- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Indirect Valuation of Wage Types

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Basically Indirect Valuation of wage types means calculation of amounts of wage types indirectly.

We had recently come across an issue as follows:

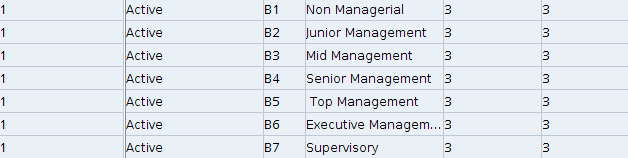

Band and grades were given as per below screen shot:

And requirements were as below:

We had done this complete configuration through Indirect Valuation.

For the purpose, bands were named as Employee Subgroups in SAP as below:

Grade was named as Payscale Groups in IT0008.

Customising step is:

SPRO > Personnel Management > Personnel Administration > Payroll Data > Basic Pay > Define EE Subgroup Grouping for PCR and Coll.Agrmt.Prov.

Check Pay Scale Type

Check Pay Scale Area

Check Assignment of Pay Scale Structure to Enterprise Structure

Determine default for pay scale data

These Steps can be customised as per requirements.

Revise Pay Scale Groups and Levels

For the purpose /TPA wage type was used for entering manual amount for monthly ctc.

1. Conveyance Allowance is fixed Rs. 800. So this can be added in the same table in amount field as shown:

2. Similary Amounts fixed are for:

LTA - Rs. 5,000.00 pm

Medical Rembursement - Rs. 1250 pm.

Gift Card - Rs. 416 pm

these three are for selected catagories only. So, according to catagories (Payscale group), values will be defaulted in the table V_T510.

The wage type characteristics for these wage type will be entered as INVAL A (Table - V_T511)

Now, next step is creating Allowance Grouping. Customising step is as below:

Payroll > Payroll India > Pay Scale Groupings > Define Pay Scale Groupings for Allowances

Assign Pay Scale Groupings for Allowances

Now in Reimbursements, Allowances and Perks

1. Assign Wage Type Model for Pay Scale Grouping for Allowances

Here, 20 depicts the number of wage types that will be allowed in IT0008. The same is defaulted in feature LGMST as below:

and so on.

2. Maintain Default Wage Types for Basic Pay - In this step we default all the wage types that needs to populate in IT0008 (Basic Pay Infotype), example can be as below:

3. Maintain Wage Type Characteristics -

This is table V_T511. Here we will determine how the wage type will be calculated based on the matrix provided. This depends on the calculation rules.

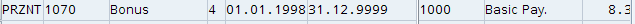

4. Maintain Valuation of Base Wage Types

Under this table we determine the percentage of the base wage type to calculate the other wage type. For example, in the matrix provided, Basic is 8.33% of basic pay. The same is maintained as below:

Also, it is given that for a particular allowance grouping, Basic pay is 25% of total ctc. So this has been achieved by adding a multiplying factor in feature 40ECS, as shown below:

And then in valuation table, the same is maintained as:

So, for this purpose in table V_T511 (WT Characteristics), the values for basic pay wage type will be as follows:

Which module variant to be used will depend on the calculation rule:

> In INVAL A the value of a wage type is fixed for an allowance grouping.

> In INVAL B, the value of a wage type is determined as a % of other wage type. You can also have a fixed component which can be different for different allowance grouping.

> In INVAL C also the value of a wage type is determined as a % of other wage types, which can be restricted to a maximum value which can be different for different allowance grouping.

> In INVAL D, the value of a wage type can depend on basic salary. It has three variants which corresponds to INVAL A, B and C.

For maintaining Special Allowance, SUMME is used. The calculation for Special Allowance was sum of all wage types minus monthly ctc.

So for obtaining this purpose, in Special Allowance wage type, characterstics were maintained as below:

And in valuation base wage type table, the same was maintained as below:

This way, in PA30, in IT 0008, we only need to maintained the amount for /TPA (Monthly CTC), as according to Employee Subgroup and Payscale Group and according to allowance grouping, all other wage type amounts will populate automatically.

Thanks and Regards,

Bhagyashree

- SAP Managed Tags:

- HCM (Human Capital Management)

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

learning content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Automate [Inventory Valuation Simulation Report] in SAP Business One in Enterprise Resource Planning Q&A

- New material type (non-valuated, no accounting view) for asset materials. in Enterprise Resource Planning Q&A

- Change material type KMAT to HALB in Enterprise Resource Planning Q&A

- how to change the valuation view for currency type in finsc_ledger? in Enterprise Resource Planning Q&A

- Inventory Split Valuation in Enterprise Resource Planning Blogs by Members

| User | Count |

|---|---|

| 3 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 |