- SAP Community

- Products and Technology

- Technology

- Technology Blogs by SAP

- The 5-click Challenge

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Here’s a challenge for any Accounts Receivable (A/R) professional: Tell me how much in receivables you expect in 90 days – then show me the top 10 customers with the largest amounts of outstanding receivables driving that total number, then drill through to a specific customer line item — and do this knowing your customers’ transactions and activities are split across multiple Enterprise Resource Planning (ERP) systems. I can do this in 5 clicks. Can you?

With the latest SAP S/4HANA Finance release (1605), the functionality included in the central finance foundation has been extended to support the replication of open items as well as their clearing status. So, for the first time, Central Finance reporting can include operational A/R reporting, in addition to “central journal” financial reporting. Because the items and clearing status are reposted into Central Finance, you benefit from the level of detail provided by S/4HANA Finance, as well as reporting without data replication or time delays. Regardless of the number of source ERP systems, release levels, and customizing settings.

This makes the Central Finance instance the place for A/R managers to access consolidated, harmonized reporting in SAP’s award-winning Fiori design. The Fiori apps, delivered as a part of S/4HANA Finance, deliver the simple click-through experience I described in the challenge above. We can begin with high-level personalized analytics, with color-coded alerting thresholds, as managers would expect. And you can drill down to the line item details your most detail-oriented accountants would expect from SAP.

SAP delivers hundreds of Fiori apps – use the publicly available Apps library (https://fioriappslibrary.hana.ondemand.com/sap/fix/externalViewer/) to view the Fiori apps designed for the role “Accounts Receivable Manager”. These are all available in the Central Finance context giving managers detailed information for their entire customer base, regardless of how many systems they may be active in:

Account Receivable Manager Fiori apps

Days Beyond Terms – overview payment behavior of customers

Days Sales Outstanding (DSO) – view DSO by customer

Dunning Level Distribution – how many customers are in which level of collection

Future Receivables – how many receivables are expected in future time periods

Total Receivables – how many receivables are expected in all time periods

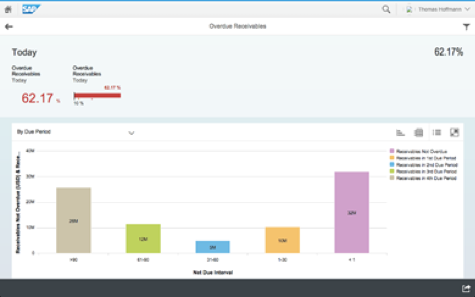

Overdue Receivables – how many overdue receivables are expected in all time periods

These analytical results are designed and delivered with people in mind – not just data fields. This means that the reporting apps might be attractive to people beyond your core finance team; you may find that you have sales leadership teams asking for authorization to access finance data because its ease of use makes it understandable to all departments, not just accounting departments.

The accountant looking for more detail might also want access to the following Fiori apps that are delivered as part of the role “Accounts Receivable Accountant”:

Account Receivable Accountant Fiori apps

Display Customer Balances – view monthly balances, compare with previous years

Manage Customer Line Items – view line items

These apps for the A/R accountant are, of course, just a subset of all the apps provided to A/R accountants. There are also Fiori apps for changing transactions, postings, etc. – but in this release of Central Finance, we are in the world of centralized A/R reporting, not A/R process execution. In this set-up, we still expect incoming payments and related processes for cash application and open item clearing to take place in the local/source ERP system.

However, in our A/R reporting, we can easily extend the scope to include receivable add-on reports, including credit management, dispute reporting, and collections prioritization. We can centrally calculate customer credit limits based on data from all ERP systems, making sure our credit limits and exposures reflect all of the business we do with the customer and ensuring enterprise-wide adoption of our credit policy. We can identify disputes based on underpayments in the source ERP systems, and then centralize all dispute-related reporting, performing an analysis of causes of invoice disputes across all the systems. Finally, we can prioritize customers for collections based on open items from all systems to develop collection strategies for the entire enterprise.

This makes a second set of Fiori apps available for our Central Finance customers who have deployed these additional receivables processes:

Credit Limit Utilization – shows customers who have used more than 80% of their credit limit

Collections Progress – see what percentage of collections have been completed / team management tool

Promises to Pay – which customers have promised to pay invoices in which time frame

Open Disputes – see total amount of money tied up in invoice disputes, their root causes, and which customers are involved

Manage Dispute Cases – edit the details and prioritization of a dispute case

As more processes are migrated to central finance reporting, the list of Fiori apps and add-ons that are relevant will continue to grow. For example, the Fiori apps related to payments will become relevant. However, there is no reason why IT has to wait for a full suite of apps to be relevant before starting on the path to adopting Fiori apps.

Real value can be delivered today – and demonstrating the value of your Central Finance approach by providing enterprise-wide customer insights with a friendly user experience will drive acceptance of the approach. And put a smile on the faces of your A/R team and sales managers.

Join me at SAP Insider Financials2016 in Vienna to continue the discussion -- click here to register.

- SAP Managed Tags:

- Digital Technologies,

- SAP HANA

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

ABAP CDS Views - CDC (Change Data Capture)

2 -

AI

1 -

Analyze Workload Data

1 -

BTP

1 -

Business and IT Integration

2 -

Business application stu

1 -

Business Technology Platform

1 -

Business Trends

1,658 -

Business Trends

91 -

CAP

1 -

cf

1 -

Cloud Foundry

1 -

Confluent

1 -

Customer COE Basics and Fundamentals

1 -

Customer COE Latest and Greatest

3 -

Customer Data Browser app

1 -

Data Analysis Tool

1 -

data migration

1 -

data transfer

1 -

Datasphere

2 -

Event Information

1,400 -

Event Information

66 -

Expert

1 -

Expert Insights

177 -

Expert Insights

297 -

General

1 -

Google cloud

1 -

Google Next'24

1 -

Kafka

1 -

Life at SAP

780 -

Life at SAP

13 -

Migrate your Data App

1 -

MTA

1 -

Network Performance Analysis

1 -

NodeJS

1 -

PDF

1 -

POC

1 -

Product Updates

4,577 -

Product Updates

343 -

Replication Flow

1 -

RisewithSAP

1 -

SAP BTP

1 -

SAP BTP Cloud Foundry

1 -

SAP Cloud ALM

1 -

SAP Cloud Application Programming Model

1 -

SAP Datasphere

2 -

SAP S4HANA Cloud

1 -

SAP S4HANA Migration Cockpit

1 -

Technology Updates

6,873 -

Technology Updates

420 -

Workload Fluctuations

1

- Consuming SAP with SAP Build Apps - Mobile Apps for iOS and Android in Technology Blogs by SAP

- fuzzy search with multiple name fields in Technology Q&A

- [XSLT]: Dynamic rows creation and values(in column) based on dynamic nested XML nodes in Technology Q&A

- Improving Time Management in SAP S/4HANA Cloud: A GenAI Solution in Technology Blogs by SAP

- Up Net Working Capital, Up Inventory and Down Efficiency. What to do? in Technology Blogs by SAP

| User | Count |

|---|---|

| 37 | |

| 25 | |

| 17 | |

| 13 | |

| 7 | |

| 7 | |

| 7 | |

| 6 | |

| 6 | |

| 6 |