- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- How G/L tolerance/clearing works. Step by Step.

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Step-1

OB57- Assign users tolerance group.

Here we are creating a blank tolerance group which is assigned to userid. However at step no: 2 (Tolerance group for users) can created as 'abc' and that can be assigned to the step no:1.

`

Step-2

OBA4 –FI Tolerance group for users

Amount per document determines that the user has a privilege to post a transaction maximum up to the specified amount per document/invoice. Amount per open item pertains only to Customer/Vendor line items (F-43,F-22) and not to G/L line items (F-02) Percentage specified in Cash discount field determines the upper limit of discount which user is authorized to process.

This permitted payment difference apply to the open item managed g/l clearing account and during Customer/Vendor payment clearing. During clearing process system considers which ever is the lowest whether the specified amount or the percentage.

Cash discount adjusted field applies during customer/vendor payment clearing. Amount specified in cash discount adjustment will add to the already existing discount conditions. If the payment received is less than the supposed amount and if the difference is not more than the amount specified in this field, system consider this as additional discount and it will reflect in the g/l assigned for discount loss/gain.

Step-3

OBA0-Tolerance for groups of G/L account in local currency

Here tolerance for groups of G/L account purely for open item managed g/l clearing account. eg; GR/IR,payable a/c, other clearing a/c which you want to clear manually or automatically.During clearing process system considers which ever is the lowest whether the specified amount or the percentage. Also system consider the lowest amount from both the conditions specified in oba4 and oba0.

Step-4

FS00 –Create following GL account.

Cash and Rent payable accounts are created as open item.

Step-5

Assign GL Tolerance group to the open item managed account.

Here we are assigning the tolerance group created (step-03) to open item g/l account.So this account will behave according to the condition specified.

Step-6

OBXZ-Maintain FI configuration: Automatic Posting –Accounts.

During the clearing process (F-03) the clearing differences will hit the gain and loss account specified here.

Step-7

F-02- Enter GL Account Posting-1

In the first posting above the clearing account is credited for 1000 and in the next transaction below the clearing account is debited for 950 and due to that a difference of 50 arises. Since 50 is equal or less than the tolerance amount specified in both G/L and user tolerance, it's eligible to get cleared. However if it was more than 50, then system will throw error and won't clear during F-03. Also it must be noted that clearing amount must meet both user and g/l tolerance condition to get cleared.

Step-8

F-02- Enter GL Account Posting-2

Step-9

FBL3N-G/L Account Line item display-Open items.RED

These two line items are from the previous two postings, which are not cleared and status is red.

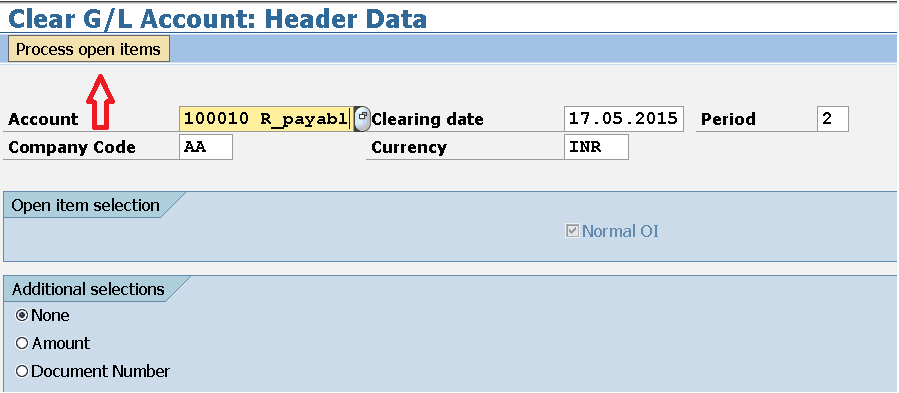

Step-10

F-03 –Clear GL Account

Here the open item managed g/l account need to be specified for clearing process.

Step-11

Click Process open items and follow the next screen below

Here the clearing difference is 50.00 which is 5% according to the condition specified in oba0 and oba4.Save it and the document will get posted in Company code AA

Step-12

FB03-Display posted document.

Tolerance gain amount got posted to the appropriate g/l account assigned in obxz.

Step-13

FBL3N-G/L Account Line item display- Select Cleared items.

Both the line items from Step-9 with status red is displayed here as cleared along with the clearing difference specified in oba0 and oba4.

Hope this will be useful.

Regards,

Sam

- SAP Managed Tags:

- FIN (Finance)

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Explanation of the Delta Posting Logic in Advanced Foreign Currency Valuation in Enterprise Resource Planning Blogs by SAP

- Exclude Agent Purchase requisition Flexible workflow in Enterprise Resource Planning Q&A

- Futuristic Aerospace or Defense BTP Data Mesh Layer using Collibra, Next Labs ABAC/DAM, IAG and GRC in Enterprise Resource Planning Blogs by Members

- SAP ERP Functionality for EDI Processing: UoMs Determination for Inbound Orders in Enterprise Resource Planning Blogs by Members

- Beyond Basic (2): Certificate-Based Authentication in SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 6 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |