- SAP Community

- Products and Technology

- Technology

- Technology Blogs by SAP

- Protect yourself with an agile information archite...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

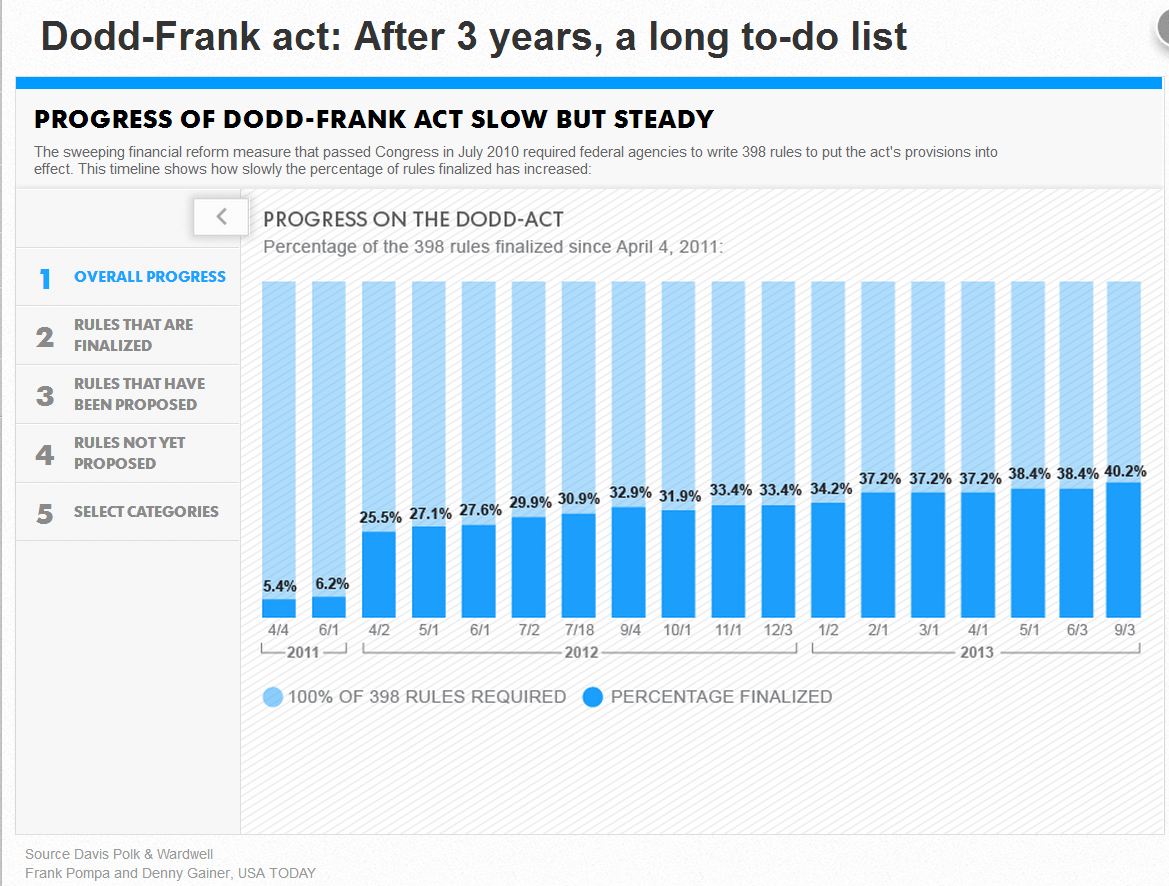

Remember the financial meltdown? Experts still can’t decide if we’re on the road to recovery…how long that road may be…or even if there is a road. As a nation, though, we did agree to more oversight over corporate financials. Enter the Dodd-Frank legislation, passed in July 2010.

A recent USA Today article shows that after three years, there’s still much work to be done to not only establish the regulations related to the legislation, but actually implement compliance to the regulation. As of September 3, 2013, only 40% of the required 398 rules had even been finalized. And 31.7% of the rules weren’t even proposed yet! (Source: Davis Polk & Wardwell, Frank Pompa and Denny Gainer, USA Today).

A recent USA Today article shows that after three years, there’s still much work to be done to not only establish the regulations related to the legislation, but actually implement compliance to the regulation. As of September 3, 2013, only 40% of the required 398 rules had even been finalized. And 31.7% of the rules weren’t even proposed yet! (Source: Davis Polk & Wardwell, Frank Pompa and Denny Gainer, USA Today).

- Centralized, shared policies on which contracts should be cleared

- Detailed, clean, fit-for-use information on each contract

- Documenting compliance with the policies

Ramifications of the New Office of Financial Research

Banking regulations also require compliance with the new Office of Financial Research to analyze data on systemic risk. Whenever a new agency with different data models and expectations of that data enters the picture, there will be challenges, like:

- Supplying appropriate risk data

- Limiting supply of data to just what is required

- Visualization of data

Preparing Your Information Architecture Strategically

Holistically, the legislation (many of the specifics still pending, as outlined above) will force organizations to think about their financial data more strategically. Beyond meeting individual compliance rules, architectural decisions must also be made to prepare you for future specifications:

- How will you manage this information going forward? Virtually, physically, in-memory?

- How will you govern this process?

- How will you prove compliance and therefore reduced risk?

You need a solid information strategy to meet these requirements. We know there won’t be FEWER requirements in the future, so create an agile information architecture to protect your company today.

I’d like to hear from you. Are you prepared for financial reform? Is your information architecture agile enough to adapt to market changes?

- SAP Managed Tags:

- Digital Technologies,

- SAP HANA

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

ABAP CDS Views - CDC (Change Data Capture)

2 -

AI

1 -

Analyze Workload Data

1 -

BTP

1 -

Business and IT Integration

2 -

Business application stu

1 -

Business Technology Platform

1 -

Business Trends

1,661 -

Business Trends

88 -

CAP

1 -

cf

1 -

Cloud Foundry

1 -

Confluent

1 -

Customer COE Basics and Fundamentals

1 -

Customer COE Latest and Greatest

3 -

Customer Data Browser app

1 -

Data Analysis Tool

1 -

data migration

1 -

data transfer

1 -

Datasphere

2 -

Event Information

1,400 -

Event Information

64 -

Expert

1 -

Expert Insights

178 -

Expert Insights

281 -

General

1 -

Google cloud

1 -

Google Next'24

1 -

Kafka

1 -

Life at SAP

784 -

Life at SAP

11 -

Migrate your Data App

1 -

MTA

1 -

Network Performance Analysis

1 -

NodeJS

1 -

PDF

1 -

POC

1 -

Product Updates

4,577 -

Product Updates

330 -

Replication Flow

1 -

RisewithSAP

1 -

SAP BTP

1 -

SAP BTP Cloud Foundry

1 -

SAP Cloud ALM

1 -

SAP Cloud Application Programming Model

1 -

SAP Datasphere

2 -

SAP S4HANA Cloud

1 -

SAP S4HANA Migration Cockpit

1 -

Technology Updates

6,886 -

Technology Updates

408 -

Workload Fluctuations

1

- It’s Official - SAP BTP is Again a Leader in G2’s Reports in Technology Blogs by SAP

- Analyze Expensive ABAP Workload in the Cloud with Work Process Sampling in Technology Blogs by SAP

- New Machine Learning features in SAP HANA Cloud in Technology Blogs by SAP

- Switch on gCTS (for existing packages) in Technology Blogs by SAP

- Unify your process and task mining insights: How SAP UEM by Knoa integrates with SAP Signavio in Technology Blogs by SAP

| User | Count |

|---|---|

| 13 | |

| 10 | |

| 10 | |

| 7 | |

| 6 | |

| 5 | |

| 5 | |

| 5 | |

| 5 | |

| 4 |