- SAP Community

- Products and Technology

- Technology

- Technology Blogs by Members

- SAP’s cloud strategy: The role of the HANA Enterpr...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Lately, there has been some degree of turbulence in SAP’s cloud strategy (to put it mildly) with Vishal Sikka and Shawn Price both leaving the company in the same week.

Before the departure of these executives, I had a pretty good understanding of SAP’s cloud strategy – at least in its general characteristics – and blogged extensively on a variety of associated topics. Very broadly, this strategy focused on HANA as the platform on which a series of cloud applications were based. This approach was manifested in a myriad of flavors ranging from Business Suite on HANA in the HANA Enterprise Cloud (HEC) to a partner application using HANA XS in the HANA Cloud Platform (HCP) (SAP’s PaaS), or Ariba or Hybris running on HANA.

This blog will explore the question whether SAP’s cloud strategy has changed following the above-mentioned departures and other recent events (such as the layoffs).

Note: Although it may be possible to describe SAP’s cloud strategy very broadly (as I tried above), there are so many different facets involved that it is almost impossible to write a sequential analysis of this strategy. I’m going to look at particular facets in detail.

Platform vs. applications

Following the departures of Sikka and Price, there was suddenly more attention on apparent signs of tension in SAP’s cloud strategy - in particular between an emphasis placed on platform (especially regarding HANA) vs. an emphasis on applications.

There has been some suggestion that there was too much focus on platform at the expense of applications in SAP’s cloud strategy.

The challenge ahead for SAP will be stepping up its cloud game. Hana is there in the background as the "powered by Hana" platform on which SaaS apps and managed deployments will run. But techno babble about platforms is not why decision makers choose cloud providers. They choose them for their depth and breadth of capabilities and the degree to which they integrate with and complement on-premises applications that, at most large companies, aren't going anywhere any time soon. [SOURCE]

It is critical to understand that there is a heavy interdependence (in marketing-speak, synergy) between these two aspects. Like a rope, they are tightly intertwined – giving each other strength. SAP needs both. CEO Bill McDermott suggests correctly that both tendencies are important:

SAP is a 50/50 company, technology and applications. We’ve said that the real excitement is for applications that can re-imagine what it means to run your business on HANA.

In a recent interview with ASUG, Bernd Leukert also emphasized this interdependence but placed greater emphasis on applications rather than platform: “the platform has to unleash its value through the applications.”

How does the greater emphasis on applications manifest itself?

A new gang in SAP’s cloud strategy emerges and is triumphant

Two years ago, I blogged about three gangs that I saw in SAP’s cloud organization and how they interacted (some might say competed) with each other.

Note: I’m using “gang” in a nice way (sort of like Our Gang) – my goal isn’t to associate any SAP employees with a criminal organization.

Based on recent changes, I think there is a new gang that has emerged which is primarily focused on a particular type of cloud application rather than a platform. In 2012, I had already identified a gang called “SaaS” that was focused on applications in the cloud – albeit SaaS applications. For this new emergent gang, the type of applications in focus is different than that of the SaaS Gang.

In my opinion, the new gang is currently focused on the idea of migrating existing OnPremise customers to the HANA Enterprise Cloud (HEC) where the core SAP applications (Business Suite, etc) are available on HANA.

Note: I know that such non-SaaS cloud-based application existed in the past but the masive organizational /marketing/sales power that supports them is a much newer phenomenon.

Some might suggest that such hosted applications are not true / real cloud applications in that they are not SaaS applications but that is primarily a definitional issue.

In an interview with the diginomica team, CEO McDermott described the strategy in these terms: “In our transition, every asset will run on HANA in the cloud. You can take that and cash that check. SAP’s core has to go into HANA cloud but we will provide choice.” [SOURCE]

In my opinion, this “core” refers to existing OnPremise applications.

In a recent blog concerning this week’s Sapphire, blogger Ray Wang suggests that SAP will focus on its existing maintenance customers at the expense of internal innovation:

Constellation believes that organic innovation will be curtailed while the focus will remain on keeping the maintenance cash cow alive. Many partners have signaled that Waldorf is undoing the work of Vishal Sikka starting with a reemergence of ABAP.

I think the story is a bit more nuanced and is reflected in the emergence of the new Non-SaaS Applications Gang which is focused on providing cloud-related benefits to existing customers via the HEC.

If you look at applications / solutions available on the HEC (Business Suite on HANA, SAP NetWeaver Business Warehouse, Analytic Tools, EPM, GRC, NetWeaver Portal, mobile, etc.), these are the core applications that most existing customers currently use.

Partners are also moving their solutions to the HEC (One example is the recent agreement between Open Text and SAP to support ECM deployments on the HEC).

Note: As the roles / responsibilities associated with such HEC-based applications demonstrate there are still many remnants of the OnPremise world that remain in the HEC-based applications.

Note: The HEC can also be used for other scenarios (Big Data with Hadoop, etc.) but such scenarios are no longer in focus and appear to have lost momentum.

This focus on non-SaaS applications is also evident in the number of sales-related job offers from SAP. There are 108 cloud-related jobs. Of these, 41 are offers that relate directly to the HEC.

The importance of this new gang is also evident in new support / service options:

With enhanced service offering for cloud migration, the SAP Services organization offers customers choice and simplified migration of SAP applications to the cloud. Customers benefit from a simplified migration experience with the new comprehensive cloud transformation services to migrate existing SAP applications to SAP HANA Enterprise Cloud. This includes options for integration to on-premise SAP applications and other SAP cloud solutions, including those from SAP companies SuccessFactors and Ariba. Maintenance, support and upgrade services will continue under customers’ existing maintenance agreements for the migrated applications. With more than 15,000 professionals and several delivery centers across the globe, SAP Services will help customers migrate to SAP HANA Enterprise Cloud, offering more simplicity and faster speed. (My emphasis)

The recent ability to consume such HEC applications via subscriptions provides an additional financial incentive for such customers.

Let’s create a baseball card for this new gang.

Why did I select Bernd to be the leader of the Gang? I couldn’t find anyone else. As CIO, Ingrid-Helen Arnold leads cloud operations and the SAP HANA Enterprise Cloud, and runs SAP’s... but I think Bernd is the ideal leader for this gang with its current scope. As McDermott responded to a question about HANA and HANA cloud/platform:: “Bernd Leukert (who now heads global development) put the suite on HANA so this guy understands the power of HANA better than anyone else”.

Note: This gang already existed previously in the form of SAP’s SME cloud offerings. For example, SAP partners have hosted Business One in the Cloud for years (here is one example from 2012). As this offer from PT demonstrates, the transition to Business One on HANA in the Cloud is also in progress. Yet, the new gang focuses on a different market – larger existing customers.

To some degree, the recent agreement with Microsoft regarding Azure also reflects this focus but to a lesser degree in that fewer applications are available in this environment (of interest is the Business Suite albeit not on HANA). Yes, I know that AWS also supports such SAP applications and Cloud Appliance Library (CAL) but I have the feeling that relationship between SAP and AWS has cooled off a bit recently (though it would be nice to see HEC being able to run on AWS).

What happened to the old gangs?

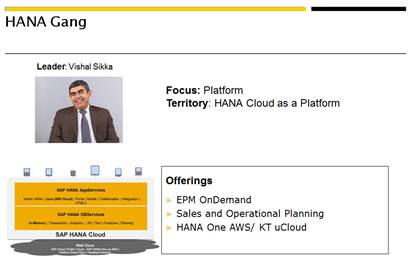

The HANA Gang

The HANA gang has been transformed. In 2012, the focus was on creating new applications (primarily SaaS) that were based on HANA. Although there are/were a few HANA based SaaS applications (EPM OnDemand, etc), this tendency really didn’t take off. Today, HANA is a platform and the underlying foundation for all cloud applications. Cloud acquisitions are transitioning to HANA (for example, Ariba) and the HEC only supports applications running on HANA . There are also IaaS and DBaaS offers that are based on HANA.

In 2012, I would have predicted that this Gang would dominate all other Gangs. At the present, however, this Gang has been pushed into the background. This change is also reflected in the broader evolution of HANA with its transition from the limelight to becoming a fundamental technology whose presence is a given – the emphasis has moved on to other more business-oriented / centered topics.

The SaaS Gang

This gang could be renamed the Line of Business (LoB) Gang and includes Ariba and SuccessFactors. In terms of contributing cloud users and revenue, this gang is the most powerful. Of all the gangs, I find the evolution of this gang the most intriguing in that there is some degree of functionality overlap with existing OnPremise applications and this leads to a certain degree of tension between both worlds. For example, some say that the OnPremise SRM is being sunseted and that existing customers should move to the appropriate Ariba modules. Something similar is occurring between Employee Central and the OnPremise HR suites.

Indeed, organizational changes in this area (as described by Jon Reed in a recent blog) shows that a melding of the OnPremise and Cloud worlds is currently in progress.

At the highest level, this question is at least partially answered, with SAP confirming that Shawn Price will not be replaced. That means, technically speaking, Rob Enslin ultimately owns cloud.

As SAP sees it, there should not be a separate line of cloud leadership in the organization. Example: on the HCM side, Mike Ettling owns all of HCM, on-premise and cloud, and reports into Enslin.

When you drill further into products, the plot thickens. Not every cloud product has a confirmed leader at this point. I was able to confirm Chakib Bouhdary now heads Ariba, also reporting into Rob Enslin. Sameer Patel leads collaboration (Jam), on-premise and cloud, ultimately reporting into Bernd Leukert. [SOURCE]

It is this organizational change that has the potential to have the greatest impact on the fundamental culture of SAP:

As the departure of Vishal Sikka grabbed most of the media attention, another organizational change, probably with a bigger impact, did not get as much coverage as it deserved. SAP has decided to merge the existing cloud organization into its main organization. This is a very bold move. If a company wants to successfully establish new business models, it is almost mandatory to set up an organization outside of the mainstream teams to allow for the development of the new DNA. SAP had built a cloud organization around the acquired teams of Successfactors and Arriba and the SAP cloud business was doing well over the past few quarters. As the new business grows, points of tensions can grow between the different sales teams (esp., if not padded by generous and expensive double compensation models), different product teams and product architecture approaches. At some points, the cost and complications of these tensions become so high, that it becomes necessary to merge the organizations. Finding the right point in time for that is very difficult. SAP has decided to do this now. [SOURCE]

These LoB SaaS are also important for those OnPremise customers that are reluctant to move core applications into the Cloud. As described by sven.denecken, SAP’s SaaS applications provide the ability to create “networked ERP” environments.

I am passionate about cloud, and I am passionate of my ERP background. Yes, I stated it: ERP. Both is needed to succeed. But do not believe the dreamers that want to build ERP again – from scratch. Lets leapfrog this attempt and build on what works that is truly stable and global and reliable – towards the “modern ERP” which is a “networked ERP” – leveraging innovative technology and cloud consumption models – as a hybrid extended deployment reality. [SOURCE]

The support of such hybrid environments is critical and is also a trend whose importance is backed by recent research:

In addition, the numbers planning to use SaaS alongside on-premise ERP — for example in ‘two-tier’ ERP deployments — leapt by more than half to 41 percent. Taken together, the survey shows that 65 percent of enterprises expect to be using SaaS in some ERP role before the end of 2015 — a massive increase of two thirds on what respondents were saying a year ago. [SOURCE]

Yet despite its importance, this Gang isn’t as powerful as the non-SaaS applications Gang – at least at the present. Sometimes, I get the feeling that this Gang should be patient – its time will come soon enough.

The Netweaver Cloud Gang

This Gang has evolved into the HANA Cloud Platform Gang - be careful this term now refers to a wide variety of cloud-related offerings ranging from IaaS to DB.... The PaaS offering (I’ll call it HCP) has gained importance in acting as an extension platform for other SAP offerings. This functionality is most evident regarding extensions for SuccessFactors. Other important components provided by the environment are the HANA Cloud Portal and HANA Cloud Integration – each of which are critical in SAP’s networked ERP concept. Despite continuous improvements in functionality, however, this Gang still languishes in the background, not receiving the attention it deserves. Perhaps, there will be announcements this week which will demonstrate its importance.

I have no idea who currently leads this Gang – Björn Goerke was its leader in 2012 – perhaps he will return.

Conclusion

“It was a different idea of how we saw the future and that’s why I left. I wish them the best. It ended in a way that I left abruptly. That’s how it goes in big companies.” Vishal Sikka after his departure from SAP [SOURCE]

Vishal’s statement could refer to a variety of things (strategy, organization, etc) but for me, it highlights a fundamental question: how does SAP really view the future in terms of cloud applications / strategy. The emergence of the new Applications Gang with its focus on the HEC is just an intermediate step. In a comment on a blog post that I wrote, fellow Mentor applebyj presented an interesting view.

I've always felt like HEC was an attempt to move the market forward rather than move into the hosting market wholesale. JHS told us in June it was intended to be a short term business whilst there were margins to be made.

The question then becomes what comes after the HEC? The applications being promoted in the HEC are largely existing OnPremise applications – enhanced with HANA – but still old applications. They aren’t the future.

The move to the cloud is more than just technological – it impacts expectations as well:

While the company has not hesitated to say that it is in transition, Nomura analyst Rick Sherlund says the key will be convincing customers that SAP can still create new products “that reflect the user-friendly culture of the cloud.” [SOURCE]

Where then are the new applications and what will they look like?

Blogger Ray Wang suggests that the new applications will come from acquisitions:

In order to meet its financial targets and avoid attrition of the customer base, SAP would have to roll out new applications at a faster pace or acquire at a faster rate to achieve their targets. Many believe that SAP has not successfully rolled out enough applications or platforms that customers want to purchase. Constellation believes SAP will have no choice but to make more acquisitions in areas where customers have been pursuing a surround SAP strategy. Some areas include customer engagement, big data, integration, internet of things, and mobile.

My opinion is that acquisitions alone won’t provide the revolutionary applications - it is the combination of different SAP assets that is the most powerful model (for example, SuccessFactors + FieldGlass or Hybris + SeeWhy, Ariba extensions running on HCP).

For such applications to appear in the marketplace, the existing gang structure must evolve again. As the current organizational changes regarding LoB applications demonstrate, the distinction between OnPremise and Cloud are disappearing – and this is the way forward.

The non-SaaS Application Gang - though powerful at the moment – and the applications it protects must also adapt itself / themselves.

As fellow blogger Blogger Vijay Vijayasankar suggests – this transformation requires the platform.

Similarly – apps that were created decades ago need to evolve without being constrained by pace of platform evolution . For the “cloud company powered by Hana” to be a reality – both apps and platform business need cloud as a vital component .

The presence of over 100+ SapphireNow sessions concerning the Internet of Things makes me hopeful that this journey – regardless of its costs on existing structures - has finally begun and is taken seriously by SAP.

Some might have noticed that my Gang definition is primarily based on technology (SaaS vs non-SaaS, etc). Just as the changes in organizational structure regarding LoB demonstrate, these technological borders must disappear as well. There must be one “Applications Gang” in which technology is secondary. Raymie Stata, current co-founder and CEO of Hadoop startup Altiscale and ex-Yahoo CTO has a useful definition of an application as opposed to platform:

“We distinguish what we call applications from tools. Tools are still horizontal. A Platfora, a Tableau — those are still horizontal tools. They certainly raise the level of abstraction versus Java, but they don’t have any what we call domain specificity. So an application to us is something that actually solves a domain-specific problem. … When you say ‘attribution analysis,’ that’s where that domain-specificity comes in that that’s to me what qualifies as a real solution.” [SOURCE]

It is this domain specificity which must be in focus of this new Gang rather than technology. I get the feeling that the increasing emphasis on industry solutions in SAP's cloud strategy (more in an upcoming blog!) also reflects this realization.

