- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Asset Impairment - Compliance under IFRS:

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Agenda

•Introduction on Asset Impairment

•Sample of the Asset impairment

•Customizing Asset Impairment

•Business Scenario

•Legacy data transfer of the impaired assets

Do You Know ?

Introduction on Asset Impairment

The state in which an asset has a market value less than its value listed on the company's records, especially when the value is unlikely to recover.

Impaired assets include bad debt, obsolete equipment and, most especially, goodwill. A company must write off its asset impairment each year.

When impairment of a fixed asset occurs, the business has to decrease its value in the balance sheet and recognize a loss in the income statement.

Why Asset impairment

- An assessment of accounting practices for asset impairments is especially important in the context of financial reporting quality I

- It requires the exercise of considerable management judgment and reporting discretion.

- The importance of this issue is heightened during periods of ongoing economic uncertainty as a result of the need for companies to reflect the loss of economic value in a timely fashion through the mechanism of asset write-downs

Factors affecting Asset Impairments

Concepts

Fair Value: FV = current market value - cost incurred in selling the asset (Example such as commission, registration)

Value in use: value in use is the present value of the future net cash flows expected to be derived from the continuing use of the asset.

Carrying cost: The term carrying amount is often used in place of book value. The carrying amount refers to the amounts that the company has on its books for an asset or a liability.

Recoverable amount: Either by selling the asset or by using the asset

Recoverable amount = higher {of Fair value - cost to sell (and value in use)}

How to Identify Asset Impairments

Calculate fair market value or value in use

1)Understand that fair value is the value that a sale might bring on the market.

2)Learn about value in use. Value in use is the future cash flow the asset is expected to generate.

Apply the fair market value and value in use to the carrying value to see which is greater.

It is impaired if the cost of holding an asset is greater than its sale or use values.

So if the NBV is more than the Recoverable amount then we need to impair

Sample of Asset Impairment

How to Configure

The implementation flow is as follows:

1. Determine the depreciation areas in which you want to manage revaluation.

2. Defining the posting rule

3. Defining of G/L accounts for Impairment

4. Create Transaction type for Impairment

5. Additional Account Assignment

The IMG node for this configuration is as follows:

- Asset accounting àSpecial Valuation àRevaluation of Fixed Assets àRevaluation for the Balance Sheet àDetermine Depreciation Areas

T-code: OABW

Set the indicator Revaluation of acquisition and production costs

Set this indicator, for the required depreciation area.

In this way, you can have the system calculate depreciation on the basis of replacement values.

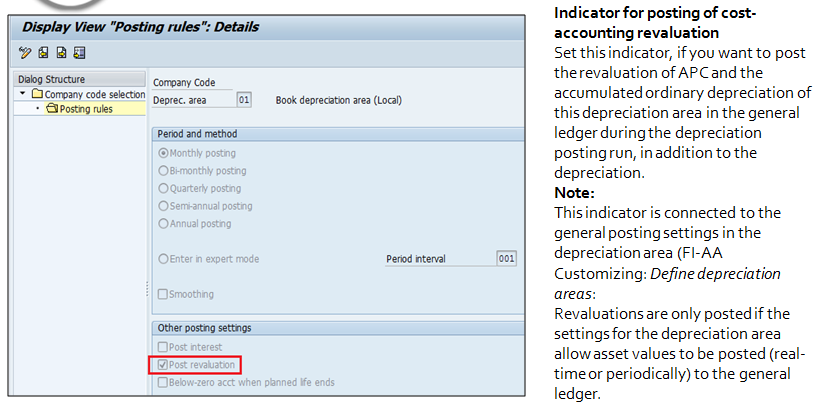

Defining the posting rule

In this step, you define the posting rules for the depreciation areas that post depreciation values to Financial Accounting. You define the posting cycle (how often depreciation is posted) and the account assignment rules for the depreciation posting run.

Path: OAYR - SPRO / Financial Accounting/ Asset Accounting/ Integration with GL/Post depreciation to the General Ledger / Specify intervals and posting rules

Go to OAYR and select the company code. Then click on the posting rules. In the book depreciation area, go to other posting settings. Check post revaluation. This setting is required for posting the impairment amount.

Defining G/L accounts for Impairment

AO90: SPRO : Financial Accounting --> Asset Accounting Integration with General Ledger Accounting à Assign G/L Accounts

Go to AO90 and create a revaluation APC for each fixed asset class and clearing account Revaluation APC.

Note: The revaluation APC has to be a reconciliation account and the revaluation offsetting account P&L category

Create transaction type for Impairment

- AO84: SPRO --> Financial Accounting --> Asset Accounting -->Transactions -->Define Transaction Types for Acquisitions

Go to AO84 and create Transaction type.

We have created the transaction type for illustration purpose‘Z80’, ‘Z81’, ‘Z82’, ‘Z83’

2.

3,

Additional account assignment

Business Scenario

After depreciation run, the depreciation amount gets re-calculated and is shown as under:

Reversal of Impairment loss:

The transaction for posting the reversal of impairment loss is ABAW:

Image showing the depreciation run and the accounting document generated after execution of AFAB

Legacy data transfer of impaired assets

During legacy migration there may be assets for which the values might be reduced and impaired costs needs to be considered. This can be done and the values will be updated only in SAP AA module. In order to update the GL values OASV transaction code is to be used. However the reconciliation account in OAMK settings needs to be removed during this transfer and then they should be reset.

Additional Learning sources

For more information on Revaluation of assets refer to below link

http://help.sap.com/saphelp_erp60_sp/helpdata/en/27/b3dc3958923402e10000000a11402f/content.htm

Newsletter and Webcasts

Q & A session

- SAP Managed Tags:

- FIN Asset Accounting

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- ISAE 3000 for SAP S/4HANA Cloud Public Edition - Evaluation of the Authorization Role Concept in Enterprise Resource Planning Blogs by SAP

- SAP GTS classification not recorded at compliance document creation in Enterprise Resource Planning Q&A

- ¿Cómo resolver el timbrado del proceso de anticipo de clientes en México? in Enterprise Resource Planning Blogs by Members

- Cruising through Compliance: Test the Regulatory Change Manager at DSAG-SAP Globalization Symposium in Enterprise Resource Planning Blogs by SAP

- What You Need to Know: Security and Compliance when Moving to a Cloud ERP Solution in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 6 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |