- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Exposure Management 2.0

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

This article is to provide basic process of how exposure management work in SAP- Treasury. For configuration please refer help.sap.com articles.

The new Exposure Management 2.0 enables you to manage exposure items for open commodity items and open currency items. In the Hedge Accounting for Exposures, you can map the hedging of commodity price risks using the corresponding hedging transactions in the Transaction Manager.

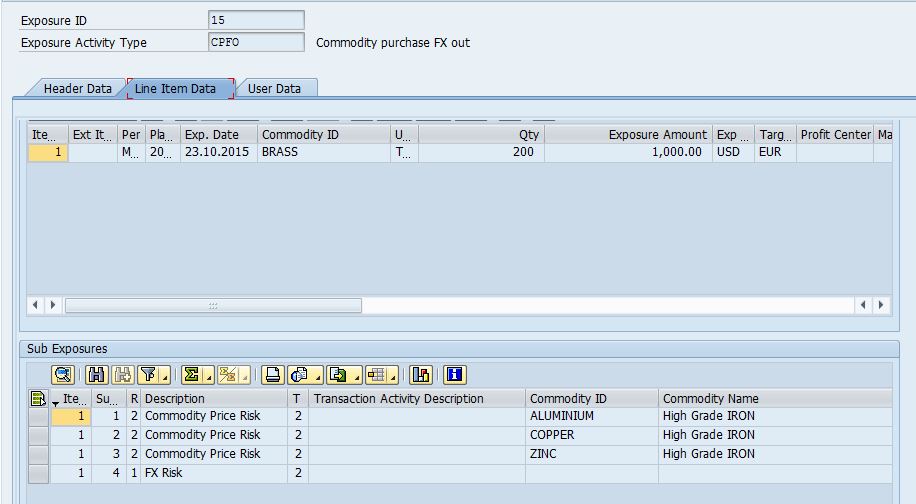

1.FTREX1: Create Raw exposure

In the below example I have created raw exposure for brass. In many cases, a commodity comprises several other commodities that bear the actual price risk. This is the case with brass for example. (FTREX7) to map such a scenario in the system.

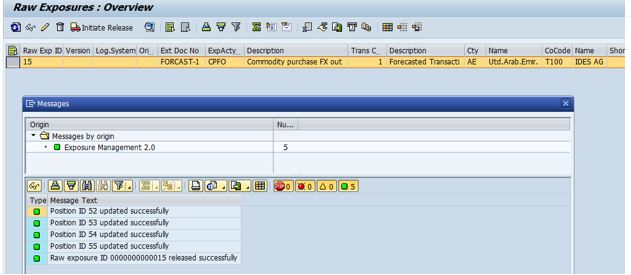

2. FTREX2: select the ID and Initial release

Once released, the Position created based on split of the brass item.

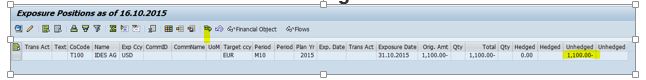

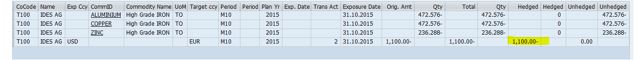

3. FTREX12: Please check the unhedged item.

4. THMEX: Create hedge plan

5. FTR_CREATE Create forward contract/deal for USD for hedging relationship

6. THMEX: Assigned hedging relationship

7 FTREX12, Please transfer the un hedge item from exposure to hedge Management.

Once transferred successfully, the amount will be reflect in Hedge item field. Please refer hedged and unhedge field.

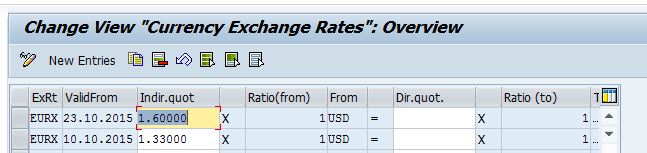

8. Please check OB08 setting for USD to EUR

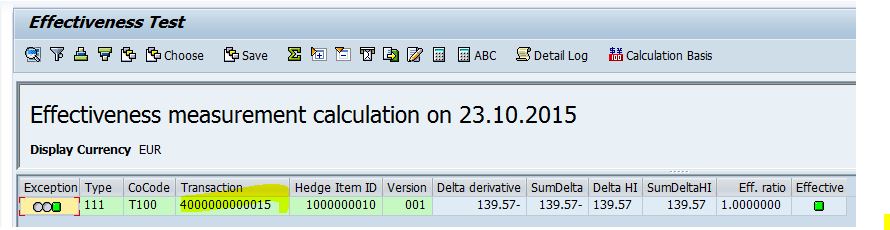

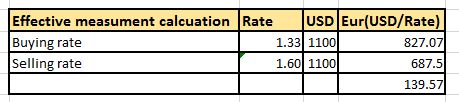

9. THM80: Effective measurement calculation.

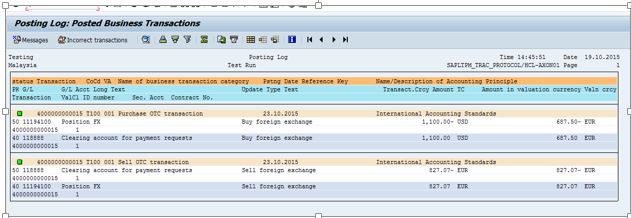

9. TBB1

Tips: Exposure Activity Type The exposure activity type is a required entry when you create a raw exposure. Sub-raw exposures created for a raw exposure take the value of the exposure values in line with what you enter here. The exposure activity type specifies a number of key settings that determine how raw exposures behave and how their data is stored.

Raw exposure

In exposure management, only the basic data relating to your operative business transactions is stored in a raw format known in the system as a raw exposure. A raw exposure is a simple mapping of an operative business transaction.

Sub raw exposure

All information relating to financial risks is stored in sub raw exposures. Here, a distinction is made between foreign currency risks and commodity price risks. Sub raw exposures form part of a raw exposure. A raw exposure can contain several sub raw exposures.

Exposure position

Raw exposures, as a total, represent the financial risk associated with your operative transaction. The total risk position is known as an exposure position, which comprises several sub raw exposures.

Differentiation and exposure transactions

Differentiation enables you to define how risks are divided. Here, the sub raw exposures are initially converted into a temporary intermediate format. They then become exposure transactions and are used to create exposure positions.

Exposure position flow

Exposure transactions are used to create exposure position flows, which, in turn, create the exposure position. An exposure position generally contains several exposure position flows.

Exposure position value

The exposure position value is the total value of the exposure position.flows for one exposure position on a particular key date.

PS:above example was created in IDES system for this post. Coming soon 2nd post in Exposure Management 2.0

- SAP Managed Tags:

- FIN Treasury

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- The Role of SAP Business AI in the Chemical Industry. Overview in Enterprise Resource Planning Blogs by SAP

- Quick Start guide for PLM system integration 3.0 Implementation/Installation in Enterprise Resource Planning Blogs by SAP

- Business Rule Framework Plus(BRF+) in Enterprise Resource Planning Blogs by Members

- Cruising through Compliance: Test the Regulatory Change Manager at DSAG-SAP Globalization Symposium in Enterprise Resource Planning Blogs by SAP

- Stock Transfer between two EWM Managed plants assigned to same warehouse in Enterprise Resource Planning Q&A

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |