- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Payroll UAE: Social Insurance Contributions in Sem...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Business Scenario

Your organization is a semi-government entity. This requires you to process the social insurance contributions using both the private sector and public sector in the localized UAE country solution for SAP HCM. As a standard solution, SAP currently only provides public sector schema (AEU0) and private sector schema (AE00), each of which process the social insurance (SI) contribution according to the laws of the respective sectors.

In this blog, I would like to discuss how the public sector and private sector social insurance (SI) funds can be processed by a single schema, catering to semi-government organizations.

Proposal

The standard schema delivered by SAP for the private sector payroll processing is AE00 and that for public sector is AEU0. The calculation of SI is handled differently for the private and public sector solutions. For a combined processing of both private and public sector SI contributions, it is necessary to merge these two schemas together and generate a unique payroll schema, which handles SI contributions laws of both the sectors.

There are four distinct steps of SI contribution processing in both payroll schemas:

- Master data maintenance

- Generation of the contribution basis for each of the SI funds

- Adjustment of the contribution bases

- Calculation of the contribution

To create a unique payroll schema, which merges the public sector and private sector processing, it may be simpler if we keep the private sector schema as the base and introduce necessary Personnel Calculation Rules (PCRs) / payroll functions for handling public sector funds.

Now, deep diving into each of these components to understand how public sector and private sector schemas can be combined.

Master Data maintenance

The social insurance infotype for UAE is 3251 (titled Social Insurance AE). In this infotype, customers can maintain the statutory and private insurance information of the employee. The different social insurance funds are configured in the following path:

- Payroll --> Payroll: United Arab Emirates --> Social Insurance --> Statutory Social Insurance Settings --> Maintain Statutory Social Insurance Funds

These funds have their respective contribution percentages and limits and are assigned to an employee in the infotype 3251. The social insurance contributions of the employee are based on these parameters during the payroll run. This is common to both public and private sector.

Generation of the contribution basis for each of the SI funds

Different wagetypes form the contribution base for different social insurance funds. For instance, for GPSSA Private Sector (GPSS), the contribution base wagetype is /102, whereas for the GPSSA Public Sector fund (PBGP), the contribution base is /106. These are generated by the payroll function AESIC (refer to Note 2156655 for more information) and are common to both the sectors. More information can be obtained from the system documentation of the wagetypes /102, /103, /104, /106 and /107.

Adjustment of the contribution bases according to the requirements of each sectors

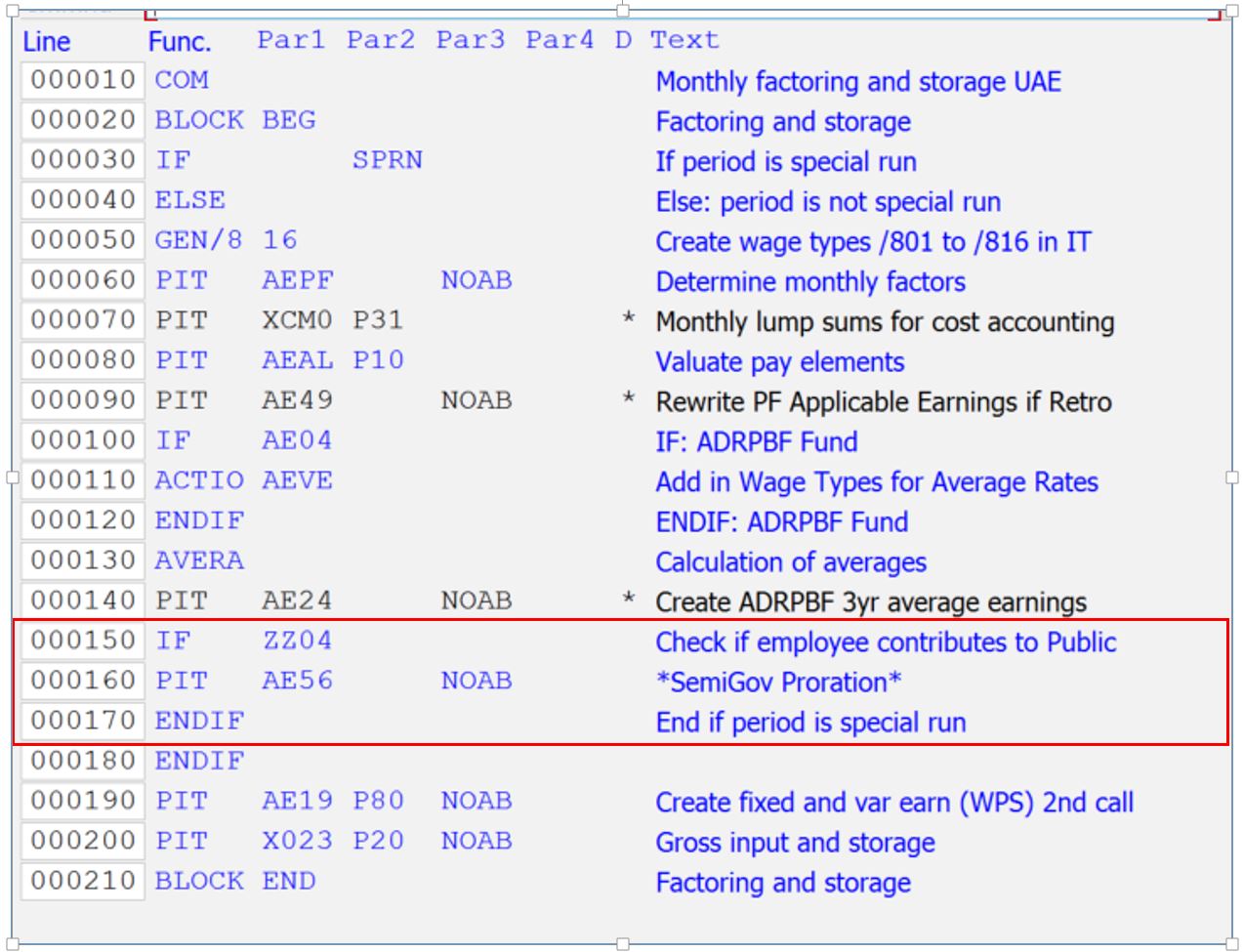

Once the contribution base wage types (/102, /103, /104, /106 and /107) have been generated by payroll function AESIC, it is necessary to prorate them based on the SI fund and the sectors. For instance, GPSSA in private sector considers the full month earnings as the base for the SI contribution (irrespective of any unpaid absences or mid-month hiring), while GPSSA in public sector considers the actual earnings as the contribution base. Hence, it is necessary to include the PCRs from the public sector schema, which performs this prorating. In the standard private sector schema, subschema AEL9 contains PCRs AEPF and AEAL, which handle the monthly factoring. Along with these, it is necessary to include a copy of PCR AE56 (from public sector schema AEU0) to handle the special proration required for public sector GPSSA. This may be added after the function AVERA (Calculation of Averages) in schema AEL9.

The PCR ZZ04 allows the processing of AE56 (thereby allowing SI-specific proration of the base) only if the employee is contributing to a public sector fund.

Calculation of contribution

The calculation of the actual contribution, based on the percentages maintained in V_T7AE02 (Payroll UAE --> Social Insurance --> Statutory Social Insurance Settings --> Maintain Statutory Fund Contribution Parameters), is performed in the payroll function AESI. This remains the same for both private and public sector contribution calculations. Once the appropriate contribution bases has been generated and prorated (previous steps), the contribution should be calculated correctly in this function.

Disclaimer

As the topic of merging the public sector schema and the private sector schema for a semi-government processing is quite vague and highly customer-specific in nature, it is highly recommended that extensive testing by experienced HR consultants is carried out to ensure the coverage of all the scenarios. The steps mentioned are intended only to provide a broad understanding of how these schemas can be fused together from an SI contribution perspective and are, by no means, conclusive in nature.

- SAP Managed Tags:

- FIN Globalization Services

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

23 -

Expert Insights

114 -

Expert Insights

151 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

205 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

85

- SAP S/4HANA Cloud Private Edition | 2023 FPS01 Release – Part 2 in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Cloud Private Edition | 2023 FPS01 Release – Part 1 in Enterprise Resource Planning Blogs by SAP

- The new Simplify withholding tax on IRRF table - Country: Brazil in Enterprise Resource Planning Blogs by SAP

- Sourcing & Procurement in SAP S/4HANA Cloud Public Edition 2402 in Enterprise Resource Planning Blogs by SAP

- Driving Sustainable Growth: The Role of Green Public Finance Management, Part 1: Understanding the Concept in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 | |

| 2 |