- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Understanding the Standard Product Cost Estimate

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Understanding the Standard Product Cost Estimate

Product costing is one of the key areas in Manufacturing and process industries. It is used for estimating and valuating the internal cost of a product.Product cost planning is used for estimating/predicting the cost incurred in producing a Finished Product . This estimate is also used for budgeting purpose . When the material is actually produced, the actual cost is incurred and the variance between planned cost and the actual cost is calculated. Based on the magnitude of variance, decision is taken to re-estimate the cost of the materials.

Standard Cost estimate is the basis of product cost planning . This is nothing but the estimation of cost of a particular product, being manufactured.

Before getting in to SAP terminologies, let’s relate it with a very simple practical scenario, so that it is more clear and understandable.

Suppose a company is manufacturing glass containers. The components used are

- The Glass

- The Cap

The above two components are raw materials and the end product container is the finished good. Below diagram represents the entire production process.

Lets divide the discussion in to two parts.

1. Master data required for cost estimate creation

2. Cost estimate creation

1. Master data required for cost estimate creation

BOM : The component materials required for the finished good creation

Suppose as per estimation 1 Each Glass and 1 Each Cap combined to produce one container.

The above line defines the Bill Of Material i.e BOM

In SAP it looks as below CS02/CS03

Routing : The activity performed during the Production Process

As can be noted in the above screenshot, the glass undergoes an operation, where the machine runs for say 2 hours to produce the container body .

The above line defines Routing and the machine used is the work center(tcode : CR01/02/03). The exact activity or the work carried out is the activity(KL01/02/03). Tcode is for the routing is CA01/02/03

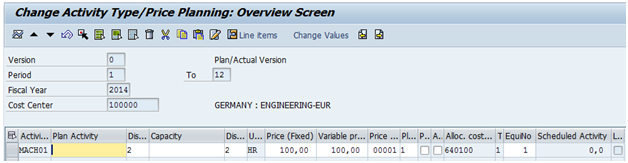

KP26 : Activity cost planning

There is a source which would be maintained, so as to be referred as a base for the activity,

So that based on the number of hours spent, it will add up to the estimated cost of the material being costed. That source is KP26 .

As can be seen above 1 hour of the machine activity would cost 200 unit amount. In our case the number of hours is 2, hence the cost would be 400 unit.

2. Cost estimate creation

Now as we are done with the master data part lets look in to the cost estimate creation.CK11N is the t-code to create the cost estimate creation.Lets talk about the different parameters involved in the same.

Costing Variant

As can be seen in the below screenshot,which is the initial screen of CK11N, costing variant PPC1 is used. Costing variant is the basis of cost estimates creation. It holds important parameters like, whether or not standard price will be updated, what is the source from which the price will be picked, the default validity period of the cost estimate, any reference costing variant etc.

The configuration of the costing variant is one of the most important configuration, in the product cost planning.The costing variant PPC1, used below is a standard costing variant. Custom costing variants, can also be created.

Below is the resulting screen.

Itemization

In the bottom grid, we see the itemization part . This is nothing but all the items that constitute the costing result. Based on the valuation strategy the cost are picked from the constituent materials. In the example above, we see Component Material cost(Picked from component Material master as per valuation strategy ) We can switch between itemization and cost component split.

Cost Component Split

Clicking on the below highlighted part takes us to the Cost Component Split. Cost component split is the split of the entire cost estimate among various cost buckets

Once the cost estimate is saved , the same is marked and released. After the same, the material standard price is updated.

The above explanation intends to simplify the basic understanding around cost estimate . This understanding can serve as the first step towards understanding the entire configurations pertaining to Standard Cost Estimates.

Your comments are most welcome.

Regards

Rudra Prasanna Mohapatra

- SAP Managed Tags:

- FIN Controlling

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Advance Return Management complete configuration(SAP ARM) in Enterprise Resource Planning Blogs by Members

- SAP GTS classification not recorded at compliance document creation in Enterprise Resource Planning Q&A

- Rebate Accruals validity period issue in Enterprise Resource Planning Q&A

- FAQ on Upgrading SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- SAP ERP Functionality for EDI Processing: UoMs Determination for Inbound Orders in Enterprise Resource Planning Blogs by Members

| User | Count |

|---|---|

| 6 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 |