- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Automatic Account Determination Overview

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

When a goods movement is entered, the G/L accounts need not be entered manually since SAP automatically determines the correct accounts. The settings for this automatic account determination & material valuation are done by using the account information set up in advance in an area of Customizing known as “Valuation & Account Assignment”.

Price Control for Material Types:

For each material, a price control is mentioned in the accounting view (Standard price ‘S’ and Moving average price ‘V’) of material Master. And it is mandatory to maintain any one of these price type in the material master.

Each material is valuated according to the price set in the material master. And this price control can be set for the material type. There are two types of price control in the material master record (Accounting View)

V-Moving Average Price & S-Standard Price

You can the material price by using transaction code MR21. Once you change the price documents will get generated which reflects old price, new price and change in valuation.

Valuation Area;

Valuation area is nothing but the valuating the materials at organization level. In SAP you can set the set the valuation area at either Company code level or at Plant level. Once the valuation area is assigned it’s very difficult to reverse.

Here is the flow chart how automatic account determination works:

Valuation Grouping Code: It is the group of valuation areas having same account determination process. Plants with different account determination process should be grouped separately. Valuation grouping code can be activated by navigation path, SPRO---->IMG---->Material Management--->Valuation and account determination---->Account Determination without wizard----Define valuation control. The valuation grouping code must be active.

Account Category reference:

Account category links the Material Type and valuation class (“Grandfather of AAC”, as said by Biju Sir). The valuation classes are defined and assigned to the material master. And finally you have to assign the material type to the account category reference.

Define Valuation class: The combination of material type, account category reference, valuation class determines the G/L accounts updated for valuation relevant transactions. The Valuation class and account category references are defined in these steps. SAP has in built valuation classes and account category references. If you want different valuation class then you can create new one. And this valuation class must be entered in the material master accounting View.

Account Grouping for Movement Type: Example of account grouping

Movement Type | Account Grouping | G/L accounts |

561-Initial entry of stock balance | BSA | 399999 |

201-GI for cost centre | VBR | 400000 |

The Account Grouping is used for following transactions:

GBB-Offsetting entry for inventory posting

PRD-Price difference

The Transactions such as MIGO are linked to the Movement type with the help of Value string. Movement types are linked to the Transaction/Event keys. These Transaction/Event Keys are linked to the Account grouping code. And Account groupings are linked to the G/L accounts. The Account Grouping is the finer and subdivision of Transaction/Event keys.

You can configure this by navigating menu, SPRO---->IMG----->Material Management------>Valuation and Account determination----->Account Determination without wizard------>Account grouping for Movement Type

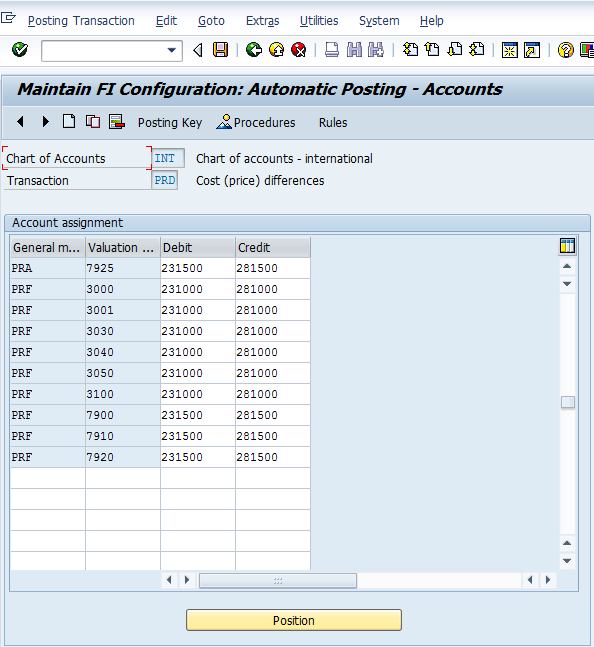

Configure Automatic posting:

You can configure this by navigating menu, SPRO---->IMG----->Material Management------>Valuation and Account determination----->Account Determination without wizard------>Account grouping for Movement Type

Under this transaction, there are different subsequent steps for configuration as per different transactions. Let us look at BSX and WRX

When the transaction such as GR is done, transaction BSX will get hit. Based on the valuation class set in the material master, Valuation grouping code (Valuation modification), and the Value string WE01(for Movement Type 101), The G/L account will be determined.

For BSX, The Valuation class and valuation modifier will be set active in RULES tab. And relevant posting key will selected in the Posting key tab. Similarly we have to configure for WRX and relevant posting key has to be selected for Debit and credit entries for the GR/IR clearing account.

PRD will come into account when standard price is maintained in the material master and if it is valuated at same price. The delivered price will not be used for valuation. And whatever the price difference it is posted to the PRD account.

Posting transaction Offsetting entry for inventory GBB is used for different transactions such GI, scrapping, physical inventory. These are assigned to the different account like consumption account.

This is the brief overview of Automatic account determination process configuration and I hope it will be useful.

- SAP Managed Tags:

- MM (Materials Management)

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Advance Return Management complete configuration(SAP ARM) in Enterprise Resource Planning Blogs by Members

- SAP Fiori for SAP S/4HANA - Composite Roles in launchpad content and layout tools in Enterprise Resource Planning Blogs by SAP

- Two main items (A+B) with one free item(C) how can we automatic determine in the Sales Order SD in Enterprise Resource Planning Q&A

- SAP ERP Functionality for EDI Processing: UoMs Determination for Inbound Orders in Enterprise Resource Planning Blogs by Members

- Turn off automatic batch determination in Enterprise Resource Planning Q&A

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |