- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Overhead cost planning using Costing Sheet

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

The costing sheet covers all the requirements of the overhead cost inclusion in the product cost. The costing sheet combines all parts of the overhead costing, and determines the rules for calculating the values to be posted. Overhead can be applied to both planned and actual costs.Overheads are applied to the reference object as the percentage rate or a quantity based rate. The usage of costing sheet is the way to apply indirect costs to the final cost of the product or process. The costing sheet links all the functions of overhead calculation. It is a very helpful and exhaustive functionality to set up various rules to allocate the overhead cost to the appropriate objects. Absorption of indirect cost is important for ensuring accurate product costing and valuation of inventory. In some industries, indirect cost represents a significant portion of the product cost.

Transaction: KZS2 define costing sheet.

Screen Shot 1: Costing sheet ZOH is created.

There are different components of the overhead costing sheet that must be defined and linked to the sheet:

Calculation Base: The direct costs to which overhead is applied. A calculation base refers to one or more primary cost elements to which overhead is to be applied. In addition to one cost element or group of cost elements we can link individual origins as well as origin intervals to the calculation bases. The bases for the overhead application are those direct cost elements that mainly influence the indirect costs. In the manufacturing industry, for example, these are usually the direct labor and material costs.

Transaction Code: KZB2 Defining base

Screen shot 2: Calculation Base

Screen shot 3: Calculation Base B000 details:

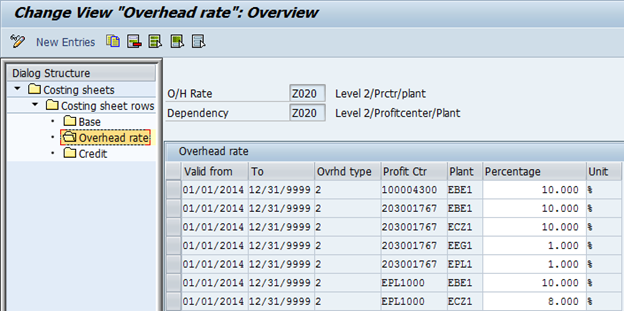

Overhead Rate: Whether overhead is allocated on a percentage basis or on a quantity basis i.e overhead for each unit of measure. The overhead rate determines to what extent the percentage-based or quantity-based overhead rate should be applied to the direct costs. It also specifies under which conditions (dependencies) the overhead rate is to be applied. For example, you can calculate a defined overhead rate for each plant by specifying a plant dependency.

Transaction code: KZZ2 Percent based Overhead rate.

Screen shot 4: Percent based Overhead rate

Screen shot 5: Percent based Overhead rate Z020

Transaction code: KZM2 Quantity based overhead rate.

Screen shot 6: Quantity based Overhead rate.

Screen shot 7: Quantity based overhead rate C180

Credit: Which object (cost center, process, or order) is credited, and under which cost element in the case of actual postings (credit key). Simultaneously as actual overhead is applied to an order another object in Controlling is automatically credited. This object is usually a cost center, but can also be another order. The overhead is allocated using a special category overhead cost element i.e 41). The credits can be stored with a validity period.

Transaction code: KZE2 Define Credit

Screen shot 8: Credit

Screen shot 9: Credit details E03

The cost element 600004 defined in the credit is linked to the cost component structure. When the product costing will be done, then the cost will be rolled up the based on the cost element assignment in the cost component structure.

Screen shot 10: Cost component structure

Screen shot 11: Cost element assignment to the cost component structure.

A costing sheet consists of multiple rows which are processed top to bottom during the overhead calculation.

- Base Rows: These can be defined by the assignment of a calculation base, so that they contain the direct costs that are to have overhead applied to them during the overhead costing.

- Overhead Rows:

They can be defined by the assignment of an overhead rate. The overhead row has the overhead rate that can be applied to a base or a totals line. An overhead row consists of a base row or a totals row. The overhead amount is calculated by multiplying the amount contained in these rows by the overhead percentage rate or quantity-based overhead rate determined through the overhead rates. As well as overheads, the overhead rows contain credit keys. These credit keys determine which object (such as a cost center or order) is to be credited under which cost element during overhead rate determination.

- Totals Rows

These rows do not have any calculation bases or overhead rates assigned to them. Credits can be assigned to the overhead rows. The amounts are allocated to the credit according to the rules you define.

With material costing the costing sheet for overhead calculation is selected through the valuation variant.

Costing sheet is linked to the costing variant with the valuation variant in the overhead. The same costing sheet can be linked to the Overhead on Finished and Semi finished Materials and also on the Overhead on Material Components. By selecting the tick “Overhead on subcontract materials” the overhead can be applied on the materials which are subcontracted.

Screen shot 12: Costing sheet assignment to valuation variant in costing variant.

Maintain Condition Tables:

Overhead conditions are defined and stored in the system. These conditions are checked during overhead calculation. If they are met, the system applies the appropriate overhead. The percentage based or quantity based rate must be applied for the overhead to be applied. In case the requirements are not met using standard overhead, then we need to create a new condition, to which you then assign the condition tables to be checked. We can use a combination of condition tables to arrive at the fields to be used to define the overhead criteria. Maintenance and assignment of condition tables is performed using access sequence.

Access sequence:

We use the access sequence to define the following:

- The condition tables which are used to access the condition records.

- The sequence of the condition tables.

- The fields which will be used for determining the overhead.

Below are the steps we follow to create our own condition tables in the IMG activity. A condition table defines the construction of an overhead rate. In the condition table we define the fields based on which we determine the overhead rate. The fields for the condition table can be selected from the list of permitted fields which are predefined.

Screen shot 13: Permitted fields available in Field catalog.

Example to create a new condition table:

You want to use the field "Overhead type", "Overhead key", "Profit center", “Plant” as conditions for calculation of the overhead.

In order to define this, we must create a new condition table and select the four fields specified from "Allowed fields" as shown below:

There are SAP standard table with the number range of 001 to 500 and which cannot be changed.

Steps to create a new condition tables, proceed as follows:

1.To create a new condition table, enter transaction KK05. Select "Condition -> Create".

Screen shot 14: Create condition table.

2. Enter a number between "501" and "999", which are allowed for defining are own tables in SAP.

3. Enter a name for your condition table.

4. Select the desired fields in the desired sequence.

Screen shot 15: Field selection for the new condition table.

5. Generate your condition table.

Recommendations:

To improve system performance, you should keep to the following field sequence:

1. Controlling area. This is required only when there are more than one controlling area.

2. Overhead type. This is required when you have to maintain the planned and actual overhead rates.

3. Business-organization related condition fields

We can create our own access sequence apart from the ones which are available in standard SAP.

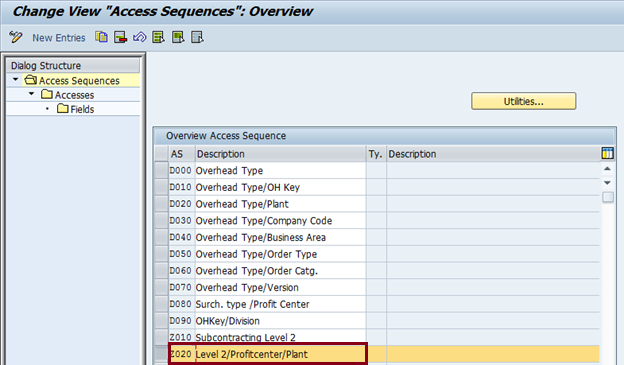

We have used the condition table 978 and created the access sequence Z020.

Screen shot 16: Access sequence Z020.

Select the access and click on Fields. We will find all the field "Overhead type", "Profit center", “Plant” in condition table 978 available for calculation of the overhead.

Screen shot 17: Fields view in the access.

We need to save the access sequence Z020 created above.

Screen shot 18: Change view of access sequence.

Select the access sequence Z020 line created above and click on Utilities button. Generate access sequence screen will appear and click on online generation and execute.

Screen shot 19: Generate acess sequence.

After execution the message log is updated as the access sequence Z020 generated online.

Screen shot 20: Message log after acess sequence generation.

We have used this access sequence Z020 and use it for overhead calculation.

Screen shot 21: Change view costing Sheet ZOH

The overhead rate Z020 is maintained using the access sequence/dependency Z020 as shown in below screen.

Screen shot 22: Overhead rate maintenance using acess sequence Z020.

Screen shot 23: Credit overview:

Example of material costed with the costing sheet ZOH created above. The Level 2 cost calculation is with credit to 600005. For material 601162 in plant EBE1, the profit center maintained in costing 1 view in material master is EPL1000. Hence the rate of 20% is applied. The base for Level1 overhead cost calculation is from 10 to 60 rows. Hence the value of Level1 overhead cost comes out to 160.09 EUR.

Similarly for Level 1 cost for material 601162 with profit center EPL1000, the quantity based overhead rate is 20 EUR per 1000 EA.

Screen shot 24: Display material cost estimate with itemization, transaction CK13N

Screen shot 25: Display material cost estimate with cost component structure details, transaction CK13N

- SAP Managed Tags:

- FIN Controlling

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Portfolio Management – Enhanced Financial Planning integration in Enterprise Resource Planning Blogs by SAP

- Using API to load WBS cost plan in Enterprise Resource Planning Q&A

- SAP S/4HANA Cloud Public Edition 财务-成本会计常见热点问题汇总FAQ in Enterprise Resource Planning Blogs by SAP

- Splitting Total Cost Recognized Values from RA at the time of Settlement in Enterprise Resource Planning Q&A

- S4 HANA Cost Center Activity Rate Calculation Hybrid Approach in Enterprise Resource Planning Blogs by Members

| User | Count |

|---|---|

| 6 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |