- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Tax Number Duplicity Restriction (CNPJ, CPF, State...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Since the companies in Brazil must not have 2 partners to the same CNPJ and/or State Inscription (IE), or CPF, you can prevent that 2 customer master records or 2 vendors created to the same Tax ID using SAP Standard (Configuration). Some time ago, this was only possible with coding / user exit.

First, let me explain about the TAX IDs in Brazil:

-Tax Number 1 (STCD1) – CNPJ -- Only for legal entities (companies)

-Tax Number 2 (STCD2) – CPF -- Only for Natural Person

-Tax Number 3 (STCD3) – State Inscription -- Only for legal entities (companies)

If exempt, must contain word “ISENTO”

-Tax Number 4 (STCD4) – Municipal Inscription -- It can contain RG (ID) if vendor is Natural Person

If exempt, must contain word “ISENTO”

-Sole Proprietr (STKZN) – Natural Person indicator -- Must be active when vendor is not a legal entity but a Natural Person

To activate the duplicity check, first go to transaction BUPA_TAXNUMTYPE and turn on the Tax ID's that you want the validation active:

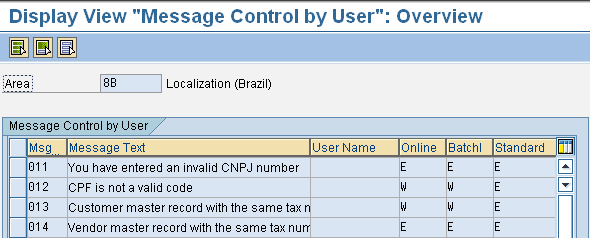

Then go to transaction OBA5 (Change Message Control) to turn the error message on (you can choose between Warning or Error, but it is strongly recommended that you select as an Error when user goes to XK01 or XD01 for example, to create the customer or vendor). You can also select the message behavior based on an user.

You have to select area 8B and message No. 011, 012, 013, 014

If you enter a specific user, for instance, end users receive the standard error message but a user in the SAP Support group only receives a warning and is able to by pass the error.

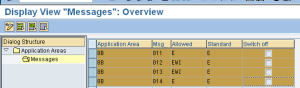

You may also check transaction OBMSG to the same area 8B and messages and do the following:

Enter the adjustable message types in the "Allowed" column ("S" = success message, "I" = Information message, "W" = warning message, "E" = error message, "A" = termination message; an example entry could be SIWE).

Once those settings are in place, when someone try to create a record for a partner that already exist, it will look like this:

When you try to create the register, the system will show that a customer/vendor already exist to a given Tax ID:

And then it will issue a message, error or warning, depending on what was configured:

Not having customers and vendors in duplicity is mandatory for SPED Reporting. You can check this information on contributor guide for SPED Fiscal (EFD) and Contributions.

- SAP Managed Tags:

- FIN (Finance)

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- How to Restrict to Create Duplicate ERS Invoice for the same Reference# for a Vendor by using Transaction Code-MRRL in Enterprise Resource Planning Blogs by Members

- Need to know is there an application in S4 HANA - giving an option to restrict a duplicate Unit of Measure. in Enterprise Resource Planning Q&A

- RESTRICT DUPLICATE MANUAL SERIES IN PO UPON APPROVAL PROCESS in Enterprise Resource Planning Q&A

- SAP B1H SP Transaction Notification for UDF field Duplication restriction in Item Master data in Enterprise Resource Planning Q&A

- Restrict Duplicate Service Entry Sheet - PO number – Short Text - Value in Enterprise Resource Planning Q&A

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |