- SAP Community

- Products and Technology

- Technology

- Technology Blogs by SAP

- GRC Tuesdays: What Does an Ideal Fraud Management ...

Technology Blogs by SAP

Learn how to extend and personalize SAP applications. Follow the SAP technology blog for insights into SAP BTP, ABAP, SAP Analytics Cloud, SAP HANA, and more.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member49

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

08-16-2016

4:00 AM

The 2016 version of the “Report to the Nations on Occupational Fraud and Abuse” ¹ by the Association of Certified Fraud Examiners (ACFE) highlights some trends and statistics that any professional involved in fraud investigation and related processes should be aware of:

- “Typical organization loses 5% of revenues in a given year as a result of fraud”

- “Average loss per case of $2.7 million” (from 2.4K cases in the study)

- “23.2% of cases causing losses of $1 million or more”

- “Nearly one third of fraud least two years before they were detected”

- “The longer a fraud lasted, the greater the financial damage it caused. At the extreme end, schemes that lasted more than five years caused a median loss of $850,000”

- “When fraud was uncovered through active detection methods, such as surveillance and monitoring or account reconciliation, the median loss and median duration of the schemes were lower than when the schemes were detected through passive methods”

- “The presence of anti-fraud controls was correlated with both lower fraud losses and quicker detection”

What Is the Ideal Solution for These Challenges?

Given such a challenging environment, organizations combating fraud need an enterprise solution that can:

- Tackle all these situations now, and be ready to address new ones in the future resulting from evolving fraud patterns that fraudsters are constantly thinking of.

- Automatically analyze huge volumes of data from multiple and heterogeneous data sources, in real time or batch mode depending on the types of fraud scenarios. Early detection of a potential fraud case is critical because it can allow transactions to be blocked before any financial losses occur.

- Work with predictive analytics, allowing users to extract insights from analyzing data with predictive algorithms and keeping up with changing fraud patterns that a rules-only approach might not be able to detect.

- Allow alerts to be created manually because an organization might receive whistle-blower type of notifications and/or staff might encounter transactions which seem suspicious. (This is in addition to automatically triggering alerts for suspicious transactions that meet certain predefined criteria.)

- Provide analytical tools to help users visualize and understand all this information, considering the large amounts of data typically analyzed during fraud investigations.

Wide Range of Use Cases: Asset Misappropriation, Purchasing, Corruption, Foreign Corrupt Practices Act, Industry Scenarios, and So On

Given the nature of fraud and the different requirements across industries and regions, a solid enterprise solution should be a flexible platform that allows users to define the relevant detection criteria for the multiple fraud scenarios they are interested in, whether it’s for a particular division/organization within a corporation or for a corporate-wide initiative.

Example of a Map with Alert Distribution Information

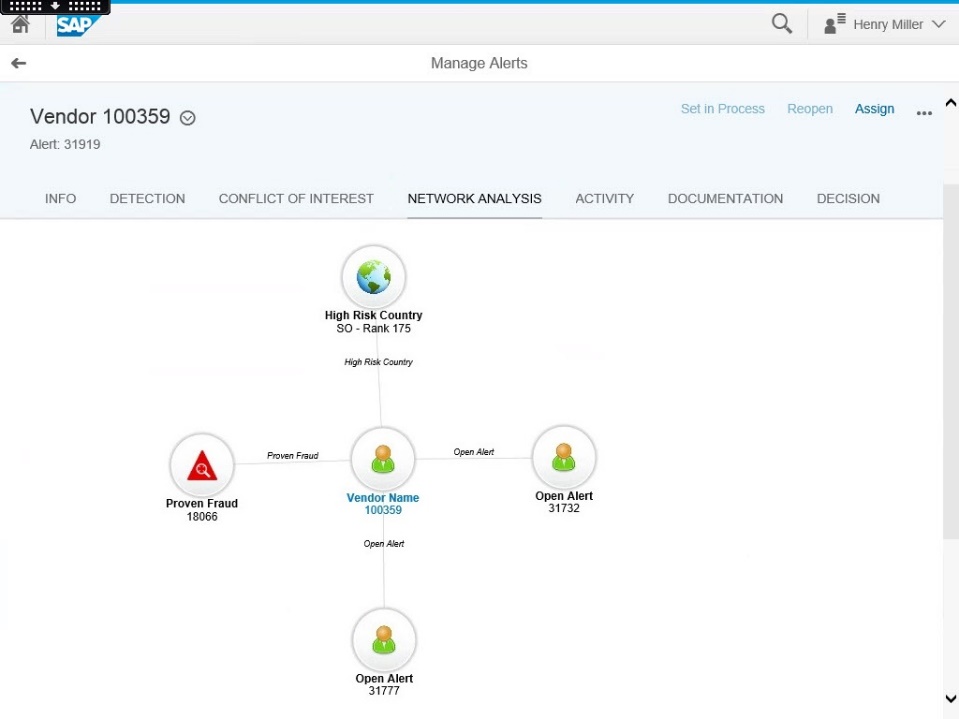

Example of Network Analyzer Showing Relationships among Different Objects in a Suspicious Case

SAP Fraud Management

At SAP, we’ve worked to create an enterprise solution that meets all these needs. Learn more about SAP Fraud Management and how it could help your organization fight fraud by leveraging the power and speed of HANA.

- Read the solution brief.

- Get started with a free trial.

¹Report to the Nations on Occupational Fraud and Abuse, 2016 Global Fraud Study, ACFE

- SAP Managed Tags:

- Data and Analytics,

- Governance, Risk, Compliance (GRC), and Cybersecurity

Labels:

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

ABAP CDS Views - CDC (Change Data Capture)

2 -

AI

1 -

Analyze Workload Data

1 -

BTP

1 -

Business and IT Integration

2 -

Business application stu

1 -

Business Technology Platform

1 -

Business Trends

1,658 -

Business Trends

91 -

CAP

1 -

cf

1 -

Cloud Foundry

1 -

Confluent

1 -

Customer COE Basics and Fundamentals

1 -

Customer COE Latest and Greatest

3 -

Customer Data Browser app

1 -

Data Analysis Tool

1 -

data migration

1 -

data transfer

1 -

Datasphere

2 -

Event Information

1,400 -

Event Information

66 -

Expert

1 -

Expert Insights

177 -

Expert Insights

298 -

General

1 -

Google cloud

1 -

Google Next'24

1 -

Kafka

1 -

Life at SAP

780 -

Life at SAP

13 -

Migrate your Data App

1 -

MTA

1 -

Network Performance Analysis

1 -

NodeJS

1 -

PDF

1 -

POC

1 -

Product Updates

4,577 -

Product Updates

343 -

Replication Flow

1 -

RisewithSAP

1 -

SAP BTP

1 -

SAP BTP Cloud Foundry

1 -

SAP Cloud ALM

1 -

SAP Cloud Application Programming Model

1 -

SAP Datasphere

2 -

SAP S4HANA Cloud

1 -

SAP S4HANA Migration Cockpit

1 -

Technology Updates

6,873 -

Technology Updates

420 -

Workload Fluctuations

1

Related Content

- Consuming SAP with SAP Build Apps - Mobile Apps for iOS and Android in Technology Blogs by SAP

- Onboarding Users in SAP Quality Issue Resolution in Technology Blogs by SAP

- How to host static webpages through SAP CPI-Iflow in Technology Blogs by Members

- Behind the compatibility - What are the compatibility means between GRC and the plugins in Technology Blogs by SAP

- Improving Time Management in SAP S/4HANA Cloud: A GenAI Solution in Technology Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 37 | |

| 25 | |

| 17 | |

| 13 | |

| 7 | |

| 7 | |

| 7 | |

| 6 | |

| 6 | |

| 6 |