANA releases. This means a broader base of companies can take value from by these apps – not just those that have upgraded to S/4. More users in the paradigm of public cloud translates to more feedback which makes it back into the engineering team. And this leads to fast feedback and improvement cycles. Improvements to the HCP apps are made available to all customers, meaning that the analyst doesn’t have to wait until the next appropriate system downtime window to get the latest innovations and functionality – they will be available usually on a biweekly basis without any impact to their on premise processes.

SAP announced at SAPPHIRE two Finance apps delivered via the HANA Cloud Platform in the financial reporting space – SAP RealSpend and SAP Financial Statement Insights. The finance operations team has gone further to address transactional scenarios via HCP apps: (1) SAP S/4HANA Finance Cloud for credit integration and (2) SAP S/4HANA Finance Cloud for customer payments. These apps work with SAP ECC6.0 as well as S/4HANA systems and are therefore a good architectural choice for tens of thousands of SAP customers.

1. SAP S/4HANA Finance Cloud for credit integration solves the problem of being able to pull credit bureau data into your embedded SAP Credit Management scorecard. Many companies have an integrated scorecard which evaluates a combination of qualitative and quantitative factors to arrive at a credit score. While a company might have different credit scorecards for different customer segments, especially in the high-volume / lower-value segments, one of the most critical inputs is credit bureau rating information.

With SAP S/4HANA Finance Cloud for credit integration customers can choose from a menu of pre-connected credit bureaus. The PDF reports from the bureaus are stored in the HCP, while key data that drives your scorecard is pushed back into your ECC or S/4HANA system. The content of the data remains your property; you maintain a commercial relationship with the credit bureau, and leave the technical details of the connection to SAP.

This means the operational credit checks in your operational processes will be using the latest-and-greatest information available – without your credit team having to manually intervene to get updated information. Your scorecard will automatically be updated, ratings and limits get updated, and our co-innovation customers expect to automate all credit processes for more than 85% of their customer base.

2. SAP S/4HANA Finance Cloud for customer payments provides your B2B customers with self-service access to their account data. Your customer does not have to wait until your shared service center in Portugal or the Philippines is open for business; instead, in times of “digital”, they can go online with any web browser to see their open items, account balance information. They can send you remittance details to accelerate your cash application processes, trigger payments, or collaborate with your team to resolve invoice disputes faster.

Your accounts receivables team will receive fewer repetitive customer inquiries – calls regarding invoice reprints or balance statements. Certain processes like following up on particular invoices might take place via email today – in the HCP approach, the information is tied to the business document and managed by the system.

The path to go-live

Another advantage of the HCP apps is that they are easy-to-try and easy-to-buy. It is possible to try out the functionality in a non-productive system with limited effort. You have to apply a couple of notes on your ECC or S/4 system, install and configure the SAP HANA Cloud Connector (a non-modifying add-on), and do a couple of steps of configuration in the on premise and HCP systems. Each of these steps can be measured in hours, not weeks. This means your business users can see the software in your environment with your data

Commercially, these apps are delivered as software-as-a-service. All infrastructure you need to run the software is included in a subscription price. And in the HCP, there is no shelfware – you only pay for software you actually use.

In summary, the finance operations engineering team at SAP is using the HCP to deliver a number of specialized apps each designed to solve a specific business challenge. Using HCP means we can very quickly deliver innovations, regardless of the release cycles for the underlying ECC or S/4HANA systems. The Cloud approach delivers continuous innovation for our customers, with easy implementation, easy subscription and continuous updates to make it easier for IT/business analysts to deliver value to the business.

This means that for our customers, they can deploy new capabilities rapidly, seamlessly integrating to your existing system landscape. They are also ready-to-use with the Central Finance implementation approach to add value to your entire system landscape during your path to S/4.

Reach out to me at katharina.reichert@sap.com to learn more or discuss how this approach of a stable core and dynamic innovation will add value to your projects.

There are however many restrictions about how often upgrades and new functionality can be made available in a productive systems landscape.

One way you can deliver innovation in a way that works with maintenance and downtime schedules is via the HANA Cloud Platform (HCP). While your ECC or S/4HANA Core system remains stable, you can extend business processes or adopt new functionality using applications (apps) available in the HCP. The HCP provides infrastructure services and an environment for the speedy development of apps. Companies can build their own apps, partners can use the HCP as a delivery mechanism for their own apps, and in some cases, SAP is delivering finished apps as well.

One advantage of the HCP, is that the apps can be developed and managed centrally, and then can work in a hybrid scenario with different release levels of backend systems. For example, an SAP-delivered app can be made available for customers on ECC releases or S/4HANA releases. This means a broader base of companies can take value from by these apps – not just those that have upgraded to S/4. More users in the paradigm of public cloud translates to more feedback which makes it back into the engineering team. And this leads to fast feedback and improvement cycles. Improvements to the HCP apps are made available to all customers, meaning that the analyst doesn’t have to wait until the next appropriate system downtime window to get the latest innovations and functionality – they will be available usually on a biweekly basis without any impact to their on premise processes.

SAP announced at SAPPHIRE two Finance apps delivered via the HANA Cloud Platform in the financial reporting space – SAP RealSpend and SAP Financial Statement Insights. The finance operations team has gone further to address transactional scenarios via HCP apps: (1) SAP S/4HANA Finance Cloud for credit integration and (2) SAP S/4HANA Finance Cloud for customer payments. These apps work with SAP ECC6.0 as well as S/4HANA systems and are therefore a good architectural choice for tens of thousands of SAP customers.

1. SAP S/4HANA Finance Cloud for credit integration solves the problem of being able to pull credit bureau data into your embedded SAP Credit Management scorecard. Many companies have an integrated scorecard which evaluates a combination of qualitative and quantitative factors to arrive at a credit score. While a company might have different credit scorecards for different customer segments, especially in the high-volume / lower-value segments, one of the most critical inputs is credit bureau rating information.

With SAP S/4HANA Finance Cloud for credit integration customers can choose from a menu of pre-connected credit bureaus. The PDF reports from the bureaus are stored in the HCP, while key data that drives your scorecard is pushed back into your ECC or S/4HANA system. The content of the data remains your property; you maintain a commercial relationship with the credit bureau, and leave the technical details of the connection to SAP.

This means the operational credit checks in your operational processes will be using the latest-and-greatest information available – without your credit team having to manually intervene to get updated information. Your scorecard will automatically be updated, ratings and limits get updated, and our co-innovation customers expect to automate all credit processes for more than 85% of their customer base.

2. SAP S/4HANA Finance Cloud for customer payments provides your B2B customers with self-service access to their account data. Your customer does not have to wait until your shared service center in Portugal or the Philippines is open for business; instead, in times of “digital”, they can go online with any web browser to see their open items, account balance information. They can send you remittance details to accelerate your cash application processes, trigger payments, or collaborate with your team to resolve invoice disputes faster.

Your accounts receivables team will receive fewer repetitive customer inquiries – calls regarding invoice reprints or balance statements. Certain processes like following up on particular invoices might take place via email today – in the HCP approach, the information is tied to the business document and managed by the system.

The path to go-live

Another advantage of the HCP apps is that they are easy-to-try and easy-to-buy. It is possible to try out the functionality in a non-productive system with limited effort. You have to apply a couple of notes on your ECC or S/4 system, install and configure the SAP HANA Cloud Connector (a non-modifying add-on), and do a couple of steps of configuration in the on premise and HCP systems. Each of these steps can be measured in hours, not weeks. This means your business users can see the software in your environment with your data

Commercially, these apps are delivered as software-as-a-service. All infrastructure you need to run the software is included in a subscription price. And in the HCP, there is no shelfware – you only pay for software you actually use.

In summary, the finance operations engineering team at SAP is using the HCP to deliver a number of specialized apps each designed to solve a specific business challenge. Using HCP means we can very quickly deliver innovations, regardless of the release cycles for the underlying ECC or S/4HANA systems. The Cloud approach delivers continuous innovation for our customers, with easy implementation, easy subscription and continuous updates to make it easier for IT/business analysts to deliver value to the business.

This means that for our customers, they can deploy new capabilities rapidly, seamlessly integrating to your existing system landscape. They are also ready-to-use with the Central Finance implementation approach to add value to your entire system landscape during your path to S/4.

Reach out to me at katharina.reichert@sap.com to learn more or discuss how this approach of a stable core and dynamic innovation will add value to your projects.

- SAP Managed Tags:

- Digital Technologies,

- SAP S/4HANA Finance,

- SAP Business Technology Platform

2 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

153 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

213 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- Update of the SAP Activate Roadmap for SAP S/4HANA (on prem) upgrades with the Clean Core Strategy in Enterprise Resource Planning Blogs by SAP

- Manage Supply Shortage and Excess Supply with MRP Material Coverage Apps in Enterprise Resource Planning Blogs by SAP

- The Role of SAP Business AI in the Chemical Industry. Overview in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Cloud Extensions with SAP Build Best Practices: An Expert Roundtable in Enterprise Resource Planning Blogs by SAP

- Deep Dive into SAP Build Process Automation with SAP S/4HANA Cloud Public Edition - Retail in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 11 | |

| 10 | |

| 7 | |

| 6 | |

| 4 | |

| 4 | |

| 4 | |

| 4 | |

| 3 | |

| 3 |