Update: SAP just announced the formation of a new Industry Cloud organization.

- SAP Managed Tags:

- SAP Sapphire,

- Cloud

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"automatische backups"

1 -

"regelmäßige sicherung"

1 -

505 Technology Updates 53

1 -

ABAP

14 -

ABAP API

1 -

ABAP CDS Views

2 -

ABAP CDS Views - BW Extraction

1 -

ABAP CDS Views - CDC (Change Data Capture)

1 -

ABAP class

2 -

ABAP Cloud

2 -

ABAP Development

5 -

ABAP in Eclipse

1 -

ABAP Platform Trial

1 -

ABAP Programming

2 -

abap technical

1 -

absl

1 -

access data from SAP Datasphere directly from Snowflake

1 -

Access data from SAP datasphere to Qliksense

1 -

Accrual

1 -

action

1 -

adapter modules

1 -

Addon

1 -

Adobe Document Services

1 -

ADS

1 -

ADS Config

1 -

ADS with ABAP

1 -

ADS with Java

1 -

ADT

2 -

Advance Shipping and Receiving

1 -

Advanced Event Mesh

3 -

AEM

1 -

AI

7 -

AI Launchpad

1 -

AI Projects

1 -

AIML

9 -

Alert in Sap analytical cloud

1 -

Amazon S3

1 -

Analytical Dataset

1 -

Analytical Model

1 -

Analytics

1 -

Analyze Workload Data

1 -

annotations

1 -

API

1 -

API and Integration

3 -

API Call

2 -

Application Architecture

1 -

Application Development

5 -

Application Development for SAP HANA Cloud

3 -

Applications and Business Processes (AP)

1 -

Artificial Intelligence

1 -

Artificial Intelligence (AI)

4 -

Artificial Intelligence (AI) 1 Business Trends 363 Business Trends 8 Digital Transformation with Cloud ERP (DT) 1 Event Information 462 Event Information 15 Expert Insights 114 Expert Insights 76 Life at SAP 418 Life at SAP 1 Product Updates 4

1 -

Artificial Intelligence (AI) blockchain Data & Analytics

1 -

Artificial Intelligence (AI) blockchain Data & Analytics Intelligent Enterprise

1 -

Artificial Intelligence (AI) blockchain Data & Analytics Intelligent Enterprise Oil Gas IoT Exploration Production

1 -

Artificial Intelligence (AI) blockchain Data & Analytics Intelligent Enterprise sustainability responsibility esg social compliance cybersecurity risk

1 -

ASE

1 -

ASR

2 -

ASUG

1 -

Attachments

1 -

Authorisations

1 -

Automating Processes

1 -

Automation

1 -

aws

2 -

Azure

1 -

Azure AI Studio

1 -

B2B Integration

1 -

Backorder Processing

1 -

Backup

1 -

Backup and Recovery

1 -

Backup schedule

1 -

BADI_MATERIAL_CHECK error message

1 -

Bank

1 -

BAS

1 -

basis

2 -

Basis Monitoring & Tcodes with Key notes

2 -

Batch Management

1 -

BDC

1 -

Best Practice

1 -

bitcoin

1 -

Blockchain

3 -

BOP in aATP

1 -

BOP Segments

1 -

BOP Strategies

1 -

BOP Variant

1 -

BPC

1 -

BPC LIVE

1 -

BTP

11 -

BTP Destination

2 -

Business AI

1 -

Business and IT Integration

1 -

Business application stu

1 -

Business Architecture

1 -

Business Communication Services

1 -

Business Continuity

1 -

Business Data Fabric

3 -

Business Partner

12 -

Business Partner Master Data

10 -

Business Technology Platform

2 -

Business Trends

1 -

CA

1 -

calculation view

1 -

CAP

2 -

Capgemini

1 -

Catalyst for Efficiency: Revolutionizing SAP Integration Suite with Artificial Intelligence (AI) and

1 -

CCMS

2 -

CDQ

12 -

CDS

2 -

Cental Finance

1 -

Certificates

1 -

CFL

1 -

Change Management

1 -

chatbot

1 -

chatgpt

3 -

CL_SALV_TABLE

2 -

Class Runner

1 -

Classrunner

1 -

Cloud ALM Monitoring

1 -

Cloud ALM Operations

1 -

cloud connector

1 -

Cloud Extensibility

1 -

Cloud Foundry

3 -

Cloud Integration

6 -

Cloud Platform Integration

2 -

cloudalm

1 -

communication

1 -

Compensation Information Management

1 -

Compensation Management

1 -

Compliance

1 -

Compound Employee API

1 -

Configuration

1 -

Connectors

1 -

Conversion

1 -

Cosine similarity

1 -

cryptocurrency

1 -

CSI

1 -

ctms

1 -

Custom chatbot

3 -

Custom Destination Service

1 -

custom fields

1 -

Customer Experience

1 -

Customer Journey

1 -

Customizing

1 -

Cyber Security

2 -

Data

1 -

Data & Analytics

1 -

Data Aging

1 -

Data Analytics

2 -

Data and Analytics (DA)

1 -

Data Archiving

1 -

Data Back-up

1 -

Data Governance

5 -

Data Integration

2 -

Data Quality

12 -

Data Quality Management

12 -

Data Synchronization

1 -

data transfer

1 -

Data Unleashed

1 -

Data Value

8 -

database tables

1 -

Datasphere

2 -

datenbanksicherung

1 -

dba cockpit

1 -

dbacockpit

1 -

Debugging

2 -

Delimiting Pay Components

1 -

Delta Integrations

1 -

Destination

3 -

Destination Service

1 -

Developer extensibility

1 -

Developing with SAP Integration Suite

1 -

Devops

1 -

Digital Transformation

1 -

Documentation

1 -

Dot Product

1 -

DQM

1 -

dump database

1 -

dump transaction

1 -

e-Invoice

1 -

E4H Conversion

1 -

Eclipse ADT ABAP Development Tools

2 -

edoc

1 -

edocument

1 -

ELA

1 -

Embedded Consolidation

1 -

Embedding

1 -

Embeddings

1 -

Employee Central

1 -

Employee Central Payroll

1 -

Employee Central Time Off

1 -

Employee Information

1 -

Employee Rehires

1 -

Enable Now

1 -

Enable now manager

1 -

endpoint

1 -

Enhancement Request

1 -

Enterprise Architecture

1 -

ETL Business Analytics with SAP Signavio

1 -

Euclidean distance

1 -

Event Dates

1 -

Event Driven Architecture

1 -

Event Mesh

2 -

Event Reason

1 -

EventBasedIntegration

1 -

EWM

1 -

EWM Outbound configuration

1 -

EWM-TM-Integration

1 -

Existing Event Changes

1 -

Expand

1 -

Expert

2 -

Expert Insights

1 -

Fiori

14 -

Fiori Elements

2 -

Fiori SAPUI5

12 -

Flask

1 -

Full Stack

8 -

Funds Management

1 -

General

1 -

Generative AI

1 -

Getting Started

1 -

GitHub

8 -

Grants Management

1 -

groovy

1 -

GTP

1 -

HANA

5 -

HANA Cloud

2 -

Hana Cloud Database Integration

2 -

HANA DB

1 -

HANA XS Advanced

1 -

Historical Events

1 -

home labs

1 -

HowTo

1 -

HR Data Management

1 -

html5

8 -

Identity cards validation

1 -

idm

1 -

Implementation

1 -

input parameter

1 -

instant payments

1 -

integration

3 -

Integration Advisor

1 -

Integration Architecture

1 -

Integration Center

1 -

Integration Suite

1 -

intelligent enterprise

1 -

Java

1 -

job

1 -

Job Information Changes

1 -

Job-Related Events

1 -

Job_Event_Information

1 -

joule

4 -

Journal Entries

1 -

Just Ask

1 -

Kerberos for ABAP

8 -

Kerberos for JAVA

8 -

Launch Wizard

1 -

Learning Content

2 -

Life at SAP

1 -

lightning

1 -

Linear Regression SAP HANA Cloud

1 -

local tax regulations

1 -

LP

1 -

Machine Learning

2 -

Marketing

1 -

Master Data

3 -

Master Data Management

14 -

Maxdb

2 -

MDG

1 -

MDGM

1 -

MDM

1 -

Message box.

1 -

Messages on RF Device

1 -

Microservices Architecture

1 -

Microsoft Universal Print

1 -

Middleware Solutions

1 -

Migration

5 -

ML Model Development

1 -

Modeling in SAP HANA Cloud

8 -

Monitoring

3 -

MTA

1 -

Multi-Record Scenarios

1 -

Multiple Event Triggers

1 -

Neo

1 -

New Event Creation

1 -

New Feature

1 -

Newcomer

1 -

NodeJS

1 -

ODATA

2 -

OData APIs

1 -

odatav2

1 -

ODATAV4

1 -

ODBC

1 -

ODBC Connection

1 -

Onpremise

1 -

open source

2 -

OpenAI API

1 -

Oracle

1 -

PaPM

1 -

PaPM Dynamic Data Copy through Writer function

1 -

PaPM Remote Call

1 -

PAS-C01

1 -

Pay Component Management

1 -

PGP

1 -

Pickle

1 -

PLANNING ARCHITECTURE

1 -

Popup in Sap analytical cloud

1 -

PostgrSQL

1 -

POSTMAN

1 -

Process Automation

2 -

Product Updates

4 -

PSM

1 -

Public Cloud

1 -

Python

4 -

Qlik

1 -

Qualtrics

1 -

RAP

3 -

RAP BO

2 -

Record Deletion

1 -

Recovery

1 -

recurring payments

1 -

redeply

1 -

Release

1 -

Remote Consumption Model

1 -

Replication Flows

1 -

Research

1 -

Resilience

1 -

REST

1 -

REST API

1 -

Retagging Required

1 -

Risk

1 -

Rolling Kernel Switch

1 -

route

1 -

rules

1 -

S4 HANA

1 -

S4 HANA Cloud

1 -

S4 HANA On-Premise

1 -

S4HANA

3 -

S4HANA_OP_2023

2 -

SAC

10 -

SAC PLANNING

9 -

SAP

4 -

SAP ABAP

1 -

SAP Advanced Event Mesh

1 -

SAP AI Core

8 -

SAP AI Launchpad

8 -

SAP Analytic Cloud Compass

1 -

Sap Analytical Cloud

1 -

SAP Analytics Cloud

4 -

SAP Analytics Cloud for Consolidation

1 -

SAP Analytics Cloud Story

1 -

SAP analytics clouds

1 -

SAP BAS

1 -

SAP Basis

6 -

SAP BODS

1 -

SAP BODS certification.

1 -

SAP BTP

20 -

SAP BTP Build Work Zone

2 -

SAP BTP Cloud Foundry

5 -

SAP BTP Costing

1 -

SAP BTP CTMS

1 -

SAP BTP Innovation

1 -

SAP BTP Migration Tool

1 -

SAP BTP SDK IOS

1 -

SAP Build

11 -

SAP Build App

1 -

SAP Build apps

1 -

SAP Build CodeJam

1 -

SAP Build Process Automation

3 -

SAP Build work zone

10 -

SAP Business Objects Platform

1 -

SAP Business Technology

2 -

SAP Business Technology Platform (XP)

1 -

sap bw

1 -

SAP CAP

1 -

SAP CDC

1 -

SAP CDP

1 -

SAP Certification

1 -

SAP Cloud ALM

4 -

SAP Cloud Application Programming Model

1 -

SAP Cloud Integration for Data Services

1 -

SAP cloud platform

8 -

SAP Companion

1 -

SAP CPI

3 -

SAP CPI (Cloud Platform Integration)

2 -

SAP CPI Discover tab

1 -

sap credential store

1 -

SAP Customer Data Cloud

1 -

SAP Customer Data Platform

1 -

SAP Data Intelligence

1 -

SAP Data Services

1 -

SAP DATABASE

1 -

SAP Dataspher to Non SAP BI tools

1 -

SAP Datasphere

9 -

SAP DRC

1 -

SAP EWM

1 -

SAP Fiori

2 -

SAP Fiori App Embedding

1 -

Sap Fiori Extension Project Using BAS

1 -

SAP GRC

1 -

SAP HANA

1 -

SAP HCM (Human Capital Management)

1 -

SAP HR Solutions

1 -

SAP IDM

1 -

SAP Integration Suite

9 -

SAP Integrations

4 -

SAP iRPA

2 -

SAP Learning Class

1 -

SAP Learning Hub

1 -

SAP Odata

2 -

SAP on Azure

1 -

SAP PartnerEdge

1 -

sap partners

1 -

SAP Password Reset

1 -

SAP PO Migration

1 -

SAP Prepackaged Content

1 -

SAP Process Automation

2 -

SAP Process Integration

2 -

SAP Process Orchestration

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud

1 -

SAP S4HANA Cloud for Finance

1 -

SAP S4HANA Cloud private edition

1 -

SAP Sandbox

1 -

SAP STMS

1 -

SAP SuccessFactors

2 -

SAP SuccessFactors HXM Core

1 -

SAP Time

1 -

SAP TM

2 -

SAP Trading Partner Management

1 -

SAP UI5

1 -

SAP Upgrade

1 -

SAP-GUI

8 -

SAP_COM_0276

1 -

SAPBTP

1 -

SAPCPI

1 -

SAPEWM

1 -

sapmentors

1 -

saponaws

2 -

SAPUI5

4 -

schedule

1 -

Secure Login Client Setup

8 -

security

9 -

Selenium Testing

1 -

SEN

1 -

SEN Manager

1 -

service

1 -

SET_CELL_TYPE

1 -

SET_CELL_TYPE_COLUMN

1 -

SFTP scenario

2 -

Simplex

1 -

Single Sign On

8 -

Singlesource

1 -

SKLearn

1 -

soap

1 -

Software Development

1 -

SOLMAN

1 -

solman 7.2

2 -

Solution Manager

3 -

sp_dumpdb

1 -

sp_dumptrans

1 -

SQL

1 -

sql script

1 -

SSL

8 -

SSO

8 -

Substring function

1 -

SuccessFactors

1 -

SuccessFactors Time Tracking

1 -

Sybase

1 -

system copy method

1 -

System owner

1 -

Table splitting

1 -

Tax Integration

1 -

Technical article

1 -

Technical articles

1 -

Technology Updates

1 -

Technology Updates

1 -

Technology_Updates

1 -

Threats

1 -

Time Collectors

1 -

Time Off

2 -

Tips and tricks

2 -

Tools

1 -

Trainings & Certifications

1 -

Transport in SAP BODS

1 -

Transport Management

1 -

TypeScript

1 -

unbind

1 -

Unified Customer Profile

1 -

UPB

1 -

Use of Parameters for Data Copy in PaPM

1 -

User Unlock

1 -

VA02

1 -

Validations

1 -

Vector Database

1 -

Vector Engine

1 -

Visual Studio Code

1 -

VSCode

1 -

Web SDK

1 -

work zone

1 -

workload

1 -

xsa

1 -

XSA Refresh

1

- « Previous

- Next »

- 10+ ways to reshape your SAP landscape with SAP Business Technology Platform – Blog 4 in Technology Blogs by SAP

- Top Picks: Innovations Highlights from SAP Business Technology Platform (Q1/2024) in Technology Blogs by SAP

- Part 4 - SAP MDG – A Stepping Stone for SAP S/4HANA Journey in Technology Blogs by Members

- CAP LLM Plugin – Empowering Developers for rapid Gen AI-CAP App Development in Technology Blogs by SAP

- Join and innovate with the SAP Enterprise Support Advisory Council (ESAC) Program in Technology Blogs by SAP

| User | Count |

|---|---|

| 8 | |

| 8 | |

| 7 | |

| 7 | |

| 5 | |

| 4 | |

| 4 | |

| 4 | |

| 3 | |

| 3 |