- SAP Community

- Groups

- Interest Groups

- Application Development

- Blog Posts

- Calculation of Service Tax on Foreign Exchange Con...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Service Tax on Foreign Currency Conversion (with effect from 1st June, 2015):

As stipulated by the Government of India, any conversion from one currency to another, both incoming and outgoing will be charged a service tax on the gross amount of currency exchanged as per the following slabs. - 0.14 % of the gross amount of currency exchanged for an amount up to INR.

1,00,000 subject to the minimum amount of INR. 35 - INR 140 and 0.07 % of the gross amount of currency exchanged for the amount of rupees exceeding INR 100,000 and up to INR 10,00,000 - INR 770 and 0.014 % of the gross amount of currency exchanged for the amount of rupees exceeding INR 10,00,000 subject to maximum amount of INR 7,000.

Gross amount of currency exchanged % of service tax on transaction value.

For an amount | Old Rate | New Rate wef 01.06.15 |

|---|---|---|

Upto Rs.100,000 | 0.12% of the gross amount of currency exchanged or Rs.30 whichever is higher. | 0.14% of the gross amount of currency exchanged or Rs.35 whichever is higher |

Exceeding Rs.1,00,000 and upto Rs.10, 00, 000 | Rs.120 + 0.06% of the (gross amount of currency exchanged-Rs.1,00,000). | Rs.140 + 0.07% of the (gross amount of currency exchanged-Rs.1,00,000) |

Exceeding Rs.10,00,000 | Rs.660 + 0.012% of the (gross amount of currency exchanged-Rs.10,00,000) or Rs.6,000/- whichever is lower. | Rs.770 + 0.014% of the (gross amount of currency exchanged -Rs.10,00,000) or Rs.7,000/- whichever is lower |

This document explains how this scenario can be addressed in SAP. SAP Configuration changes for TAXINN Procedure.

1. Create Two new Forex Condition Type for Service Tax with Scale. (OBYZ)

- ZFR1 : Service Tax Forex %.

- ZFRX : Service Tax Forex Value.

2. Create two account key.

3.Maintain Tax Procedure (TAXINN) to accommodate these changes (OBYZ)

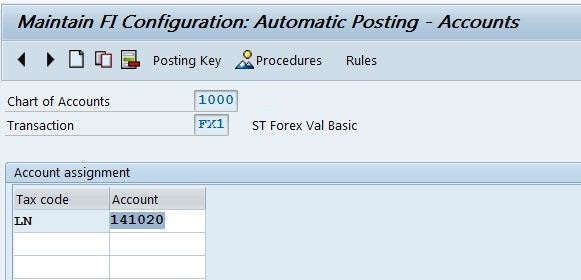

4. Assign G/L accounts to Tax Code

Even though we only require Tax code “” but due to TAXINN and maintaining rates in FV11. In OB40 assign LN tax codes in Transactions “FX1” and “FZ1”.

5.Maintain Tax rates in FV11

We need to maintain tax codes and use “LN” as central for conditions.

FV11 - ZFR1 & ZFRX.

Condition Type : ZFR1 - Condition type on % Basis.

Maintain Scales for condition type

Condition Type : ZRFX Forex condition Value Base.

Creation of Purchase document.

- Creation of Purchase order < 25,000 /-

2.Creation of Purchase order > 25,000 /-

Please share your valuable feedback, thoughts and add additional information/corrections if any :smile:

Regard's

Sachin Indulkar.

- SAP Managed Tags:

- Internationalization and Unicode

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

A Dynamic Memory Allocation Tool

1 -

ABAP

8 -

abap cds

1 -

ABAP CDS Views

14 -

ABAP class

1 -

ABAP Cloud

1 -

ABAP Development

4 -

ABAP in Eclipse

1 -

ABAP Keyword Documentation

2 -

ABAP OOABAP

2 -

ABAP Programming

1 -

abap technical

1 -

ABAP test cockpit

7 -

ABAP test cokpit

1 -

ADT

1 -

Advanced Event Mesh

1 -

AEM

1 -

AI

1 -

API and Integration

1 -

APIs

8 -

APIs ABAP

1 -

App Dev and Integration

1 -

Application Development

2 -

application job

1 -

archivelinks

1 -

Automation

4 -

BTP

1 -

CAP

1 -

CAPM

1 -

Career Development

3 -

CL_GUI_FRONTEND_SERVICES

1 -

CL_SALV_TABLE

1 -

Cloud Extensibility

8 -

Cloud Native

7 -

Cloud Platform Integration

1 -

CloudEvents

2 -

CMIS

1 -

Connection

1 -

container

1 -

Debugging

2 -

Developer extensibility

1 -

Developing at Scale

4 -

DMS

1 -

dynamic logpoints

1 -

Eclipse ADT ABAP Development Tools

1 -

EDA

1 -

Event Mesh

1 -

Expert

1 -

Field Symbols in ABAP

1 -

Fiori

1 -

Fiori App Extension

1 -

Forms & Templates

1 -

General

1 -

Getting Started

1 -

IBM watsonx

1 -

Integration & Connectivity

10 -

Introduction

1 -

JavaScripts used by Adobe Forms

1 -

joule

1 -

NodeJS

1 -

ODATA

3 -

OOABAP

3 -

Outbound queue

1 -

Product Updates

1 -

Programming Models

13 -

Restful webservices Using POST MAN

1 -

RFC

1 -

RFFOEDI1

1 -

SAP BAS

1 -

SAP BTP

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Build CodeJam

1 -

SAP CodeTalk

1 -

SAP Odata

1 -

SAP UI5

1 -

SAP UI5 Custom Library

1 -

SAPEnhancements

1 -

SapMachine

1 -

security

3 -

text editor

1 -

Tools

17 -

User Experience

5

| User | Count |

|---|---|

| 3 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |