- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Basics of Costing - Understanding Actual Cost

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Hello Friends,

I try to put together a common document for Actual Cost, the information is available in SCN forums and i try to put it together in a document form so it is available at one place,

In my earlier Documents I have explained about standard costing and various settings required for executing Standard Cost estimate. In this document we will talk about more on Actual Costs.

T-code KKBC_ORD - Looking at below screenshot it shows the actual cost postings at different time of transactions and its origin. I will try to explain where does these things flow from.

Figure 5.1

Note- KKBC_PKO can be used to see the above transactions as well.

There are several business transactions where we got actual costs; based on posting origin we can divide the transactions External Postings ( Any other module origin such as FI, PP, SD, MM) to Controlling called Primary Cost.

Business transactions within controlling module called Secondary costs we will see in detail about these in this document. I must say there is various documents and discussion in Forum about these things. However i would like to elaborate more on what is the financial impact during different stages of transactions

Primary Costs

We will take example of production order here, During Goods are issued from Inventory P/L account is debited and B/S account is credited automatically. For this we generally create identically primary cost element of consumption account. Posting to these consumption accounts (primary cost elements) also generate parallel postings to a controlling cost object. In this case

At GI:

|

At GR:

|

Figure 5.2

Outside buys, sub-contracting scenarios where we purchase services or goods are recorded as credit to GR/IR account and debit to external expenses account.

Secondary Costs

When the production activities confirmed, the cost center is credited and product cost collector is debited. A production cost center receives debit due to primary costs such as payroll, Electricity etc. Confirmation of these activities allocates these activities across many products.

Figure 5.3

Credits

Finished goods are derived from the production order. The credit value is calculated by multiplying standard price by finished goods quantity delivered to inventory .Total variance is the order balance

Figure 5.4

This balance post after the variance calculation, this is basically the difference between standard cost and actual cost. Now let's talk about actual cost

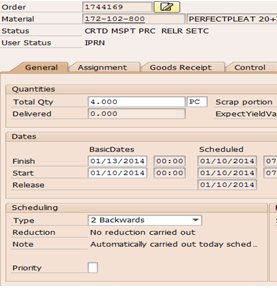

Post Actual Cost Let's create and release a production order CO01.

Figure 5.5

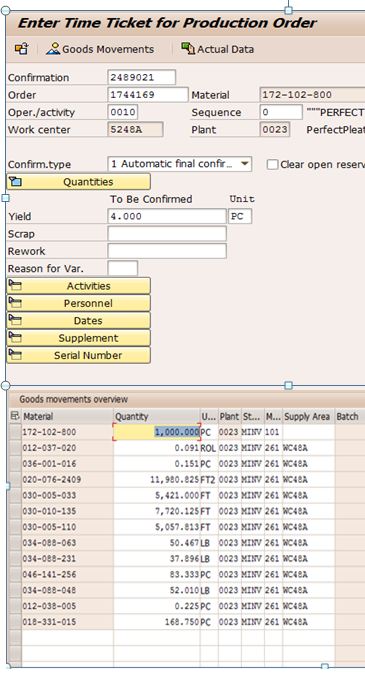

Confirm Activities CO11n, while confirming you can see there are different this is when the actual Secondary cost get posted to Controlling.

There is no accounting entry for activity confirmation only CO postings happens

Dr Production order

Cost center Cr

Fig 5.6

and during Activity confirmation posts accounting with below entry

Dr. Activity cost GL(P/L)

Activity cost GL(P/L) Cr

During closing activities we execute several other transactions to settle the costs, Overhead calculation and the variances. I will try to cover these in my next postings.

Note-This is basics document and intended for basic understanding of Actual Cost.I will continue to edit the document after the suggestion.

Best Regards

Hrusikesh Dalai

- SAP Managed Tags:

- FIN Controlling

- accelerator

- accounting

- alv

- available

- bapi

- bcp75

- beginner

- bpc

- budget

- business process expert

- Center

- check

- consolidations

- controlling

- copa

- copc

- cost

- costing

- costing variant

- costplanned

- costsstandart

- direct debit item

- ebs

- electronic bank statement

- enterprise resource planningtasksplanningtagsscn

- enterprise support academy

- ERP

- erp financials

- es academy

- Excel

- fico

- ficobeginers

- ficops

- Finance

- financials

- logistics

- management accounting

- mandate

- mapping

- material

- material ledger

- Material Management

- material planning

- materials management

- md04

- md05

- mrp

- mrp list

- order

- ordersap erp logistics materials management

- planned

- planned orders

- planning consolidations

- plant

- pp module

- product costing

- production

- Production order

- production scheduling

- purchasing

- Sales

- sales order

- SAP

- sap developer network

- sap enterprise support academy

- sap finance and controlling acceleratortopicsbusiness process man

- sap sd

- sapmentor

- sd module

- sepa

- sepa integration

- sepa mandates

- sepa sdd frst

- single euro payments area

- standard

- stock requirements list

- « Previous

-

- 1

- 2

- Next »

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

learning content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Portfolio Management – Enhanced Financial Planning integration in Enterprise Resource Planning Blogs by SAP

- How to check the calculation for "Actual Cost Rate Calculation - Cost Centers (KSII)"? in Enterprise Resource Planning Q&A

- Message no. KA465 in Enterprise Resource Planning Q&A

- SAP S/4HANA Cloud Public Edition 财务-成本会计常见热点问题汇总FAQ in Enterprise Resource Planning Blogs by SAP

- Actual Cost Component Split always active? in Enterprise Resource Planning Q&A

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 |