- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Payment Order Configuration

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Payment order is a Standard SAP tools used in payment process .. its firstly assign a payment order number against the open item paid with no payment entry generated then when processing bank reconciliation if the payment order appear in bank statement the system generates the payment entry and close the open item.. assignment of payment order number is preventing from duplicate payment ..

The configuration steps is:

T-code: OT84

- ( Create account symbols) Y12 “Payment Order”

- (Assign Accounts to Account Symbol ) assign Y12 to GL Account ++++++ as below

- (Create Keys for Posting Rules) create a Keys for posting rule Y12

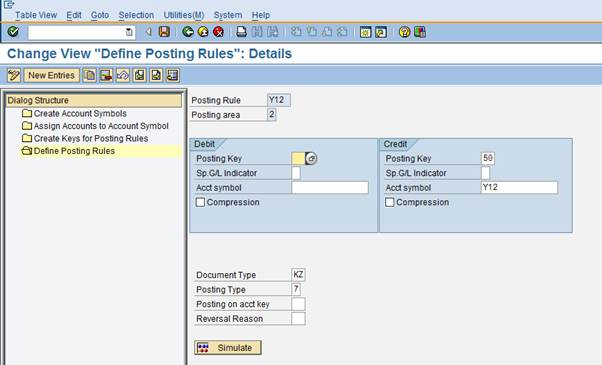

- (Define posting rule) define a posting rule like below

Posting Area 2 “Sub ledger posting “

Document Type: KZ

Posting Type : 7 “clear Debit Sub ledger account

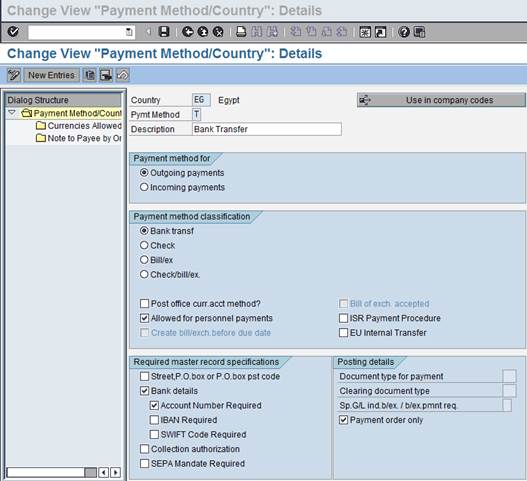

- T-Code FBZP “ Pmnt method in country” in posting details section choose Payment order only

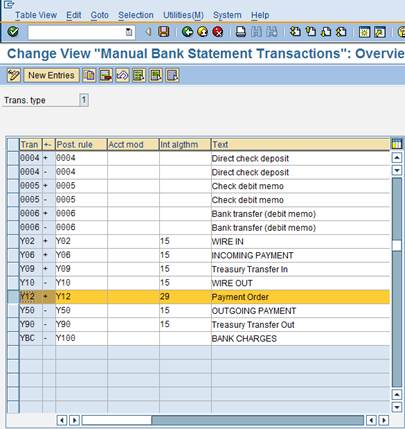

- T-code OT52 create manual bank statement posting rule

Interpretation Algorithm : 29 “Payment order”

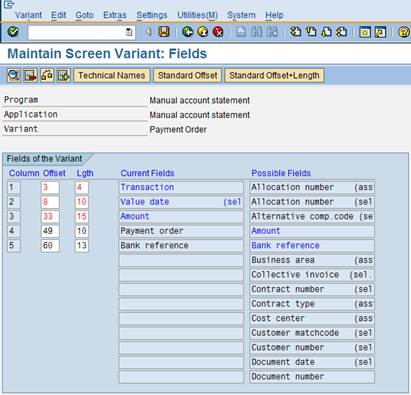

- T-code: OT43 Define Variant for Manual bank Statement

You have to add the payment order to variant

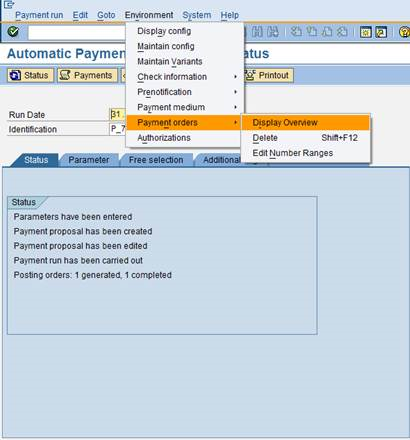

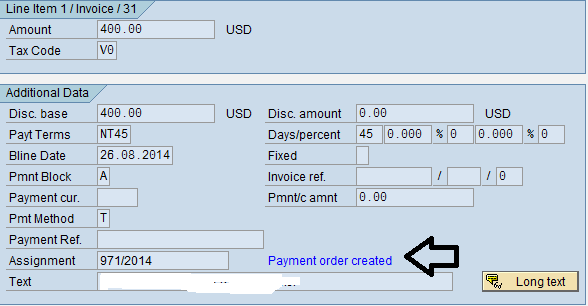

- While Run F110 , SAP will create payment order Number for the selected invoice to be paid

- You can display the payment order created from F110

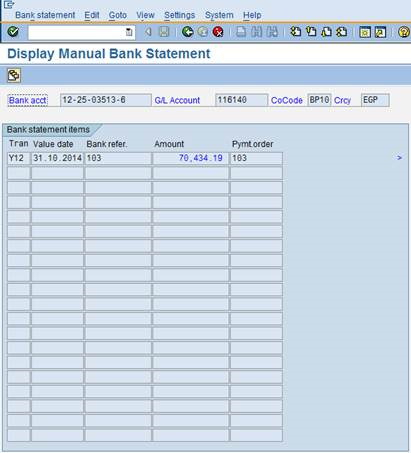

- When Run FF67 .. you have to enter payment order Number

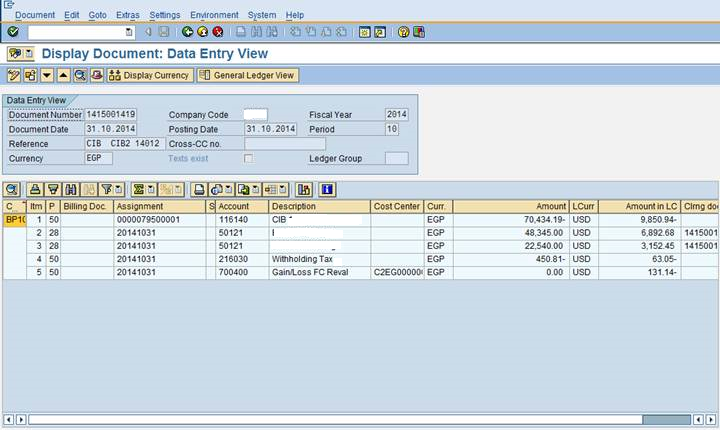

- SAP will create the below entry and clear the open item

Note that the payment order will not appear in FBL*N report due to standard SAP behavior .. you may refer the below link to insert the payment order number in FBL*N report

How to insert Payment Order in FBL1N or FBL5N

Regards

Mahmoud EL Nady

- SAP Managed Tags:

- FIN (Finance)

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Business Rule Framework Plus(BRF+) in Enterprise Resource Planning Blogs by Members

- Introducing the market standard of electronic invoicing for the United States in Enterprise Resource Planning Blogs by SAP

- Intercompany Execution of Services (aka "Dual Order") in Enterprise Resource Planning Blogs by SAP

- FAQ: S/4HANA Cloud, public edition - Sales in Enterprise Resource Planning Blogs by SAP

- Output Type SPED trigger Inbound Delivery after PGI for Inter-Company STO's Outbound delivery in Enterprise Resource Planning Blogs by Members

| User | Count |

|---|---|

| 5 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |