- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Without a proper understanding on pricing, can bus...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

This blog is in continuation to my previous blog Seller-Price, Buyer-Cost, Profitability. Where I implied we shouldn't have a notion that business not always think of "cost plus pricing". Pricing itself is big subject as like cost. In this blogs, I will dig more into understand & need of effective pricing and profitability management.

Lets look at an example, where a particular brand charges premium being cult in nature. Or.a new niche technology smart wearable "costs" $250, wherein market it is "priced" at $2500.

So, where cost plus pricing went? Why $2500? Does system or business consider cost plus pricing? As technology is new and manufacturer is looking for premier customer and accordingly priced that at premium. Once that premier customer segment is near to saturation, they will have the revise the price to preach into new customer segment. The same happened to desktops, laptops, smartphones, smart-watches, automobile, bikes to name a few.

Even though we have example around us as mentioned above. But still, every business is always under continual pressure to increase profits for shareholders and satisfying continuous demand from customers for effective price. But, out of all the parameters available to a business to produce those increases or control. Which is the most effective? Which of these parameters hasn't already been tapped out?

According to the McKinsey & Co study, "a 1% increase in realized price delivers the greatest improvement – a healthy 10% increase in operating profits. Despite this power, few businesses have effectively taken advantage of pricing to improve profits."

In this competitive business era, achieving profits through sales growth is hard-fought and hard-won. Equally the stress to deliver continues bottom-line growth remains.

Then question arises, "Why is business unable to leverage pricing effectively to drive profits?"

Generally, pricing is often treated/considered as a simple & a point problem. When, it is in fact a highly-complex enterprise-wide problem.

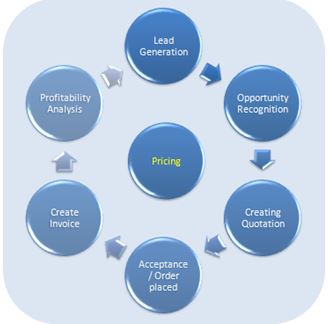

Processing of pricing spread across the organization, functional areas like marketing, sales & finance and different roles like executives, sales reps & managers. In complex large businesses, pricing may be processes based on the product line. All these issues make it hard to foresee effective pricing across all business function. If we run through lead-to-cash cycle, this is one of the critical factors and required at several stages of that process cycle.

Fig. - Pricing in Lead to Cash Cycle

Even in one the McKinsey & Co report on new economy has given pricing one of the top priorities for any business to deal with. Even most of the marketers would agree that pricing is one the 4 P’s of marketing for seller, which produces revenue and is part of tactical marketing in value –delivery process.

Fig. “Sellers 4 P’s of Marketing”(Source: Adopted from Marketing Management by Kotler)

Where, 3 of the 4 P’s of marketing Product, Place (distribution) & Promotion create value. In compare to those, pricing harvest values. Therefore, during strategy proposal, business works to achieve the lowest production and distribution costs so that it can price lower than competitors and win more market share. The problem is the competition may emerge with further lower costs, derail your strategy.

In fact,

Seller’s Price ∝ Customer’s Cost

Various business challenges like continuous innovation, global price pressure and product liability where businesses must overcome in order to grow, compete and perform in line with stakeholder’s expectations. So, if pricing is not handled professionally or effectively, this can became a nightmare for any business.

If we look at profit and loss statement of any business, pricing decision will effect on “revenue” and subsequently on other. Whereas cost will be derived out of cost of goods sold and operating expenses.

Fig. Profit & Loss Statement

But, very often there is confusion in the understanding of the difference between price and cost that I even mention in previous post.

Some say,

“If a business increases the cost, the profits will rise".

Other,

"If the business wants to increase its profits, it could increase its costs and hope to sell more"

Well, price refers to the amount of money that consumers have to give up to acquire a product or service. That amount reflects in Revenue section of the income statement.

Apart from misunderstanding between cost & pricing, there are some other challenges which business faces are in form of profit leakage.

Profit leakage can be referred as the amount of money that reduces your business profitability that is not genuine expenditure. It can be the result of one or many operating inefficiencies. Failure to control such leakages can divert profits away from your business. Example, for forms of profit leakages are direct sales commissions, installation costs and other expenses taken directly off the selling price factors that reduce your gross profit.

This implies without proper understanding on pricing & control profit leakage, a business can’t have vision for future.

In next blogs, I will dig more into how and what we have that can effectively manage pricing and profitability.

- SAP Managed Tags:

- SAP Profitability and Cost Management,

- SD Sales

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- VAKEY operation used in PCR to refers to custom ABAP code in Enterprise Resource Planning Q&A

- Cost in the Pricing tab when creating Customer Return wo reference in Enterprise Resource Planning Q&A

- Rebate Accruals validity period issue in Enterprise Resource Planning Q&A

- FAQ on Upgrading SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- Futuristic Aerospace or Defense BTP Data Mesh Layer using Collibra, Next Labs ABAC/DAM, IAG and GRC in Enterprise Resource Planning Blogs by Members

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 |