- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Modifying Standard PCR Related To Factoring Paid &...

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member19

Participant

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

05-02-2016

1:09 PM

Introduction

I was going through SCN on factoring wage types differently based on paid and unpaid absence types for UAE Payroll especially when it comes to modifying only one wage type in a particular manner where as remaining all other wage types are factored in the same manner and frankly did not get much insight into it. They are multiple approaches for solutioning this particular requirement and for the purpose of this document, I would be covering step by step configuration using one of the approaches.

My objective would be to cover step-by-step configuration of the entire solutioning of this requirement with the approach of using processing classes insync with PCR specific for UAE Payroll.

Assumption

This document is made on the assumption that all the absence types required are already present in the system. We would be focusing only on the payroll part of the requirement as the requirement is related to absence valuation.

Client Requirement

Below was one of the requirements from the client.

Transportation allowance calculation for UAE Payroll needs to be modified as per the below requirements

AS-IS Process

In case Absence records are present in IT 2001 then

Transportation allowance needs to be prorated accordingly based on the records.

Transportation allowance needs to be prorated accordingly based on the records.

- Annual Leave

- Leave without pay

- Bereavement leave

- Maternity leave

- Paternity leave

- Child birth leave

- Wedding leave

TO-BE Process

In case Absence records are present in IT 2001 then Transportation allowance needs to be prorated accordingly based on the records.

- Annual leave

- Leave without pay

- Bereavement leave

- Maternity leave

- Paternity leave

- Child birth leave

- Wedding leave

AS- IS | TO BE |

Monthly Transportation Allowance 1000 USD | |

Start Date: 01-Jan- End Date: 30-Jan | |

Annual/Wedding/Child birth/Bereavement leave for 10 calendar days Transportation allowance = 1000/30*(30-10) | Annual/Wedding/Child birth/Bereavement leave for 10 calendar days Transportation allowance = 1000 |

Sick/Emergency leave for 10 calendar days Transportation allowance = 1000 | Sick/Emergency leave for 10 calendar days Transportation allowance = 1000 |

Maternity leave for 20 calendar days Transportation allowance = 1000/30*(30-20) | Maternity leave for 20 calendar days Transportation allowance = 1000/30*(30-20) |

In Other words, As part of the new requirement Transport allowance wage type needs to be modified to ensure that only in case an employee applies for maternity or paternity leaves should the Transportation Allowance be reduced for those and not for any other leave type effective from the new year.

Solution Design

Firstly, lets break up the requirement-

- Change should be from a new date- This would mean that all previous records should not be impacted. To achieve this the approach I took was to create a new wage type and configure all the changes to this wage type so that in case any retro or old

wage type needs to run, the HR team can use the old wage type and in case the new calculation is required, they can use the new wage type. This way there is more flexibility to the whole solution. - Should not impact any other wage type- As per the requirement, all other wage types, when absence records are present be it Earned leave, Loss of pay, Wedding leave etc, the amount assigned in the wage type needs to be prorated based on the number of absent days. Whereas in the new wage type only paternity and maternity leaves should be deducted and no other wage type. To achieve this, the methodology used by me was to assign a unique or unused value in Processing Class 10 in the

newly created wage type. This way when all the other wage types have the value assume 1 in PC 10, the new wage type would be having the value say 5. - Differential payment based on Absence types- This would be the meat of the entire requirement and to have this implemented, I wrote a PCR under the factoring Schema specifically under the factoring technical wage type based on the value assigned in the Processing class 10. This would be explained in detail in the Implementation section below

along with screenshots.

Implementation

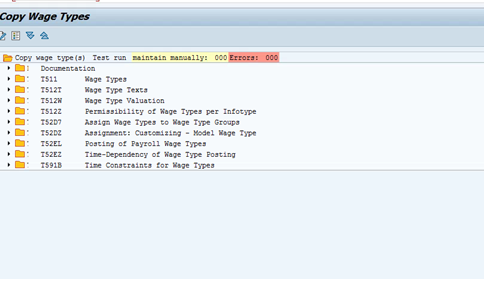

Step 1: The entire approach would start with creating a new wage type by copying the already existing transportation allowance and shall name it as Transportation Allowance Dubai

Below screenshot

T-Code | OH11 |

Now run the same by removing the test run checkbox and the wage type would be copied successfully.

Step 2: We would now need to assign a unique value in PC 10 for this newly created wagetype so that the processing can be impacted via the PCR to get the desired calculation.

T-Code | SE16 |

Table | V_512W_D |

Now the newly created wage type 1038 Transport Allowance has the unique factoring value of 5 as seen in the above screenshot.

With this we ensure that the wage type would be factored in payroll using the technical wage type /805.

With this in mind now, we can modify the behavior of the new wage type by editing the technical wage type/805 to ensure that the calculations in payroll are in consistent with the new requirements.

Step 3: Now we would start to modify the PCR which calculates the /805 wage type in payroll to ensure only maternity and paternity absence types are deducted from the allowance in payroll and no other absence type.

Note: Whenever you have requirements to modify the standard solutions given by SAP, the best approach would be to copy the standard solution, rename it and use the same for modifying as per the client requirements. Its always in the best interest of the user to ensure that standard programs are not modified.

For UAE payroll, the standard PCR used for Partial Period factors is AEPF. So we create a custom PCR by first copying the standard PCR and shall name it as ZAPF

T-Code | PE02 |

Now we modify the custom PCR ZAPF and the wage type /805

We modify the /805 wage to be shown as below:-

Here the TKAP** are the paid absence which would be deducted from the calendar days before being used for calculating the transport allowance. In case of unpaid absences, include TKAU** which would ensure any unpaid absences would be deducted.

Here in my case, the values 06, 07 and 09 and maternity and paternity absence types.

Save the above changes in the PCR.

As far as the requirements are concerned, the process is complete. Now all is required is to include the custom PCR in our payroll

schema for UAE (AE00) so that the same is considered for processing while payroll is run.

schema for UAE (AE00) so that the same is considered for processing while payroll is run.

Results

With the above configuration in place, lets run a monthly payroll for an employee to see if the wage type is being calculated as per requirement.

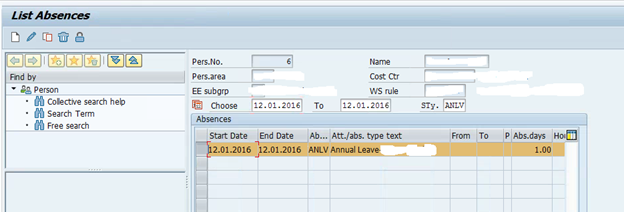

Step1: Include the wage type in the employee records using the Tcode PA30

Step 2: Apply any Earned leave in the system in IT2001.

Step 3: Execute Payroll for the employee and see if any proration happens for the newly created wage type.

If the amount is paid as whole with no proration then that would mean our scenario is successful. In the above screenshot the entire amount is being paid to employee.

Now repeat the above Steps 1-3 and this time apply maternity and paternity absence types in the employee records and rerun payroll.

You would have the wage type pro-rated based on the number of days the absence types are present for the month in which payroll is run as shown in the below screenshot.

This would bring me to the conclusion of this document and sincerely hope this comes in handy for our HCM consultants and need not reinvent the wheel.

Wish you all the best..

Thanks and regards,

Shine Sebastian Joseph

- SAP Managed Tags:

- HCM (Human Capital Management),

- HCM Payroll

9 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- Streamlining Real-time Business Processes with SAP Event Mesh: A Prototype Exploration in Enterprise Resource Planning Blogs by SAP

- wage type based on start date in Enterprise Resource Planning Q&A

- PRATE Functionality- Recurring Payments/ Deductions in Enterprise Resource Planning Blogs by Members

- Pay Days Calculation for a Specific Client's Practice in Enterprise Resource Planning Blogs by Members

Top kudoed authors

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 |