- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- KSA GOSI: Mid Year Go-live handling

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member18

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

04-06-2016

9:56 AM

In the standard KSA Country solution, there are two rules that they will check whether the period is January or the first hire month. They are SA26 (Set Default GOSI Applicable Earnings) and SA38 (Create GOSI Basic Base and Transfer from Previous Period), if the period is unmatched, they will capture /370 and /374 from last RT, the relevant logic is involved in the objects as follows: AMT=L /370 and AMT=L /374. Before you run the payroll of February (the very first payroll of go-live), you could temporarily comment the objects AMT=L /370 and AMT=L /374, after the run for the first month, you need to recover the objects. In the next month, the calculation of GOSI will continue to capture last RT in your system.

In our case, this is a midyear go-live. The period for payroll run is neither January nor the first hire month of employee, but Feb 2014 (for example sake)

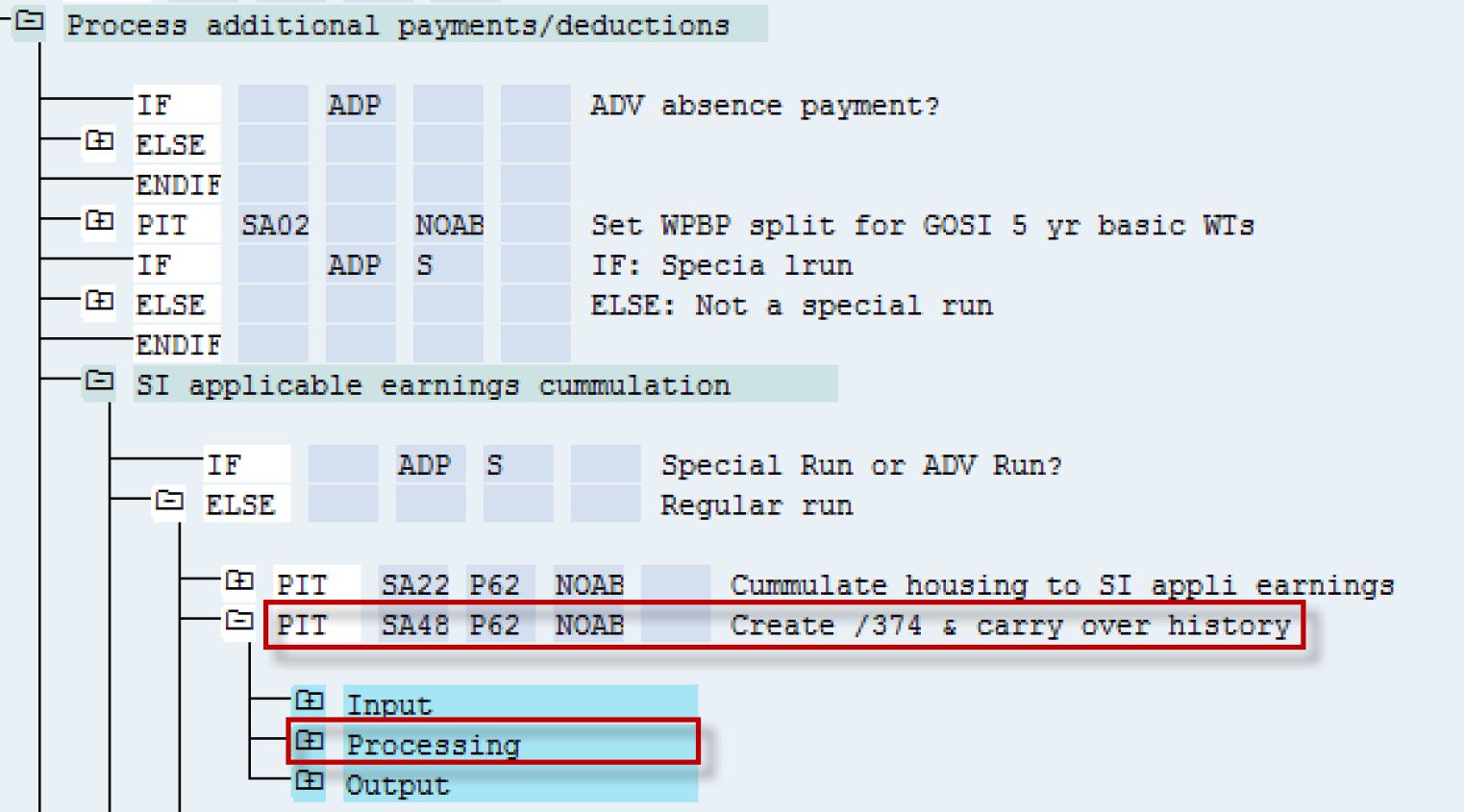

1. For the calculation of /374, it depends on the determination of period, if the period is neither January nor the first hire month, the amount of /374 will capture from the last result.

The logic of capture /374 from last result is in the rule SA38 (Create GOSI Basic Base and Transfer from Previous Period).

2. For the calculation of /370, if the period is neither January nor the first hire month, the amount of /370 will capture from the last result.

The logic of capture /370 from last result is in the rule SA26 (Set Default GOSI Applicable Earnings).

For the proposed workaround, I will take the rules in standard solution for example; you could change it according to manage mid-year Go-Live.

1. Firstly, comment “AMT=L /370” in the rule SA26.

2. Secondly, comment “AMT=L /374” in the rule SA38.

3. After running the payroll for first month (i.e. Feb), you must recover the two rules by uncommenting the commented line.

As always, the above proposal is just a workaround and it is always prudent to test extensively prior to adoption.

- SAP Managed Tags:

- SAP ERP,

- HCM Payroll

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

22 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

157 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

217 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- Building Low Code Extensions with Key User Extensibility in SAP S/4HANA and SAP Build in Enterprise Resource Planning Blogs by SAP

- Advanced WIP reporting in S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- Review Business Role Changes before a Major Upgrade in the SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- Message =Data loss occurred when converting 20244900000941 in Enterprise Resource Planning Q&A

- SAP S/4HANA Cloud Private Edition | 2023 FPS01 Release – Part 2 in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 13 | |

| 11 | |

| 10 | |

| 8 | |

| 7 | |

| 6 | |

| 4 | |

| 4 | |

| 4 | |

| 3 |