- SAP Community

- Groups

- Industry Groups

- SAP for Public Sector

- Blogs

- Record Indirect Costs in Grants Management for Gra...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Indirect Costs in Grants Management for Grantee (GM-GTE) are occurred when Sponsor have agreed to provide a certain %age of selected combination of Sponsored Programs and Sponsored Classes of a Grant as Indirect Expense. Indirect Expense might cover the processing cost of a Grant (e.g. legal formalities, Court Stamp Charges, Salaries Paid to Person managing grants etc) and any other costs not directly covered in the grant.

Since I didn't find any useful document on SCN regarding Indirect Costs in GM-GTE, I decided to post one.

We can record Indirect Costs using T-Code GMIDCPOST. The whole process is explained below:

1. Go to T-Code GMCLASS to create Indirect Expense and Indirect Revenue Sponsored Classes, which will be used to record Indirect Costs.

Once both the classes have been created. We will head towards Configuration for its settings:

2. Go to IMG Path SPRO>PSM>Grants Management>Grantee Management>Configure Indirect Cost Rules

Create following IDC Rules or with any other name suitable as per client Scenarios. We will further select IDC Rule 2 "Commitments" to insert the value types on which IDC cost can be charged.

Value Types 51, 52, 65, 99 have been inserted to record IDC on PR, PO and FI JV Postings. That means any posting on PR, PO, FI documents, which hit the concerned SP and SC, will then be able to charge IDC on them.

3. Next, Go to IMG Path SPRO>PSM>Grants Management>Grantee Management>Chart of Account Settings for GM Indirect Costs

There we have to maintain the relevant GL's, IDC classes on each Grant Type. We have to select following 3 GL's:

I. Cost Reimbursement GL - This is the revenue GL of Profit and Loss A/c on which IDC Revenue is booked on Internal Fund against IDC Expense booked on External/Sponsor Fund

II. IDC Revenue Sp Class - We will insert the IDC Revenue Sp Class created earlier

III. IDC Expense Acct - This is the expense GL of Profit and Loss A/c on which IDC Expense will be booked on External/Sponsor Fund

IV. IDC Expense Sp Class - We will insert the IDC Expense Sp Class created earlier

V. Cash Clearing - This is the Cash clearing GL of Balance Sheet A/c having same nature of any other GR/IR Clearing A/c, which system uses as clearing A/c working to charge IDC Expense of External Fund and IDC Income on Income Fund. This account will be charged for both revenue and expense items resulting in net zero balance.

Once the COA settings of Sponsor IDC has been completed. Next step is to create a Grant with IDC characteristics.

4. Next, Go to T-Code GMGRANT and create a Grant

Now in Dimension Tab, we have to provide Internal Fund, which will be used as IDC recovery fund, that is the revenue booked on IDC will be charged on Recovery Fund. Check the Internal Fund as IDC Recovery Fund.

In next step, select the relevant classes as IDC Relevant classes. The moment, when IDC Relevant check is made, the system populates two IDC classes provided in configuration.

Now head towards Overhead Costs Tab, where select the rule configured earlier, i.e. Rule 2 "Commitments" and assign the %age of IDC on the combination of SP and SC selected earlier. Here we assign 10%

In the next tab of Overhead Cost Limits, we can define max caps of IDC allowed on individual combination of SP and SC and also on the whole Grant level. Please note the system will not allow to exceed individual SP and SC cap over total grant level cap. The system will also not allow to post the amount exceeding the total of Grant level.

For example, the IDC calculated on a particular SP and SC is USD 10,000/- but there is a cap of USD 5,000/- on grant level, the system will not through an error but will post document utilizing the limit of USD 5,000/-.

5. Next, Go to T-Code GM_CREATE_BUDGET or IMG Path Accounting>PSM>Grants Management>Grantee Management>Budgeting>Entry Documents>GM_CREATE_BUDGET and Create an Unreleased Budget Document and in next step, Go to T-Code GM_BDGT_RELEASE or IMG Path Accounting>PSM>Grants Management>Grantee Management>Budgeting>Tools>GM_BDGT_RELEASE to release the budget created.

Here we have allocated the direct budget of USD 100,000/- from where the system have calculated the IDC of USD 10,000/-. IDC cost don't have to be posted and released separately as in case of Cost Sharing, where we have to post and release budget seperately. IDC budget will be posted and released alongwith Sponsor Direct or Cost Sharing budget.

After releasing the budget, the next step is to charge the cost on combination of SP and SC, where IDC check was selected. We have charged the cost of USD 50,000/- after setting values in GM Derivation Rules. Document was posted on 01.03.2015.

6. Next, Go to T-Code GMIDCPOST or IMG Path Accounting>PSM>Grantee Management>Grant Management Specific Posting>Indirect Costs>GMIDCPOST to record Indirect Costs.

Here we have to insert parameters for recording IDC. Cutoff Date represents the date upto which the IDC calculated on Direct SP and SC is to be recorded. In our case, since we posted the accounting document in the month of Mar 2015, therefore the cutoff date along-with Document and Posting Date of 31.03.2015 has been selected.

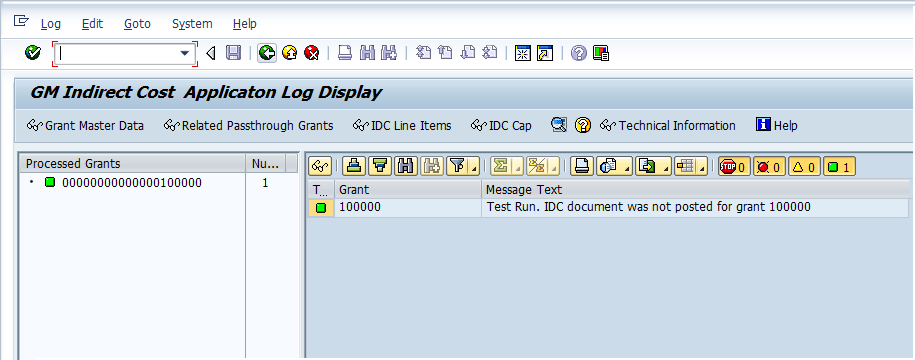

The program is executed in Test Run first and upon successful run, the same is executed in production run to post the IDC document.

Once posted we select IDC Line Items Button to show the relevant IDC entries created.

The accounting entries generated represents the IDC Expense charged on External Fund, whereas, its double entry effect of IDC revenue was booked on Internal (Recovery Fund). The same document can also be viewed in FB03, where the system will show the full entries including Clearing A/C configured in system.

Since we have kept the budget of USD 10,000/- on the selected SP and SC combination, therefore the cost of USD 5,000/- was recorded on and the remaining limit of USD 5,000/- can also be utilized.

I hope the document will be useful for those, who don't know much about IDC and its posting.

Feedback on the document will be highly appreciated

- SAP Managed Tags:

- Public Sector

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.