- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

This document is for an explanation of SAP TRM Market Risk Analyzer - Net Present Value for Yield Interest Rate from the End User perspective.

For configuration refer to Risk Analyzers | Gopa Kumar S or SAP Service Marketplace - SAP Treasury and Risk Management Building Block Y26

SAP TRM-MR calculates NPV based on yield interest curves.

MS Excel calculates NPV by using a discount rate and a series of future payments (negative values) and income (positive values).

SAP uses Zero Bond Discount Factor (ZBDF) to calculate NPV Values. SAP Notes 105693, 110812, 204331 gives some information on the logic.

Reference Interest Rate:

A reference interest rate is an interest rate to which the contract interest rate refers in the condition items. It is adopted directly as contract interest rate in the context of variable interest calculation or used as part of the formula for the calculation of the contract interest rate.

IMG: Financial Supply Chain Management -> Treasury and Risk Management -> Basic Functions -> Market Data Management -> Master Data -> Check Reference Interest Rates

IMG: Financial Supply Chain Management -> Treasury and Risk Management -> Basic Functions -> Market Data Management -> Master Data ->

Check Reference Interest Rates -> Define Reference Interest Rate

Yield Category: The yield category specifies reference interest rates and yield curves.

The following yield categories are available:

- Par rate (annual distribution)

- Zero bond yield (distribution at the end of the term)

Currency: Currency for the Interest

Int Calc. Method: Interest Calculation Method

Quotation Type: Middle, Bid Ask

Unit of Time: Time Dimension

Term: Terms in the Unit of Time

Foward YC Type: The calculation of a forward rate for a reference interest rate is based on the assigned forward curve type.

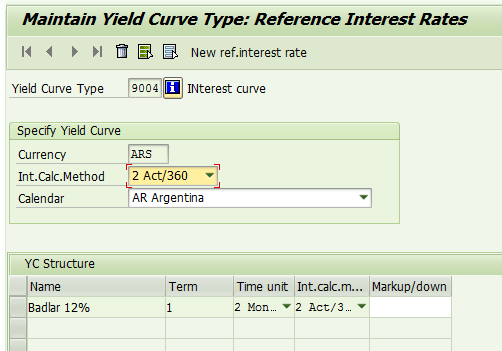

Yield Curve:

A yield curve type contains one yield curve structure for each different currency. On the validity date, the yield curve structure generates a yield curve, which serves as the basis for NPV calculation.

IMG: Financial Supply Chain Management -> Treasury and Risk Management -> Basic Functions -> Market Data Management -> Master Data ->

Check Reference Interest Rates -> Define Yield Curve Type

Yield Category: The yield category specifies reference interest rates and yield curves. Same as Reference Interest.

Interpolation Procedure: It determines which method is used to calculate missing grid points using existing reference interest rates. The following interpolation procedures are supported. Function: ISB_CONVERT_PAR_TO_ZBAF

- Linear interpolation. - perform zbaf_bis_360 -.

- Cubic spline interpolation: With cubic spline interpolation, third-degree polynomials are used for the interpolation. - perform zbaf_ab_360 -.

Select Currency and click on Detail icon

Select the appropriate "Int.Calc.Method" and add "New ref, Interest rate" as needed. You can have more than 1 if they have different periods.

ie:

Zero Bond Discount Factor

Zero Bond Discounting Factors{} - Price Calculator for Financial Instruments - SAP Library

It is the Discount factor of a loan/investment as if all interest and repayment is done at the end of life of the transaction.

Pt: Interest Rate

dt: Days

bt: Base Days

The zero bond discounting factors are used, among other things, for the following purposes:

- Base amount for calculation of the margin net present value

- Base amount for calculation of the similarly structured opportunity interest rate

You use zero bond discounting factors especially when the yield curve is not flat. The ZBDFs are determined from interest rates sequentially, meaning from the cumulated ZBDFs of the previous years. The matched maturities-valuation of a cash flow requires duplication of the cash flow course of a financial instrument (specified by the payment amount and time) using various other financial instruments.

Example: trx JBYC

In case the Int Method between the Yield Curve (YC Type) and the Reference Interest Rate is different, you will need to convert from one method to another before calculating ZBDF.

Forward Rates

Forward Rates - Price Calculator for Financial Instruments - SAP Library

Forward rates or implied forward rates are interest rates for transactions that are in the future but that are determined by a current yield structure curve.

FRt0: Forward Rate Interest T0

FZBDF: Forward Zero Bond Discount Factor

Ie:

Validate with trx JBYC

Risk Hierarchy

Create Risk Hierarchy (trx JBRR) for Analysis in NPV (trx JBRX) and a Node with Risk Type "Yield Curve"

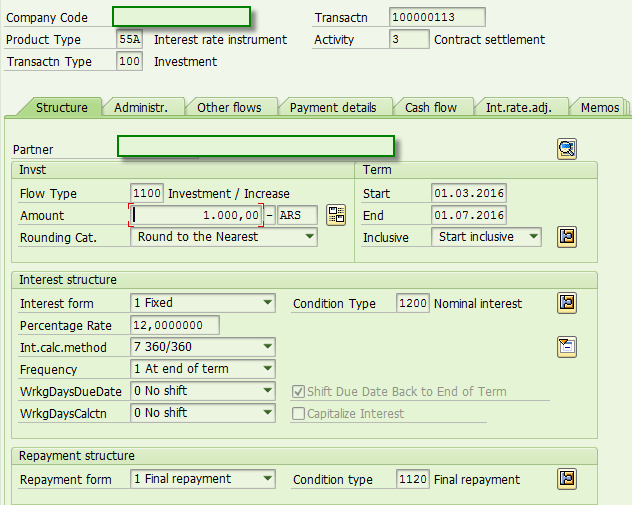

NPV Margin

NPV margin - Profitability Analysis - SAP Library

The net present value margin (NPV margin) is the value that results when a cash flow is discounted to a defined point in time, (the market interest date). The NPV margin of a transaction corresponds to the total of the NIM contributions discounted to the market interest rate date. For transactions with fixed cash flows, the NPV margin is calculated by discounting the payments from the cash flow using the zero bond discounting factors (ZBDF) for the defined date.

If the "Horizon" equals the "Valuation Date" data is obtained from trx OB83 , if not it is calculated with Forward Rate.

ie:

CashFlow

Excel

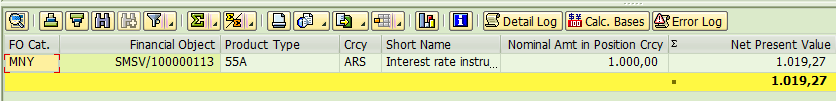

trx: JBRX

in case you add scenario and calculates based on yield curve

Calculation of NPV through MS Excel NPV function

Conclusion:

There is not much difference between SAP and MS Excel method (1019,68 vs 1019,91) but numbers are not the same.

You could find results similar if

- Interest Rate is same across all periods

- Interest is payed fully at the end of life

- Repayment is done at the end

If conditions differ, only Excel XNPV function will approach to SAP NPV.

Attached are 2 Excel files, one with the results and the other (en_XML) with formulas.

ie:

- SAP Managed Tags:

- FIN Treasury

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- SAP Fiori for SAP S/4HANA - Composite Roles in launchpad content and layout tools in Enterprise Resource Planning Blogs by SAP

- Planning of Business Entities (Universal Allocation, Internal Allocation, EC-PCA) in Enterprise Resource Planning Q&A

- The Role of SAP Business AI in the Chemical Industry. Overview in Enterprise Resource Planning Blogs by SAP

- How to add characteristics for profitability analysis? in Enterprise Resource Planning Q&A

- Status and Progress Analysis in Enterprise Resource Planning Q&A

| Subject | Kudos |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| User | Count |

|---|---|

| 6 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |