- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Calculation of TDS U/S 194J in SAP Under New Amend...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Dear All,

based on the below circular I did some configuration changes and tested with two case scenarios. Please check if this is helpful

Purpose:Based on the below circular, certain modifications have been effected to meet the conditions. The document also projects the accounting treatment in SAP for payment made under section 194J where Service tax is explicitly mentioned or not mentioned in the invoice.

Circular 01/2014 dated 13.01.2014 reproduced hereunder.

F. No_ 275/59/20124T(B)

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

Circular No.01/2014

New Delhi, the 13th January-'2014

Subject: TDS under Chapter XVII-,13 of the Income-tax Act, 1961 on service tax component comprised in the payments made to residents - clarification regarding

- 1. The Board had issued a Circular No.4/2008 dated 28-04-2008 wherein it was clarified that tax is to be deducted at source under Section 194-1 of the Income-tax Act, 1961 (hereafter referred to as 'the Act'), on the amount of rent paid/payable without including the service tax component. Representations/letters has been received seeking clarification whether such principle can be extended to other provisions of the Act also.

- 2. Attention of CBDT has also been drawn to the judgement of the Hon'ble Rajastlian High Court dated 01.07.2013, in the case of CIT(TDS) Jaipur vs Rajasthan Urban Infrastructure (Income-tax Appeal No.235, 222, 238 and 239/2011), holding that if as per theterms of the agreement between the payer and the payee, the amount of service tax is to be paid separately and was not included in the fees for professional services or technical services, no TDS is required to be made on the service tax component u/s 194J of the Act.

- 3. The matter has been examined afresh. In exercise of the powers conferred under section 119 of the Act, the Board has decided that wherever in terms of the agreement/contract between the payer and the payee,the service tax component comprised in the amount payable to a resident is indicated separately, tax shall be deducted at source under Chapter XVII-B of the Act on the amount paid/payable without including such service tax component.

- 4. This circular may be brought to the notice of all officers for compliance.

Configurational Changes

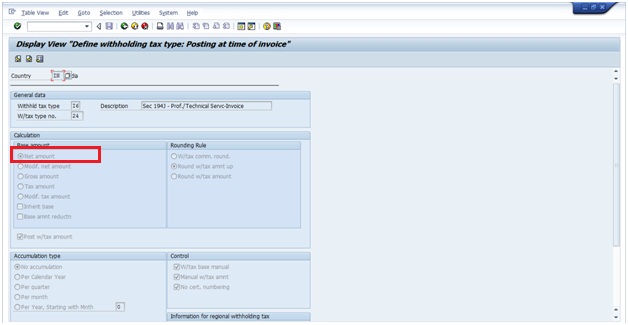

**** (New)→Withholding Tax→Extended Wtt→Define Wtt Type for invoice posting

Change the Settings from Gross Amount to Net Amount as shown below.

By considering the following example, we will take two scenarios,

►Service Amount : 10000

►Service Tax @12%: 12000

►Edu Cess @2%: 240

►Sec Edu Cess 1%:120

►Total :112360

Scenario 1 - where the bill amount is 112360 and service tax component is not shown separately

TDS will be | 11236 |

Net Payment to vendor | 101124 |

At the time of executing the invoice (FB60/Miro), user is required to select the NIL tax code, system will

automatically pick up the base amount for calculation of TDS if the relevant tax code is maintained in the vendor master.

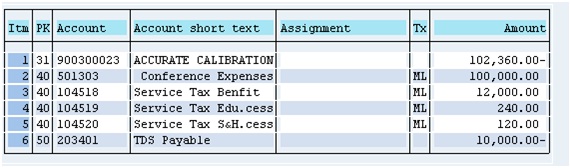

Scenario 2 - where the bill amount is 112360 but the service tax component is shown separately

At the time of executing the invoice (FB60), user is required to select the relevant service tax code ,system will pick up the net amount for calculating the TDS by excluding the service tax amount. The relevant TDS tax code should be maintained in vendor master

I hope this will help you in understanding the new changes.

best regds

Subha

- SAP Managed Tags:

- FIN (Finance)

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- CDS view Required - S4Hana Public Cloud MD04 - stock functionality (released) in Enterprise Resource Planning Q&A

- Posting Journal Entries with Tax Using SOAP Posting APIs in Enterprise Resource Planning Blogs by SAP

- How do I write a PCR to accumulate the rate values from certain wage types in the arrears table? in Enterprise Resource Planning Q&A

- Fixed Assets - Change the base value to the beggining of the first adquisition - MACRS depreciation in Enterprise Resource Planning Q&A

- How to check the calculation for "Actual Cost Rate Calculation - Cost Centers (KSII)"? in Enterprise Resource Planning Q&A

| User | Count |

|---|---|

| 5 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 |