- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Automatic Settlement of Assets under Construction

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

I'd like to cover with this document, Settings that are required for Asset Under Construction Creation and Settlement Rule for direct settlement of the expenses to fixed assets for projects that are linked to an asset under construction.

If you want to select asset under construction functionality in your system configuration.

Step 1 : Scoping

To find this option, go to Business Configuration work center, and choose Implementation Projects view. Select your implementation project, and click Edit Project Scope. In the Scoping step of the guided activity, select Financial and Management Accounting, then Fixed Assets, and Fixed Assets Files.

Step 2 : Assign AuC

You need to have a Asset Class which supports AuC and for this either you create a default class where all assets under construction are created. You can either mark the standard available fixed asset class 4000 as the default class to create asset under construction or create a custom fixed asset class.

So, here marked 4000 Asset Class as AuC class and also the depreciation method should always be 0000 - No automatic depreciation

Note: Before you mark 4000 as AuC, make sure that you have not created any other Non-AuC assets / Fixed Asset

Step 3 : Create a AuC Asset

Step 4 : Assign an AuC to a project task

From Cost and Revenues work center > Projects view

Create/Select a direct cost project and click on Assign AuC or Settlement Rule

You can assign the AuC which you have created

Step 5 : Maintain the Settlement rule and for this you need to go to the fixed asset work center and select the asset under construction

Note: This settlement rule button will be enabled only for AuC and not for other assets

Settlement Factor, Enter the quote for each receiver as an absolute value. Taken as a whole, the settlement factor represents the settlement ratio (such as for instance 60:40) for which costs are allocated. The system automatically calculates the percentage for each unit.

Once the first project postings are done, 100% of the expenses are automatically settled to the linked AuC.

For instance, we have posted a supplier invoice to capitalize the AuC for the project cost

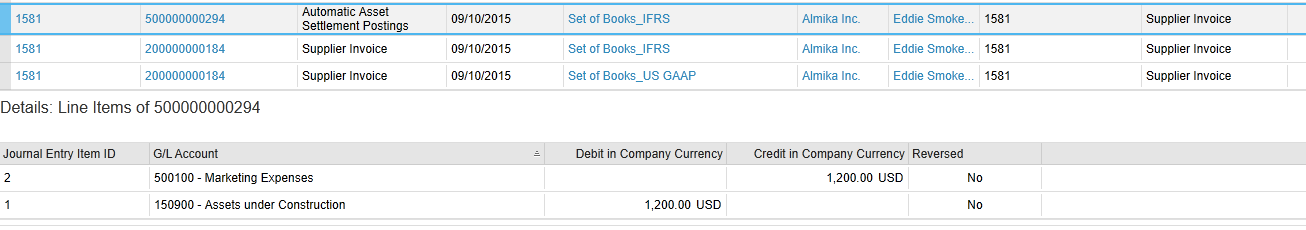

At, this stage you will see two postings

1 : Supplier Invoice

2 : Automatic Asset Settlement Postings

Step 6: Execute the Settlement Run

You can execute the settlement runs to capitalize the cost accumulated on AuC

As per the settlement rule that receiver assets that we selected in above rule were Asset 78-0 & 73-0, we can see above settlement is also done for the same assets.

After the settlement run you can see that in AuC - 82, the settlement run transfer postings appear

Also, since the settlement is done completely, the AuC net book value shows 0,00 but with the capitalized status

FAQ's :

1 . Will the AuC will have the status Capitalized or In-process during initial expense postings ?

A : So, When posting the initial expenses/cost the AuC asset is changing its status to Capitalized - Yes this is right AuC is nothing but a fixed asset with a special fixed asset class (with the AuC Indicator set to true).So there is no difference in the status handling between AuCs and FXAs.

2. Upon settlement run execution, if the settlement is for 100 % then having the status as Capitalized with zero value ?

A : Yes this works similar to normal assets as well, supposing you do partial transfer of individual material with 100% amount and the status would still remain capitalized.

In case of questions, feel free to post them below.

Thanks

Lokesh Sharma

- SAP Managed Tags:

- SAP Business ByDesign

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

153 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

208 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

88

- ACM capabilities in a nutshell - Contracting Part 3 in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Cloud Private Edition | 2023 FPS01 Release – Part 2 in Enterprise Resource Planning Blogs by SAP

- ACM capabilities in a nutshell - Contracting Part 2 in Enterprise Resource Planning Blogs by SAP

- Sales in SAP S/4HANA Cloud Public Edition 2402 in Enterprise Resource Planning Blogs by SAP

- Concept of AUC processing through WBS element complete process. in Enterprise Resource Planning Q&A

| User | Count |

|---|---|

| 11 | |

| 10 | |

| 6 | |

| 6 | |

| 4 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 |