- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Changes in Asset Accounting for Indian Companies A...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Below is the changes that will be taking place in the system due to changes in Company's Act 2013 incorporation:

1.) If life of the asset has decreased:- e.g. there is asset for which original life is 10 years, 3 years already completed as on 31st March 2014 and now life has decreased to 7 years. In this scenario, WDV as on 31st March 2014 should be depreciation over the period of 4 years instead of 7 years. How to carry out this change

- A New Depreciation key would be created which will calculate the depreciation on the remaining useful life of assets as maintained in the Asset Master.

- For the New Assets, no changes are required but for Existing Assets, the changes in the Asset Master is required to be done in the Useful Life of Asset as well as in the Depreciation Key of the Asset. This changes will be done by the User's.

2.) If life of the asset has increased:- e.g. there is asset for which original life is 10 years, 3 years already completed as on 31st March 2014 and now life has decreased to 12 years. In this scenario, WDV as on 31st March 2014 should be depreciation over the period of 9 years instead of 7 years. How to carry out this change

- This will be catered in the same way as is done for the above point (1.)

3.) If the life of the asset is already over after change in rates:- e.g. there is asset for which original life is 10 years, 7 years already completed as on 31st March 2014 and now life has decreased to 6 years. In this scenario, WDV as on 31st March 2014 should be charged to the opening reserve. How to carry out this change

- In this case an entry is to be posted in the system by User, for which the GL's needs to be provided by the business.

Below shows the detailed example for the above mentioned points.

1. If the Life of asset has decreased:

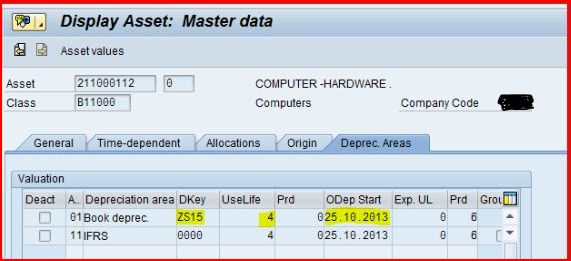

Asset No. : 211000112

Depre key – ZS15 – which is depreciating the Asset on Useful Life basis.

The planned values for depreciation posting is as below for Fiscal year 2015 :

Now changing the useful life of assets from 4 years to 3 years. So now the Asset will be write off in 3 years as shown below:

The Comparison tab is as below:

Depreciation planned values for the year 2015 is as follows:

From above we can see that depreciation per period has changed from 415.63 to 581.88 due to change in useful life of assets.

2. If the Life of asset has increased:

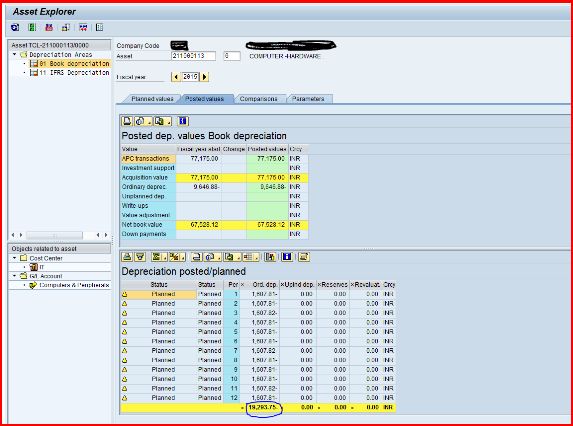

Asset No. : 211000113

Depre key – ZS15

The planned values for depreciation posting is as below for Fiscal year 2015 :

Now changing the useful life of assets from 4 years to 5 years. So now the Asset will get written off in 5 years as shown below:

The Comparison tab is as below:

Depreciation planned values for the year 2015 is as follows:

From above we can see that depreciation per period has changed from 1607.81 to 1250.52 due to change in useful life of assets.

3. If the life of the asset is already over after change in rates:

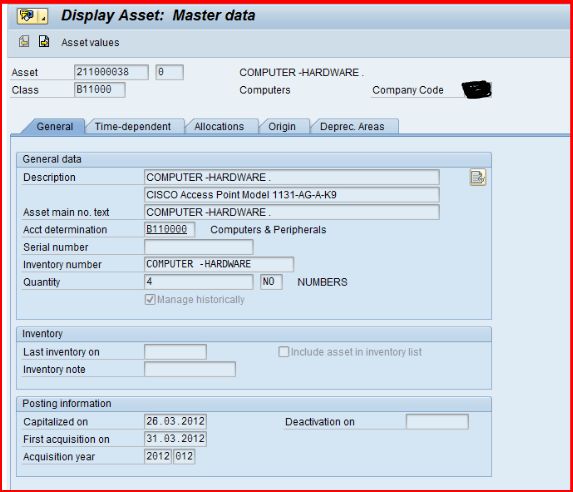

Asset No. : 211000038

Depre key – ZS15

The planned values for depreciation posting is as below for Fiscal year 2015 :

Now changing the useful life of assets from 4 years to 1 years. But here already the expired useful life is of 2 years, whereas according to Company's Act, 2013 the useful life of Asset should be 1 year only.

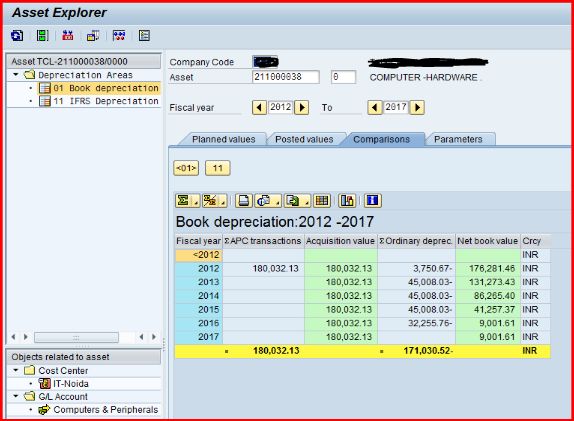

The Comparison tab is as below:

Depreciation planned values for the year 2015 is as follows:

From above we can see that depreciation per period has changed from 3750.66 to 0 due to change in useful life of assets. And the remaining NBV of the Asset of 86265.40 will be removed by executing T-Code ABAA for this Asset as shown below:

Then press enter. After this on next screen enter the NBV of the Asset i.e. 86,265.40

After this save the Document as below:

We can check in the Asset Explorer that the above document is posted and the NBV of the Asset is 'Nil'

Here the Document is posted in AA only and not in FI. The unplanned Depreciation entry will get posted in FI when Depreciation Run is executed for this period through T-Code – AFAB as below:

After this Execute the same :

From above we can see that this entry will be getting posted in the system. The accounting entry for the same is :

This is the testing GL that we have used in posting key 40, that would be the Reserve GL that would be provided by the Client.

After this the entry will be posted in the FI and by AA and FI will be in synchronization.

Kindly revert if any additions or changes or suggestions for the above document.

Regards,

Malhar.

- SAP Managed Tags:

- FIN Asset Accounting

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Account Balance Validation in SAP S/4HANA Cloud, Public Edition in Enterprise Resource Planning Blogs by SAP

- What are the pre-requisite to get SAP B1 Partner for any company? in Enterprise Resource Planning Q&A

- Manage Supply Shortage and Excess Supply with MRP Material Coverage Apps in Enterprise Resource Planning Blogs by SAP

- Portfolio Management – Enhanced Financial Planning integration in Enterprise Resource Planning Blogs by SAP

- Enterprise Portfolio and Project Management in SAP S/4HANA Cloud, Private Edition 2023 FPS1 in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |