- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Group Asset creation & Dep under Indian Income Tax...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Summary

While there are many documents over the internet that guides us to configure the asset accounting starting from maintaining the chart of depreciation to passing asset transactions. However for maintaining the group asset specifically for the Indian scenario (ie as per Income Tax Act 1961) , details available are quite fragmented. Hence I have prepared this document in an effort to sum up the steps that needs to be followed for creating group asset and assign it to the Tax Depreciation.

For Indian context, we need to have two depreciation areas, one will be used for the depreciations being followed at company level (in SLM method). The other depreciation area (15) required to meet the statutory requirement of following the WDV method at Group level, hence we require group asset. There are depreciation rates that authority provides, however I will focus more on the config part. Yes , I have worked with two depreciation keys accordingly. Following steps.

Create Asset Class (OAOA): Apart from maintaining the asset class for individual asset, you are also required to configure additional asset class which will be used as group asset. You can create them by copying.

Indicate asset class as Group (OAAX)

Here I have to indicate which asset class has to be considered for group asset.

Indicate Tax depreciation area (15) against the group asset (OAYM)

Note: This step is necessary otherwise system will not allow you to create the group asset. It will throw error as no depreciation area maintained for this group asset.

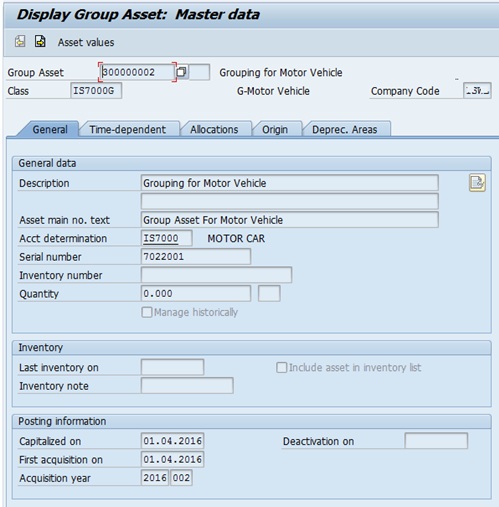

Create the Group Asset (AS21)

You need to create as many group asset as the number of asset heads you have. Heads like Plant & Machinery, F &F. I have worked on creating Motor Vehicle.

Make Group asset field mandatory in AO21 for screen layout 1000, make it mandatory.

Map Individual asset’s dep area with group asset (OAYZ)

Select the tax depreciation area and click on Edit ->Change Field Contents

Select group asset and press OK.

Create Normal asset (AS01)

Now create the normal asset, remember, when you try to save, it will open the following screen with the below message. Enter the group asset here and then save again. This field can be normally located when you check the Tax depreciation inside the Depreciation Area Tab of AS01 screen.

Other Checks:

OADB Check: Since Tax depreciation is only for reporting purpose, hence we need to have entry posting in this area. Hence you can keep the following settings.

OABC Check: Since in Dep area 15 theres no actual posting happening, hence it has to derive the values from the Book depreciation level. Hence we should have the following maintenance for the derivation.

After Posting Asset acquisition entry F-90

AW10N screen displaying the year wise depreciation in SLM method with 17 years as the useful life.

AS23 Screen displaying the asset depreciation as per IT Act 1961 in WDV method. Depreciation is at 9.5%

I hope you all find this document of some value, any feedback is always welcome.

best regds

Subha

- SAP Managed Tags:

- FIN (Finance)

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Automatic Account Determination for without material master in SAP S/4HANA On premise 2021 in Enterprise Resource Planning Blogs by Members

- Historical Balances Migration in SAP S/4HANA Cloud, Public Edition in Enterprise Resource Planning Blogs by Members

- Service in SAP S/4HANA Cloud Private Edition 2023 in Enterprise Resource Planning Blogs by SAP

- Electronic Invoicing in SAP S/4HANA Cloud, public edition in Enterprise Resource Planning Blogs by SAP

- System Audit/review findings - OTC in Enterprise Resource Planning Blogs by Members

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |