- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- TAN Exemption process in vendor master

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Hi

1. Hi

I am sharing the TAN exemption Process in vendor master after implementing the SAP Note 1945137

1. Maintain TAX exemption detail in Vendor changes Tcode : FK02

Purpose :

Maintain amount based accumulation in CIN details TAN exemption tab for both Invoice time and payment time tax type tax code.

Trigger : Update Tax Exemption detail in the vendor master

Prerequisite : Create a vendor first than add W/H tax type and tax code in the vendor master

1. 2. Maintain table for mapping the W/H tax Type and codes TCode : SE16

Purpose

Map the Invoice time tax type tax code with Payment time tax type tax code in View ‘V_FIWTIN_TDS_MAP’.

Note:

· Do not activate the standard accumulation functionality in your withholding tax type if you are using TAN based accumulation.

· Multiple exemption certificates can be maintained for the same tax type but the Exemption from date should be different

1. 3. Invoice Booking Tcode FB60

Purpose :

Invoice booking against the vendor

Prerequisite :

Create a vendor code and update the withholding tax type and code in the withholding tax tab and save it and update the TAX exempted section ,

dates , rates and value in TAN Exemption Tab in CIN

Business Process :

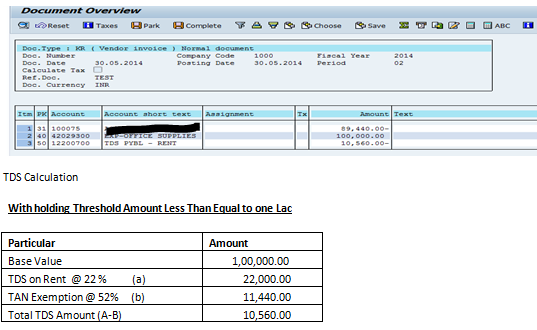

SCENARIO: 1

Amount Less then Equal to one lac for rent @ 22% on base value include 52% on TAN Exemption for Rs.100000 as W/H threshold Amount

· For section code 1004 : : “ xxxxxxxxxxxxxxxI”

· W/H Tax Type RI : Sec 194I Rent Invoice

· W/H Tax Code R1 - Sec 194I Rent Invoice - CO @ 22% for rent

· TAX Exemption 52% on W/H threshold Amount 100000/-

SCENARIO: 2

Amount More than one lac for Profession fess @ 22% on base value include 52% on TAN Exemption for Rs.100000 as W/H threshold Amount

· For section code 1000 : : “xxxxxxxxx”

· W/H Tax Type P1 : Sec 194J Fees Professional/Technical Inv

· W/H Tax Code P1 - Sec 194J Invoice – CO @ 22 %

· TAX Exemption 52% on W/H threshold Amount 200000/-

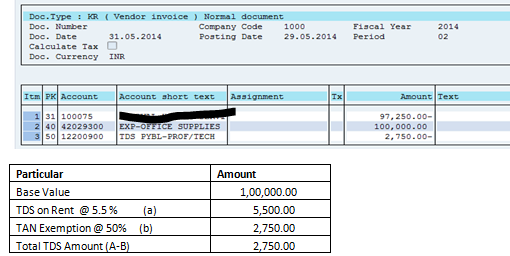

SCENARIO: 3

Amount Less then Equal to one lac for Profession fess @ 5.5% on base value include 50% on TAN Exemption for Rs.100000 as W/H threshold Amount

· For section code 1000 : : “xxxxxxxxxxxI”

· W/H Tax Type P1 : Sec 194J Fees Professional/Technical Inv

· W/H Tax Code P1 - Sec 194J Invoice – CO @ 5.5 %

· TAX Exemption 50% on W/H threshold Amount 100000/-

SCENARIO: 4

Amount More than one lac for Profession fess @ 5.5% on base value include 50% on TAN Exemption for Rs.100000 as W/H threshold Amount

· For section code 1000 : : “xxxxxxxxxxxxxx”

· W/H Tax Type P1 : Sec 194J Fees Professional/Technical Inv

· W/H Tax Code P1 - Sec 194J Invoice – CO @ 5.5 %

· TAX Exemption 50% on W/H threshold Amount 100000/-

SCENARIO: 5

Tax Calculation after expire of Validation date given in the TAN Exemption screen from 01.04.2014 to 30.06.2014. Less than one lac as this scenario working fine for Professional Fess @ 5.5%

Thanks

Trinath

- SAP Managed Tags:

- Implementation Methodologies

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Enterprise Portfolio and Project Management in SAP S/4HANA Cloud, Private Edition 2023 FPS1 in Enterprise Resource Planning Blogs by SAP

- The Role of SAP Business AI in the Chemical Industry. Overview in Enterprise Resource Planning Blogs by SAP

- Intercompany Billing - Func.Area and Porfit center determination in Enterprise Resource Planning Q&A

- Quick Start guide for PLM system integration 3.0 Implementation/Installation in Enterprise Resource Planning Blogs by SAP

- Business Rule Framework Plus(BRF+) in Enterprise Resource Planning Blogs by Members

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |