- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- 1099-Misc Changing tax code

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

A custom program/transaction (Z_RFWT0020) needs to be developed using program RFWT0020 provided by SAP.

This transaction code can be used two ways:

1) To update transactions already posted without withholding tax information after the withholding tax fields have been updated for the vendor so that the company can issue the vendor a 1099-MISC.

2) To update transactions already posted with withholding tax information after the withholding tax fields have been updated with tax type NA and tax code 99 for the vendor so that the vendor will NOT receive a 1099-MISC.

Steps: Z_RFWT0020 - TO UPDATE W/T TRANSACTIONAL DATA 0NCE A VENDOR HAS BEEN CHANGED TO TURN ON FOR 1099-MISC REPORTING

Summary:

Step | Activity | Dependency |

| Change Vendor Master | |

| Populate WHT data for Invoice docs | A |

| Populate WHT data for payment docs | B |

| Check Z_1099 Report |

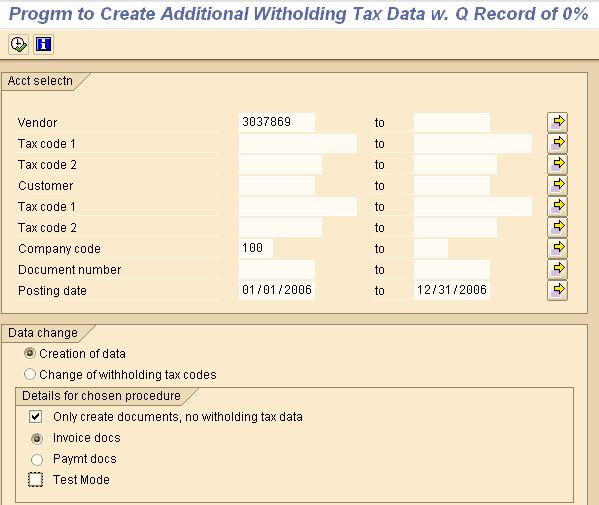

B) Updating Invoice Docs with Withholding Tax information:

This procedure is followed when a vendor, which previously had not been set up for 1099-MISC reporting, is updated because the company must issue a 1099-MISC.

Selection Criteria:

CC: 100

Date range: 1/1/06 to 12/31/06

Upload the selected list of ZPIs

Radial button: Creation of data

Check the box: only create documents, no withholding tax data

1) Radial button: Invoice docs / test run

2) Uncheck the test run button, leaving the "invoice docs" radial button checked

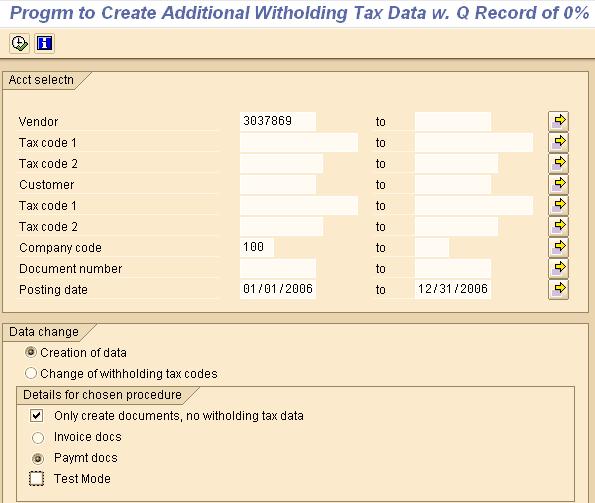

C) Updating Payment Docs with Withholding Tax information:

1) Radial button: Payment docs / test run

2) Uncheck the test run button, leaving the payment docs radial button checked (this updates the payment docs)

D) Run Z_1099 for the same list of vendors -those with payments in 2006 will show

Steps: Z_RFWT0020 - TO CHANGE THE WITHHOLDING TAX CODES IN THE W/T TABLE TO NA TO TURN OFF 1099-MISC REPORTING for vendors who were mistakenly set up by CBG for receiving a 1099-MISC.

Summary:

Step | Activity | Dependency |

| Change Vendor Master and replace WHT type FE with NA and W/tax code with 99. The liable box remains checked. | |

| Change WHT data for Invoice docs | A |

| Change WHT data for payment docs | B |

| Check Z_1099 Report |

B) Change Invoice Docs with Withholding Tax Type/code NA/99:

Selection Criteria:

CC: 100

Date range: 1/1/06 to 12/31/06

Upload the selected list of ZPIs

Radial button: Change of withholding tax codes

Check the box: only create documents, no withholding tax data

1) Radial button: Invoice docs / test run

2) Uncheck the test run button, leaving the invoice docs radial button checked

C) Updating Payment Docs with Withholding Tax Type/Code NA/99:

1) Radial button: Payment docs / test run

2) Uncheck the test run button, leaving the payment docs radial button checked (this updates the payment docs)

D) Run Z_1099 for the same list of vendors - no 1099-MISC DATA should appear.

- SAP Managed Tags:

- FIN (Finance)

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Quick Start guide for PLM system integration 3.0 Implementation/Installation in Enterprise Resource Planning Blogs by SAP

- One legal entity with multiple company code or One company code with multiple plant-Changes to setup in Enterprise Resource Planning Q&A

- Deleting only some rows (not all) from product tree with DI API in Enterprise Resource Planning Q&A

- SAP Table Creation, Maintenance, and Authorization in Enterprise Resource Planning Blogs by Members

- How can I get the output of t-code me2l in grid/table format? Parameter change in SU3 req'd? in Enterprise Resource Planning Q&A

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |